P a u l W . ...

advertisement

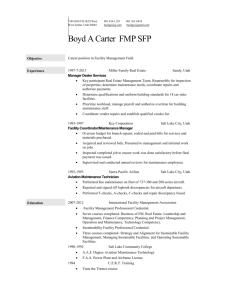

Paul W. Jones Experience Paul Jones concentrates his practice in tax, estate planning, wills, trusts and probate. He has also assisted clients in the areas of business and real estate matters and has experience in a wide array of transactions. Paul is also a licensed CPA. Representative Work Successful refund litigation in federal district court of levied funds for U.S. executive living abroad. Successful representation of businesses and individuals before the IRS and in tax court: audits, determinations, penalties, trust funds, liens, levies and other matters. Tax compliance work: tax reporting issues, U.S. taxation of international Of Counsel transactions, mergers and acquisitions, real estate transactions, sales tax, property tax, and other tax transactions. Preparation of comprehensive estate planning documents: wills, trusts, powers of attorney, advanced directives (health care powers of attorney and living wills), deeds, beneficiary designations, charitable planning, etc. Corporate and business entity formation and planning. Probate of wills and providing estate and trust administration. Professional Honors and Activities Officer, Tax Section, Utah State Bar Member, Utah Association of Certified Public Accountants Presentations "Probate Process From A to Z," National Business Institute, Salt Lake City, Utah, 2014 "Foreign Earned Income: Exclusion and Other Tax Issues for Expat Workers," Strafford Publishing, Salt Lake City, Utah, 2014 Salt Lake City (Holladay), UT (801) 998-8471 direct (801) 208-8995 fax paul.jones@stoel.com Education University of Utah, J.D., with honors Weber State University, M.Pr.A. (Masters of Professional Accountancy) University of Utah, B.A., Accounting Admissions Utah U.S. District Court for the District of Utah Utah Supreme Court U.S. Tax Court "Federal Estate and Gift Tax 2014," Foxmoor Continuing Education, Salt Lake City, Utah 2014 "Trusts 101," National Business Institute, Salt Lake City, Utah, 2013 "Foreign Earned Income: Exclusion and Other Tax Issues for Expat Workers" Strafford Publishing, New York, New York, 2013 Languages Spanish Paul W. Jones "Tax Planning for Trusts and Estate," National Business Institute, Salt Lake City, Utah, 2012 "Unpaid Payroll Taxes: Handling an IRS Trust Fund Penalty from Administrative Proceedings Through Litigation," Utah State Bar Summer Conventions, Sun Valley, Idaho, 2012 "Cooperative Development of Oil and Gas Resources," Oil, Gas and Mineral Land Law, Salt Lake City, Utah, 2009 "Accounting for Estates and Trusts," Accounting for Estates and Trusts Conference, Salt Lake City, Utah, 2009 Publications Paul maintains a monthly blog at http://pauljonesattorney.com/ that provides updates on tax and estate planning legal issues. "How to Form a Nonprofit Organization: Public Charities and a Private Foundations[sic]," ArticleBase, 2009