Emir Ibrahimovic Chelsea Behrens Caleb Pols Mark Blazo

advertisement

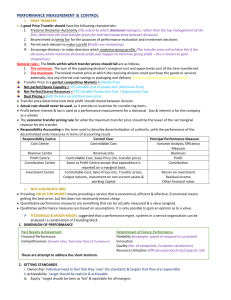

Emir Ibrahimovic Chelsea Behrens Caleb Pols Mark Blazo Company Background • Leading provider of diversified general contracting, design and build, and self-perform construction services • Comprised of for different parts: Building Group, Civil Group, Specialty Contractors Group, and Management Services • Casinos, Hotels, Resorts, Hospitals, Educational Facilities, Highways, Bridges, etc. • Operating history of 115 years • Approximately 8,000 employees around the world Growth • The businesses are integrated with resources shared across business units • They have structured a balanced business between Civil and Building operating capabilities • Geographic footprint expanded through acquisitions • Significant new contract opportunities exist in their core markets • US infrastructure rehabilitation need • Military buildup and relocation to Guam • Reconstruction activities in Afghanistan & Haiti SWOT Analysis • Strengths – • Civil Segment Backlog • Acquisitions • Competitive Advantage • Weaknesses – • Unrealized Revenue • International • Building Segment is still majority of revenue • 83% in 2009, 70% in 2010, and 49% in 2011 SWOT Analysis • Opportunities – • American Jobs Act • U.S. Military • Threats – • Current Economic Conditions • Budget Shortfalls Current Activities • Recession • Two years of projects in pipeline. • Any additional projects will help increase profit margins. • Recently added a $94 million project to repair part of the Washington Monument. • In the processes of building new corporate facilities for Amazon.com, Facebook, and Apple • Apple intends to build a corporate campus in Cupertino, California, which will be approximately 2.8 million square feet. Quarter 3 Results • Revenue of $1.10 billion compared to $1.17 billion in Q3 2011 • Net income of $42.6 million (adjusted net income of $25.8 million) compared to $35.5 million in Q3 2011 • Diluted EPS of $0.88 (adjusted diluted EPS of $0.54) compared to $0.74 in Q3 2011 • Affirming FY2012 guidance: Revenue of $4.0 billion to $4.5 billion; Diluted EPS of $1.50 to $1.70, excluding discrete items Period Ending Assets Current Assets Cash And Cash Equivalents 31-Dec-11 31-Dec-10 31-Dec-09 Net Receivables 1,633,429 1,023,800 1,235,434 Other Current Assets Total Current Assets Long Term Investments 239,677 76,928 494,928 42,314 348,309 30,811 1,950,034 1,561,042 1,614,554 62,311 88,129 101,201 Property Plant and Equipment 491,377 362,437 348,821 Goodwill Intangible Assets Other Assets 892,602 197,999 18,804 621,920 132,551 13,141 602,471 134,327 19,280 Total Assets 3,613,127 2,779,220 2,820,654 Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Total Liabilities 1,333,275 59,959 1,393,234 946,780 1,280,102 21,334 31,334 968,114 1,311,436 612,548 109,597 374,350 44,680 84,771 57,044 97,921 79,082 78,977 2,213,300 1,466,226 1,532,228 61.2% 52.8% 54.3% Stockholders' Equity Common Stock Retained Earnings 47,329 402,679 47,090 316,531 Capital Surplus 993,434 985,413 1,012,983 Other Stockholder Equity Total Stockholder Equity Net Tangible Assets -43,615 -36,040 48,539 260,121 -33,217 1,399,827 1,312,994 1,288,426 309,226 558,523 551,628 Period Ending: 12/31/2011 12/31/2010 12/31/2009 12/31/2008 Total Revenue $3,716,317 100.0% $3,199,210 100.0% $5,151,966 100.0% $5,660,286 100.0% Cost of Revenue $3,320,976 89.4% $2,861,362 89.4% $4,763,919 92.5% $5,327,056 94.1% 10.6% 10.6% Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Operating Income Add'l income/expense items Earnings Before Interest and Tax $0 0.0% $0 0.0% 7.5% $0 0.0% 5.9% $0 0.0% $226,965 6.1% $165,536 5.2% $176,504 3.4% $133,998 2.4% $0 0.0% $0 0.0% $0 0.0% $224,478 4.0% $168,376 4.5% $172,312 5.4% $211,543 4.1% ($25,246) -0.4% $4,421 0.1% ($2,280) 4.6% $172,797 $35,750 Income Tax $50,899 $170,032 Net Income $86,148 2.3% $103,500 3.2% -0.3% 0.1% $68,079 $137,061 0.2% ($15,687) $7,501 1.7% $9,559 4.1% 0.3% $55,968 0.0% $212,641 $10,564 1.4% $1,098 5.3% 1.0% Interest Expense -0.1% 0.1% $4,163 1.3% 2.7% $55,290 ($75,140) 1.0% -1.3% Ratio Analysis Ratio 2010 2011 2012 Industry Current Ratio 1.2 1.6 1.4 1.3 GPM % 7.5% 10.6% 10.6% 9.7% Long Term Debt % 3% 13.5% 17% 12% Operating Exp 3.4% 5.2% 6.1% 6.5% As of October 30, 2012 the average S&P 500 P/E ratio is 15.95. As of March 31, 2012 the TPC P/E ratio is 9.558 Technical Analysis • Yahoo Analysts - $18.00 • MarketWatch Analyst - $18.67 Risks • Diversification • Where are their revenues coming from? • 39% Private • 7% Federal Government • 54% State & Local Government • 1 year price per share history • 2011 $14.53 • 2012 $10.28 • Debt • $690.34 Million • Profit Margin • -6.04% Proposal • 150 shares @ $10.21 = $1,531.50 • Long term holding for IPO: 3-5 years Questions?