The European Energy Market Emanuela CESAREO Xavier NOEBES

advertisement

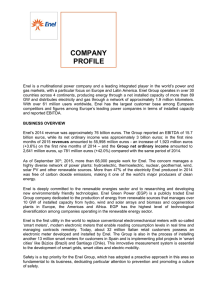

The European Energy Market Emanuela CESAREO Xavier NOEBES Léna THONON Presentation of Energy situation in Europe Europe's citizens and companies need a secure supply of energy at affordable prices in order to maintain our standards of living. At the same time, the negative effects of energy use, particularly fossil fuels, on the environment must be reduced. That is why EU policy focuses on creating a competitive internal energy market offering quality service at low prices, on developing renewable energy sources, on reducing dependence on imported fuels, and on doing more with a lower consumption of energy. 1. What do you think are the economic benefits of liberalizing the EU energy market ? Consumers benefits: and energy companies should both have -Customers should have more choices of energy providers and have more possibilities to pay less their energy. -The energy companies could buy energy from the cheapest source. -The larger companies should realize economy of scale which would enable them to be more competitive. -Greater efficiency leads to lower costs and prices which is improving competitiveness. Eurelectric, the union for the EU electricity industry, says the liberalisation process has brought "considerable benefits" to Europe in terms of price and cost reductions as well as labour productivity gains. However, Eurelectric believes that it is vital to maintain the momentum and reinforce trust in the liberalisation process. The Commission has consistently argued that liberalisation increases the efficiency of the energy sector and the competitiveness of the European economy as a whole. Who stands liberalization? to gain the most from Energy Commissioner Andris Piebalgs said the deal benefited both consumers, who would get the "lowest possible prices" and better protection, and businesses, which would "gain more business in a competitive market". "A clear regulatory framework for a functioning internal gas and electricity market will help the EU to meet the challenges of climate change, increased energy import dependence and global competitiveness,” But, we can imagine that the biggest national electricity groups like Electricité de France, GDF-Suez, EON or Enel will have more opportunities to buy their competitors. In April 2005, Greenpeace published a report analysing the market shares of Europe's ten largest electricity utilities (EdF, E.ON, RWE, ENEL, Vattenfall, Electrabel, EnBW, Endesa, Iberdrola and British Energy). According to the environmental pressure group, the liberalisation process has worked in favour of these large established utilities as demonstrated by the wave of takeovers that ensued after the opening of the market. The Commission is also keen to see more powerful energy regulators to fight anti-competitive behaviour, improved cooperation between network operators and increased investment. Paradoxically, the liberalisation of the energy market, which is meant to promote competition, has led to a number of giant mergers in recent months, which reduces the number of companies. 2.What are the implications of liberalization for energy producers in the EU ? How will the environment they face change after liberalization ? What actions will they have to take ? Implications: - will permit to replace the markets of the 27 members states by a single continentwide market for electricity and gas. - will permit to the biggest energy groups to acquire other energy firms in all Europe (example: Enel and Endessa, the largest spanish utility). Changes : - many mergers and acquisitions in the energy markets. - fights between governments protecting their firms and the biggest groups which want to acquire them. Actions : alliances, lobbying to protect its advantages and for being protect as much as possible by the government. 3. Why is the deintegration of large international company seen as much an important part of any attempt to liberalize the EU energy market ? Vertical integration of generation and supply activityies have reduced incentives to trade on wholesale market and thus, a lack of liquidity in these markets, in turn an entry barrier. Another fact is the insufficient or unavailable cross-border transmission capacity as a a barrier to integration of national markets together with lack of transparency , reliability and timeliness of information on network availability. The actual biggest energy groups are national. They have many advantages and they have monopol such as Electricité de France. The deintegration of the biggest companies will encourage the smallest companies to be more actives and permits the market to be more fair and the energy firms to be more equal. It would permit the introduction of new operators on the energy market. In this way competition between them would naturally increase the affordability and dependability of the service. 4. Why do you think progress towards the liberalization of EU energy market has been fairly slow so far ? The countries have tried to protect their small energy firms from the biggest groups of the others. This protectionism has made this liberalization being slowly.. After 10 years, we can’t really say that the energy market in UE face with a lot of competition. In the majority of the countries, the governments and the national companies make their best to protect them from « the others ». Only the minority of big firms like E.ON, EDF, GDFSuez, Centrica, Enel or RWE, which represents 4 countries (UK, France, Germany and Italy) are really ready to face with their competitors and to increase their presence and power in Europe. Sources http://www.euractiv.com/en/energy/liberali sing-eu-energy-sector/article-145320 http://www.thefinancialexpress-bd.com/ Any questions ? Thanks for your attention