ACCT350, Assign. 7g&h, Endowments

advertisement

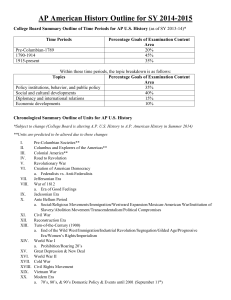

ACCT350, Assign. 7g&h, Endowments 1. Refer to the instructor notes on endowments for Ch. 7. (A) Explain the difference between the three types of endowments. (B) What is an endowed chair and how do endowed chairs aid an academic department? (C) In the history of endowed chairs, give two early examples. (D) T or F: The WWU School of Business will eventually have an endowed chair worth several million dollars. (E) What is the difference between a scholarship and fellowship? (F) T or F: All states, including Washington, have now adopted UPMIFA. (G) What is the major change of UPMIFA over UMIFA? What is the major impact of UPMIFA on nonprofits? (H) T or F: Since UPMIFA is effective in Washington State, it overrides any restrictions/provisions made by donors on how to spend endowment earnings. (I) What are the main criticisms of endowments? 2. Refer to the table linked below or see the link on the course webpage. http://www.nacubo.org/Documents/EndowmentFiles/2015_NCSE_Endowment_Market_Values.pdf For each organization listed below, state the latest endowment value and the percentage change in value from the previous year: (Hint: you can use the search function in the pdf file). (A) Harvard University (B) Whitman College (C) University of Washington (D) Pacific Union College (sister school in California) (E) Walla Walla University (F ) What was the average percentage change for all endowments listed? How does WWU’s return compare? 3. (A) Refer to the endowment size rankings in the previous question and the information below to calculate the average endowment per student. In addition, if the endowment earns 10% a year on average, determine how much endowment earnings each school has available to spend every year on one student. (1) Harvard University, which has about 21,000 students. (2) Whitman College, which has about 1,500 students. (3) Walla Walla University, which has about 1800 students. (B) Refer to https://www.insidehighered.com/news/2016/02/16/congress-returns-scrutiny-wealthy-universityendowments. Why are many government circles critical of schools with huge endowments, such as Harvard? Do you agree with these criticisms? 4. Refer to the end of the instructor notes where it has endowment information excerpted from the WWU’s latest audited financial statements. (A) When did WWU adopt UPMIFA? (B) T or F: For the latest year, endowment investment return exceeded the amount of endowment assets appropriated for expenditure. (C) What is WWU’s endowment spending rate? (D) What is WWU’s anticipated future endowment earnings rate? Do you think rate is reasonable? (E) For the latest decade, what was the average WWU endowment earnings? What was the average inflation rate? Would a 4% spending rate allow WWU to grow its endowment principal by more than the inflation rate? (F) T or F: WWU has no underwater endowments at the end of the latest year. (G) If WWU receives $4 million in subsidy every year from the North Pacific Union Conference of SDA, about what amount of off-balance sheet endowment principal does this equate to, assuming a spending rate of 4%? 5. Refer to the instructor notes on endowment accounting. Suppose a scholarship endowment of $100,000 is created for WWU accounting students by Ann Alumna, a 1975 accounting grad. Ann specified that 3% of the beginning endowment balance must be added to principal each year in order to maintain the earnings power of the endowment against inflation. Ann also specified that the rest of the earnings are to be spent on scholarships to female, junior accounting majors. (A) If the endowment increased in value during the first year by 6% of beginning assets, and half of that increase was spent on scholarships, what was the endowment balance at the end of the first year in each of the three classes of net assets: unrestricted, temporarily restricted, and permanently restricted? (B) If the endowment decreased in value during the second year by 10% of beginning year assets, and yet 3% of beginning year assets was added to principal, and 4% was spent on scholarships, what was the endowment balance at the end of the first year in each of the three classes of net assets: unrestricted, temporarily restricted, and permanently restricted? New Era Scam 6. Not-for-profits seem particularly vulnerable to scams and fraud. Read the story of Albert Meyer and the New Era scam in the first article listed below. In addition, refer to the other articles below as needed. Complete the following: (A) Prepare a brief summary of the story. (B) How did this scandal affect nonprofits in terms of damage? (C) What eventually happened to John Bennett? (D) Do you think NFPs are particular susceptible to scams and fraud? Why or why not? (E) What did you learn from this story? How A Teacher Exposed New Era He Returns To A Quiet Life After Seeing Through The Huge Charity Scam. By Jeff Gammage, INQUIRER STAFF WRITER POSTED: SEPTEMBER 24, 1997 ELKHART, Ind. — These days Albert Meyer works in a small office in a downtown bank building, picking stocks for millionaire investors. You might not know him. John G. Bennett Jr. probably does. And if he doesn't, he has the next 12 years to think about it. It was Meyer, then an unknown accounting teacher at an obscure Christian college in the Michigan farmlands, who alerted the world two years ago that Bennett's Foundation for New Era Philanthropy had fraudulently collected millions of dollars on the promise of a double-your-money return. This week, as a Philadelphia judge sentenced Bennett to prison, Meyer went home to his wife and children, resuming a quiet life, as he puts it, ``in some little town in Indiana.'' Helping expose the biggest charity scam in U.S. history hasn't brought him fame or fortune. It hasn't even brought Meyer, a South African national, the right to live in this country on a permanent basis. ``Things haven't turned out all that great for us,'' Meyer said in his office at Martin Capital Management in the KeyBank building here. His immigration status is no small concern. He is faced always with the possibility of having to uproot his wife and his thoroughly Americanized sons and return to Africa. It weighs on him, more than any repercussions from the New Era affair. When asked if he's proud of himself, of the two years of perseverance that ultimately led to New Era's collapse, he betrays no sense of achievement, no satisfaction at having been right when everyone else was wrong. Asked to name his greatest achievement, he talks about students of his who passed the CPA exam on their first try. ``I'm just an average person with a little common sense,'' he said. ``I never for one minute thought I would get any credit.'' Meyer, who is in his 40s, has heard the term ``whistleblower'' applied to him and doesn't think it fits. He was an outsider, not an insider who broke ranks. He didn't know John Bennett. In fact, Meyer spoke to Bennett only once, when his threat to post New Era's financial reports on the Internet brought a quick response from the foundation's Radnor offices. Bennett - as he was sentenced Monday on 82 counts of money-laundering, fraud and tax violations for a scheme that bilked hundreds of universities, museums and charities out of millions of dollars - said he had meant no harm. ``I never intended to defraud or to hurt anyone,'' Bennett tearfully told the court, saying he operated under a hallucinogenic drive to ``change the world for the glory of God.'' `VERY CUNNING' Meyer doesn't buy it. He says Bennett got what he deserved. ``I think Bennett was very cunning,'' Meyer said, pulling out correspondence in which Bennett showed a solid grasp of dates and detail. ``In one way I feel sorry for the guy, but in another way, to say you had this benefactor who never existed, that's a lie. He misrepresented himself, which is what a fraud is. And he damaged careers and he damaged reputations.'' Meyer's role in New Era's downfall began inauspiciously. He and his wife, devout Baptists, had moved to Michigan so he could teach accounting at Spring Arbor College. Meyer also worked part time in the business office, balancing the college's books. While doing that work, he noticed a $294,000 transfer to the Heritage of Values Foundation. The name reminded him of the Heritage USA theme park run by televangelist Jim Bakker. Meyer questioned the payment. He said Janet Tjepkema, the vice president for business affairs, told him Heritage of Values was connected to a consultant who had introduced the college to New Era, for which the money was ultimately earmarked. GROWING ANNOYANCE The accounting teacher began studying New Era, to the growing annoyance of his superiors. College president Allen Carden sent faculty members a letter endorsing ``healthy skepticism'' about college matters but warning that ``crusading zeal'' could be counterproductive. Meyer worried that, as an untenured foreigner on a temporary work visa, he might be fired and kicked out of the country. At one point, he thought he had persuaded the college to avoid New Era; the school hesitated on a $1 million investment. Two days later administrators sent the money - part of a $1.5 million payment, a considerable sum for a school with a $6 million endowment. ``I was crushed,'' Meyer said. He decided that if he couldn't protect the college, he would protect others - that's what certified public accountant means, he said, public accountant. In one two-month period he made 155 phone calls, contacting New Era investors, the Internal Revenue Service, the American Institute of Certified Public Accountants, the Brookings Institution, the Christian Coalition, the Wall Street Journal, The Philadelphia Inquirer, and the office of Chuck Colson, the Watergate felon turned preacher, to name a few. It was his 1995 letter to the Securities and Exchange Commission that prompted the investigation that led to New Era's demise. Today Meyer says - without a trace of irony or conceit - that his efforts were a fight for truth and justice. ``I'm a guest in this country, and I didn't want to rock the boat,'' Meyer said. ``But I could never have looked my colleagues in the eye if I just said, `Ah well, let it go.' . . . We have to be truthful.'' Meyer speaks of accountants as if they have the potential to be superheroes, people whose impartiality and integrity make them ``a powerful force in America.'' But he also wonders, how could so many accountants have missed the fact that New Era was a classic Ponzi scheme, paying early participants with money collected from later ones? Meyer left Spring Arbor College just over a year ago. There was no pressure to go, he said. College president Carden even sent him a letter calling his actions ``heroic.'' But some people there considered him ``a bit of a traitor.'' And, most of all, he left because the state refused to grant him certification as an accountant. The problem is that he's a chartered accountant, the United Kingdom's equivalent of a CPA. And for that reason, despite his having passed the CPA exam, the state refused to grant him certification, saying he lacked the requisite experience. Meyer felt he couldn't stand before students and extol a profession to which he was denied entry. So he joined Martin Capital Management, an eight-person firm that invests money for clients worth at least $2 million. His job is to roam among profiles of 8,000 companies, evaluating their potential. ``I don't feel like a victim,'' he said of his move from accounting. ``I really tried to represent the profession.'' Foundation for New Era Philanthropy The Foundation for New Era Philanthropy was a notorious Ponzi scheme that operated from 1989 until its collapse in 1995 after having raised over $500 million from 1100 donors and embezzled $135 million of this. Most of the money was stolen from Christian religious organizations and charities in the Philadelphia, Pennsylvania area. The scheme was publicly discovered by an accounting teacher at a college in Michigan and by the auditing firm Coopers & Lybrand working with its client, a local religious college in Los Angeles who suffered no loss in its participation. Origin The Foundation was founded by John G. Bennett Jr., a Philadelphia-area Christian businessman who had previously run a variety of different entities, including some Pennsylvania state drug education centers and a corporate training business. In 1989, Bennett invited several friends to become "beneficiary donors" in a new organization he was founding. They were told that if they contributed at least $5000 for three months, he would double it. He explained that he had identified secret donors who would match charitable contributions raised by his friends. So rather than donating $5000 to charity, a sponsor gave the money to New Era Philanthropy for three months, then he or she could donate $10,000. His friends obliged by giving him various amounts, which Bennett used to pay his bills. He was able to pay them their doubled funds in January of 1990 by tapping a payment made to a consulting business he ran on the side. This was the last "real" income paid to investors. To have funds ready to pay off the climbing number of deposits, he increased the minimum "contribution" to $25,000 and lengthened the minimum waiting period. Different donors were told different things; over time the waiting period grew from six to nine to ten months. The number of anonymous donors, anonymous benefactors, and anonymous philanthropists also varied, though Bennett eventually settled on claiming to have nine of them. John M. Templeton, Jr., son of John Templeton, Sr., the famous investor and philanthropist, was a friend of Bennett, and people believed that he was one of the anonymous donors. In addition, Prudential Securities was a prominent part of the setup (and became the subject of a $90 million lawsuit accusing them of complicity). In 1994, Bennett expanded the program to allow "donations" by nonprofit organizations. The program remained small until 1993, when the Philadelphia Academy of Natural Sciences asked for a quarter-million dollar match. After successfully completing that match, many major organizations such as the Philadelphia Public Library and the University of Pennsylvania joined, along with churches and other Christian organizations. Like most modern pyramid or Ponzi schemes, Bennett's was an 'affinity' scheme, in which he defrauded people of common interest: in this case, local nonprofit organizations and Christian charities. Using the swelling funds from these churches, Bennett expanded further, establishing offices in Radnor, Pennsylvania. He had glossy brochures and a staff to process all the money coming in. He expanded his sales force by encouraging organizations to take a "finder's fee" from any money they raised. In other words, if a representative could convince donors to give $10,000,000, the agent could keep $1,000,000 for himself, give the remaining $9,000,000 to New Era and get back $18,000,000 for the nonprofit in six months. By and large his donors did not ask many questions. When they wanted proof that the money they donated was not being stolen, he provided evidence that the Foundation owned government bonds. However, he was showing the same bonds to everybody, and they had been pledged as collateral on loans anyway. He also had prospective participants speak with supposed representatives of Prudential Bache Securities. One of the conditions of the participation was that various tranches had to be committed to. One of the schemes was to space out the participation over the course of one year in three tranches with one being repaid and two tranches always held by New Era. One of the tip offs of the fraud were the tax returns filed by the Trust, which were publicly available. The accounting for the numerous funds held by New Era were not evident in the financial statements. New Era used a small one-man CPA firm which had erroneous financial opinions on the financial statements which Coopers & Lybrand investigated. This was one of several red flags noted. Bennett told prospects that his anonymous donors met several times a year, in person or by phone. Former U.S. Treasury Secretary William Simon, who ironically lost a lot of money to the scam, asked to be admitted to the donor panel. Bennett never responded to the request and Simon gave him money anyway. With the cash flowing though his hands, Bennett made all sorts of private investments. He bought a share of a travel agency and ran all of New Era's travel business through it. He also purchased a publishing house and other businesses. In early 1995, The Foundation for New Era Philanthropy was receiving praise in the press for giving money to religious organizations and involving high school students in charitable events. However, the end came swiftly. On May 15 1995, a skeptical article about the Foundation appeared on the front page of the Wall Street Journal. The same day, the Foundation capitulated in the face of a lawsuit demanding repayment of a $44,000,000 loan and filed for chapter 11 bankruptcy protection. In filing, the foundation stated that its assets were worth $80 million with liabilities of $551 million. A close examination of the documents filed in the subsequent lawsuits reveals that more than $354 million passed through New Era's hands and that Bennett took $8 million of that for himself. In the end, by liquidating all of Bennett's personal assets and reclaiming funds that had been paid to earlier participants, the court was able to bring the total loss down to $135,000,000, spread among all participants in the scheme. In other words, participants who got out early and suffered no losses were required to give the money back, to be shared with others who were less careful (or less lucky). Bennett faced 82 federal counts of money laundering and wire, mail and bank fraud. He planned to claim in his defense that he had been possessed by "religious fervor", but the judge did not allow this. In the end Bennett pleaded no contest to all the charges in March of 1997. Though federal sentencing guidelines indicated a sentence of 22 to 27 years, the judge gave him 12. The scandal touched 1,100 individuals and charities, including more than 180 evangelical groups, colleges, and seminaries. A partial list appears below. Reasons for collapse All Ponzi schemes die sooner or later, as they are inherently unsustainable. Bennett's particular scam collapsed because of an investigation headed by Mary Beth Osborn, head of the Charitable Trust Section of the Pennsylvania attorney general's office. She had received a letter in 1993 from a suspicious whistleblower within New Era. Her inquiry eventually resulted in New Era's registry with the IRS. As Bennett started to disclose greater financial details, New Era caught the wary eye of Albert Meyer, a Spring Arbor College accounting professor, whose institution in Michigan had been drawn into the matching scheme. Meyer's research indicated that the Foundation was a scam, but Spring Arbor College successfully collected on its early investment. College officials told Meyer that he was going to endanger their ability to get matching grants if he kept asking so many questions. They went so far as to wave a check from New Era in Meyer's face before investing more money. Meyer however was sure he was right and alerted federal investigators and The Wall Street Journal that New Era had all the features of a pyramid scam. After New Era collapsed, the president of Spring Arbor College called Meyer to apologize. "You were right all along. We should have listened to you," he admitted. Partial list of investors Charities According to the PA Attorney General's complaint, prominent victimized charities (listed without dollar amounts) included the Boy Scouts of America, the Environmental Defense Fund, Haverford College, Harvard University, Princeton University, The Nature Conservancy, One to One Partnership Inc., Planned Parenthood, the Philadelphia Orchestra, Stanford University Medical School, the United Way and Yale Law School. Some of the organizations with known involvement amounts included (in alphabetical order): Academy of Natural Sciences, Philadelphia, Pennsylvania, $2.7 million Biblical Theological Seminary, Hatfield, Pennsylvania, $5.8 million CB International, Wheaton, Illinois, $4.6 million Covenant College, Lookout Mountain, Georgia, $5 million Detroit Institute of Arts, Detroit, Michigan, $4 million Houghton College, Houghton, New York, $4 million John Brown University, Siloam Springs, Arkansas, $4 million International Missions, Reading, Pennsylvania., $5 million International Teams, Prospects Heights, Illinois., $5 million King College, Bristol, Tennessee., $5 million University of Pennsylvania, $2.1 million Wheaton College, Wheaton, Illinois, $4.6 million Donors George F. Bennett Jr., Boston, $3.3 million Peter Ochs, ( address unknown ), $3.2 million Buford Television Inc., Dallas, $3 million Henry F. Harris, Wyndmoor, Pa., $3 million Westwood Endowment, Indianapolis, $2.8 million (less than $280,000) Don Soderquist, Rogers, Ark., $2.8 million William Kanaga, Orleans, Mass., $2.4 million Henry W. Longacre, Souderton, Pa., $2 million Whitehead Foundation, New York, $2 million (about $1 million) Amelior Foundation, Morristown, N.J., $1.9 million ============================================================ Heaven Can't Help Them How A Tiny Bible College Lost Its Faith Daniel McGinn NEWSWEEK Updated: 3:48 PM ET Feb 29, 2008 When Gilbert Peterson heard about the Foundation for New Era Philanthropy, he thought his prayers had been answered. For 16 years the former minister has headed Lancaster Bible College, a tiny school in the heart of Amish farm country. The college had long hoped to expand, but its building fund was empty. That changed when New Era, a Philadelphia-based charity, came calling with a miraculous offer: for every dollar Peterson raised from donors and deposited with New Era, the charity's anonymous benefactors would match it, allowing the college to double its money every six months. The college signed on, and the school's account at New Era soon swelled to $16 million. It bought 64 acres of farmland and made plans to build a new library, a graduate center and a 1,300-seat chapel. But two weeks ago the plans were abruptly canceled. New Era was bankrupt, taking with it the school's $16 million--and its dreams of a new and improved campus. In the avalanche of press coverage that's followed New Era's spectacular demise, the focus has fallen squarely on the big-name philanthropists who've been fleeced by what authorities say was a half-billion-dollar Ponzi scheme. Among the victims: venture capitalist Laurance Rockefeller and former treasury secretary William Simon. But these deep-pocketed donors are in far better shape than the hundreds of institutions-many of them small evangelical groups--that were stripped of cash by New Era's fall. None has been hit harder than Lancaster Bible, and its tale shows how even cautious souls can fall victim to a wellrun seam. While accountants and the Feds sort through the mess, Peterson tried to explain how he got duped. He first heard about New ra from a friend two years ago and saw it as a quick way to bulk up the building fund. "It looked like a great answer to a need we'd been thinking and praying about," he says, as the words "God is faithful" float on his computer's screen saver behind him. He did his homework before signing on, scrutinizing New Era's records and calling other colleges, which all said the program worked swell. It worked smoothly for Peter-son, too, until two weeks ago when a colleague called. "Have you seen The Wall Street Journal?" he asked. "I've read my Bible. . .but I haven't read The Wall Street Journal," Peterson replied. The paper broke the story of New Era's troubles; hours later the charity filed for bankruptcy. Since then he's been calling board members and reassuring students that their scholarships are safe. Last week he sent letters sking supporters to pray for the school. Just outside his office, the farmland where the new library was to go will now grow corn for years to come; and without the new chapel, the school will keep holding church services in its gym. Peterson says he's not angry--he's even praying for New Era founder John G. Bennett Jr., who faces SEC charges--and intends to reconstruct the building fund "one donor at a time . . . one dollar at a time." For now, he and the rest of New Era's believers are left with a grim reality: what seemed like pennies from heaven will probably come back as pennies on the dollar. Lessons from New Era Largest, non-profit Ponzi scheme fraud John Bennett scammed hundreds of respected institutions and individuals by adopting one of the simplest and oldest fraud schemes - the Ponzi. Are there lessons for internal auditors in this classic case? Between 1989 and 1995, 180 organizations and 150 of the most financially-savvy philanthropists in America fell victim to the largest fraud ever to occur in the non-profit sector. More than $400 million was invested with New Era Philanthropy and John G. Bennett, Jr. in what turned out to be a grand Ponzi scheme. How was Bennett able to perpetrate such a massive scam among such an impressive list of participants? The answers reveal some of the most common tactics employed by fraud perpetrators, tactics that internal auditors should fully understand as they search for fraud in their own commercial and non-profit organizations. THE RISE OF BENNETT AND NEW ERA In 1989, Bennett established the Foundation for New Era Philanthropy to advise non-profits on management and fundraising techniques. Bennett had been operating in non-profit circles since 1982 when he began advising corporations on what charitable organizations deserved support. But it was New Era's matching gifts program that made Bennett's name within charity circles. DOUBLE THE MONEY Bennett's program provided for a group of anonymous and extremely wealthy donors to match funds raised by non-profit institutions and philanthropists. After being invited to participate in the program, non-profit institutions would raise funds and deposit them with New Era. Similarly, philanthropists would deposit funds earmarked for designated charities. One major requirement was that New Era hold the funds for six months. During this time, New Era would deposit the funds in a "quasi-escrow" account with Prudential Insurance, where they were to be invested in T-bills. This holding period was designed to give New Era time to collect enough interest to cover administrative expenses and find a matching donor. The anonymous donors would contribute funds to New Era, doubling the original amounts raised by the institutions and donated by the philanthropists. After six months, the deposited funds, plus the matched funds, would be transferred to the appropriate non-profit organization. TRIPLE THE GROWTH In its first year, New Era reported contributions of $306, 210. Growth was reasonable until late 1993, when an official at the Academy of Natural Sciences in Philadelphia asked if New Era could match $250,000. New Era agreed, and soon many of Philadelphia's major institutions, such as the University of Pennsylvania, the public library, and several evangelical Christian organizations, churches, and colleges, joined the program. Increasing numbers of philanthropists also signed on, seeking to double their donations to designated charities. As Bennett watched contributions explode to $41.3 million in 1993 and $100 million in 1994, he often boasted, "We give away more money than the Carnegies, Mellons, and Rockefellers!" Bennett's efforts earned him great respect in the non-profit community. He rapidly ascended through Philadelphia's philanthropic circles and was invited to serve on the boards of several impressive organizations. Bennett befriended many prominent people, including Philadelphia Mayor Edward Rendell, who believed New Era was the answer to Philadelphia's prayers. "I was counting on Jack to push us over the top, to make Philadelphia the best destination city in the Northeast." Many savvy and successful business people were also attracted to Bennett, some because of his reputation for Christian principles, others for his genuine interest in charitable causes. Dan O'Neill, president and co-founder of Mercy Corps International described him: [Bennett] seemed like a very cordial and engaging guy - not a shark. He certainly did not seem like a manipulator or someone who was out to get rich. He dressed like the average businessperson working for IBM...I believe the man at his heart is genuinely moved by charity. When he took me out to lunch, I think it was in a Toyota. It was not a Rolls-Royce. It was not a Mercedes. He did not flash dollars, and he did not talk big-money payoffs that seemed exorbitant. Bennett's charisma, charm, and religious dedication captured the trust and attention of those around him, and he was perceived as a saint with a mission to rescue charities in need of funds. It was this unchallenged public trust that allowed Bennett to perpetuate his massive Ponzi operation. THE SCAM Bennett's scheme was ingenious. Only a small amount of funds deposited with New Era were ever actually invested. Instead, some of the money was used to secure a large loan at Prudential. The rest of the invested funds, along with the borrowings from the Prudential account, were used to pay off previous promises whose six-month terms had expired. At some point, New Era raised the six-month waiting period to nine and ten months, claiming that the time lapse was "specified" by the anonymous donors and was therefore non-negotiable. Bennett also siphoned a portion of the funds, which eventually totaled $5 million, into corporations he owned. Bennett Group International Ltd., a consulting company where Bennett served as CEO, received $2.5 million. Bennett claimed the money was provided by a group of philanthropists so he could draw a salary; but the money actually came from funds that were supposed to have been invested in T-bills. Another $345,000 went to a near-bankrupt employee-assistance firm that Bennett had rounded in 1994. Bennett also diverted $2.5 million to save a New York publisher of religious books from bankruptcy. Although he did not collect a salary from New Era, Bennett did receive millions in salaries from these other organizations. Federal authorities estimate another $3.5 million was transferred to Bennett for his personal use. PERPETUATION OF THE SCAM Bennett's scheme was fueled by a combination of elements ranging from his charismatic personality to participants' word-ofmouth endorsements. One of the most effective tools early on was the use of "finders," or people who recruited non-profit organizations and philanthropists to participate in New Era's matching program. One of the first charity participants was Glen Blossom, pastor of the Chelten Baptist Church and founder of the Seminary of the East. Blossom, along with Seminary president Russell Russet, became finders, spreading the news to other charities. Funds from other charities were funneled through Blossom's church and seminary and then forwarded to New Era. Blossom and Rosser often received finder's fees of about five percent. Scott Lederman, treasurer of University of Pennsylvania, was skeptical when first approached by New Era. But after a Pennsylvania trustee endorsed the program and two Philadelphia museums told him they had received double their money back from New Era, he relented and wrote a $600,000 check. Lederman was relieved and excited when New Era fulfilled its promise to match the funds. Like most of the contributors, the University sent New Era additional funds to be matched. Before the scam was made public, Lederman was quoted as saying, "I can fully understand why this would be suspicious to a lot of people. It sounds too good to be true, and it's got all the earmarkings of a Ponzi scheme." Even after news of the scam broke, many of the institutions and individuals who participated in New Era's program did not lose confidence in the charity. The previously doubtful Lederman told The Wall Street Journal, "There's been a record of them complying with everything they said they would do." THE DISCOVERY AND THE FALL Bennett perpetrated his fraud for five-and-a-half years. During this time, several individuals were suspicious of New Era. However, only one person was successful in exposing the scam. WARNINGS In November 1993, Prudential Securities stockbroker Andrew R. Lowe warned a potential donor of illegal activity at New Era, calling the double-your-money offer and other representations made by Bennett "highly suspicious." He had spoken with officials at the Commonwealth of Pennsylvania and the Office of the u.s. Postal Inspector, both of whom said the matching program was most likely a "scam operation." Lowe's final words to the donor were, "Be careful!" Prudential had previously conducted an internal investigation of the substantial inflow and outflow of the account and had concluded that the transactions were legitimate but the account should be watched. However, no further action was taken. Unfortunately, Lowe was unaware that New Era had a Prudential account, and Prudential was unaware of Lowe's suspicions. New Era's bankruptcy trustee later sued Prudential, claiming the firm had overlooked obvious signs of fraud to gain commissions and "excessive" interest. Bennett was also investigated by the Pennsylvania attorney general's office in 1993. Bennett complied with their demands and supplied them with the requested documents, but he did not have to disclose the identity of the anonymous donors. Unable to find any dissatisfied donors, Ernest Preate, the attorney general and an acquaintance of Bennett, gave New Era a clean bill of health. In explanation, Renardo Hicks, director of the state's public protection division, later said, "there is no law in Pennsylvania that specifically prohibits a Ponzi scheme." ENTER ALBERT MEYER Albert Meyer, an associate accounting professor and bookkeeper for Spring Arbor College, staunchly opposed his school's participation in Bennett's matching program and was openly critical of New Era. Despite his warnings, which began in August 1993, the school repeatedly increased its payments to New Era. Its last payment consisted of $1 million, which represented one-sixth of its total endowment. Dr. Allen Carden, president of Spring Arbor, commented on Meyer's opposition: "I know Albert Meyer, and his intentions are good. But I have communicated to Mr. Bennett that Albert's actions should in no way be interpreted as coming from Spring Arbor College." Once he had the security of a tenured position, Meyer began a full-scale investigation of New Era in March of 1995. He reviewed New Era's 1993 tax return and discovered that it did not show any contributions from anonymous donors. In addition, the return indicated interest earnings of only $34,000. According to Meyer's calculations, the deposited funds should have generated as much as $1 million in interest. Armed with the tax return, Meyer contacted the SEC, the IRS, the Pennsylvania attorney general's office, and Steve Stecklow, The Wall Street Journal's national education journalist, calling New Era a Ponzi scheme and a "double-your-money racket." In his letter to the IRS he stated, "college presidents and the like are failing for this deception in alarming numbers...I have been called an alarmist on campus. However, as public funds are at stake, a dose of alarmism may not be out of place." THE AFTERMATH Meyers' letters initiated quick action. The SEC contacted certain participating charities as well as Prudential Securities. Prompted by the SEC, Prudential conducted a routine look at a New Era account in Kenosha, Wisconsin that held about $60 million in T-bills. The firm became alarmed when it discovered New Era had borrowed $52 million on margin and had repaid only $7.1 million. When Bennett could not account for the $44.9 million still owed, Prudential gave him 24 hours to repay. Bennett did not come through with the money, and Prudential sued. On Friday, May 12, Prudential Securities liquidated $44-9 million of T-bills in New Era's account. Meanwhile, Steve Stecklow began his own investigation of New Era and contacted Bennett, who immediately realized he was going to be exposed. On Saturday, May 13, Bennett called New Era employees into his office. He was crying, and his pastor was standing by his side. Bennett told them he had been thinking of ways to kill himself. He then dropped the bombshell: The anonymous benefactors did not exist. The staff broke out in sobs while he tried to explain that he had only wanted to devise a method for people to give money to help others, and he never wanted to hurt anyone. On Monday, May 15, Stecklow went public with his findings in a Wall Street Journal article that publicly scrutinized New Era for the first time and asked serious questions about its practices. That same day, New Era filed for bankruptcy-court protection with $80 million in assets and reported liabilities of $551 million. New Era's lawyers claimed the organization had received in excess of $400 million from donors, and $135 million of those funds had not yet been repaid. They also explained that the total liabilities of $551 million reflected the matching promises related to these outstanding funds. Eventually, the bankruptcy trustee identified liabilities between $175 and $225 million. In September 1997, Federal Judge Edmund V. Ludwig sentenced Bennett to 12 years in federal prison without parole for 82 counts of fraud, money laundering, and tax evasion. Judge Ludwig described the harm Bennett caused to the charities as "incalculable." Arlin M. Adams, the New Era bankruptcy trustee elected by New Era creditors, eventually recovered many of the lost funds. Organizations that profited from the matching program agreed to repay $41 million, securities houses paid $30 million, and Prudential Securities settled for between $15 and $18 million. Additionally, Bennett turned over about $1.2 million in property, cash, and securities. This amount included his $620,000 home, his daughter's $249,000 house, and his 1992 Lexus, all of which were purchased with New Era funds. LESSONS FROM THE NEW ERA FRAUD While most organizations and internal auditors may never fall prey to schemes like Bennett's, they will likely encounter some type of fraudulent activity. The principles behind the Ponzi are easily assimilated into many types of fraud, and auditors can learn important lessons from the New Era case and the actions of Albert Meyer. MAINTAIN AN ATTITUDE OF PROFESSIONAL SKEPTICISM. One quality Albert Meyer exhibited that was lacking in nearly everyone else involved with New Era was a healthy dose of professional skepticism. Most participants in the scheme simply did not question the assertions made by Bennett and New Era. From the beginning, Meyer doubted the veracity of New Era because of their "double your money" promises. His skepticism prompted him to further action and investigation, even though it wasn't his job to do so. INVESTIGATE WHAT DOES NOT MAKE SENSE. Successful Ponzi schemes pattern themselves after normal business procedures or operate in a manner that on the surface seems to make good business sense. However, upon closer examination, something that isn't quite right will usually surface. Where deceit is involved, there are often pieces of evidence that just don't fit together. Examining these inconsistencies and obtaining the right evidence to determine what is really happening is no small task. Good auditing requires that each piece of relevant evidence be considered in light of all other pieces of evidence. Albert Meyer ultimately uncovered the fraud by linking together representations made by Bennett that were not corroborated by New Era's tax return. It simply didn't seem right to Meyer that the organization earned only $34,000 in interest income for the year 1993. If the funds were in escrow at Prudential, as Bennett had claimed, then the interest earned should have been much higher. IF IT SEEMS TOO GOOD TO BE TRUE, IT USUALLY ISN'T TRUE. Fraudsters, particularly those perpetrating Ponzi schemes, rely on investor greed to pull off their scams. The only way to keep a Ponzi scheme from collapsing is to keep bringing in ever-increasing amounts of money. To do so, the perpetrator must offer abnormally high rates of return. In addition, the perpetrator often tries to slow the outflow of funds, as Bennett did by increasing the time the investors were required to leave their money on deposit and encouraging people to reinvest the money he paid out to them. The prospect of receiving double their money in such a short period of time clouded the judgement of those taken in by the scheme. FRAUD STARTS SMALL AND GROWS. Perpetrators often start out small, paint themselves into a corner, and then feel forced into making their fraud larger to cover their tracks. Bennett was no exception. Bennett actually started his scam as a result of overdrafts in his personal bank accounts; he had been kiting checks among at least eight different accounts. Becoming nervous that someone would uncover his tracks, he began the scheme that ultimately led to the single largest not-for-profit bankruptcy in u.s. history. Once he started, Bennett had no way out of the fraud. The fraud had to grow or it would die, leaving him exposed. BEWARE OF TRUST OVER REASON. The New Era seam demonstrates that some people will believe what they want, regardless of how unreasonable the belief may be. People trusted Bennett so much that even after news of the seam broke, many of the institutions and individuals who participated in New Era's program did not lose confidence in the charity. After all, New Era always doubled their money on time. When asked about the Wall Street Journal article questioning New Era's practices and bankruptcy filing, a wealthy mutual fund manager and trustee for New Era's London office said, 'I think he will have good answers; and as people get to know him, I think people will have the same view of him that I do. " AVOID PLACING FAITH IN OTHER PEOPLE'S FAITH. In the New Era seam, many investors were drawn in because they perceived Bennett as a man of strong religious conviction. They did not scrutinize New Era because they believed in the character of Bennett and those who worked with him. Without the tie of religious beliefs between these individuals, there may have been more skepticism toward the investment. BE WARY OF LIMITED TIME OFFERS OR EXCLUSIVE STATUS. When Bennett started his scheme, he created the illusion that not everyone was allowed to participate in the double-yourmoney offer - a classic Ponzi tactic. Instead, organizations had to apply or be recommended by someone. Organizations also had to explain what they intended to use the funds for so New Era could determine if the intended use was "good enough." Perpetrators realize that the perception of exclusivity creates in many people an even greater desire to participate. DON'T JUMP ON THE BANDWAGON. Many investors were drawn into the New Era scam because they saw other reputable organizations participating. They reasoned that if the United Way and the University of Pennsylvania were participating, then New Era must be reputable. This thought process underscores the importance of reaching conclusions based upon one's own investigation. It is sometimes tempting to rely on the judgment of others. It may appear to be less costly and time-consuming; however, the cost of not taking a fresh look can be astronomical. Just ask some of the organizations that invested with New Era. CHARISMA IS NO SUBSTITUTE FOR SUBSTANCE. Investors in the New Era seam commented on Bennett's charm and charisma. They felt compelled to invest because of his zeal and positive outlook. If they had critically evaluated New Era instead of focusing on his demeanor, many people might not have invested their organization's funds. ULTIMATE LOSSES ARE LARGER THAN DOLLARS INVESTED. Fraud has ramifications that extend beyond the initial financial loss. In the New Era fraud, not only were philanthropists' initial investments at risk, but the individual donors and participating organizations could come under the scrutiny of the IRS. New Era, as a fraudulent enterprise, could lose its tax-exempt status. If that happens, participants' charitable contribution tax deductions could be jeopardized. The IRS wrote a letter in 1990 saying New Era was entitled to a tax-exempt status, so it is unlikely donors would lose their deductions retroactively. However, if philanthropists designated their money to go to certain charities, and it never ended up there, the IRS could disallow the deduction. Furthermore, the IRS has investigated whether or not donors to New Era committed tax fraud by claiming double deductions for charitable contributions. Tax lawyers have suggested that the matching program might have tempted some donors to double or even triple their taxable deductions even though they are only entitled to the amount they actually gave to New Era. For example, suppose a donor gave $5,000 to New Era via a church. The church would then send the donor a note acknowledging receipt of the contribution amount of $5,000. When the designated charity received the matching funds, the charity would send a thank you note to the donor recognizing the receipt of $10,000. Each of the notes received by the donor could be used as proof of charitable contributions, when only the $5,000 is legally deductible. Organizations that counted on matching gifts are probably the biggest losers. Not only did they lose the matching funds, but only about 80 percent of their initial investment was recouped. This has placed many organizations in a bind because they planned their budgets around the matching gifts, and in most cases the funds have already been committed or spent. Some of these organizations continue to suffer the effects of the fraud because traditional donors have lost confidence and donations are down. RED FLAGS Fraud is always easier to recognize using hindsight. Once it is exposed, picking out the clues that might have revealed the fraud becomes a no-brainer. The New Era case is no exception. In retrospect, the red flags indicating deceitful behavior and the importance of professional skepticism become obvious. If auditors can maintain a healthy skepticism and incorporate the lessons learned from the case into their fraud detection efforts, perhaps a "new era" of fraud prevention will occur. RELATED ARTICLE: THE PONZI Ponzi schemes are fraudulent investment swindles that attract increasing funds by offering enormous returns to investors. In a Ponzi scheme, however, the money is never actually invested in anything. Instead, the organizers keep a large share of the cash and use the rest of the investors' deposits to pay off those who invested first. As long as new investors keep joining, the pyramid can be sustained. Those who get in early can make a profit; but the moment supplies of fresh money dry up, the entire structure collapses, leaving latecomers with nothing. The Ponzi is illegal in all countries. The scheme gets its name from Charles Ponzi, an Italian-born American immigrant who in 1920 scammed nearly 15 million dollars out of 40,000 investors by promising to double their money in 90 days. He claimed this fabulous rate of return was the result of his dabbling in International Reply Coupons - relatively low-value vouchers that could be obtained in one country and redeemed for postage stamps in another. Ponzi was allegedly buying the coupons in a nation with a weak currency, trading them for American postage stamps, and then converting the stamps into cash at a huge profit. When the scam was exposed, Ponzi possessed only $30 in postal coupons. Salesmanship is a crucial attribute for the Ponzi master. Successful perpetrators generally possess a criminal flair and knowledge of the psychology of their intended victims. In Utah, for instance, a funeral organist knew that widows often experience financial uncertainty after sudden bereavement. He managed to raise more than $16 million by offering his widowed customers high returns on bonds in what proved to be a fictional finance company. Ponzi schemes usually fall apart after a year or two. Charles Ponzi's operation lasted a short eight months. Occasionally a scam can run for quite some time, however. Dennis Helliwell, who was sentenced to federal prison last year, ran his Ponzi for 11 years. Ponzi-style fraud has been in existence as long as investment itself, and it continues to flourish today. In fact, as financial markets, instruments, and capabilities have grown, so have the opportunities for more advanced and creative forms of the Ponzi. In addition, technological innovation and the globalization of capital markets have led to exponential increases in the capacity to alter financial structures and appearances. And the Internet has, of course, provided a new medium for pitching and spreading the word of get-rich-quick scams. Some experts estimate that, in the U.S. alone, some $750 million has found its way into these pyramid-type scams over the last 10 years. Ponzi schemes flourish outside U.S. borders, as well. Almost one-fifth of Albania's population was duped by promises of a "guaranteed" eight-fold increase in their money in three months. In Russia, 10 million people have fallen victim to the MMM Ponzi operation; and Serbian private 'banks' have offered huge interest rates on hard currency deposits. In the last three years the U.K.'s Department of Trade and Industry has closed 18 Ponzi-style operations, and new regulations will make it a criminal offense for scheme participants to recruit others to join. ROBERT ALLEN, PHD, CPA, is Assistant Professor in the School of Business at the University of Utah in Salt Lake City. MARSHALL B. ROMNEY, PHD, CPA, CFE, is Professor in the School of Accountancy and Information Systems at Brigham Young University in Provo, Utah