I N D E ... A B

advertisement

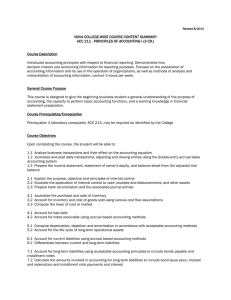

I N D E X A B Accrual Uniform Presentation Framework Balance Sheet 8-1 Budget scope 1-27 Comparison to accrual based accounting reports 8-6 Concepts of government finance statistics (GFS) 8-2 Departure from GFS principles 1-15 (also known as Statement of Financial Position) Accrual uniform presentation framework tables Concepts Management 8-26 1-24, 8-3 xvii, 4-1 1-26 Sectorial classifications 8-6 Budget Balancing Assistance 3-22, 7-3 (also known as Transitional Assistance) Accrual Uniform Presentation Framework Tables Factors affecting Budget outcomes 5-18 Budget Result i, 1-8 8-19 General government sector expenses by function 8-38 (also known as net lending / (borrowing)) General government sector taxes 8-38 Budget estimate for 2002-03 Loan council reporting requirements 8-39 Factors affecting Budget outcomes 5-14 NSW public sector balance sheets 8-26 Forward estimates 1-10 NSW public sector cash flow statements 8-32 NSW public sector operating statements 8-20 Non-financial public sector Agriculture, Forestry and Fishing Asset Acquisitions 2-32 x, 1-12 Budget estimates for 2002-03 1-12 By policy area 2-13 Factors affecting Budget outcomes 5-17 Private provision of infrastructure PTE sector Revised estimates for 2001-02 8-40 PTE sector Revised estimates for 2001-02 Sensitivity to alternative economic scenarios AAS31 financial statements 1-8, 1-19 5-12 Cash Flow Statement Accrual uniform presentation framework tables Concepts 1-17 8-32 1-24, 8-5 8-8 1-21 Cash Result PTE sector Australian Accounting Standard 31 (AAS31) Departure from Australian Accounting Standards 8-19 8-12, 8-16 C Historical Series Comparison to GFS 1-8 1-16 v, 1-18 8-12, 8-17 1-24 1-25 Classification of agencies - See also Budget Paper 3 C-1 A-1 Commonwealth Grants - See Revenue Australian Economy - See Economic Situation and Outlook Budget Statement 2002-03 i-1 I N D E X Commonwealth-State Financial Arrangements Employment 7-2 Commonwealth Grants Commission 2002 Update of State Relativities 7-8 Intergovernmental Agreement 7-2 National tax reform 7-2 7-4 Vertical fiscal imbalance Concessions Gross state product 5-5, 5-9 Interest rates 5-8, 5-11 Risk factors Horizontal Fiscal Equalisation - See Horizontal Fiscal Equalisation 2002 Treasurers' Conference 5-5, 5-9 5-2 State final demand 5-5, 5-9 Wages 5-5, 5-9 Education 2-22 Electricity Tariff Equalisation Fund 3-20 7-11 6-1, B-27 By function Concepts Detailed estimates 6-6 Employment - See Economy 6-1 B-27 Environmental Protection Consumer Price Index - See Economy Expenditures - See Service Delivery Contingent Liabilities - See Liabilities Expenses 2-35 vi, 1-11 Budget estimates for 2002-03 Contracts and Conveyances Duty - See Taxation Revenue Credit Rating By policy area - See Service Delivery Capital expenditure - See Assets Acquisitions vi, 1-2 D Debt Management 1-11 Factors affecting Budget outcomes 5-15 Forward estimates 1-13 PTE sector 8-16 Revised estimates for 2001-02 1-20 4-18 F Dividends - See Revenue Fines - See Revenue E Economic Situation and Outlook First Home Owners Scheme Australian economy 5-8 International economy 5-8 Medium term outlook 5-11 NSW economy Recent performance Economy Consumer Price Index i-2 3-16, 3-23, 7-3 xix, 5-2 Fiscal Principles - See Fiscal Strategy Fiscal Strategy iii, 1-1 5-8 5-3 General Government Debt Elimination Act 1995 v, 1-2 Position and outlook i, 1-1 xix, 5-1 Statement 5-5, 5-9 Targets and principles 1-2 1-6, 3-7 Budget Statement 2002-03 I N D E X Financial impact 7-3 G Gambling Taxes - See Taxation Revenue Government Finance Statistics - See Accrual Uniform Presentation Framework General Government Agencies - See also Budget Paper 3 Asset acquisitions C-1 Balance sheet 1-15 Budget Result i, 1-8 Cash flow statement 1-17 Cash result Guaranteed Minimum Amount vi, 1-11, 1-13, 1-20 H v, 4-11 Health i, 4-1 Net interest expense 4-13 Net worth Revenues 3-28, 4-2 7-11 Cross subsidy to other States 7-13 Review of Commonwealth-State funding 7-14 2-31 I Infrastructure - See Asset Acquisitions Insurance Liabilities - See Liabilities Insurance Management 4-18 3-22 5-18 Inter-governmental Financial Relations - See Commonwealth-State Financial Arrangements GMA - See Guaranteed Minimum Amount Goods and Services Tax 7-2 Commonwealth grants 3-22 - See Commonwealth-State Financial Arrangements Budget Statement 2002-03 4-8 Horizontal Fiscal Equalisation Housing and Water - See General Government Factors affecting Budget outcomes 2-13 HIH Insurance Group xiv, 1-9, 1-12, 1-19, 3-1 General Government Sector General Purpose Payments 7-2 5-18 1-13 1-10, 1-22 General Government Debt Elimination Act 1995 See Fiscal Strategy General Government Liability Management Fund Factors affecting Budget outcomes v, 1-6 Net financial liabilities Operating statement Gross State Product - See Economy 4-5 Fiscal targets Net debt Grants and Contributions - See Revenue 1-16, 1-18 Cost of servicing major financial liabilities Expenses GST - See Goods and Services Tax x, 1-12, 1-21 International Economy - See Economic Situation and Outlook Interest Expense - See Net Debt i-3 I N D E X Investment Income - See Revenue Non-financial Corporation Sector - See PTE Sector L Non-financial Public Sector Land Tax - See Taxation Revenue Net lending / (borrowing) 8-19 Net operating balance 8-18 Law and Order - See Public Order and Safety O Liabilities Contingent liabilities Operating Revenues - See Revenue 5-17 Cost of servicing major financial liabilities 4-5 Operating Statement Insurance liabilities 4-8 Net financial liabilities i, 4-1 Public liability issues 4-10 Superannuation liabilities 4-5 Unfunded insurance liabilities 4-9 Unfunded superannuation liabilities Concepts 8-20 1-23, 8-3 Other Economic Services, Mining, Energy and Construction 2-40 Other Purposes Portfolio 2-42 P Payroll Tax - See Taxation Revenue 8-39 M Medical Negligence Insurance Accrual uniform presentation framework tables 4-14 Licences - See Revenue Loan Council Reporting Requirements 1-10, 1-22 Police - See Public Order and Safety 4-8 Policy Priorities - See Service Delivery Motor Vehicle Tax - See Taxation Revenue Public Authorities (Financial Arrangements) Act 1987 N Net Debt Net interest expense PTE sector Net Financial Liabilities v, 4-11 Public Liability - See Liabilities 4-13 4-4, 4-7 i, 4-1 PTE sector 4-4, 4-6 State sector 4-4 Public Order and Safety NSW Economy - See Economic Situation and Outlook 2-25 Public Trading Enterprise (PTE) Sector 8-8 (also known as Public Non-financial Corporation Sector) Capital investment 8-8 Cash result Net Lending / (borrowing) - See Budget Result i-4 4-17 8-12, 8-17 General government equity 8-11 Expenses 8-16 Net lending / (borrowing) 8-12, 8-16 Budget Statement 2002-03 I N D E X Net operating balance Operating statement Revenues 8-14 8-12, 8-14 Specific Purpose Payments Factors affecting Budget outcomes 3-24 5-18 8-15 Stamp Duties - See Taxation Revenue R Recreation and Culture Regional NSW 2-38 2-3, 5-4 State Final Demand - See Economy Statement of Financial Position - See Balance Sheet - See also Budget Highlights for Regional and Rural New South Wales Revenue Social Security and Welfare xiv, 3-1 Commonwealth grants 3-22, 5-18 Dividends 3-24, 5-19 Factors affecting Budget outcomes 5-18 Fines 3-26 Goods and Services Tax - See Goods and Services Tax Grants and contributions 3-29 Investment income 3-28 Licences 3-26 Operating revenues 3-27 PTE sector 8-15 Royalties 3-27 Sale of goods and services Tax equivalents S Sale of Goods and Services - See Revenue Expenses by policy area Strategic objectives 2001-02 expenses and asset acquisitions 2002-03 expenses and asset acquisitions Budget Statement 2002-03 SPP's - See Specific Purpose Payments Superannuation Factors affecting Budget outcomes 5-16 Funding plan 4-17 General Government Liability Management Fund 4-2 Liabilities 4-5 Trustee 4-18 Unfunded Liabilities 4-14 T Tax Equivalents - See Revenue 3-28 3-24, 5-19 Taxation - See Taxation Revenue Service Delivery 2-17 vi, 2-1 Tax Expenditure 6-1, B-1 By function 6-5 By type of tax 6-4 Concepts 6-1 Detailed estimates B-1 Tax Policy Measures xiv, 3-2 2-11 2-2 Tax Restraint 3-7 2-7 Taxation Revenue 2-9 3-12 Contracts and conveyances duty 3-15 Gambling taxes 3-20 Land tax 3-19 i-5 I N D E X Motor vehicle taxation 3-19 Payroll tax 3-19 Stamp duties 3-18 Total State revenue xv, 3-12 TMF - See Treasury Managed Fund Transport 2-28 Transitional Assistance - See Budget Balancing Assistance Treasurer's Advance 5-16 Treasury Managed Fund 4-8 U Unfunded Insurance Liabilities - See Liabilities Unfunded Superannuation Liabilities - See Liabilities Uniform Presentation Framework - See Accrual Uniform Presentation Framework V Vertical Fiscal Imbalance - See Commonwealth-State Financial Arrangements W Wages General - See Economy Factors affecting Budget outcomes i-6 5-16 Budget Statement 2002-03