Unit 8 - Part I Quiz Practice Questions: US Economy and Government

advertisement

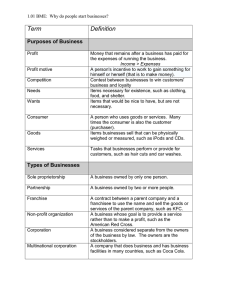

Unit 8 - Part I Quiz Practice Questions: US Economy and Government Name________________________________________ Block______________ Your Unit 8 Test is multiple-choice questions and one essay. The MC questions focus on: Vocabulary - Pg. 151-152 US Economy – Pg. 156 Circular Flow – Pg. 158 Types of Business Ownership – Pg. 160 THIS PACKET IS YOUR PASS TO SEE YOUR CIVICS TEACHER TO CHECK YOUR ANSWERS TO THIS PACKET Economic Vocabulary Practice: Use pages 143-144 in your notebook for help! Match the vocabulary word in the bank below to the correct definition. Answers can be used MORE THAN ONCE! Answer Definition Money made by working The amount of money in the economy Paper money Rate charged by banks for using their money (loans) Rate paid to you for depositing money into banks (banks use your money to make loans) Money borrowed from banks in the form of loans Too much money in the economy Items accepted as a form of payment (coins, currency, checks, debit cards) Not enough money in the economy Money collected by the government from the amount you make at work Picture Clue US ECONOMY: Use page 148 in your notebook for help! 1. The United States has a _________________ (mixed, free market, command, traditional) economy which is more __________________________(mixed, free market, command, traditional). 2. Circle from the list below principles that are true for the United States economy. Mostly Public Property Centrally-Planned Mostly Private Property Competition Supply and Demand sets MOST prices Consumer Sovereignty Profit Government sets SOME prices Government sets ALL prices For each of the following statements, label the statement true or false: 3. 4. 5. 6. 7. _______In the US, there is limited interference in the private sector from the government. _______ In the US, most economic decisions about what is produced are made in the public sector. _______ The US has a private sector. _______ The US has a public sector. _______ In the US, the government gets involved in the economy when the benefits to Americans outweigh the costs. Business Ownership Extra Practice: Use page 152 in your notebook for help! 8. All of the following are true of ALL entrepreneurs, EXCEPT: a. Starts a business b. Searches for profit c. Takes risk d. Have proprietorships 1. What are the three types of businesses you can start? a. ____________________________________ b. ____________________________________ c. ____________________________________ 2. A proprietorship means there are (one, a few, many) owner(s) of business. 3. A partnership means there are (one, a few, many) owner(s) of business. 4. A corporation means there are (one, a few, many) owner(s) of business. 5. Pros are (good or bad) and Cons are (good or bad). 6. All of the following are true of starting a proprietorship EXCEPT: a. You get to keep all the profit b. You can use your own ideas c. You share the risk and debt d. You get to keep all the money 7. Which of the following is NOT TRUE of being a part owner of a corporation? a. You are taking risk that is limited to the amount you invested. b. You share decision-making and profit with many, many owners. c. You are a stockholder or shareholder. d. You are in the type of business ownership with the most risk. 8. Which of the following is NOT TRUE of partnerships? a. You can have 2 owners b. You can have 3 owners c. You can have 5 owners d. You take all the risk Remember, owning a business involves risk! The amount of risk depends on the type of business and number of owners! 9.Least Risk 10. Which of the following types of business has the MOST risk involved? a. Proprietorship b. Partnership c. Corporation Most Risk 11. Which of the following types of business has the LEAST risk involved? a. Proprietorship b. Partnership c. Corporation 12. All of the following are TRUE of a corporation EXCEPT: a. Your liability is limited to the amount of your total investment b. Authorized by law to act as a legal entity regardless of the number of owners c. d. Owners are called stockholders and own shares of the company Often the riskiest to own but you get to keep all the profit 13. Emily invested $500 in Apple. Apple has gone bankrupt! What is the most money Emily can lose from her investment? a. $200 b. $500 c. $1000 d. $1500 Circular Flow: Use page 150 in your notebook for help! Directions: Use the word bank to label the different pieces inside the balloon. Word Bank for Questions 13-15 Private Financial Institutions Businesses Individuals Sell Resources 13._________ ___ 14._______________ ___ 15._________ __ Sell Products 16. Everything inside the balloon is part of the (private or public) sector. Circular Flow: Use page 150 in your notebook for help! Directions: Use the word bank to label the different pieces inside the balloon. Products Word Bank for Questions 17-19 Businesses Resources Individuals 17. Selling: a. Individuals sell ______________ to businesses. b. Businesses sell _______________ to individuals. 18.Buying: a. Individuals buy _______________ from businesses. b. Businesses buy _______________ from individuals. 19. Individuals sell _____________________ and Businesses sell ________________________. a. Resources; Products b. Products; Resources 20. When individuals and businesses are exchanging resources, goods and services, they are also exchanging money. a. When individuals sell resources to businesses they earn (profit or income). b. When businesses sell products to individuals they earn (profit or income). 21. Which of the following is TRUE of economic circular flow between individuals, businesses, and the government? a. Money, goods, and resources flow in the economy. b. Businesses sell resources to Individuals. c. Individuals sell products to Businesses. d. Private Financial Institutions tax individuals and businesses. 22. All of the following are examples of Private Financial Institutions EXCEPT: a. Banks b. Credit Unions c. Government d. Savings and Loans 23. Private Financial Institutions loan money to individuals and businesses. The loan is __________________. a. Stocks and Bonds b. Interest Rate c. Financial Capital d. Mortgage Rate 24. A business would borrow financial capital from PFI’s to do all of the following EXCEPT: a. To expand their business b. Buy more resources from individuals c. Buy goods from other businesses d. To tax the profit of businesses