Adopting as an accessible and user friendly tool within your organisation.

Adopting Real Options as an accessible and user friendly tool within your organisation.

David Houldridge

Technology Valuation Manager

E-mail. David.Houldridge@Smith-Nephew.com

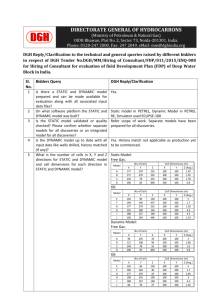

DGH/ROG/06/00

1

Contents

Overcoming Barriers to adoption

–

Why they may exist.

– How Smith & Nephew overcame some.

Upside of using options

–

What it may lead to

Practical advice on using Real Options

DGH/ROG/06/00

2

Innovation from Objectives

“The innovation process must be set at the highest level of the corporation by identifying goals and priorities, ... The targets you set must be clear and challenging, for you cannot wait for innovation just to show up at your company one day. But you need not, and should not, possess the entire solution to the challenge you set. You have to be sure…that that you raise is realistic, though it might appear impossible.”

-

Akio Morita - Sony Corporation

The Innovation Lecture London Feb 1992

DGH/ROG/06/00

3

Why do barriers exist?

C = SN([Ln(S/X)+(r+

2 /2)t]/

t) -

Xe -rt N([Ln(S/X)+(r-

2 /2)t]/

t)

V= G e r t

t * d(k,h; r

)-K e r t d(k-

t * , k-

tr

-K* e r t

D(k-

4

DGH/ROG/06/00

Culture

“Successful investment risk management is dependent on the right company culture being in place , so chief executives and senior management must take a major interest in the development and application of their procedures.”

5

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

Accountants?

“The challenge from the point of view of the finance department is to put parameters around curiosity and determine what is and what is not productive. After all, our success or failure in R&D won’t result from the quality of our scientists alone; it will also come from the quality of our thinking about where to invest

”

Scientific Management at Merck. - an Interview with CFO Judy Lewent. Harvard Business Review, 1994.

DGH/ROG/06/00

6

DGH/ROG/06/00

Company characteristics

Rules

“Quality” systems

Planning

‘Bean counters’

Predictability

Tasks

Budgets

Assets

vs

Flexibility

quality “Systems”

What ifs

Investors

Uncertainty

Objectives

Resource Flexibility

Knowledge

7

“Typical” decision maker characteristics

Intuitive

Computer averse

Short attention span

Skim readers

Set in ways

Make ‘long lasting’ decisions

Are right most of the time

Have invested a lot of themselves in the old way

vs

Analytical

Utilise technology

Focussed

Flexible

Accuracy is not needed

Conceptual

Knowledge gathering

Utilise “Team”

DGH/ROG/06/00

8

Intuition

Decisions based on intuition are commonly flawed because of bias and missing or misleading information.

9

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

Proper analysis

Alternatively, proper analysis may be discouraged because it is seen as

– too complex to conduct,

– too time-consuming,

– too costly or ineffective.

Individuals may prefer to rely on intuition, ‘gut feelings’, to determine their course of action.

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

10

Black Box Mentality

What decade did your decision makers learn their trade?

Inputs

What was the current state of technology at that time?

DGH/ROG/06/00

Output??

11

Advisors

What are they employed for?

How much have they invested in their advice?

How much has the company invested in their advice?

Do they know their job?

DGH/ROG/06/00

12

Flicking the switch

How do we get them turned on?

GO

DGH/ROG/06/00

13

Spreading the ‘Word’

Assumption: being right will not gain support and buy-in.

Permeation will occur when and where weaknesses allow it.

14

DGH/ROG/06/00

Let them adopt it for their needs

DGH/ROG/06/00

Smith & Nephew for example

Lead customer

Early adoption by a big customer

Raised as questions in other business situations

– Not imposed on middle management

– Just communicated with examples for discussion

Raised awareness of opinion leaders within S&N

Used as part of idea selection

– adoption by scientists / project leaders.

15

Key diffusion issues within Smith

& Nephew

Broadly accepted need

– Justified gut feel projects that other methods throw out.

Key enablers in place to allow adoptions

– Forecasting, Portfolio management

Solution not threatening to top management

– Presented as a decision support tool for top management

Methodology allowed better representation of key information

–

Presenters and recipients were more comfortable

DGH/ROG/06/00

16

Luehrman Portfolio

GRC Project Portfolio

-2.0

Consider Carefully

HOLD

NEVER

-1.5

-1.0

7

6

Probably

Invest

3

2

5

4

1

NOW

-0.5

0

0.0

0.5

1.0

LN(Value/Cost quotient)

1.5

2.0

BUILD

2.5

3.0

DGH/ROG/06/00

17

When do “Real Options” make a difference?

Traditionally

–

If Return is >>> Investment

“No Brainer”

–

If Investment >>> Return

“Kill”???

Look for marginal calls, where the decision maker has a vested interest.

18

DGH/ROG/06/00

Comparison of Methods

Value

Option

£0

DTA

DCF

DGH/ROG/06/00

From Vrettos & Steiner.In Vivo May 1998, p27-32

Project Lifetime

19

Pet projects

Tissue Engineering ten years ago?

Traditional approaches with negative £ value led to

– “gut feel”

– Soft items

Science

Ambition

Legacies

Real Options can incorporate gut feel especially where it relates to upside £

DGH/ROG/06/00

20

NPV

Reducing Uncertainty and Expectations

Max

Actual

Outcome

Possible outcomes at review dates

Min

Time

DGH/ROG/06/00

21

Managing Uncertainty -

after Newton and Pearson

Regulatory

Project Timeline

Development

End of Research

Project start

Return

DGH/ROG/06/00

22

Qualitative and Quantitative

The risk management process requires the integration of qualitative and quantitative analytical support in an iterative cycle of management activities through the whole life of an investment.

The quantitative analysis tests the insights and conclusions developed during the qualitative analysis by producing real dimensions required for most decisions.

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

23

Opening up opportunities that may have been dismissed

Volatility

–

Our volatility is limited by the thoughts of the organisation?

–

What if?

Should lead to how?

?

££££

DGH/ROG/06/00

24

Setting targets and Contingency levels

0%

Cumulative Probability

20% 40% 60% 80% 100%

Maximum Cost

Expected Cost

Target Cost

Minimum Cost

20% probability of attaining cost target

Time (years)

20% probability of attaining schedule target

Expected

Target

100%

80%

60%

40%

20%

0%

DGH/ROG/06/00

25

Raising targets

How often do you get…

– “I can guarantee to deliver that”

Does this lead to rapid growth or maintenance of the status quo?

Commitment or committed?

DGH/ROG/06/00

26

Intangible assets

Intelligent use of Real Options can lead to a

“valuation” of intangibles such as Knowledge, patents…

Relies on definition of the work and imposing decisions after the acquisition of the intangible.

££

££

££ NOW

FUTURE

STOP

DGH/ROG/06/00

27

Upside of risky decisions

Given that some of our investments will fail, how do we know our more risk acceptance culture will pay back?

–

If we are risk averse, why should we change our nature?

28

DGH/ROG/06/00

Our Current Portfolio is low risk.

Risk comfort line

New Products

Current Products

DGH/ROG/06/00

Current Markets New Markets

29

Total accumulated revenues, 1976 –1994, of all companies employing each entry strategy

From: Clayton M Christensen, The opportunity and threat of disruptive technologies, 1997

Total Revenues Accumulated by all firms, 1976 -1994

$237

Average per Company $16

New Products

Total Revenues Accumulated by all firms, 1976 -1994

$14420

Average per Company $1800

Current Products

Total Revenues Accumulated by all firms, 1976 -1994

$3056

Average per Company $83

Total Revenues Accumulated by all firms, 1976 -1994

$36050

Average per Company $1500

DGH/ROG/06/00

Current Markets New Markets

30

Level of accuracy

If the future is uncertain why do we need to be certain about now?

What are we trying to do?

–

Justify this piece of work?

–

So how positive does it need to be?

If the precision improves our thinking on the model of the future it is worthwhile, otherwise…

DGH/ROG/06/00

31

What are we valuing?

C = SN(d

1

) - Xe -rt N(d

2

) t

C

YES

NO

X

DGH/ROG/06/00

C,X,S all in £

max

S

min

32

Simple software allows easier examination of inputs

Sensitivity Analysis

33

-0.60

DGH/ROG/06/00

-0.50

-0.40

-0.30

-0.20

-0.10

0.00

0.10

0.20

Qualitative and Quantitative

“Whenever we are tempted to further refine our scoring of uncertainties, we should ask ourselves if we are attempting to use qualitative analysis to produce quantitative measures.”

34

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

Real world scenarios into real options calculations

Five data points

Have an NPV (S)

Have Cost (X)

Know T-t

R is often given

Sigma – guess or use Pert methods

Quick Black - Scholes, change variables and understand what happens when the calculation goes belly up off we go.

DGH/ROG/06/00

35

Pert Method of Forecasting

EV = (a + 4m + b)/6

s.d = (b-a)/6

= s.d/EV

a = pessimistic

b = optimistic

m = most likely

Needs experts!

DGH/ROG/06/00

Can use Delphi approach

36

Management

Successful investments are not delivered by analysis alone and management of both objectives and risks must continue throughout the whole life of an investment.

37

From Strategic Investment Decisions. Harnessing opportunities managing risks. L Krantz, A Thomason. FT/Prentice Hall. London.1999.

DGH/ROG/06/00

Speculation and Investment

“

Speculation is an effort, probably unsuccessful, to turn a little money into a lot. Investment is an effort, which should be successful, to prevent a lot of money becoming little.”

–

Fred Schwed – FT 22/11/99

38

DGH/ROG/06/00