Status of Implementation of 1993 SNA in the world

advertisement

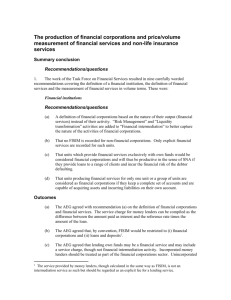

FISIM UN STATISTICS DIVISION Economic Statistics Branch National Accounts Section UNSD/NA/MR 1 Background Developments in the financial markets have changed the way financial corporations operate Is the 1993 SNA recommendation for calculating output of financial corporation services still relevant? Current SNA definition of financial intermediaries Financial corporations are defined as “…all resident corporations Financial intermediation itself is defined as or quasi-corporations principally engaged in financial intermediation or in auxiliary financial activities which are closely related to financial intermediation” (Paragraph 4.77). “…a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions in the market. The role of financial intermediaries is to channel funds from lenders to borrowers by intermediating between them. They collect funds from lenders and transform, or repackage, them in ways that suit the requirement of borrowers. They obtain funds by incurring liabilities on their own account, not only by taking deposits but also by issuing bills, bonds or other securities. They use these funds to acquire financial assets, principally by making advances or loans to others but also by purchasing bills, bonds, or other securities. Current SNA By the current SNA definition, financial intermediaries exclude own-funds. Own-funds by banks and money lenders are not supposed to generate services. Interest payments paid on own-funds are pure interest. Consequently, output of financial intermediaries is calculated as: Fisim + explicit service charges Fisim = Propety income receivable (not including those on own-funds) less interest payable. Change in financial environment Financial corporations, even banks, currently operate in broad ranges of activities, besides liquidity transformation. They incur liabilities like deposits, but also other securities (bills, bonds, mutual funds, market funds, etc.) and then acquire assets such as loans but also other financial assets (stocks, bills, bonds and other securities). Financial corporations are involved in risk management, liquidity transformation and/or auxiliary financial activities. Thus, financial corporations are redefined and recommended by the AEG as resident corporations or quasi-corporations principally engaged in providing financial services to other institutional units. The production of non-insurance financial services is the result of risk management, liquidity transformation and/or auxiliary financial activities. Output of financial corporations Output of financial corporations is recommended by the AEG to be broadly termed financial services instead of only intermediation. Therefore: services provided by using own-funds should be also taken into account. Returns from all financial investments including shares should be used in calculating Fisim. Fisim calculation Though broadly defined, fisim is still conservatively measured on the basis of deposits and loans using the reference rate. fL + fD = (rL –rr)L + (rr – rD)D Fisim on own funds: fL: fisim on loan, fD: fism on deposits rr: reference rate, rL: interest rate on loans, rD: interest rate on deposit L: stock of loans, D: stock of deposits. (rL –rr)L Advantage: fisim can be easily allocated to borrowers and depositors. Reference rate a rate that has no service element in it and reflects the risk and maturity structure of the financial assets and liabilities to which indirect service charges applies. single reference rate should be used but, when relevant, a country could choose to use multiple rates. different reference rates should be used for transactions in other currencies. Reference rate can be simply calculated as follows: rr R 0.5 D D RL L Thank You Central bank (CB) output Separate establishments should be established for units in the CB undertaking market and non-market production when market is significant. Non-market activities are treated as collective services consumed by general government with a matching income transfer from CB to general government so that there is no net cost to the government. Market output is provided on an individual basis to all sectors against their payment for these services. When interest rate set by CB is so high or so low, the difference with average interest rate should be treated explicitly as tax or subsidy by government.