BUS 2001: Accounting for Non-Business Students Meeting Faculty Name

advertisement

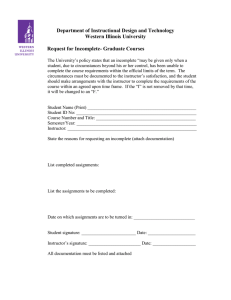

BUS 2001: Accounting for Non-Business Students Semester 20XX Class Information: Meeting Day : Time CRN: XXXXX Classroom: Schneider XXXX Faculty Name Office Number Office Hours E-mail Telephone Fax Website Course Description This is an introductory course in accounting which focuses on the role of accounting information in the planning, decision-making, and reporting of business organizations. Topics include transaction analysis, basic financial statement analysis, profit planning, cost behavior and cost control, and performance evaluation. This course integrates important subjects from both financial and management accounting. The Department of Accountancy in the Haworth College of Business offers and staffs this course. This course is not equivalent to Accountancy 2100 or Accountancy 2110 and does not count toward satisfaction of the Department of Accountancy core courses required for an accounting major or minor. Prerequisites Sophomore level standing Course Objectives This course is designed to give students a basic understanding of the role of accounting information in business. It focuses on business events throughout the management planning, performing, and evaluating cycles, and the effects of these events on the financial reporting and decision making of the organization. The course will include key concepts from financial and management accounting. Measurable Learning Outcomes By the completion of this course students are expected to: 1. understand the role of accounting in organizations 2. explain the purpose of the financial statements (i.e. balance sheet, statement of owners’ equity, income statement and statement of cash flows) 3. analyze basic business transactions including their effect on financial statement elements and implications for decision making 4. perform basic financial statement analysis 5. understand cost behavior, cost accumulation and cost allocation 6. plan for profit and cost control 7. evaluate performance in organizations 1 Text and Required Materials Survey of Accounting by Edmonds, Edmonds, McNair, Olds, Tsay and Milam; McGraw Hill/Irwin Publisher. Purchase of a one semester subscription to McGraw Hill’s Homework Manager supplement is also required. Course Work Students should plan to attend every course meeting and to complete reading assignments and homework by the due date on the assignment schedule provided by the instructor. Course meetings will include lecture, discussion and labs (in class assignments or teamwork). There will be three course exams and a comprehensive final. Following are approximate points that may be earned for coursework: Three Course Exams @ 100 points Comprehensive Final Homework, labs, other course work Total Course Points 300 150 150 600 Grading Scale Percentage of Points Earned 90 – 100% 86 – 89% 80 – 85 76 – 79 70 – 75 66 – 69 60 – 65 Below 60 Grade A BA B CB C DC D E Incompletes Incomplete grades will be awarded strictly in accordance with University policy. An incomplete is given only when circumstances beyond the control of the student prevent timely completion of course requirements. An incomplete grade may not be given as a means of avoiding a failing grade. 2 Classroom Policies o Attendance & Late Arrival - This course is comprehensive in nature. The material studied is cumulative and requires that students stay abreast of the coursework. Therefore attendance and timely arrival is required. o Participation – Students are expected to participate in classroom discussions and labs. Specific points may be earned for labs and class participation may be considered in final grading. o Absences – As mentioned above, it is strongly recommended that students attend every course meeting. However in that an absence is unavoidable, students are responsible for keeping up with the coursework. o Acceptance of Late Assignments – late assignments will not be accepted. Academic Honesty You are responsible for making yourself aware of and understanding the policies and procedures in the Undergraduate and Graduate Catalogs that pertain to Academic Honesty. These policies include cheating, fabrication, falsification and forgery, multiple submission, plagiarism, complicity and computer misuse. [The policies can be found at http://catalog.wmich.edu under Academic Policies, Student Rights and Responsibilities.] If there is reason to believe you have been involved in academic dishonesty, you will be referred to the Office of Student Conduct. You will be given the opportunity to review the charge(s). If you believe you are not responsible, you will have the opportunity for a hearing. You should consult with your instructor if you are uncertain about an issue of academic honesty prior to the submission of an assignment or test. Topics Introduction and the role of accounting in organizations Financial and management accounting Overview of financial statements and the elements of financial statements Understanding the accounting cycles Accounting for elements of financial statements: inventories, receivables, long-term assets, liabilities Types of business organizations: Proprietorships, Partnerships, and Corporations Cost behavior, operating leverage, and profitability Cost accumulation, tracing, and allocation Relevant information for special decisions Planning for profit and cost control Performance Evaluation Schedule The schedule for the course will be provided by the instructor. 3