SYSTEM OF ECONOMIC SURVEYS in UGANDA Addis Ababa, 17

advertisement

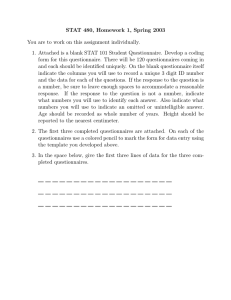

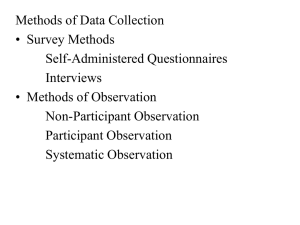

SYSTEM OF ECONOMIC SURVEYS in UGANDA Addis Ababa, 17th October 2007 Musana Atai Imelda Principal Statistician, Uganda Bureau of Statistics. Mobile. 256-772680087 Imelda.atai@ubos.org; asekenye@hotmail.com www.ubos.com What are Economic Surveys? A Business Inquiry is an Economic Survey aimed at collecting data from all Industrial sectors necessary for the computation of the main economic indicators such as: Gross Output Value Added, Intermediate Consumption Operating surplus Productivity among others. Types of Surveys needed and why? Censuses/Large Surveys conducted every 5 or 10 years (depending on availability of funds). Inter-Censual Businesses Surveys or Annual Surveys, conducted every 2 or 3 years (depending on the availability of funds). This will provide an update of the census data Other Adhoc Surveys, to be conducted when there is no Inter censual Survey or otherwise. ..\History.doc Objectives of Business Inquiries (BI) Compute data on main Economic Indicators such as Value Added by Sector, Gross Output by sector, and Intermediate Costs among others Value Added by sector is the basis of weight development in GDP estimation thus improvement of estimates of GDP Determine sector productivity and contribution of each sector to economic growth Objectives of BI Development of Input –Output Tables (IOT), Supply and Use Tables (SUT) which finally feed into the Social Accounting Matrix (SAM). Provide data required for Macro Economic Modeling as required by the Ministry responsible for planning and policy formulation Provide a framework for monitoring economic development over time Objectives of BI Development of weights for use in index number computation such as Index of Industrial production (IIP), Producer Price Indices (PPI), Construction Sector Indices (CSI) etc. Sampling Frame for other detailed economic surveys for instance: The Foreign Private Capital Flows survey undertaken by Central Bank; The Investment Surveys by Investment Authority and other such surveys Facilitate in-depth analysis by Researchers and their policy implication What are the good practices in BI survey design and organization? K E Y S T E P S 1 Questionnaire Design 2 Sample Design and Selection 3 Training of Staff 4 The Pretest and Pilot 5 Organization of Field Work 6 Organization of Office Work 7 Data Editing Questionnaire Design Separate questionnaires should be designed for the different sectors to take in account the peculiarities in each sector and collect data that will be useful. The large questionnaire which is more detailed issued to Business Establishments with Final Accounts, containing questions relating to: The small questionnaire contained less detailed questions but relating to data required as mentioned and administered to those establishments that did not keep final accounts The questionnaires should be able to provide data relating to: Activities and location of the business; General information on employment and ownership and statement of Fixed Assets; Capital expenditure at the end of each year; and Total sales, income and costs. Types of Questionnaires Description 1 Agriculture and Fishing 2 Mining & Quarrying 3 Manufacturing 4 Construction 5 Trade 6 Hotels & Restaurants 7 Business & Personal Services 8 Finance 9 Insurance 10 Education & Health 11 Non-Governmental Organization 12 Small Trading & Services (All Service Sectors 13 Small Mining & Manufacturing (All production sectors) New Questionnaire to be administered in the next Survey due to the need for Institutional Satellite Accounts. Sample Design and Selection The sample design for an economic survey is complex as compared to the Household Survey however the sample should be at least 5% of the population. Procedure could be: Stratify the population by industrial classification Within each Industry, further stratify by number of employees based on predetermined employment size bands for each industrial group e.g 1 – 4; 5 – 9; 10 – 19; 20 – 49; 50 – 99; and 100 Plus. Sample Selection To minimise the expected variance of total turnover (for the large establishments) over all strata, within each stratum CUT -OFF sampling method should be applied for some business establishments whose employment is equal or above a certain employment size band, are selected in totality. (in Uganda all businesses employing 20 or more persons were selected, about 30% of the population) For the remaining businesses Proportional Allocation was used to determine sample sizes for each stratum and thereafter businesses were selected using Systematic Sampling. Training of Staff Need for in-depth training of staff aimed at: Acquainting staff with the basic accounting ideas and terminologies, Understanding the different coding system sucgh as the ISIC, CPC etc Understanding GDP and System of National Accounts, SNA 1993 Understanding the structures of Final Accounts Understanding the proposed UBI questionnaires to be used Extracting information from the Final Accounts and an example of a questionnaire Training of Staff Examinations and Role Plays After each training sessions, participants should be subjected to examinations to test their ability to extract data from specific final accounts. Further, Role-Plays should be emphasised because it is argued that the presentation of an enumerator before a General Manager will in most cases determine the kind of response obtained. Good public relations and building of rap pours between the enumerator and the respondent increases the response rate Finally the Issue of confidentiality of the information should be more than emphasized during the training. All staff must take the Oath of Secrecy. Pretest & Pilot Survey The Pilot Survey should be undertaken with a few selected Business Establishments. This will help: polish up the instruments to be used, remove any redundancies and further train the enumerators in the assignment among others things Organization of the Field work Field Teams should be properly designed. Teams are organized in such a way that they are centralized and administer questionnaires in a specific geographical location this has the advantage of reducing the costs of the Survey (Ideally it would be good to allocate questionnaires of a specific sector to a team thus ensuring consistency). The Field Team should have a Supervisor/Team Leader, Enumerators and Drivers, each with clearly spelt out assignments: Organisation of Office work Proper organisation of Office work with TEAM SPIRIT is a key to a successful Survey. The office activities involve among other things: preparation of fieldwork activities, providing technical support, staff payments, receiving of returns from the field, editing of returns, data capture, managing and maintaining of vehicles; and other administrative work etc The different roles should however be distributed among those involved in the office activities. Data Editing Data editing should be taken seriously and it should be undertaken both at the field and in the office. Field Editing In the field the interviewer/enumerator should be the first Editor who would then pass on the completed questionnaire to his/her supervisor for further editing including: Allocation of appropriate ISIC, CPC codes Ensuring the return is completed Ensuring the questionnaire is balancing etc When an error is discovered, the supervisor re-visits the Establishment to rectify the problems with the concerned authorities. This should be done before submission of the questionnaire to the office Office Editing Office Editing would include: Receipt and assigning of different return codes depending on the type of questionnaire. The return codes could be: 1. Good Return; 2. Fixed Assets Missing, 3. Refusal 4. Partial data, no employment etc. The return type codes assigned help in analysing the status of each establishment and the performance of each interviewer at a given time. Office Editing Ensuring that the right ISIC & CPC codes were allocated and all the administrative units are coded. Undertaking Intelligent Edits. E.g issues like ‘Cost of Staff’ being greater than the ‘Total Income of the business’ should be queried Challenges in Data Processing Selection of the right personnel Training and Clear allocation of duties Developing a proper system of Data Entry, what application should be used? Does it provide for self editing/checking? Error Levels? Record workloads for each Data Entrant? Access levels for all staff with passwords? What are the security checks? Challenges in Data Analysis What Statistical Package will be used, SAS or STATA or otherwise? Do you have the Tabulation Scheme, was is discussed and agreed? How have you provided for weights and consequently grossing up? The fact that businesses have different accounting periods, this is a challenge; Different currencies used. During analysis all currencies should be converted into one. Uniform exchange rates should be used for all businesses providing data in say dollars Challenges in Data Analysis Imputation for missing data is a challenge what approach should be adopted? Provision of District estimates is not possible since the sampling was done using the Industry (ISIC), and employment size bands as the main sampling variables. Challenge is to provide Gross Output and Value Added by District, what should be done?ugandamap.jpg The formulae for computation of Value Added and Gross Output vary from sector to sector and this should be provided for during analysis. Challenges of Conducting a BI How to ensure that BIs are conducted at least every 5 years although this will depend on the availability of funds. In some countries every 10 years. Undertake inter censual surveys every 2 or 3 years to update the census information? To what extent can this be achieved? Induce Governments to put more emphasis on the Business Inquiries and therefore fund them. In Uganda most of the Inquiries have been mainly funded by Donors Apathy by the Business Community due to the time taken to fill a specific questionnaire, how can we increase their interest? Most of the data required is obtained from the Final Accounts and access to these accounts normally requires prior clearance from the Board, Top Management, and this takes a lot of time. Challenges of Conducting a BI Poor training may lead to poor filling of questionnaires. Need for thorough understanding of Final Accounts and the different Audit formats Undertaking intelligent edits to determine whether the data has been falsified, Need to put in checking questions. Proper coding of activity codes according to the UN ISIC Rev 3. When should we adopt ISIC Rev 4? How to handle secondary activities in the business, Can we apportion value Added to the secondary activities? Challenges of Conducting a BI Businesses which are partly private and partly government, difficult to determine their contribution. The different accounting periods adopted by the businesses is a great challenge, how should the be handled? Is the computer system for data entry and analysis integrated? To what extent are security systems provided in the system? Penalties for Non Response, to what extent can the Statistics Office invoke the law and ensure a response is obtained? Challenges of Conducting a BI How do you achieve response rates above 60 percent? How big should the sample be? How can we determine value addition in specific sectors? The sampling frame for the survey, how often should it be updated? Challenges in surveying the Informal sector The informal sector is one of the difficult sectors to measure in the country. This sector cuts across all the Industrial sectors but especially Manufacturing, Trade, Agriculture, Mining and Quarrying, Transport. It has been difficult to determine the actual contribution of the informal sector to the overall growth. The sampling frame for the informal sector is difficult to determine. Propose that we use the Businesses Register and population figures to determine the location of the informal sector activities and then administer questionnaires using simple random sampling, is this feasible? Challenges in the Informal Sector The definition of the Informal Sector is a challenge. Businesses employing less than 5 persons excluding the Service Sector? Businesses without Final Accounts, Businesses without a fixed location? The nature of the informal sector businesses, which have a life span of 3 months. After developing the sampling frame one goes to administer the questionnaire and the business has closed. Border-to-Border businesses, how to measure their contribution to growth? Household Enterprises, how to measure their value added especially when the purchases are both for the household and for the business. Most of the businesses are not registered, do not have a name, and most times the respondents are not the owners and therefore cannot provide accurate information. Conclusion Undertaking a Business Inquiry is a REAL challenge that we should address and try to see solutions around it. The presence of a highly productive Informal Sector, which is not measured is however a bigger challenge. THANK_YOU