FINA351 – Managerial Finance, Chapter 11, (Ref. 11b)

advertisement

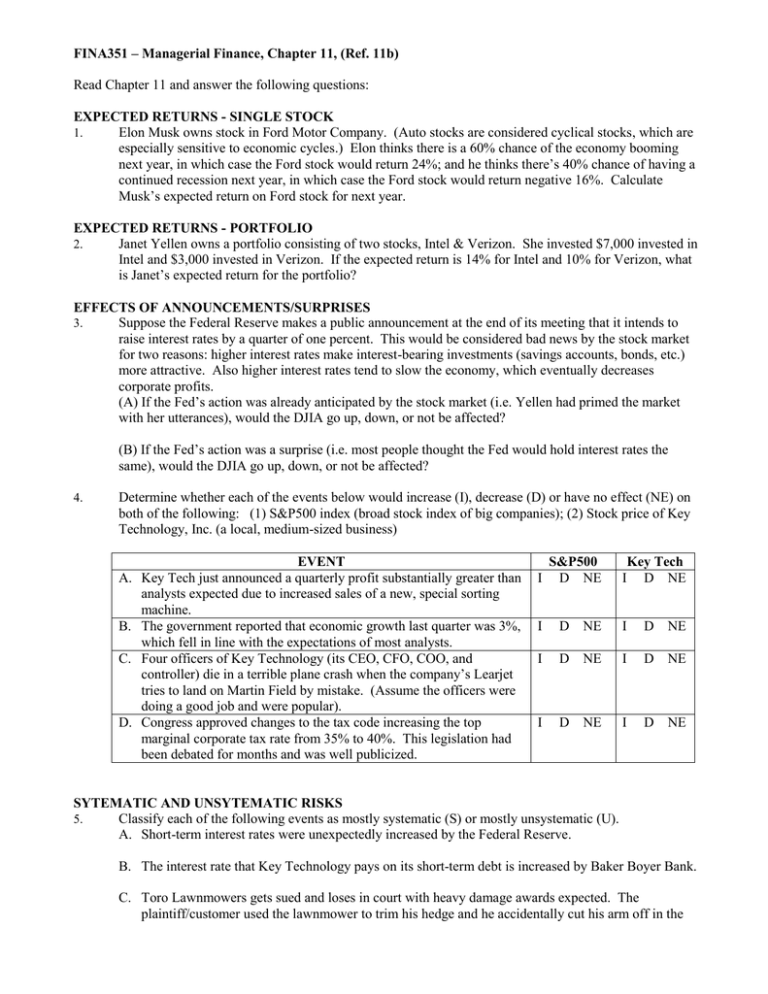

FINA351 – Managerial Finance, Chapter 11, (Ref. 11b) Read Chapter 11 and answer the following questions: EXPECTED RETURNS - SINGLE STOCK 1. Elon Musk owns stock in Ford Motor Company. (Auto stocks are considered cyclical stocks, which are especially sensitive to economic cycles.) Elon thinks there is a 60% chance of the economy booming next year, in which case the Ford stock would return 24%; and he thinks there’s 40% chance of having a continued recession next year, in which case the Ford stock would return negative 16%. Calculate Musk’s expected return on Ford stock for next year. EXPECTED RETURNS - PORTFOLIO 2. Janet Yellen owns a portfolio consisting of two stocks, Intel & Verizon. She invested $7,000 invested in Intel and $3,000 invested in Verizon. If the expected return is 14% for Intel and 10% for Verizon, what is Janet’s expected return for the portfolio? EFFECTS OF ANNOUNCEMENTS/SURPRISES 3. Suppose the Federal Reserve makes a public announcement at the end of its meeting that it intends to raise interest rates by a quarter of one percent. This would be considered bad news by the stock market for two reasons: higher interest rates make interest-bearing investments (savings accounts, bonds, etc.) more attractive. Also higher interest rates tend to slow the economy, which eventually decreases corporate profits. (A) If the Fed’s action was already anticipated by the stock market (i.e. Yellen had primed the market with her utterances), would the DJIA go up, down, or not be affected? (B) If the Fed’s action was a surprise (i.e. most people thought the Fed would hold interest rates the same), would the DJIA go up, down, or not be affected? 4. Determine whether each of the events below would increase (I), decrease (D) or have no effect (NE) on both of the following: (1) S&P500 index (broad stock index of big companies); (2) Stock price of Key Technology, Inc. (a local, medium-sized business) A. B. C. D. EVENT Key Tech just announced a quarterly profit substantially greater than analysts expected due to increased sales of a new, special sorting machine. The government reported that economic growth last quarter was 3%, which fell in line with the expectations of most analysts. Four officers of Key Technology (its CEO, CFO, COO, and controller) die in a terrible plane crash when the company’s Learjet tries to land on Martin Field by mistake. (Assume the officers were doing a good job and were popular). Congress approved changes to the tax code increasing the top marginal corporate tax rate from 35% to 40%. This legislation had been debated for months and was well publicized. S&P500 I D NE Key Tech I D NE I D NE I D NE I D NE I D NE I D NE I D NE SYTEMATIC AND UNSYTEMATIC RISKS 5. Classify each of the following events as mostly systematic (S) or mostly unsystematic (U). A. Short-term interest rates were unexpectedly increased by the Federal Reserve. B. The interest rate that Key Technology pays on its short-term debt is increased by Baker Boyer Bank. C. Toro Lawnmowers gets sued and loses in court with heavy damage awards expected. The plaintiff/customer used the lawnmower to trim his hedge and he accidentally cut his arm off in the process. He sued on the basis that Toro did not warn its customers that lawnmowers were not meant to trim hedges. D. The Supreme Court substantially broadens product liability for injuries suffered by product users. E. Oil prices around the world unexpectedly rise significantly. F. Exxon Valdez III ship wrecks off the Oregon Coast and spills oil all over the beaches and birds. THE EFFECTS OF DIVERSIFICATION & ETHICAL ISSUES 6. T or F: If unsystematic risk can be diversified away, then systematic risk is the only risk that a large portfolio manager must deal with. (Note: The portfolio is large but the manager may not be.) 7. T or F: By the time there are ten different stocks in a portfolio, most of the benefit of diversification has been realized; and by the time there are 30 stocks, there is little benefit remaining from diversification. 8. T or F: Although international diversification should reduce the standard deviation of a portfolio to some degree, the effect of international diversification is becoming less pronounced as markets become more globalized. 9. Mutual funds are obviously the most convenient way to diversify investment holdings. For example, if you put $2000 into an S&P500 fund, your investment would automatically be split 500 ways. This may cause an ethical dilemma for some people because a portion of investment might be in companies such as Altria Group (Phillip Morris-cigarettes), Boston Beer, or MGM (gambling). One way to solve this dilemma is to used screened-funds that block out sin stocks. Questions: (A) How do you personally feel about investing in a mutual fund that includes some “sin” stocks (e.g. companies promoting alcohol, tobacco, gambling, or whatever)? (B) Does it make any difference to you that only a tiny fraction of your money may be invested in such stocks or is it the principle that counts? (C) Many food companies (e.g. Post, Nabisco, Kraft, etc.) are, or have been, owned by tobacco companies. Suppose you opposed tobacco of any kind because it kills people. How would you rank the following actions from high support for tobacco to low support? a-- buy shares in a mutual fund, a small portion of which holds stock in tobacco companies b-- buy a pack of cigarettes c-- directly buy stock of a tobacco company d-- buy food from a food company that is owned by a tobacco company 10. George Soros is one of the wealthiest people in the world. He made his money in financial market speculation (e.g. he netted $1.1 billion in one day on Sept. 16, 1992, called Black Wednesday, by speculating in British Pounds). According to Soros, choosing particular stocks (e.g. tobacco stocks) is an amoral decision (i.e. morals do not play a part). He says that when small-time investors (like you and me) buy or sell a stock, it doesn’t change the price of the stock. If you didn’t buy or sell, someone else would, and so you really have no impact. This is how efficient markets work. They are amoral. As long as you are an anonymous investor, you can’t change the outcome. If you become a public figure who can influence masses of people, or you make extremely large trades, then the situation may change. But as a small-time private investor, you can’t change the outcome. For example, suppose you oppose tobacco so you avoid tobacco stocks. The tobacco companies will have no trouble raising capital without you. So, according to Soros, your little moral protest really has no effect on anything and is silly. Do you agree with Soros? Why or why not? SYTEMATIC RISK AND BETA 11. T or F: If you were rich enough to include in your investment portfolio one share of every single stock traded in the U.S. market, your stock portfolio would have beta of zero. 12. If the S&P500, which measures the overall market, moved up by 10%, what percent movement and direction (e.g. up by 10%) would each stock below have: A. A stock with a beta of -1 B. A stock with a beta of 2 C. A stock with a beta of 1 D. A stock with a beta of .5 E. A stock with a beta of 0 13. (A) Which of the following do you think would have a higher beta over the last few years and why? (1) General Mills (GIS), maker of cereals, yogurt, soup, dry/frozen dinners/deserts, baking products, frozen pizzas, snacks, etc. or (2) Vanda Pharmaceuticals (VNDA), a highly volatile biotech company whose fortunes rise and fall with FDA approval or not. (B) Look up the betas for these two companies at http://finance.yahoo.com (enter the ticker and find the beta in the summary quote). Was your intuition correct? 14. Refer to Table 11.8 in your textbook(reproduced here). Suppose you managed a $50,000 equity mutual fund consisting of the following: $15,000 invested in eBay, $10,000 invested in Apple stock, and $25,000 invested in Costco. Use the betas listed in Table 11.8 to calculate the portfolio beta. Table 11.8 THE SECURITY MARKET LINE (Capital Asset Pricing Model) 15. T or F: The Security Market Line (SML) is the same line that was on the risk-return graph discussed in Ch. 10 (see Ch. 10 notes). 16. Read the blip at the end of this document about the origins of the Capital Asset Pricing Model (CAPM). (A) T or F: A Nobel Prize in Economics was awarded to William F. Sharpe in 1990 for the CAPM. (B) T or F: The main purpose of the CAPM is that it helps measure the return an investor should expect given a certain level of risk. 17. Use the CAPM to calculate the following: A. A stock has a beta of 1.2, the expected return on the market is 17%, and the T-bill rate is 8%. Calculate the justified expected return on this stock. B. Stock M has a beta of 1.4 and an expected return of 25%, while Stock N has a beta of .85 and an expected return of 12%. The T-bill rate is 6% and the expected return on the market is 16.3%. Which of these two stocks is the better investment, given its risk? In other words, which stock has the highest reward-to-risk ratio? 18. The chart below summarizes the famous work of Nobel Prize winner Harry Marowitz. According to the chart, what is the effect of mixing stocks and bonds in your investment portfolio (as opposed to exclusively stocks or bonds)? ORIGINS OF THE CAPITAL ASSET PRICING MODEL Modern Portfolio Theory was not yet adolescent in 1960 when William F. Sharpe, a 26-year-old researcher at the RAND Corporation, a think tank in Los Angeles, introduced himself to a fellow economist named Harry Markowitz. Neither of them knew it then, but that casual knock on Markowitz's office door would forever change how investors valued securities. Sharpe, then a Ph.D. candidate at the University of California-Los Angeles, needed a doctoral dissertation topic. He had read "Portfolio Selection," Markowitz's seminal work on risk and return—first published in 1952 and updated in 1959—that presented a so-called efficient frontier of optimal investment. While advocating a diversified portfolio to reduce risk, Markowitz stopped short of developing a practical means to assess how various holdings operate together, or correlate, though the question had occurred to him. Sharpe accepted Markowitz’s suggestion that he investigate Portfolio Theory as a thesis project. By connecting a portfolio to a single risk factor, he greatly simplified Markowitz’s work. Sharpe has committed himself ever since to making William Sharpe finance more accessible to both professionals and individuals. From this research, Sharpe independently developed a heretical notion of investment risk and reward, a sophisticated reasoning that has become known as the Capital Asset Pricing Model, or the CAPM. The CAPM rattled investment professionals in the 1960s, and its commanding importance still reverberates today. In 1990, Sharpe's role in developing the CAPM was recognized by the Nobel Prize committee. Sharpe shared the Nobel Memorial Prize in Economic Sciences that year with Markowitz and Merton Miller, the University of Chicago economist. Every investment carries two distinct risks, the CAPM explains. One is the risk of being in the market, which Sharpe called systematic risk. This risk, later dubbed "beta," cannot be diversified away. The other—unsystematic risk—is specific to a company's fortunes. Since this uncertainty can be mitigated through appropriate diversification, Sharpe figured that a portfolio's expected return hinges solely on its beta—its relationship to the overall market. The CAPM helps measure portfolio risk and the return an investor can expect for taking that risk. Nearly four decades have passed since the CAPM's introduction, and Sharpe has not stood still. A professor of finance at the Stanford University Graduate School of Business since 1970, he has crafted several financial tools that portfolio managers and individuals use routinely to better comprehend investment risk, including returns-based style analysis, which assists investors in determining whether a portfolio manager is sticking to his stated investment objective. The Sharpe ratio evaluates the level of risk a fund accepts vs. the return it delivers. Sharpe’s latest project is characteristically ambitious, combining his desire to educate a mass audience about risk with his longtime love of computers. Technology is democratizing finance, and Sharpe is helping to push this powerful revolution forward. Through a venture called Financial Engines, Sharpe and his partners bring professional investment advice and analysis to individuals over the Internet. Note: The Sharpe Ratio (named after William F. Sharpe) is similar to the reward-to-risk ratio discussed in your chapter, except the risk denominator is measured by standard deviation rather than beta. The higher the Sharpe Ratio, the greater the reward per unit of risk.