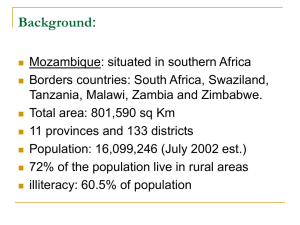

M O Z A M B I Q U E

advertisement

Strategy for PARPA improving the Business Climate MOZAMBIQUE Introduction 1 or two paragraphs to highlight the will of Member States and commitment to being investment friendly. POLICY, PLANS AND PRIORITIES 1 The government has 5-Year Development Plans with the new plan just starting now from 2010-2014. Every year, the Government publishes a Social Economic Plan (“Plano economic social”) that sets the target for the year. In addition there is an economic and social development strategy for 2011-2014 which is called “Action Plan for the Reduction of Poverty (PARP)”. PARP 20112012 is the continuity of PARPA II which has been adopted in 2006, covering the period 2006-2009, and extended up to 2010. Since PARPA I in 2001, poverty reduction goals are integrated in Government’s Five Year Plans. The main objective of PARP 2011-2014 is to reduce poverty from 54.7% in 2008/09 to 42% in 2014 and its approach is based on the following objectives and pillars: The increase of production and agro-fishery productivity The increase of job opportunities Human and social development Pilar 1- Good governance Pilar 2- Macroeconomy The Mozambican Government has identified that an improvement of the business climate is vital for economic development in the country. This position was already reflected in PARPA II. To better define a strategy with mechanisms to work specifically on the different areas, the Strategy for the Improvement of the Business Climate was developed and approved in the Resolution No. 3/2008. It entails diverse strategic activities to be performed until 2012 and defines the instruments to be employed: Legal Reform of legislation dealing with the following matters: constitution and register of societies, licensing of activities, labour conditions, bankruptcy of companies, inspection of economic activities, import and export, informal sector; Fiscal and Financial Environment; Infrastructure; Governance: Purchase of contracts, investor protection, registration of property One example is the company registration process. The aim is to reduce the number of days for incorporation of a company from 7 to 1 day. EMAN(ii) The government has approved a new strategy to improve the business environment. The principal objective is to simplify the procedures of doing business and the competitiveness of companies. 1 INVESTMENT PROMOTION 1 IPEX MIC GAZEDA CPI 1.1 Institutions The Centro de Promoção de Investimentos (CPI) was established in 1993 and is responsible for all investment procedures and the promotion of Mozambique as investment destination. It works under the Ministry of Planning and Development which is the responsible Ministry for investment in Mozambique. With the Resolution No. 26/2009, CPI received a new status which revealed the Decree No. 39/95 from 18 October and the alterations of Decree No. 9/2001 of 20 March. CPI is a public institution of administrative and financial independence. Its functions include, among others: Promote the investment opportunities in Mozambique within and outside the country; Propose and define policies to attract, and promote national and international investments; Receive and present proposals for development to improve the investment legislation; Receive, verify and register investment proposals; Guarantee the inter-institutional coordination in regard to the creation of appropriate conditions for implementation and realisation of investment projects; Provide additional support services and to investors; Assure and intervene in the facilitation of processes such as licenses and permits necessary for the implementation of the investment project; Keep a register of authorized investment projects; Assure and observe legislation and Government politics in regard to investments. CPI intends to develop to a One-Stop Shop one day. It also provides “After Care Services” helping the investor to settle in the country. GAZEDA is the institution in charge of the Industrial Free Zones and Economic Special Zones. The Ministry of Industry and Commerce (MIC) is in charge of trade and industrial policy formulation. The Instituto para a Promoção de Exportações (IPEX) is the traditional trade promotion body promoting exports from Mozambique in destination markets. Its role covers the identification and advice to exporters and investors on market access opportunities and export-related logistical services. The core activity is organizing missions to trade fairs. MIREM - The Ministry of Mineral Resources (MIREM) is in charge of mineral resources policy formulation as well as investments made or to be made in the areas of prospecting, research and production of petroleum and gas and mineral resources extraction industries. 1.2 Investment and Export Incentives Investment incentives are provided to registered and authorised investors according to the Code of Fiscal Benefits, Law No. 4/2009, of 12 January. It provides foreign and national investors the same set of incentives covering: customs duty exemptions, tax credits, VAT exemption, deductions from taxable income, deductions from tax, investment tax credit, and accelerated depreciation for new immovable assets. 2 Export Benefits Requirements General Industrial Free for Qualification Zones Requirement for entitlement to fiscal benefits according to the Code is that the investment is entitled to incentives according to the Investment Law. In addition, investments that do not qualify according to the Law are entitled if they are: Investments carried out outside the scope of the investment law in commercial and industrial activities in rural areas; Investment in new infrastructures that are built for retail and wholesale commerce; Manufacturing and assembly industries. Besides this exception, investments in commercial activities are generally excluded to enjoy fiscal benefits, except investment in new infrastructures built for retail and wholesale commerce. General benefits granted are: Exemption on import duties on equipment of class “K” of the Customs Tariff Schedule (with the exception of VAT); Investment tax credit of 5% to 10% of the total investment realized, deductible from the Corporate Income Tax (IRPC) payable but which shall not exceed the tax otherwise payable, for a period of five tax years from the commencement of operations. For specific tax-related incentives, please see section 2.4. IPEX provides support for exporters and investors on market access opportunities and any export-related logistical services. The most important export promotion strategy is the Industrial Free Zones. Details on incentive provided are found in section 2.3. Aside of that, Mozambique does not provide any export subsidies. 1.3 EPZs, Freeports and other Special Economic Zones The system of Industrial Free Zones (IFZs) exists since 1999 and is Mozambique’s main export promotion strategy. IFZs are not restricted to a geographical location but can also be individual business entities. The most well-known example of an IFZ is the Mozal aluminium smelter. When the investor wants to establish an IFZ, he needs the authorisation from the Council of Ministers in relation to the creation of an IFZ based on the proposal by the Investment Council. Privately initiated proposals for the creation of an IFZ shall be submitted to GAZEDA which is responsible for the analysis of the proposals and drafting of the opinion to be submitted by the Investment Council to the Council of Ministers for the purpose of deciding on the creation of the IFZ. Once approved, an IFZ Developer Certificate will be issued. Companies wishing to establish in an IFZ will be issued an IFZ Enterprise Certificate. An important requirement is that at least 70% of annual production is destined for export. Ineligible activities for IFZs are exploration and extraction of natural resources. Investors and/or business entities operating in Industrial Free Zones benefit from the exemption of payment of customs duties on the import of: construction materials, machinery, equipment, accompanying spare and accessory parts and other goods used in the carrying out of the licensed Industrial Free Zones activity; 3 goods and merchandise to be used in the implementation of projects and exploration of activities which have been authorised under the terms of the Industrial Free Zones Regulations. VAT exemptions under this regulation apply to both on import and on internal acquisitions as provided for in the VAT Code. Rapid Rural Special Economic Zones Development Zone Benefits for Industrial Free Trade Zones Developers as well as Free Zone enterprises with respect to Corporate Income Tax (IRPC) are: IPRC exemption in the ten tax years; a 50% reduction on IPRC tax from year 11th to 15th tax year; a 25% reduction on IPRC tax for the remaining life of the project. Isolated Free Zones Enterprises approved in accordance with the terms of the Free Zone Regulations benefit from the following incentives with respect to the Corporate Income Tax (IRPC) IPRC exemption for the first 5 years; 50% reduction on IPRC tax from year 6 to 10; 25% reduction on IPRC tax for the remaining life of the project. Sales from an IFZ to the national market and territory are considered as an import and are, hence, subject to import duties and taxes. The same applies to the sale. The Code of Fiscal Benefits provides that Special Economic Zones Developers and Enterprises receive benefit in form of an exemption from the payment of customs duties (including VAT on import and on internal acquisitions) on the import of construction materials, machinery, equipment, accompanying spare and accessory parts and other goods used in the carrying out of the licensed Special Economic Zones activity. 1. From the date of the issuance of the respective Certificate, Special Economic Zones Developers benefit from the following incentives with respect to Corporate Income Tax (IRPC): a) IRPC exemption in the first five tax years; b) a 50% reduction in the rate of IRPC tax from the 6th to the 10th tax year; c) a 25% reduction in the rate of IRPC for the remaining life of the project. 2. From the date of the issuance of the respective Certificate, Special Economic Zone enterprises benefit from the following incentives with respect to Corporate Income Tax (IRPC): a) IRPC exemption in the first three tax years; b) a 50% reduction in the rate of IRPC tax from the 4th to the 10th tax year; c) a 25% reduction in the rate of IRPC for the remaining life of the project. 3. Special Economic Zone enterprises in the service sector approved in accordance with the terms of the Special Economic Zone Regulations benefit from a 50% reduction in the rate of IRPC tax for a period of five tax years. Rapid Development Zones (ZRD) are geographic areas within the national territory of Mozambique that possess a great natural resource potential but which are lacking in infrastructure and have a weak level of economic activity. Currently, ZRDs include the Zambeze River Valley zone, Niassa Province, Nacala district, Ilha de Moçambique (Moçambique Island) and Ibo Island. Further areas may be approved by the Council of Ministers as competent authority. The Zambeze River Valley zone includes: all districts in Tete Province; the districts of Morrumbala, Mopeia, Chinde, Milange, Mocuba, Maganja da Costa, Nicoadala, Inhassunge, Namacurra and Quelimane in Zambézia Province; the districts of 4 Expenditure Customs Investment Training costs Duties Tax to be Gorongosa, Maringué, Chemba, Caia, Credit (CFI) as Fiscal Marromeu, Cheringoma and Muanza in Sofala considered Costs Province; the districts of Bárue, Guro, Tambara and Macossa in Manica Province. Eligible Activities for fiscal benefits are: agriculture; tree plantations; aquaculture; stock-raising, forestry operations; wild life related operations; water supply; electricity generation; transport and distribution; telecommunications; construction of public use infrastructures; housing construction; construction of agriculture related infrastructures; construction of hotel infrastructure and hotel operation; tourism and related activities; construction of trade infrastructure; industry; cargo and passenger transport; education; health. The incentives are: Exemption on customs duty and VAT on import goods of category “K” including spare parts and accessories; Investment tax credit of 20% for five years on the total investment realized; Any portion not used in the respective tax year may be carried forward and used in the 5 successive years; Costs on training as described apply Expenditures considered as fiscal costs apply. 1.4 Tax Incentives The Code of Fiscal Benefits (2009) specifies in Article 6, that exemption from customs duties is granted for goods imported and not produced in Mozambique, or if they are produced in Mozambique do not satisfy the specific characteristics for the purpose of function required. Food, drinks, tobacco, clothing, passenger vehicles and other articles of personal and domestic use are excluded from this incentive. For project implementation, exemption from customs duties and VAT are granted for a period of 5 years. Investment Tax credit is a deduction from the corporate income tax granted during 5 fiscal exercises and applies to x percent of the total investment realised. The percentage is as following: 5% for Maputo Cidade 10% for investment projects carried out in the other provinces 20% for investment projects in the Rapid Development Zones. Costs for professional training of Mozambican employees is deductable from the taxable corporate income during the first 5 years to a maximum of 5% of the taxable income. For the case of training in the utilization of equipment that is considered as new technology, up to 10% is deductable. Article 19 of the Code covers costs that can be considered as Fiscal Costs and are treated the following way: 1. During a period of five tax years dating from the date of commencement of operations, investments eligible for fiscal benefits under the terms of this Code the following allowances may be also considered as costs for the determination of taxable income for corporate income tax (IRPC) purposes: a) in the case of investments carried out in the City of Maputo, 110% percent of the value of expenditure in the construction and rehabilitation of roads, railways, airports, mail delivery, telecommunications, water supply, electrical 5 Tourism Rural Infrastructure Manufacturing Agriculture Commerce andand Hotels and energy, schools, hospitals and other works that and Industry Assembly Fishery Industry are considered to be of public utility by the competent authority; b) In the case of the other provinces, an amount equal to 120% percent of the expenditure, under the same terms as the previous paragraph. c) In the case of expenditure for the acquisition for personal ownership of works of art and other objects that are representative of Mozambican culture as well as activities that contribute to the development of such works under the terms of the Law for the Defence of Cultural Patrimony, Law 10/88, of 22 December, only 50% of the expenditure is deductible as a cost for tax purposes. 2. The terms and provisions of the previous paragraph shall be applicable to income subject to the Personal Income Tax (IRPS), but only in respect of income from activities belonging to the Second Category of IRPS. For private investments or investments conducted under public-private partnerships in the infrastructural sector, custom duties and VAT payments are exempted for goods classified under category “K” in the Customs Tariffs Schedule including accompanying spare parts and accessory parts. Investments with exclusive objective or establishing basic public infrastructure receive: 80% reduction in Corporate Income Tax (IRPC) rate in the first 5 years; 60% reduction in the IRPC rate from year 6 to 10; 25% reduction in the IPRC rate from year 11 to 15. In case the taxpayer is subject to personal income tax, the described benefits apply only to the taxable income derived from the activity benefitting from the incentive. Investments in the construction and/or rehabilitation of infrastructure to be used exclusively for the conduct of commercial and industrial activity in rural areas receive customs duty and VAT exemption for import goods of category “K”, as well as the goods: freezers, scales, weights, cash registers, oil and fuel meters, counter. Investments in this sector receive the following incentives: Manufacturing industry: duties exemption on import of raw materials to be used in the manufacturing process Assembly of motor vehicles, electronic equipment, computer and communications technology: exemption on import duties for material to be used in the industrial production process. This sector has the following incentives: Customs duty and VAT exemption for import goods of category “K” and accompanying spare and accessory parts 80% reduction on IPRC until 31 December 2015 50% reduction on IPRC from 2016 until 2025 Costs for training deductable on IPRC as described above Specific incentives are applicable for investments in: a) Construction, rehabilitation, expansion or modernization of hotelery units and the respective complementary and related parts, with the principal purpose being the provision of tourism services; b) Development of infrastructure for the establishment of camping and caravan parks with a minimum three star classification; c) Equipment for the development and exploration of marinas; 6 US market Special Agreements access d) Development of wild life reserves, national parks and game reserves for tourism. Excluded from special incentives are: a) Rehabilitation, construction, expansion or modernization of restaurants, bars, cafés, food establishments, discotheques and other similar units when not a part of the units referred to in the previous paragraph; b) Car rental; c) Travel agencies, tourism operators and similar activities. The incentives are exemption from duties and VAT on import of goods in category “K” of the Customs Tariff Schedule, as well as construction materials excluding cement, blocks; tiles, paint and varnish; rugs and carpets; sanitary equipment; furniture; textiles; elevators; air conditioners; kitchen equipment; refrigeration equipment; tableware and restaurant and bar articles; communication equipment; safes; computer and sound equipment; televisions; recreational watercraft, yachts and related equipment and water sports security equipment; aircraft, airplanes, helicopters, hang-glider, gliders, flight simulators, equipment, and related equipment and tourist activity security equipment. The stated goods also qualify for benefits under the Investment Tax Credit. Furthermore, accelerated depreciation of new immovable assets, vehicles, automobiles and other tangible fixed assets used in the hotel industry and for tourism activities may be increased by 50%. Further special incentives are granted for investments in the Science and Technology Parks, and for large dimension projects. Please see the Code of Fiscal Benefits for details. 1.5 International Trade & Export Promotion PARPA II also targeted reviewing Mozambique’s trade policy and strategy which was adopted in 1999. The review shall emphasise more on deepening trade Being signatory to the Cotonou Agreement between the European Community and the ACP states for preferential access to the EU market. The EPA negotiations with various ACP regional groupings are mostly ongoing and Mozambique is part of the SADC negotiation group. An Interim EPA was signed end of 2007 and the final EPA is suspected to be completed soon. Since 2004, Mozambique had also benefited from preferences granted under the Sugar Protocol. As LDC, another possibility for preferential market access is the “Everything But Arms” (EBA) initiative. Preferential access to the US market is given through the African Growth and Opportunity Act (AGOA) which grants duty-free and quota-free access for a range of about 6,400 products until 2015 under its Generalised System of Preferences (GSP). In addition, Mozambique signed a Trade and Investment Framework Agreement (TIFA) with the US for bilateral consultations on trade and investment matters. Mozambique does not have import quotas but an often time-consuming and bureaucratic customs clearing system. Many consider it a significant non-tariff barrier according to the US Commercial Guide (2006). Preferential trade agreements have been signed with Malawi (2005) and Zimbabwe (2004). The agreement with Malawi allows duty free treatment to originating imports except for certain products such as beer, branded soft drinks, 7 Minimum Import Definition Equality License ofof FDI chicken, cooking oil, eggs, petroleum products, Investment Restrictions Requirements and sugar and tobacco. The agreement with Treatment Investment Taxes Requirement Zimbabwe covers similar duty-free treatment with exception of beer, manufactured tobacco, branded soft drinks, road motor vehicles, and sugar. Goods entering under these treatments have to pass specific customs posts, and vice versa. There are no import taxes except on sugar and some luxury items. Tariffs and VAT have to be paid. Importers have to be licensed with the National Directorate of Trade which is part of the Ministry of Industry and Commerce. ACCESS AND ADMISSION OF FOREIGN INVESTORS 2 1.6 Foreign Investment & Capital Mobility According to the Law on Investment, Law No. 3/93 of 24 June, article 1, the definition of Foreign Direct Investment (FDI) is the following: “any form of foreign capital contribution valuable in monetary terms which constitutes own equity capital or resources at the own account and risk of the foreign investor, brought from external sources and to be used in an investment project for carrying out an economic activity, through a company registered in Mozambique and operating from Mozambican territory.” The Law on Investment, 1993, guarantees in article 4 equal treatment of foreign investors, employers and workers in terms of rights, obligations and requirements to Mozambican nationals in accordance with Mozambican legislation. An exception specified in paragraph 2applies to cases when projects of nationals may merit special treatment and support by the Government due to their nature of scale of investment. Private investors are free to invest in any economic activity that is not exclusively reserved to the Government or public sector initiative according to Article 11. These areas can be defined by the Council of Ministers and included to a certain degree private investment. Article 6 of the Regulations of the Investment Law, 2009 sets the minimum value for foreign direct investment at MZN 2,500,000.00 (approximately US$ 90,000) for eligibility for external remittance of profits and re-export of invested capital. Furthermore, if an investor satisfies the following requirements, he also qualifies: (a) “Generates an annual sales volume that is not less than three times the amount fixed in the preceding clause 6.1 as from the third year of operations; (b) Registers annual exports of goods or services with a value equivalent to one million five hundred thousand Meticals (1,500,000.00Mts); (c) Creates and maintains from the second year of operations at least twenty five direct employment positions for Mozambican nationals who are registered with the social security system.” Most economic sectors are open to foreign equity ownership with the exception of media and telecommunications. Foreign ownership in media enterprises including TV channels and newspapers is only allowed up to a maximum of 20%. The fixedline telecommunication sector is reserved for public investment and only the Mozambican company Telecomunicações de Moçambique S.A.R.L. is allowed to operate in this sector. 8 Investment project application 1.7 Foreign Investment Establishment, Registering and Licensing Processes The investment project proposal shall be submitted in quadruplicate to CPI or GAZEDA (in case of a special economic zone or industrial free zone) for approval and registration purposes. The application can be in either English or Portuguese language and can also be submitted electronically. Required documents under article 9 of the Regulations of the Investment Law are: Copy of the identification document of each proponent investor; Certificate of company registration or company name reservation certificate for the Project Implementing Company; Topographic plan or drawing of the proposed location for implementation of the project; In case the project is executed by a local branch of a foreign entity, a copy of the Commercial Representation License issued shall also be attached. After reception of the application, CPI or GAZEDA shall review the application thoroughly by consulting with other relevant regulatory institutions and ministries within a period of 7 days. If there is no response from the entity having regulatory oversight of the sector to CPI or GAZEDA, a favourable response and approval is deemed to be given. The different authorisation competencies and time periods for investment project decisions are specified in Article 12 of the Regulations of the Investment Law, 2009, and are the following: 1. “The decision regarding the approval of an investment project received by CPI shall be made by: a) the Governor of the Province, within a maximum period of three (3) business days after the receipt of each proposal, in respect of national investment projects with an investment value not greater than the equivalent of one billion five hundred million Meticals (1,500,000,000.00Mts); b) the General Director of CPI, within a maximum period of three (3) business days after the receipt of each proposal, in respect of foreign and/or national investment projects with an investment value not greater than the equivalent of two billion five hundred million Meticals (2,500,000,000.00Mts); c) the Minister with oversight of Planning and Development matters, within a maximum period of three (3) business days after the receipt of each proposal, in respect of foreign and/or national investment projects with an investment value not greater than the equivalent of thirteen billion five hundred million Meticals (13,500,000,000.00Mts); d) the Council of Ministers, within a maximum period of thirty (30) business days after the receipt of each proposal, for: i) investment projects with an investment value greater than the equivalent of thirteen billion five hundred million Meticals (13,500,000,000.00Mts); ii) investment projects that require a land area greater than ten thousand hectares, to be used for any purpose except for the purpose specified in the following clause 1(d)(iii); iii) investment projects that require a forestry concession area greater than one hundred thousand hectares; iv) any other projects that have foreseeable political, social, economic, financial or environmental impacts that by their nature 9 Business Investment Authorisation Registration should be reviewed and decided by the Council of Ministers, on the proposal of the Minister who has oversight of Planning and Development matters. 2. The General Director of GAZEDA has the competency to approve ZEE and IFZ regime investment projects within a maximum period of three (3) business days after the receipt of each proposal. 3. Taking into account the complexity or political, social or economic implications, the General Directors of CPI and GAZEDA may submit investment project proposals within their respective limits of authority for consideration by the Minister who has oversight of Planning and Development matters.” Upon approval, the authorisation issued shall include a draft ministerial order (Despacho) or Council of Ministers Internal Resolution which contains the specific terms in relation to the respective project. The authorisation shall include: identification of the proponent investors; the project designation and objectives; the name of the implementing company; the location and scope of operations; the value and structuring of the investment; the investment incentives and guarantees; the number of national and foreign persons to be employed; the time limit and terms for the start of the implementation of the project; other specific terms to be included in the authorisation that are relevant given the characteristics of the project. Once the authorisation is issued and the project approved, the implementation shall start within a maximum of 120 days counting from the date of notification of the authorisation, unless a different time period had been fixed in the authorisation. The process for business registration has recently been simplified due to the new Commercial Code, approved by Decree-Law No. 2/2005 of 27 December, and complementary legislation. The process for registration involves now: Checking and reservation of the Company name at the Conservatory of Legal Entities Registration; Agreement on the wording and final documents of the company’s Articles of Association by the shareholders (consider article 92 of the Commercial Code); Recommendation to review the company’s Articles of Association by a professional; Open a bank account for the purpose of depositing the share capital. Necessary documents for that are a certified copy of the company’s name reservation certificate, draft of the Articles of Association of the company, and certified copy of the shareholders identification documents; Formalize the company registration at the Conservatory of Legal Entities Registration by submitting the following documents: Copy of the company name reservation certificate Draft of the company’s Articles of Association Proof of bank deposit of share capital Certified copy of the shareholders’ identification documents. The company registration is effected by the public One-Stop-Shop Bureaus (Balcões de Atendimento Único-BAUs) which have been established in every provincial capital in the country through the Decree No. 14/2007 of 30 May. Once successfully registered, the investor receives an operating license. The Articles of Association have to be published then in the Official Gazette (Boletim da 10 Foreign Business Special BoM Doing Registration Business Licenses Labour Types Evaluation Quotas República), followed by the fiscal registration at the fiscal office to receive a tax registration number (NUIT). Once all that has been successfully done and all other required operation licenses obtained the company can start operating. The new Company Code allows five (5) forms of companies, being LDA (sociedade por quotas) and the SA (sociedade anonima) the most common types of company adopted for setting up business. Companies operating in industrial or commercial activity need to obtain a licence from the Ministry of Industry and Commerce. The Ministry also licenses foreign business representations and foreign trade operators. Other licenses are issued by the authorities of the respective sectors of activity and other entities that supervise the area of activity (tourism, fishery, agriculture and livestock, telecommunication, construction, cargo and passenger transport, health, education, etc). Within a period of 90 days after authorisation of the project, the foreign investor then shall register the foreign direct investment (FDI) with the Bank of Moçambique (BoM). The investor has to submit the deposit receipts (bordereaux) issued by the respective national banking institutions or the documents as confirmed by the customs authorities depending on the nature or form of the respective investment. Funds that are not transferred via the national banking system do not qualify as authorised FDI as part of the investment project. Furthermore, payments abroad do also not qualify as FDI unless the documentary proof is provided that goods of corresponding value have entered into Mozambique. In 2009, requirements for starting a business were still numerous and complicated putting Mozambique on rank 143 in the world (out of 178 countries) for ease of starting a business. Improvements achieved in the licensing process and general facilitation by also reducing the required days and costs involved brought Mozambique’s position up to rank 96 in 2010, out of 183 countries. 1.8 Foreign Employment & Residence The Regulation of the Investment Law, Decree No. 43/2009 states in Article 32 the following on the Immigration regime: 1. Authorised investors and their representatives as well as individual owners of EZETIs in the case of residential tourism projects, together with their spouses and minor children, shall be granted the right of permanent residence provided that compliance with the requirements is duly documented by GAZEDA. 2. Foreign employees contracted to provide services in a ZEE shall be granted temporary residence. 3. A foreign national who holds title to an individual EZETI shall be granted an annual multiple entry tourism visa. 4. Foreign professional consultants such as architects, lawyers, economists shall generate annual gross receipts of not less than one million Meticals from their services in order to be granted the right of permanent residence. 5. Specialists contracted to carry out certain activities within a ZEE shall be granted a short-term temporary residence authorisation. According to the Labour Law adopted in 2007, any employer (national or foreign) who wishes to employ a foreigner needs the authorisation of the Minister of Labour or an agency to which it delegates powers upon application. If the employer employs within the allowed quotas, he may provide a simple communication to the Minister of Labour or the respective agency. 11 DUAT Restrictions and Obligations The maximum numbers of quotas for foreign staff are: in large firms: up to 5% of the total number of workers; in medium firms: up to 8% of the total number of workers; in small firms: up to 10% of the total number of workers. The definition of large company is over 100 employees, medium has 10 to 100 employees, and a small firm consists of 1 to 10 employees. In case that an investment projects approved by the Government stipulates a number of foreign workers greater or lesser than the quota indicated above, no authorization is required. For such case, it is sufficient in such cases to inform the Minister of Labour within 15 days of the arrival of such workers in the country. However, there are restrictions on the hiring and firing of foreign workers. The first requirement is that the foreigner has academic or professional qualifications necessary for the position which no Mozambican citizen has or their number is insufficient. Foreigners entering on diplomatic, courtesy, official, tourism, visitors, students or business visas are not allowed to be employed. Furthermore, foreign workers with a temporary residence may not remain in Mozambique after the contract period has expired on which they entered the country. The contracting of foreign workers by authorization of the Minister of Labour is regulated by Decree No. 57/2003 of 24 December. There is a possibility that this decree may be amended to be made more consistent with the Labour Law. The Decree specifies that the burden to ensure the legality of the foreign worker falls on the employer and that the employer is required to inform the Ministry of Labour when the employment agreement terminates. 1.9 Foreign Investor Access to Land and Property Rights According to the WTO (2008), the regime to land access is still restrictive. The Mozambican constitution, Article 109, reserves ownership rights to the State alone. Foreign and domestic persons can obtain non-transferable usage rights based on the Land Law as adopted in 1997. Land cannot be sold, mortgaged or otherwise alienated. Through the Land Law, the right to use land as conferred by the State is called “Direito de Uso e Aproveitamento de Terra” or “DUAT” (which means literally translated the right to use and enjoyment of Land). A DUAT is guarantees legal possession of a tract of land and represents a formal proof of possession where documented. That enables the State to organize its land cadastre as well. The Land Law provides for three ways in which a DUAT can be acquired as described in the ACIS & GTZ Legal Framework on the Acquisition of Land (p.11): By customary norms and practices - Occupation by individuals and local communities based on customary norms and practices. This means that individuals and local communities can obtain DUAT by occupation based on local traditions, such as inheritance from their ancestors; By good faith occupation – Occupation by individuals who have, in good faith, been using the land for at least ten years. This type of occupation only applies to national citizens; By authorisation of an application presented to the State as established in the land legislation. This is the only type of DUAT applicable for foreign natural and legal persons. A foreigner (as a natural person) may obtain access to land having residence in Mozambique for at least five years. Legal persons must be established or 12 Contacts and Legislative Framework Requirements registered as a company in Mozambique. In both cases foreign individual and corporate persons may be holders of land use rights and benefits, provided that they have an investment project that is duly approved. Application for land use is made to the Cadastre which may grant land on a provisional basis for two years to foreigners and five years to nationals. In the period of operation, an inspection will be conducted to determine whether the land is being used for the purpose specified. If the inspection is positive, a definitive authorization can be granted for 50 years which is renewable for another 50 years. 3 FOREIGN INVESTMENT OPERATIONS 1.10 Employment The legislative framework covering labour and employment consists of: The Constitution of the Republic of 2004; International conventions to which Mozambique is a party; Law No. 23/2007 of 01 August, called the “Labour Law”; Law No. 8/98 of 8 July (the “Law 8/98” in effect until 30 October 2007); Other laws and regulations, some of which predate the Labour Law but remain in effect, others of which are subsequent to the Labour Law and, usually in the form of decrees, that specifically regulate matters in that law; and Sector-specific legislation touching on labour questions. There are generally two types of contracts: indeterminate period contracts and fixed term contracts. ACIS, GTZ (2007) have developed an overview of the different rights and obligations for the two types of contracts (p. 17): Fixed period contract: Maximum duration per contract = 2 years Maximum number of renewals = 2, though small and medium companies may renew them freely during the first 10 years of activity. Days probation = o 90 days for contracts longer than one year; o 30 days for contracts between six months and one year; o 15 for contracts up to six months; o 15 days for fixed period contract for periods uncertain projected to last for 90 days or more. Leave = one day per month in the first year; two days per month in the second year in 30 days per year from the third-year on. Termination = Severance based on time left until end of contract. Indeterminate period contract: Maximum duration = indeterminate Maximum number of contracts = not applicable Days probation = o 90 days for most workers; but o 180 days for medium and higher level technicians and employees in positions of management and direction Leave = one day per month in the first year; two days per month in the second year in 30 days per year from the third-year on 13 Termination = highly variable. See severance tables, below. The severance regime for the employees hired when Law 8/98 was in effect will remain in effect for certain periods in respect of employees with rights vested thereunder. Protection Payment Social Essential Work Dispute Security and of Minimum wages Documentation Resolution Maternity and Paternity Wages are regulates by the Labour Law and by a Ministerial Order which established the minimum wage every year. Every year, the minimum wages are negotiated by the Government, representatives of the private sector and unions in the Labour Consultative Committee. Social Security is governed by articles 256-258 in the Labour Law, Law No. 4/2007 (the “Social Protection Law”) that provides the basis for social security and recognizes the social security system. There is basic, compulsory, and complementary social security. The basic social security is managed by the Ministry. Compulsory social security is authorised by INSS, and the complementary social security falls either under public or private management and is based on regulations as approved by the Council of Ministers. It is a legal requirement to register all employees, weather national or foreign, for social security. In case of a foreign worker being registered in the social security system in their home country, they do not have to be registered in Mozambique (upon proof). The monthly contribution is 7% of a worker’s monthly salary of which the employer covers 4% and the employee 3%. The employer has to withhold both shares and pay the corresponding amount monthly to the INSS until the 10 th of the following month. Employers have to establish a registrar of a number of documents required by the Ministry of Labour. They cover: Individual employee files; List of employees by name; Vacation plan; Internal regulations. The individual employee file has to contain (taken from ACIS, GTZ (2007), p. 52): A copy of the ID document; The employment contract; A copy of the INSS registration card; IRPS (personal income tax code) registration form; Results of medical examinations undertaken when admitted (and monthly ones for employees in the food and beverage sector); The Letter or card issued by the Provincial Labor Department indicating that the employee was unemployed before being hired by the company; Photos; Records of any disciplinary proceedings, or other documents (certificates, training plans etc.). Dispute resolution in the labour field is covered by a combination of laws. In addition to the relevant provisions of the Labour Law (Articles 180-193), dispute resolution is also regulated by the Labour Courts Law, and Law No. 11/99 of 8 July (the “Arbitration Law”). In addition, the Labour Procedure Code (“Código do Processo de Trabalho”), the Civil Procedure Code (“Código do Processo Civil”) and the Civil Code (“Código Civil”) also apply. Law No. 8/98 as well the Labour Law (Law No. 23/2007) grants women workers maternity leave of 60 consecutive days which may begin 20 days before the probable date of birth. If the woman or her child is hospitalized during after the birth of the child, the maternity leave is considered to be suspended for as long as the hospitalization continues. This only applies, however, if the employer is informed about it in a timely manner. In addition, the father has the right to take paternity 14 Health Corporate VAT Environmental Safety DTTs andIncome Impact leave of one day, every two years, and which has to be taken on the day immediately following the birth. The working father wishing to take paternity leave has to inform his employer, in writing, either before or after the birth. The Labour Law of 2007 furthermore regulates employment of minors and handicapped people, working hours and compensation for overtime or special working time, leave regulation, disciplinary measures and procedures, collective bargaining rights and instruments of collective bargaining, and strike procedures. 1.11 Business Taxation The general corporate income tax (IRPC rate) is 32%, except for agriculture and cattle breeding activities which shall benefit from a reduced tax rate of 10% until the 31 December 2015. The standard Value Added Tax (VAT) is 17% and a new system was developed in 2008. VAT is assessed on the c.i.f. customs value for imported goods originally. Exempt from VAT are bread, bicycles, condoms, corn flour, corn, fresh and refrigerates tomatoes, garlic, jet fuel, lamp oil, onion, powdered milk for children, flour, salt, smoked fish, and wheat. Mozambique has 9 Double Taxation Treaties (DTTs) in place (see table below section 5). 1.12 Environment, Physical Planning, Health & Safety, Consumer Protection The Law on Investment prescribes the conduction of Environmental Impact Assessment (EIA) and other relevant studies evaluating any environmental impact, pollution and sanitation concerns that may result from the investment activities in article 26. Responsibility for this lies in the investor as well as then responsibility to undertake appropriate measures for the prevention and minimisation of potential negative effects. Law N⁰20/97, of 1 October, and its regulation, establishes the regime of environmental licensing, based on assessing the environmental impact of activities or undertaking of a particular scale and/or nature. Occupational health and safety is firstly covered by Article 85 of the Constitution, at a second instance by the Labour Law, and finally by a broad body of subordinate legislation which dominantly is of colonial origin. Mozambique is subscribed to the ILO Convention No. 17 which covers compensation for workplace accidents, and ILO Convention No. 18 that stipulates compensation for occupational illnesses. General worker conditions such as the right to a fair wage, rest and vacation, the right to a safe and hygienic work environment is provided under Article 85 of the Constitution. 1.13 Competition Policy & Law In the process of developing a general policy on competition, Mozambique has sought assistance of the Zambian Competition Commission. The policy was developed in 2007 but the regulatory framework was still in discussion and development. 15 The policy targets the possible existence of anti-competitive practices such as the imposition of excessive prices, price discrimination, predatory pricing, refusal to sell or to buy, conditional sales, as well as abuse of dominant positions, agreements between companies designed to reduce the competition in the market, and concentrations that impede competition. Anti-competitive practices are not explicitly subject to remedy, but authorities may exert informal pressure on the enterprises concerned by such a practice. Several independent assessments identified that Mozambique could benefit from a legal competition policy framework seen the rather small market and the high concentration in the production of only few important products. Especially the sugar sector operates as a cartel controlling production and distribution, and, thus, all respective imports and exports. 1.14 PPP- Law on the Public and Private Partnership The Law N⁰ 15/2011, of 10th August, establishes the norms and guidelines of the process of contracting, implementation and monitoring of public private undertakings of large scale projects and business concessions. The main purpose of the PPP Law approval is the establishment of a legal framework which enables, on one hand, an increased involvement of the private partners and investors in private and public partners, large scale projects and business concessions and, on the other hand, an increased efficiency, effectiveness and quality in the exploitation of resources and other national public assets, as well as the efficient supply of goods and services to the society and equitable sharing of the respective benefits. Scope of the PPP Law The present law has the objective of establishing the guiding norms of the process of hiring, implementation and monitoring private and public undertakings (PPP), large scale projects (PGD) and business concessions (CE). Sectorial Responsability PPP, PGP and CE are under the sectorial tutelage of the government entity responsible for the sector or area concerned, and the functions and competences of the sectorial tutelage on PPP, PGP and CE undertakings are complemented by the competences of the respective regulatory body of the sector or subsector. It is up to the regulatory authority, especially in the respective area of sectorial or sub sectorial specialization to ensure the economic and financial equilibrium between the contracting parties, the protection of user’s interests and maintenance and sustainability of the undertaking. Financial Tutelage The financial tutelage of PPP, PGP and CE undertakings is exercised by the government entity that supervises the area of finance, which must, for the purpose, define and establish the mechanisms and procedures of permanent inter institutional articulation with each entity responsible for the sectorial tutelage. It is up to the government to designated and build capacity of the entity responsible for the inter-sectorial coordination and centralization of the economic and financial analysis and evaluation of PPP, PGP and CE undertakings, as well as for the monitoring of an equitable sharing of benefits and prevention of risks in the referred undertakings. Legal framework of PPP contracting 16 Foreign Exchange The general legal regime of the contracting of PPP undertakings is that of public tender, applying the rules that govern public contracting. Considering the public interest and with all the legal requisites met, the PPP contracting can follow the tender modality with prior qualification or tender in two stages. The proposals of PPP undertakings of private initiative are subject to public bidding aimed at ascertaining the adequacy of the technical terms and quality, price and other conditions offered by the proponent, with the enjoyment of the right and 15% margin of preference in the evaluation of the technical and financial proposals resulting from the tender and without the right to compensation for the costs incurred in the proposal preparation. Contract The awarding of the PPP undertaking follows one of the following contractual modalities: Concession contract; Exploration cessation contract; Management contract; The concession contract can assume one of the following concession submodalities: Operate and Transfer; Design Build, Operate & Transfer; Build, Own, Operate and Transfer; DBOOT-Design, Build, Own, Operate and Transfer; Rehabilitate, Operate and Transfer; or Rehabilitate; Operate, Own and Transfer 1.15 Monetary Policy, Foreign Exchange and Foreign Investors The Bank of Mozambique (Banco de Mocambique, BoM) is operating as Central Bank since its establishment in 1992. In June 2007, the BoM’s Monetary Policy Committee was established which is now meeting monthly to discuss and provide statements to the public in an effort for more transparency. End of 2008, the currency was changed to the New Mozambican Metical which eliminated 3 digits of the old currency. According to Law No. 11/2009 of 11 March, all foreign exchange operations have to be registered and authorised by BoM. Residents are allowed to hold foreign exchange accounts in Mozambique and abroad. Repatriation of net profits and dividends is also subject to authorisation by BoM. Article 14 of the Law on Investment guarantees the remittance of funds abroad in connection with: Exportable profits resulting from investments eligible for export of profits under the regulations of the Law; Royalties and other payments for remuneration of indirect investments that are associated to the granting and transfer of technology; Amortization of loans and payment of interest on loans that are contracted in the international financial market and apply to the respective investment projects; Proceeds of any compensation paid in case of nationalisation or expropriation; Invested and re-exportable foreign capital, independently of eligibility of the investment project to export profits under the regulations of the Law. 17 Industrial Property IPI All remittances have firstly to satisfy national tax obligations and exchange formalities. The regulations of the Investment Law approved by Decree No. 43/2009, of 21 August specify further in Article 34, that all external remittance of profits and dividends is subject to the prior authorisation of the BoM and have been previously registered with the Central Bank. Repatriation of capital is permitted taken into account the provisions of specialised legislation. 1.16 Public Procurement The Decree 54/2005 of 13 December which is also known as the Procurement Regulation was introduced in 2005 and replaced by the Decree No. 15/2010 of 24 May which is regulating the contracting of public works, supply of goods and provision of services to the State. It enabled a streamlining of procedures that had previously been subject of various, and at times overlapping, pieces of legislation. State procurement is now centralized in the Ministries of Finance and Public Works and is in line with international norms and standards. All public works, goods and services procured by the government at all levels (national, provincial, district and municipal as well as companies in which the State holds 100% of the capital, and where the financial activities of any of the aforementioned entities are linked to the State budget) as well as procurement undertaken using funds from donor governments has to be undertaken in accordance with the requirements provided in the Regulation. It furthermore regulates consultancies and concessions. The responsibility for the oversight of the Procurement regulations has the Unit for the Supervision of Acquisitions (Unidade Funcional de Supervisão das Aquisições – UFSA). The Regulation requires in article 4 the adhesion to a number of principles such as legality, public interest, transparency, openness, equality, competitiveness, impartiality and sound financial management. The procurement processes have to be decentralized wherever possible and must strive for optimise the benefits of procurement like through collective purchasing. Contracts are open to nationals as well as foreign bidders meeting the requirements as set out in Decree No. 15/2010 of 24 May. In addition to the Procurement Regulation, the Anti-Corruption law (Law 6/2004 of 17 June) is of importance in the process of fair procurement. 1.17 Intellectual Property The industrial property regime in Mozambique is administered by the Instituto da Propriedade Industrial (IPI) since May 2004. IPI is a self-financing autonomous agency that operates under the technical responsibility of the Ministry of Commerce and Industry. The copyright regime, however, is administered by the National Institute of Books and Recordings (INLD), which is a division of the Ministry of Culture. Industrial Property is regulated under Decree No.4/2006 of 12 April. It covers patents; utility models; industrial designs; marks; trade names and insignia of establishments; appellations of origin and geographical indications; and logos, accompanied in each case by a term of protection. The industrial property titles have to be published in the Industrial Property Bulletin. The law also provides for a compulsory licence which can be issued by the Minister of Industry and Commerce which can be done for public interest and without the 18 Regional Copyright Law International on Investment and consent of the proprietor but with adequate related rights 1993 remuneration. The first and only such license was issued for the manufacture of antiretrovirals (ARVs) in 2004. The General Inspectorate of the Ministry of Industry and Commerce is responsible for the supervision of industrial property rights, in consultation with IPI. The existing copyright regime with the Law No. 4/2001 of 27 February was adopted in 2001 and covers artistic, literary, scientific work, and computer programs explicitly identified as literary work. The term of copyright protection covers the life of the author plus 70 years, a term of 50 years for performers’ rights and sound recordings, and 25 years for broadcast programmes. Mozambique recognised industrial property titles as secured through the regional authorization ARIPO. IPI is also the relevant institution for applications under the Patent Cooperation Treaty and for applications for international registration for marks under the Madrid Agreement. Mozambique is member of the World Intellectual Property Organization (WIPO) since December 1996. In addition, it has signed the Paris Convention for the Protection of Industrial Property, the Madrid Agreement (International Registration of Marks), and the Madrid Protocol in 1998. Mozambique also acceded the Patent Cooperation Treaty (PCT) in May 2000 and the Nice Agreement (Classification of Goods and Services) in 2002. Since May 2000, Mozambique has furthermore been a member of ARIPO (African Regional Intellectual Property Organisation). 1.18 Investment Protection and Dispute Settlement Article 13 of the Law on Investment, 1993, states the following concerning the protection of property rights. “1. The Government of Mozambique shall guarantee the security and legal protection of property on goods and rights, including industrial property rights, comprised in the approved investments carried out in accordance with this Law and its Regulations. 2. When deemed absolutely necessary for weighty reasons of national interest or public health and order, the nationalization or expropriation of goods and rights comprised in an approved and realised investment under this Law shall be entitled to just and equitable compensation. 3. In the event of any complaint submitted by an investor under the terms regulated by the Council of Ministers not being resolved within a period of ninety (90) days, and when such fact has led the investor to incur in financial losses on the invested capital, the said investor shall have the right to a just and equitable compensation for such losses incurred and which are of evident responsibility of Government institutions. 4. For the purpose of determining the value of compensation or remuneration to be paid under paragraphs 1 and 2 of this Article, the evaluation of goods and/or rights nationalised or expropriated, including financial losses suffered by an investor which are of evident responsibility of Government institutions, will be carried out within ninety (90) days by a team especially appointed or by an auditing company of recognised expertise and competence. 5. The payment of the compensation or remuneration referred to in the preceding paragraphs of this Article shall take place within ninety (90) days counted from the date of acceptance by the competent Government authority. The time for assessment for decision making on the evaluation made and submitted to the competent Government authority shall not exceed forty-five 19 US market Dispute MIGA Regional Arbitration Settlement access (45) days counted from the date on which the Agreements evaluation dossier was submitted and received.” Mozambique is member of the Multilateral Investment Guarantee Agency (MIGA) which offers investor guarantees for non-commercial risks. In case of disputes on the interpretation and application of the Investment Law which cannot be resolved on a friendly basis or by negotiation shall be submitted to the judicial authorities according to Article 25 of the Law on Investment. Disputes between then foreign investor and the Government that cannot be resolved by national jurisdiction is then entitled to resolution through international arbitration such as: The rules of the International Convention for the Settlement of Investment Disputes (ICSID); The ICSID Additional Facility in case the investor does not fulfil the requirements of Article 25 of the ICSID Convention, or The rules of arbitration of the International Chamber of Commerce which is based in Paris. Furthermore, the Centre for Arbitration, Mediation and Conciliation (CAMC) was created in 2002 and provides dispute resolution services to individuals on commercial maters. 1.19 International Agreements and Obligations – Trade and other Agreements, BITs, DTTs Mozambique is member of the WTO and recognized as Least Developed Country (LDC). As such, it qualifies for preferential market access to the EU under the Everything But Arms (EBA) Initiative. Mozambique is in the SADC group for EPA negotiations with the EC. Mozambique is member of the World Customs Organisation (WCO). Mozambique is a founding member of the African Union (AU) and is part of the New Partnership for Africa’s Development (NEPAD). In 2004, it joined the NEPAD African Peer Review Mechanism (APRM), a self-monitoring mechanism adopted by member countries to enhance good governance and the exchange of experience. The first review is still to come. Agreements with the US contain the AGOA and its Generalised System of Preferences (GSP) for quota-free and duty-free access to the US market, and the Trade and Investment Framework Agreement (TIFA) on bilateral consultation on trade and investment matters. Furthermore, Mozambique qualifies for support of the Millennium Challenge Corporation which is operating project funding as Millennium Challenge Account (MCA) since 2009. 4 SADC RELATED ISSUES Mozambique is one of the founding members of SADC when it was first establish in 1992 as Southern African Development Coordination Conference (SADCC). The Regional Indicative Strategic Development Plan (RISDP) entails clustering of national programmes in key areas to promote integrated national policy-making. Under this integrated focus, Mozambique started to develop “corridors”. In terms of trade, Mozambique plays a significant role for its land-locked neighbour states 20 Zimbabwe, Zambia and Malawi. The port of Beira is an important access for both Zimbabwe and Zambia, Nacala port in the North of Mozambique for Malawi and Zambia. Important infrastructure improvement projects have recently been launched by the ministers of Zambia, Malawi and Mozambique developing transport corridors from the respective ports. The 2008 WTO Trade Policy Review acknowledges that Mozambique aims to deepen trade and investment ties with partners in the SADC region through the Regional Indicative Strategic Development Plan (RISDP). 21 Double Taxation Bilateral Investment Treaties Agreements Bilateral Investment Treaties with Mozambique as of 1 June 2010 Partner Country Date of signature Date of Entry into force 1 Algeria 12-Dec-98 25-Jul-00 2 Belgium and 18-Jul-06 01-Sep-09 Luxembourg 3 China 10-Jul-01 26-Feb-02 4 Cuba 20-Oct-01 26-Feb-02 5 Denmark 12-Oct-02 30-Dec-02 6 Egypt 08-Dec-98 25-Jul-00 7 Finland 03-Sep-04 21-Sep-05 8 France 15-Nov-02 06-Jul-06 9 Germany 06-Mar-02 15-Sep-07 10 India 19-Feb-09 11 Indonesia 26-Mar-99 25-Jul-00 12 Italy 14-Dec-98 17-Nov-03 13 Mauritius 14-Feb-97 26-May-03 14 Netherlands 18-Dec-01 01-Sep-04 15 Portugal 28-May-96 31-Oct-98 16 South Africa 06-May-97 28-Jul-98 17 Sweden 23-Oct-01 01-Nov-07 18 Switzerland 29-Nov-02 17-Feb-04 19 United Arab Emirates 24-Sep-03 20 United Kingdom 18-Mar-04 12-May-04 21 United States 01-Dec-98 03-Mar-05 22 Vietnam 16-Jan-07 29-May-07 23 Zimbabwe 12-Sep-90 24 Spain 18-Oct-10 Double Taxation Agreements with Mozambique as of 1 May 2012 Partner Country Type of Agreement Date of Signature 1 Mauritius Income and Capital 14-Feb-97 2 Portugal Income and Capital 21-Mar-91 3 South Africa Income 18-Sep-07 4 United Arab Emirates Unspecified 24-Sep-03 5 Macau Income and Capital 15-June-07 6 Botswana Income and Capital 27-Sep-09 7 India Income and Capital 30-Sep-10 8 Vietname Income and Capital 03-Sep-10 9 Italy Income and Capital 14-Dec-98 Sources included ACIS, SAL & Caldeira & GTZ (APSP) (2007) Legal Framework: For Employment in Mozambique, Edition I, September 2007 ACIS, Ministry of Finance of Mozambique & GTZ (APSP) (2008) Legal Framework: For Procuremoent of Public Works, Goods and Services by the Government of Mozambique; Edition I, August 2008 CPI (2010) website including all revelant information 22 CUTS International (2006) Competition Regimes in the World – A Civil Society Report Government of Mozambique: Diverse legislation ICC (2001) An Investment Guide to Mozambique: Opportunities and Conditions, June 2001 UNCTAD (2010) Bilateral Investment Treaties and Double Taxation Treaties, http://www.unctad.org/Templates/Page.asp?intItemID=4505&lang=1 World Bank (2010) Doing Business Report 2010, www.doingbusiness.org/ World Bank (2010) Investing Across Bordern 2010: Indicators of foreign direct investment regulation in 87 economies, http://iab.worldbank.org WTO (2008) Trade Policy Review, Mozambique, Report by the Secretariat, http://www.wto.org/english/tratop_e/tpr_e/tp309_e.htm 23