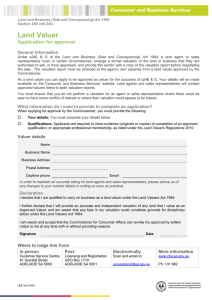

FORM O-6 [See rule 8D]

![FORM O-6 [See rule 8D]](http://s2.studylib.net/store/data/016947424_1-7b6742454a5315425643d91040d4e3e9-768x994.png)

FORM O-6

[See rule 8D]

Report of valuation of stocks, shares, debentures, securities, shares in partnership firms and business assets including goodwill

ALL QUESTION TO BE ANSWERED BY THE REGISTERED VALUER.

IF ANY PARTICULAR QUESTION DOES NOT APPLY TO THE PROPERTY UNER VALUATION,

HE MAYINDICATE SO. IF THE SPACE PORVIDED NOT SUFFICIENT, DETAILS MAY BE

ATTACHED ON SEPARTE SHEETS

Registration No. Name of registered valuer

1. Purpose for which valuation is made

2. Date as on which valuation is made

3. Name of the owner(s) of the asset(s) for which valuation is made

4. If the asset is under joint ownership/co-ownership, share of each owner:

5. Full description of the asset(s) of which valuation is made

6. Valuation of the asset(s) in question

[ the valuer should be discuss in details the factors which have been taken into account. In arriving at the valuation of shares, the profits of the company in question, its dividend policy, the prospects of the industry and of the company, nature and extent of controlling interest of those in management, factors regarding non-marketability, attractiveness to special purchasers, possibilities of capital appreciation and other relevant factors should be taken into account where the valuation is made in accordance with the Wealth-tax Rules,

1957, the particular rule in terms of which the valuation is made and the full computation in terms of the said rule should be indicated]

7. I hereby declare that__

(a) the information furnished above is true and correct to

Date the best of my knowledge and belief;

(b) I have no direct or indirect interest in the assets valued;

Place: Signature of registered valuer

![FORM O-9 Report of valuation of works of art [See rule 8D]](http://s2.studylib.net/store/data/016947428_1-6b57f4ec8e756f54db6fca918305533b-300x300.png)

![FORM O-7 Report of valuation of machinery and plant [See rule 8D]](http://s2.studylib.net/store/data/016947425_1-b38b4ad4fd54d30d9b19f70f569111be-300x300.png)