FISIM, Property Income and Current Transfers

advertisement

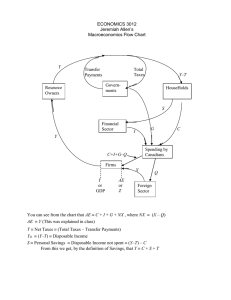

FISIM, Property Income and Current Transfers International Workshop on Household Income, Consumption and Full Accounting of the Households Sector 26-28 March 2012, Beijing, China UN STATISTICS DIVISION • • • • • • • Financial intermediation services indirectly measured (FISIM) • Concept • Estimation Financial services using own funds • Concept • Estimation Property income • Primary income • Concept • Allocation of primary income account • Estimation • Balance of primary income Taxes on income and wealth • Concept • Estimation Social contributions and benefits • Current transfers • Concept • Secondary distribution of income account • Estimation • Disposable income Other current transfers • Concept • Estimation Social transfers in kind • Current transfers • Concept • Redistribution of income in kind account • Adjusted disposable income • Estimation 2 • • • • Indirect measure of the value of financial intermediation services provided but for which financial institutions do not charge explicitly Needs to be imputed because no explicit fees are charged Split actual interest transactions into • SNA interest • FISIM Applies to loans and deposits • Financial institutions 3 Bank interest receivable Loans Deposits SNA interest receivable Bank interest payable FISIM SNA interest payable FISIM 4 FISIM FISIM L FISIM D rL rr YL rr rD YD • • • • • • • • • • FISIML = FISIM on loans FISIMD = FISIM on deposits rL = lending rate rD = deposit rate rr = reference rate YL = stock of loans YD = stock of deposits rL YL = actual bank interest receivable on loans rD YD = actual bank interest payable on deposits rrYL (rrYD) = SNA interest on loans (deposits) • Record in allocation of primary income account 5 Reference rate • Between interest rates on loans and deposits • No service element • Reflects risk and maturity structure of deposits and loans • One reference rate per currency • One method • Average of the ratio of interest payable on deposits to the stock of deposits and ratio of interest receivable on loans to the stock of loans 6 Allocation • Some portion of domestically-produced FISIM to households • Final consumers (final consumption expenditure) • Owners of dwellings Intermediate • Owners of unincorporated enterprises consumption • Same for imports of FISIM 7 Data sources Domestically-produced FISIM • If data on average stocks of loans and deposits and interest by sector from monetary authorities are available • Calculate FISIM on loans to households sector • Owners of dwellings (dwelling loans) Intermediate • Owners of unincorporated enterprises consumption • Other loans (final consumption expenditure) • Calculate FISIM on deposits to households sector • Owners of unincorporated enterprises (intermediate consumption) • Deposits as final consumers (final consumption expenditure) • Bottom up method 8 • Complete breakdown of data not always available • Compute total FISIM on loans and deposits for households • Allocate FISIM on loans to Intermediate • Owners of dwellings (dwelling loans) consumption • Owners of unincorporated enterprises • Other loans (final consumption expenditure) Using indicators such as breakdown of data on loans from other sources 9 • Allocate FISIM on deposits to • Owners of unincorporated enterprises (intermediate consumption) • Households as final consumers (final consumption expenditure) Using indicators from other sources such as • Ratio of stocks of deposits to VA for smallest size corporations • Ratio of stocks of deposits to turnover for smallest size corporations • Other solutions? • Equal split? • Professional judgement • All FISIM on deposits to households as final consumers 10 Imports of FISIM • Data on stock of loans and deposits and interest on loans and deposits from rest of world account • Reference rate • Total FISIM on loans and deposits • Allocate FISIM on loans and deposits to households sector according to distribution of domesticallyproduced FISIM • Lack of data by currency to calculate imports of FISIM seems to be a problem in many countries 11 • Need to remove effects of changes in price from current-price FISIM – volume measures • Deflation method preferable to output indicator method • Deflate stock of each type of loan and deposit using general price indexes • GDP deflator (excluding FISIM) • Final domestic demand deflator (excluding FISIM) • All-items CPI • Calculate base period margin of each type of loan and deposit • Base period margin on loan (deposit) = difference between interest rate on loan (deposit) and reference rate • Apply base period margin on loan (deposit) to deflated stock of loan (deposit) • Aggregate to obtain volume measures of FISIM 12 • Possible for some financial institutions to make loans without accepting deposits • Own funds • Examples • Credit card issuers • Finance associates of retailers responsible for financial leasing • Pawnshops • Moneylenders • Corporations • Unincorporated enterprises • Production and consumption • Likely to be important in developing countries 13 FL rL rr YL • • • • • • FL = Financial service on loans rL = lending rate rr = reference rate YL = stock of loans rL YL = actual interest receivable on loans rrYL = SNA interest on loans 14 Possible Source Credit card issuers Monetary and financial statistics Enterprise survey Balance of payments Finance associates of retailers Monetary and financial statistics Enterprise survey Balance of payments Pawnshops Monetary and financial statistics Enterprise survey Balance of payments Moneylenders Monetary and financial statistics Enterprise survey HUEMs survey Balance of payments Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 15 Property income • Accrues when owners of financial assets and natural resources put them at disposal of other institutional units • Sum of investment income and rent • Investment income • Income receivable by owner of financial asset in return for providing funds to another institutional unit • Rent • Income receivable by owner of natural resource (lessor or landlord) for putting natural resource at disposal of another institutional unit (lessee or tenant) for use of natural resource in production • Resource lease • Record in allocation of primary income account 16 Breakdown • Investment income • Interest • Distributed income of corporations • Dividends • Withdrawals from income of quasi-corporations • Reinvested earnings on foreign direct investment • Other investment income • Investment income attributable to insurance policyholders • Investment income payable on pension entitlements • Investment income attributable to collective investment fund shareholders • Rent 17 Interest • Form of income receivable by owners of certain kinds of financial assets for putting financial asset at disposal of another institutional unit • Deposits SNA interest • Loans • Debt securities (for example, bills, bonds) • Accrual basis (continuously) 18 Distributed income of corporations Dividends • Investment income to which shareholders become entitled as a result of placing funds at disposal of corporations • Shareholders are collective owners of corporations • Record at point at which share price starts to be quoted on ex-dividend basis 19 Distributed income of corporations Withdrawals of income from quasi-corporations • Part of distributable income that owner withdraws from quasicorporation • Analogous to payment of dividends • Exclude withdrawals realised by sale of assets Reinvested earnings on foreign direct investment • Retained earnings of a corporation or quasi-corporation which are equal to distributable income less dividends payable or withdrawal of income from corporation or quasi-corporation respectively 20 Investment income disbursements Investment income attributable to insurance policyholders • Non-life, life insurance and reinsurance • Standardized guarantees • Result of investment of technical reserves of insurers Investment income payable on pension entitlements • Defined contribution and defined benefit schemes • Defined contribution – investment income on the funds and net operating surplus from renting land/buildings owned by the fund • Defined benefit – actuarial calculation of increase in pension entitlement coming from past service 21 Investment income attributable to investment fund shareholders • Include mutual funds and unit trusts • Dividends • Retained earnings attributed to investment fund shareholders • Distribute to shareholders and reinjected via transaction in financial account Rent on natural resources • Land • • • Different from rentals payable on buildings or other structures In practice, single payment for rent and rentals Treat entire payment as rent if value of land exceeds value of buildings/structures • Subsoil assets • Minerals or fossil fuels 22 Possible Source Investment income SNA Interest Monetary and financial statistics Enterprise survey HUEMs survey Balance of payments Interest on bonds, bills, etc Monetary and financial statistics Enterprise surveys Government finance statistics Balance of payments Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 23 Possible Source Distributed income of corporations Dividends Stock exchange Tax authority Household survey Enterprise survey Balance of payments Withdrawals of income from quasicorporations Enterprise survey Balance of payments Reinvested earnings on foreign direct investment Balance of payments Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 24 Possible Source Other investment income Investment income attributable to insurance policyholders Monetary and financial statistics Insurance Supervisory Commission Balance of payments Investment income payable on pension entitlements Monetary and financial statistics Pension Supervisory Agency Balance of payments Investment income attributable to investment fund shareholders Monetary and financial statistics Enterprise surveys Balance of payments Rent Household survey HUEMs survey Government finance statistics Enterprise survey Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 25 Current transfer • Transaction in which one institutional unit provides a good or service to another unit without receiving from the latter any good or service directly in return as counterpart and does not oblige one or both parties to acquire, or dispose of, an asset • Directly affects level of disposable income • Should influence consumption • Relatively small, often made frequently and regularly 26 Breakdown • Current taxes on income, wealth • Social contributions and benefits • Other current transfers • Record in secondary distribution of income account 27 Taxes in general • Compulsory, unrequited payments, in cash or in kind, made by institutional units to government units • Transfers • Levied on incomes of households and corporations • Accrual basis of recording • Evidenced by tax assessments, declarations or other instruments • Include interest, fines, other penalties in practice 28 Taxes on income • Taxes on incomes, profits and capital gains • Include taxes on • Individual or household income • Income of corporations • Capital gains • Winnings from lotteries or gambling 29 Other current taxes Current taxes on capital • Taxes that are payable periodically, usually annually on the property or net wealth of institutional units, excluding taxes on land or other assets owned or rented by enterprises and used by them in production, such taxes being treated as other taxes on production • Exclude • Taxes on property or wealth levied infrequently and at irregular intervals, or in exceptional circumstances • Income taxes assessed on basis of value of property when incomes cannot be estimated 30 Other current taxes Current taxes on capital • Include taxes on • Land and buildings • Net wealth • Other assets Miscellaneous current taxes • Include • Poll taxes • Expenditure taxes • Payments by households to obtain certain licenses (for example, own or use vehicles, boats or aircraft, recreational hunting, shooting or fishing) • Taxes on international transactions 31 Social contributions • Actual or imputed payments to social insurance schemes to make provision for social insurance benefits to be paid • Payable by employers and employees • Part of compensation of employees (primary allocation of income account) • Payable by households in capacity as employed, self-employed or unemployed persons in secondary distribution of income account Net social contributions • Social contributions • plus contribution supplements (investment income payable on pension entitlements) • less service charge Social benefits • Current transfers received by households intended to provide for the needs that arise from certain events or circumstances, for example, sickness, unemployment, retirement, housing, education or family circumstances • Social security benefits in cash (pension and non-pension) • Other employment-related social insurance benefits (pension and non-pension) • Social assistance benefits in cash 32 Other current transfers • Insurance-related transactions • Net non-life insurance and reinsurance premiums • Premiums earned and premium supplements less service charge • Non-life insurance and reinsurance claims • Some proportion may be recorded as capital transfers • Net fees under standardized guarantees • Fees earned and fee supplements less service charge • Calls under standardized guarantees • Current transfers within general government • Consist of current transfers between different government units 33 Other current transfers • Current international cooperation • Consists of current transfers in cash or in kind between governments of different countries or between governments and international organizations • Miscellaneous current transfers • Current transfers between central bank and general government • Current transfers to NPISHs (for example, membership dues, subscriptions, voluntary donations, etc, on a regular or occasional basis) • Current transfers between households (for example, remittances) • Fines and penalties • Lotteries and gambling • Payments of compensation for injury to persons or damage to property not settled by non-life insurance claims 34 Possible Source Taxes on income Individual or household income Tax authority Balance of payments Income of corporations Not applicable to households Capital gains Tax authority Balance of payments Winnings from lotteries or gambling Tax authority Balance of payments Other current taxes Tax authority Balance of payments Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 35 Possible Source Net social contributions and benefits Monetary and financial statistics Pension Supervisory Agency Government finance statistics Enterprise survey Balance of payments Other current transfers Insurance-related transactions Monetary and financial statistics Insurance Supervisory Commission Balance of payments Current transfers within general government Not applicable to households Current international cooperation Not applicable to households Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 36 Possible Source Current transfers between central bank and general government Not applicable to households Current transfers to NPISHs Household survey Enterprise survey Current transfers between households Household survey Balance of payments Fines and penalties Government finance statistics Balance of payments Lotteries and gambling Enterprise survey Balance of payments Payments of compensation for injury to persons or damage to property not settled by non-life insurance claims Administrative data Household survey Enterprise survey Balance of payments Note: If direct estimation is not possible, the total may need to be allocated to households using indicators. 37 • • • Property income and current transfers receivable/payable by households and other sectors Source data may be able to provide estimate of proportion allocated to households • Direct estimation is possible If not, use source data to estimate amount allocated to households in conjunction with various indicators 38 Specific example • Source data may only be able to provide total investment • income attributable to non-life insurance policyholders • Direct estimate of amount attributable to households not available Allocate estimate of investment income attributable to non-life insurance policyholders who belong to households by share of premiums for households in total premiums 39 Social transfers in kind • Goods and services provided to households by government and NPISHs either free or at prices that are not economically significant • Final consumption expenditure of general government and NPISHs on behalf of households • Individual goods and services (for example, health and education) • Distinct from collective services (for example, defence and street lighting) • Estimated from government finance statistics and survey of NPISHs 40 Thank You 41