Document 17569650

advertisement

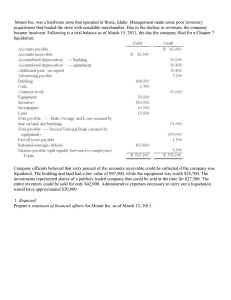

Acct 450, Fall 2010 Final quiz, Chpts 13,9 & 10 qz chpt 13 9 10 Key 1. Sparkman Co. filed a bankruptcy petition and liquidated its noncash assets. Sparkman was paying forty cents on the dollar for unsecured claims. Bailey Co. held a mortgage of $150,000 on land that was sold for $110,000. The total amount of payment that Bailey should have received is calculated to be A. $110,000. B. $44,000. C. $126,000. D. $150,000. E. $60,000. Sale of land $110,000 + 40% of remaining $40,000 owed = $126,000 Quincy Corp., about to be liquidated, has the following amounts for its assets and liabilities: The mortgage is secured by the land and building, and the note payable is secured by the equipment. Quincy 2. How much should Quincy expect to pay on the accounts payable? A. $240,000. B. $128,000. C. $120,000. D. $96,000. E. $146,000. Assets available for priority claims and unsecured creditors $220,000 - priority claims $100,000 = $120,000 $120,000/$300,000 unsecured = payment of 40% on unsecured dollars. 40% x $240,000 A/P = $96,000 3. How much should the mortgage holder expect to collect from the liquidation? A. $474,000 B. $510,000 C. $450,000 D. $480,000 E. $478,000 Land and building sold for $450,000 leaves $60,000 unsecured still owing. 40% x $60,000 = $24,000 Mortgage holder expects $450,000 + $24,000 = $474,000 Mandich Co. had the following amounts for its assets, liabilities, and stockholders' equity accounts just before filing a bankruptcy petition and requesting liquidation: Of the salaries payable, $30,000 was owed to an officer of the company. The remaining amount was owed to salaried employees who had not been paid within the previous 80 days: John Webb was owed $10,600, Samantha Jones was owed $15,000, Sandra Johnson was owed $11,900, and Dennis Roberts was owed $2,500. The maximum owed for any one employee's claims for contributions to benefit plans was $800. Estimated expense for administering the liquidation amounted to $40,000. 4. What was the total amount of unsecured liabilities with priority? A. $130,000. B. $155,000. C. $165,000. D. $170,000. E. $200,000. Pension $10,000 + Salaries $35,000 (= $10,600 + $10,950 + $10,950 + $2,500) + Taxes $80,000 + Liq. expenses $40,000 = $165,000. 5. What amount would the company have expected to pay for every dollar of unsecured liability without priority? A. $.30. B. $.40. C. $.50. D. $.60. E. $.75. Assets available for priority claims and unsecured creditors $495,000 - Priority claims $165,000 = Assets available for nonpriority unsecured creditors $330,000. $330,000/$660,000 unsecured liab. = $.50. 6. Pigskin Co., a U.S. corporation, sold inventory on credit to a British company on April 8, 2011. Pigskin received payment of 35,000 British pounds on May 8, 2011. The exchange rate was £1 = $1.54 on April 8 and £1 = 1.43 on May 8. What amount of foreign exchange gain or loss should be recognized? (round to the nearest dollar) A. $10,500 loss B. $10,500 gain C. $1,750 loss D. $3,850 loss E. No gain or loss should be recognized. Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: 7. For what amount should Sales be credited on December 1? A. $5,500. B. $16,949. C. $18,182. D. $17,241. E. $16,667. 8. Mills Inc. had a receivable from a foreign customer that is due in the local currency of the customer (stickles). On December 31, 2010, this receivable for §200,000 was correctly included in Mills' balance sheet at $132,000. When the receivable was collected on February 15, 2011, the U.S. dollar equivalent was $144,000. In Mills' 2011 consolidated income statement, how much should have been reported as a foreign exchange gain? A. $0. B. $36,000. C. $48,000. D. $10,000. E. $12,000. On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows: 9. How much foreign exchange gain or loss should be included in Shannon's 2010 income statement? A. $3,000 gain. B. $3,000 loss. C. $6,000 gain. D. $6,000 loss. E. $7,000 gain. 10. How much foreign exchange gain or loss should be included in Shannon's 2011 income statement? A. $1,000 gain. B. $1,000 loss. C. $2,000 gain. D. $2,000 loss. E. $8,000 loss. 11. Gunther Co. established a subsidiary in Mexico on January 1, 2011. The subsidiary engaged in the following transactions during 2011: What amount of foreign exchange gain or loss would have been recognized in Gunther's consolidated income statement for 2011? A. $800,000 gain. B. $760,000 gain. C. $320,000 loss. D. $280,000 loss. E. $440,000 loss. 12. Sinkal Co. was formed on January 1, 2011 as a wholly owned foreign subsidiary of a U.S. corporation. Sinkal's functional currency was the stickle (§). The following transactions and events occurred during 2011: What was the amount of the translation adjustment for 2011? A. $52,000 decrease in relative value of net assets. B. $60,800 decrease in relative value of net assets. C. $61,200 decrease in relative value of net assets. D. $466,400 increase in relative value of net assets. E. $26,000 increase in relative value of net assets. Certain balance sheet accounts of a foreign subsidiary of the Tulip Co. had been stated in U.S. dollars as follows: 13. If the subsidiary's local currency is its functional currency, what total amount should be included in Tulip's balance sheet in U.S. dollars? A. $609,000. B. $658,000. C. $602,000. D. $630,000. E. $616,000. 14. If the U.S. dollar is the functional currency of this subsidiary, what total amount should be included in Tulip's balance sheet in U.S. dollars? A. $609,000. B. $658,000. C. $602,000. D. $630,000. E. $616,000. A subsidiary of Porter Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the stickle (§), the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2010, for §120,000 that was sold on January 17, 2011 for §156,000. The subsidiary paid for the inventory on January 31, 2011. Currency exchange rates between the dollar and the stickle were as follows: 15. What amount would have been reported for cost of goods sold on Porter's consolidated income statement at December 31, 2011? A. $24,000. B. $26,400. C. $22,800. D. $27,600. E. $28,800.