Exam 1 – Spring 2009 Finance 3321 – Moore

advertisement

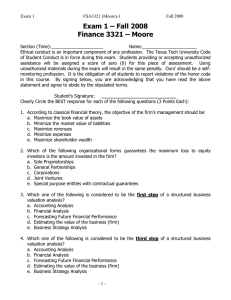

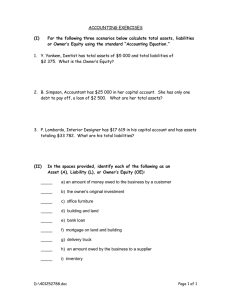

Exam 1 FSA3321 (Moore)-1 Spring 2009 Exam 1 – Spring 2009 Finance 3321 – Moore Section (Time):_____________________ Name:______________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions (3 Points Each): 1. According to classical financial theory, maximizing shareholder value is results from: a. Maximizing the book value of assets b. Minimizing the market value of liabilities c. Maximizing revenues d. Minimizing expenses e. Maximize the market value of assets 2. Which of the following organizational forms has no limits to the maximum loss equity investors are exposed to? a. Private Corporations b. General Partnerships c. Public Corporations d. Limited partners in a Limited Partnership e. Government entities 3. Which one of the following is considered to be the second step of a structured business valuation analysis? a. Accounting Analysis b. Financial Analysis c. Forecasting Future Financial Performance d. Estimating the value of the business (firm) e. Business Strategy Analysis 4. Which one of the following is considered to be the fifth step of a structured business valuation analysis? a. Accounting Analysis b. Financial Analysis c. Forecasting Future Financial Performance d. Estimating the value of the business (firm) e. Business Strategy Analysis -1- Exam 1 FSA3321 (Moore)-1 Spring 2009 5. Market failure and the value of information, within the context of the insurance industry, has been examined. Assume PG is the fair insurance price for Good drivers and PB is the fair insurance price for Bad drivers, where PG < PB and 25% of the drivers are Good drivers. If insurers do not have a mechanism to distinguish good and bad drivers, what price(s) will result in the voluntary insurance market? a. PG for good drivers and PB for bad drivers b. PG for good drivers and PB for bad drivers c. (PG + PB )/2 for everyone d. (.25PG + .75PB ) for everyone e. PB for everyone 6. If, in Question 5 (above), imperfect information regarding the type of driver were available to insurers and insurance were mandatory, what prices would obtain? a. Good drivers pay more than PG but less than (.25PG + .75PB) while bad drivers pay PB b. Good drivers pay PG and bad drivers pay PB c. Good drivers pay PG and bad drivers pay more than PB d. Good drivers pay more than PG but less than (.25PG + .75PB) while bad drivers pay less than PB but more than (.25PG + .75PB) e. Both Good and Bad drivers pay (PG + PB )/2 since information is imperfect 7. Which of the following IS part of the firm’s accounting environment? (Figure 1-2) a. Choice of Accounting Policies b. Accounting conventions and regulations c. Choice of reporting environment d. Choice of reporting format e. Choice of supplementary disclosures 8. Which one of the following is an element of the Business Environment (Fig 1-2): a. Scope of Business b. Operating Activities c. The Accounting System d. Third-Party Auditors e. Product Markets 9. Which of the following intentional fraudulent accounting practices did the Satyam Computer CEO not admit to in his resignation letter. a. Overstating revenues b. Understating Loan Guarantee Liabilities c. Overstating Cash Balances d. Overstating Operating Income e. Overstating Non-Current Assets such a Plant, Property and Equipment -2- Exam 1 FSA3321 (Moore)-1 Spring 2009 10. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. 11. a. b. c. d. e. Which of the following is correct? Conservative accounting choices are mandated by republicans Aggressive accounting policies (choices) lead to lower earnings and higher assets The independent auditor’s opinion and statement on the 10-K guarantee the information contained in the financial reports are correct. The information contained in financial reports reflect “people-made” numbers and choices that may contain material errors and biases. The information contained in audited financial reports are unquestioned facts because GAAP and the SEC required perfect information to be contained in 10-K’s. 12. What is the fifth step (of six) of a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies 13. The degree to which external users of financial reports get a true and fair view of the company’s activities and accomplishments is a measure of which of the following? a. Financial reporting relevance b. Financial reporting conservatism c. Financial reporting opaqueness d. Financial reporting transparency e. Financial reporting disaggregation 14. The fact that a credit analyst would use a different set of information to analyze a firm than would an equity analyst is a result of: a. Managers’ superior information on business activities b. Noise from estimation errors c. Business strategy analysis d. Business application context e. Financial Analysis 15. Which of the following would lead to the lowest degree of price competition? a. Low Product differentiation b. Low industry growth rates c. Low barriers to exit industry d. High threat of new entrants to the industry e. Low industry concentration -3- Exam 1 FSA3321 (Moore)-1 Spring 2009 16. An industry displaying a mixture of price competition and product differentiation would be characterized by: a. Low Industry Concentration, Few Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First mover advantage, High Product Differentiation c. High Industry Concentration, High Investment in R&D, Low Excess Capacity d. Low Industry Concentration, High Fixed-Variable Cost Ratio, Low Product Differentiation e. Supply > Demand, High Industry Switching Costs, Steep Industry Learning Curves 17. Which of the following would lead to the highest degree of industry price competition? a. High Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, Low Product Differentiation c. Low Industry Concentration, High Legal Barriers to Entry, Steep Learning Curves d. High Industry Concentration, High Fixed-Variable Cost Ratio, Low Industry Growth e. Supply < Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 18. Which of the following strategies would lead to pure cost leadership or pure product differentiation strategies? a. Economies of scale and scope, high R&D investment, tight cost control b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on Cost Control e. Simpler product designs, Tight cost control, superior product quality 19. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of which? a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 20. WalMart’s ability to dictate price & delivery terms to a glove supplier is an example of: a. Bargaining power of the firm over Customers b. Bargaining power of Customers over the firm c. Bargaining power of Suppliers over the firm d. Bargaining power of the firm over Suppliers e. A case where no bargaining power is present 21. The main purpose of a firm’s financial reports is to: a. Present Assets, Liabilities and Equity b. Present Revenues and Expenses c. Present Operating, Investing and Financing Cash Flows d. Provide equity investors a means of determining the market value of the firm e. Credibly communicate economic consequences of business activities to users of financial statements. -4- Exam 1 FSA3321 (Moore)-1 Spring 2009 22. Which of the following components of the annual financial report is not audited: a. Balance Sheet b. Income Statement c. Management discussion and Analysis d. Statement of Cash Flows e. Statement of Owners Equity 23. An example of conservatism in accounting that can lead to understating the perceived value of assets is: a. Recording physical assets at historical cost b. Capitalizing goodwill c. Incorporating comprehensive income adjustments in shareholder equity d. Marking financial assets to current market value e. Marking physical assets to current market value 24. Target Company has a pre-acquisition balance sheet with the following values: Assets = $35,000; Liabilities = $15,000 and Equity = $20,000. Acquirer Company buys Target for $90,000 and revalues liabilities at $30,000. The amount of Goodwill that Acquirer recognized from the purchase was $60,000. What was the total amount of revalued assets recognized on the purchase of Target? a. $60,000 b. $40,000 c. $35,000 d. $30,000 e. $15,000 Use the following information for Problems 25 and 26 ABC Company booked $12,000,000 of customer deposits covering the next five years of technical consulting as revenue in 2007. The deposits were received on March 1, 2007. The error was caught in February 2009 and an amended 10-K was issued immediately to correct the mistake. Assume a tax rate of 30% for ABC and that ABC has a fiscal (financial) year end at the end of December in each year. 25. The impact to the original 2007 10-K would be: a. Revenues were overstated by $12,000,000 b. Expenses were overstated by $10,000,000 c. Equity was overstated by $10,000,000 d. Assets were overstated by $12,000,000 e. Liabilities were understated by $10,000,000 26. The amended 2008 10-K would reflect which one of the following adjustments? a. Increase revenues by $10,000,000 b. Increase net income by $1,680,000 c. Increase assets by $10,000,000 d. Reduce owners’ equity by $7,600,000 e. Increase net income by $2,400,000 -5- Exam 1 FSA3321 (Moore)-1 Spring 2009 Use the following information for Problems 27 through 30 ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive highway construction equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 25 years and that their annual cost of debt is 5.1%. The annual lease payments are $4,000,000. The present value of the future lease payments is $55,815,000 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 30%. 27. Adjust ABC’s books to reflect the lease as being capitalized. Adjusting for the initial recognition of the capital lease would have the following impact on the balance sheet (Asset and Liability Accounts) in terms of debits and credits a. Debit Lease Liabilities for $100,000,000 and Credit Leased Assets for $100,000,000 b. Debit Leased Assets for $4,000,000 and Credit Lease Liabilities for $4,000,000 c. Debit Leased Assets for $55,815,000 and Credit Lease Liabilities for $55,815,000 d. Debit Leased Assets for $100,000,000 and Credit Lease Liabilities for $100,000,000 e. Debit Lease Liabilities for $55,815,000 and Credit Leased Assets for $55,815,000 28. Adjust ABC’s books to reflect the lease as being capitalized. The reduction in lease liabilities after the third payment is (assume payments made at the end of the year): a. $557,850 b. $689,860 c. $1,212,260 d. $1,274,085 e. $4,000,000 29. Adjust ABC’s books to reflect the lease as being capitalized. charge for interest expense in the second year. a. $4,000,000 b. $2,787,740 c. $2,797,639 d. $2,725,915 e. $2,755,636 Compute the appropriate 30. Compute the overall effect on Net Income in the second year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax). a. $1,409,022 Lower b. $ 848,582 Higher c. $1,020,340 Lower d. $ 714,238 Lower e. $1,237,180 Higher -6- Exam 1 FSA3321 (Moore)-1 Spring 2009 Problem 1 – Overs and Unders (10 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) Assets 1 The company used an unrealistically high bad debt expense ratio 2 The company used too large a growth rate to estimate the present value of future medical benefit costs on a defined benefit pension healthcare plan 3 The company failed to write down obsolete inventory 4 The company recognized revenues on customer deposits before they were earned 5 The company wrote down excessive goodwill in 2008 since shareholders were expecting severe losses, anyway -7- Liabilities Equity Revenues Expenses Net Income