Chapter Eleven Cost Behavior, Operating

advertisement

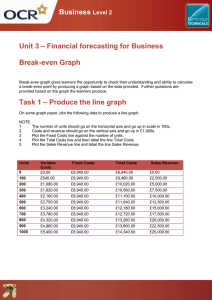

Chapter Eleven Cost Behavior, Operating Leverage, and Profitability Analysis © 2015 McGraw-Hill Education. LO 1 LO 9 Identify and describe fixed, variable, and mixed cost behavior. 11-2 Fixed Cost Behavior When activity . . . . Increases Decreases Total Fixed Cost Remains constant Remains Constant Fixed Cost Per Unit Decreases Increases Consider the following concert example where the band will be paid $48,000 regardless of the number of tickets sold. 11-3 Fixed Cost Behavior Tickets sold 2,700 3,000 3,300 Total cost of band $ 48,000 $ 48,000 $ 48,000 Per ticket cost of band $ $ $ 17.78 16.00 14.55 $48,000 ÷ 3,000 Tickets = $16.00 per Ticket 11-4 LO 2 LO 9 Demonstrate the effects of operating leverage on profitability. 11-5 Operating Leverage A measure of the extent to which fixed costs are being used in an organization. Operating leverage is greatest in companies that have a high proportion of fixed costs in relation to variable costs. Small percentage change in revenue Large percentage change in profits Fixed Costs Consider the following concert example where all costs are fixed. 11-6 Operating Leverage 10% Revenue Increase When all costs are fixed, every additional sales dollar contributes one dollar to gross profit. 90% Gross Profit Increase 11-7 Risk and Reward Assessment 10% Revenue Increase Shifting the cost structure from fixed to variable not only reduces risk but also the potential for profits. 10% Gross Profit Increase 11-8 Risk and Reward Assessment Risk refers to the possibility that sacrifices may exceed benefits. Risk may be reduced by converting fixed costs into variable costs. Let’s see what happens to the concert example if the band receives $16 per ticket sold instead of a fixed $48,000. 11-9 Variable Cost Behavior The total variable cost increases in direct proportion to the number of tickets sold. Variable unit cost per ticket remains at $16 regardless of the number of tickets sold. 11-10 Variable Cost Behavior Total variable cost increases in direct proportion to the number of units sold. The behavior of variable cost per unit is contradictory to the word variable, because variable cost per unit remains constant regardless of how many units are sold. 11-11 Variable Cost Behavior When activity . . . Increases Decreases Total Variable Cost Increases Proportionately Decreases Proportionately Variable Cost Per Unit Remains Constant Remains Constant Consider the concert example where a band receives $16 for each ticket sold. The more sold will increase the band’s take from the concert, but they can only receive a constant $16 from each individual ticket sold. 11-12 LO 3 LO 9 Prepare an income statement using the contribution margin approach. 11-13 An Income Statement under the Contribution Margin Approach 11-14 LO 4 LO 9 Calculate the magnitude of operating leverage. 11-15 Measuring Operating Leverage Using Contribution Margin Operating Leverage Contribution margin = Net income Show me an example. 11-16 Measuring Operating Leverage Using Contribution Margin Bragg $140 = Operating $20 = Leverage 7 Biltmore Operating = Leverage $80 $20 = 4 For Biltmore, this means that a 10 % increase in sales results in a 40 % increase in net income (or 10% x 4). 11-17 Operating Leverage Operating leverage itself is neither good nor bad; it represents a strategy that can work to a company’s advantage or disadvantage, depending on how it is used. Shifting the cost structure from fixed to variable reduces not only the level of risk but also the potential for profits. 11-18 Effect of Cost Structure on Profit Stability Level of Fixed Cost Earnings Volatility High High Low Low Fixed Costs Variable Costs 11-19 Cost Behavior Summarized 11-20 Mixed, or Semivariable, Costs Mixed costs ( or semivariable costs) include both fixed and variable components. For example, Star Productions, Inc., has to pay a janitorial company a base fee of $1,000 plus $20 per hour required to do each cleanup job. The $1,000 base fee is fixed. The $20 per hour is variable. If 60 hours are required to accomplish a cleanup, the total mixed cost is: $1,000 + ($20 x 60 hours) = $2,200 11-21 The Relevant Range Example: Office space is available at a fixed rental rate of $30,000 per year in increments of 1,000 square feet. As the business grows more space is rented, increasing the total cost. Continue 11-22 Rent Cost in Thousands of Dollars The Relevant Range $90 $60 Relevant Range $30 0 0 1,000 Total fixed cost remains constant for a range of activity, and then jumps to a new higher cost for the next higher range of activity. 2,000 3,000 Rented Area (Square Feet) 11-23 Total Cost The Relevant Range Our variable cost assumption (constant unit variable cost) applies within the relevant range. Relevant Range Possible Variable Cost Behavior Our Variable Cost Assumption Activity 11-24 Context Sensitive Definitions of Fixed and Variable Recall the earlier concert example, where the band was paid $48,000 regardless of the number of tickets sold. The cost of the band is fixed relative to the number of tickets sold for a specific concert. The cost of the band is variable relative to the number of concerts produced. 11-25 LO 5 LO 9 Determine the sales volume necessary to break even or to earn a desired profit. 11-26 Determining the Break-Even Point Bright Day Distributors sells one product called Delatine, a nonprescription herb mixture. The company plans to sell the product for $36. Delatine costs $24 per bottle. The company’s first concern is whether it can sell at least enough bottles of Delatine to cover its fixed costs! The break-even point can be calculated using the equation method, the contribution margin per unit method, or the contribution margin ratio method. 11-27 The Equation Method At the break-even point: Sales = Variable cost + Fixed cost We can look at the above equation like this: Selling price per unit × Number of units sold = Variable cost per unit × Number of units sold + Fixed cost 11-28 Determining the Break-Even Point Using the Equation Method The break-even point is the point where total revenue equals total costs (both variable and fixed). For Bright Day, the cost of advertising is estimated to be $60,000. Advertising costs are the fixed costs of the company. We use the following formula to determine the break-even point in units. The equation method begins by expressing the income statement as follows. At the break-even point, profit is equal to zero. Sales – Total variable cost – Total fixed cost = Profit $36N - $24N - $60,000 = 0 $12N = $60,000 N = $60,000/$12 = 5,000 Units 11-29 Determining the Contribution Margin per Unit The contribution margin per bottle of Delatine is: Sales revenue per bottle Variable cost per bottle Contribution margin per bottle Break-even volume in units = = $ 36 24 $ 12 Fixed costs Contribution margin per unit $60,000 $12 = 5,000 units 11-30 Determining the Break-even Point The break-even sales volume expressed in dollars can also be determined by dividing the fixed cost by the contribution margin ratio (which is contribution margin divided by sales) computed using either total or per unit figures. Contribution margin ratio = Contribution margin ÷ Sales Break-even = volume in dollars = $60,000 = $60,000 / $180,000 Fixed costs Contribution margin ratio $60,000 .33333 = $180,000 11-31 Determining the Break-even Point For Delatine, the breakeven point in sales dollars is $180,000 (5,000 bottles × $36 selling price). 11-32 LO 6 LO 9 Calculate and interpret the margin of safety measure. 11-33 Calculating the Margin of Safety Recall that Bright Day must sell 4,375 bottles of Delatine to earn the desired profit. In dollars, budgeted sales are $122,500 (4,375 x $28 per bottle). The margin of safety measures the cushion between budgeted sales and the break-even point. It quantifies the amount by which actual sales can fall short of expectations before the company will begin to incur losses. Break-even unit sales assuming no profit would be: Break-even = volume (units) $30,000 = 1,875 units $16 11-34 Calculating the Margin of Safety Budgeted sales Break-even sales Margin of safety In Units 4,375 (1,875) 2,500 In Dollars $ 122,500 (52,500) $ 70,000 Margin of Budgeted sales – Break-even sales = safety Budgeted sales Margin of = safety $122,500 – $52,500 $122,500 = 57.14% 11-35 Management considers a new product, Delatine that has a sales price of $36 and variable costs of $24 per bottle. Fixed costs are $60,000. Breakeven is 5,000 units. Management wants to earn a $40,000 profit on Delatine. The sales volume to achieve this profit level is 8,334 bottles sold. Marketing advocates a target price of $28 per bottle. The sales volume required to earn a $40,000 profit increases to 25,000 bottles. 11-36 Target costing is employed to reengineer the product and reduces variable cost per unit to $12. To earn the desired profit of $40,000, sales volume decreases to 6,250 units. Target costing is applied and fixed costs are reduced to $30,000. The sales volume to earn the desired $40,000 profit is 4,375 units. In view of the 57.14% margin of safety, management decides to add Delatine to its product line. 11-37 End of Chapter Eleven 11-38