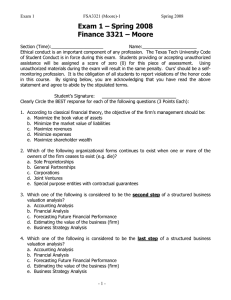

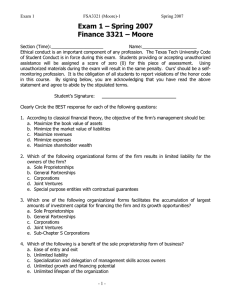

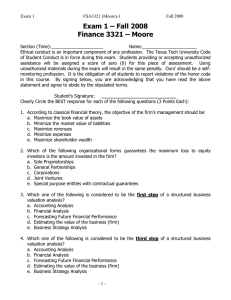

Exam 1 – Fall 2007 Finance 3321 – Moore

advertisement

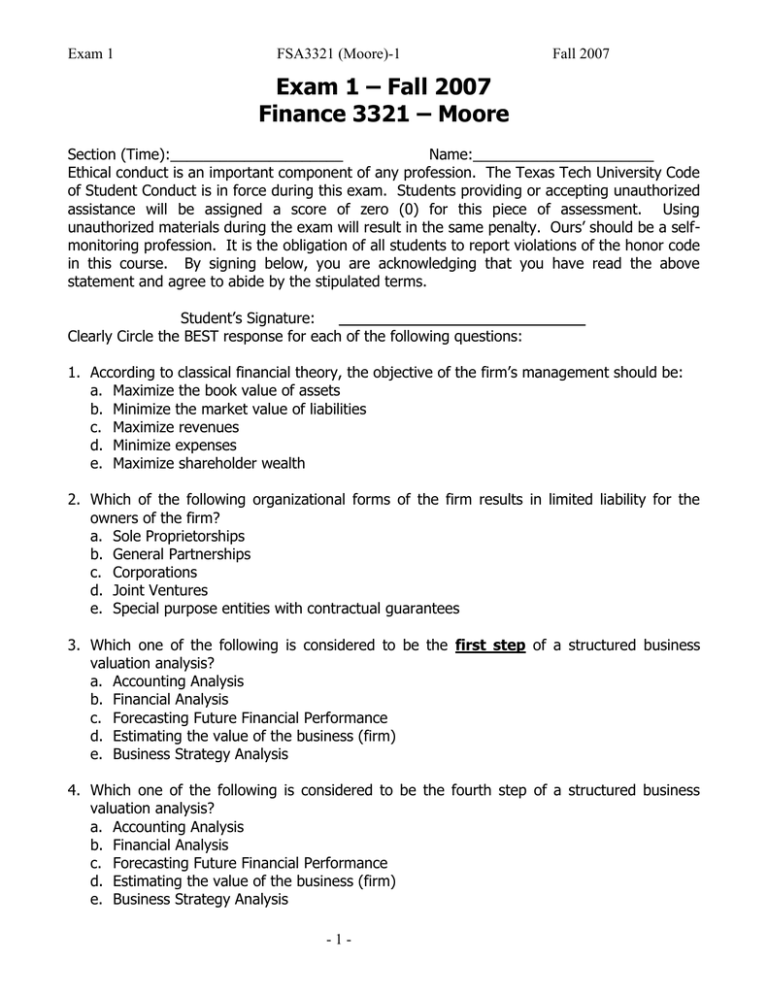

Exam 1 FSA3321 (Moore)-1 Fall 2007 Exam 1 – Fall 2007 Finance 3321 – Moore Section (Time):_____________________ Name:______________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. According to classical financial theory, the objective of the firm’s management should be: a. Maximize the book value of assets b. Minimize the market value of liabilities c. Maximize revenues d. Minimize expenses e. Maximize shareholder wealth 2. Which of the following organizational forms of the firm results in limited liability for the owners of the firm? a. Sole Proprietorships b. General Partnerships c. Corporations d. Joint Ventures e. Special purpose entities with contractual guarantees 3. Which one of the following is considered to be the first step of a structured business valuation analysis? a. Accounting Analysis b. Financial Analysis c. Forecasting Future Financial Performance d. Estimating the value of the business (firm) e. Business Strategy Analysis 4. Which one of the following is considered to be the fourth step of a structured business valuation analysis? a. Accounting Analysis b. Financial Analysis c. Forecasting Future Financial Performance d. Estimating the value of the business (firm) e. Business Strategy Analysis -1- Exam 1 FSA3321 (Moore)-1 Fall 2007 5. Market failure and the value of information, within the context of the insurance industry, has been examined. Assume PG is the fair insurance price for Good drivers and PB is the fair insurance price for Bad drivers, where PG < PB and 40% of the drivers are Good drivers. If insurers do not have a mechanism to distinguish good and bad drivers, what price will result in the voluntary insurance market. a. PG b. PB c. (PG + PB )/2 d. (.4PG + .6PB ) 6. The market failure described in Question 5 (above) results from: a. Efficient market hypothesis (semi-strong form) b. Efficient market hypothesis (weak form) c. The Modigliani and Miller Theorem d. Information Asymmetry e. The Capital Asset Pricing Model 7. Which of the following IS NOT an accounting strategy choice for the firm? (Figure 1-2) a. Accounting Policies b. Contracting and Governance c. Accounting Estimates d. Reporting Format e. Supplementary Disclosure 8. Which one of the following is an element of the Business Environment (Fig 1-2): a. Competitive Positioning b. Operating Activities c. Product Markets d. Third-Party Auditors e. Reporting the economic consequences of business activities 9. Which one of the following business analysis tools involves the evaluation of performance using ratios and cash flow analysis? a. Business strategy analysis b. Prospective analysis c. Accounting analysis d. Financial analysis e. Valuing the firm 10. The items in question 7 represent the steps to a structured valuation analysis. Put these steps in sequential order below: a) a, b, c, d, e b) c, a, b, e, d c) a, c, d, b, e d) a, c, b, e, d e) e, d, a, b, c -2- Exam 1 11. a. b. c. d. e. FSA3321 (Moore)-1 Fall 2007 Which of the following is correct? Conservative accounting choices are mandated by republicans Aggressive accounting policies (choices) lead to lower earnings and higher assets The independent auditor’s opinion and statement on the 10-K guarantee the information contained in the financial reports are correct. The information contained in financial reports reflect “people-made” numbers and choices that may contain material errors and biases. The information contained in audited financial reports are unquestioned facts because GAAP and the SEC required perfect information to be contained in 10-K’s. 12. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. 13. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies 13. What is the second step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies 14. The fact that a credit analyst would use a different set of information to analyze a firm than would an equity analyst is a result of: a. Managers’ superior information on business activities b. Noise from estimation errors c. Business strategy analysis d. Business application context e. Financial Analysis 15. Which of the following would lead to the highest degree of price competition? a. Low Product differentiation b. High industry growth rates c. Few barriers to exit industry d. High bargaining power over customers e. Low industry-wide fixed/variable cost ratios -3- Exam 1 FSA3321 (Moore)-1 Fall 2007 16. An industry displaying a mixture of price competition and product differentiation would be characterized by: a. Low Industry Concentration, Few Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First mover advantage, High Product Differentiation c. Low Industry Concentration, Low Investment in R&D, High Excess Capacity d. High Concentration, Low Fixed-Variable Cost Ratio, High Differentiation e. Supply > Demand, High Investment in R&D, Steep Industry Learning Curves 17. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, High Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, Low Fixed-Variable Cost Ratio, Low Customer Switching Costs e. Supply < Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 18. Which of the following strategies would lead to pure cost leadership or pure product differentiation strategies? a. Economies of scale and scope, high R&D investment, tight cost control b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on Cost Control e. Simpler product designs, Tight cost control, superior product quality 19. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of which? a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 20. WalMart’s ability to dictate price & delivery terms to manufacturers is an example of: a. Bargaining power WalMart over Customers b. Bargaining power of Customers over WalMart c. Bargaining power of Suppliers over WalMart d. Bargaining power of WalMart over Suppliers 21. The main purpose of a firm’s financial reports is to: a. Present Assets, Liabilities and Equity b. Present Revenues and Expenses c. Present Operating, Investing and Financing Cash Flows d. Provide equity investors a means of determining the market value of the firm e. Credibly communicate economic consequences of business activities. -4- Exam 1 FSA3321 (Moore)-1 Fall 2007 22. Which of the following components of the annual financial report is not audited: a. Balance Sheet b. Income Statement c. Management discussion and Analysis d. Statement of Cash Flows e. Statement of Owners Equity 23. An example of conservatism in accounting that can lead to understating the perceived value of assets is: a. Expensing research and development activities b. Capitalizing goodwill c. Incorporating comprehensive income adjustments in shareholder equity d. Marking financial assets to current market value e. Marking physical assets to current market value 24. Target Company has a pre-acquisition balance sheet with the following values: Assets = $10,000; Liabilities = $5,000 and Equity = $5,000. Acquirer Company buys Target for $25,000 and revalues assets at $20,000 and liabilities at $4,000. The amount of Goodwill that Acquirer will recognize on its balance sheet resulting from the acquisition is: a. $20,000 b. $10,000 c. $25,000 d. $9,000 e. none of the above Use the following information for Problems 25 and 26 ABC Company was established in 2006 and sells product warranty contracts on household appliances. These product service contracts last for 4 years. On December 31, 2006, ABC sold $16,000,000 of service contracts. All $16,000,000 were credited to revenue for 2003. In 2007, the auditor caught the error in accounting and forced ABC to adjust its accounts to reflect service contract liabilities. Assume a tax rate of 30%. 25. The adjustment to 2006 revenues would be: a. Increase revenues $16,000,000 b. Decrease revenues $16,000,000 c. Decrease revenues $12,000,000 d. Decrease revenues $4,000,000 26. The long term portion of unearned service contract revenues, at the end of 2007, would be (assume no further sales contracts during 2007)? a. $4,000,000 b. $8,000,000 c. $12,000,000 d. $16,000,000 -5- Exam 1 FSA3321 (Moore)-1 Fall 2007 Use the following information for Problems 27 through 30 ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive highway construction equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 25 years and that their annual cost of debt is 8.08%. The annual lease payments are $5,000,000. The present value of the future lease payments is $53,000,000 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 35%. 27. Adjust ABC’s books to reflect the lease as being capitalized. Adjust for the initial recognition of the capital lease would have the following impact on the balance sheet (Asset and Liability Accounts) in terms of debits and credits a. Debit Lease Liabilities for $125,000,000 and Credit Leased Assets for $125,000,000 b. Debit Leased Assets for $80,000,000 and Credit Lease Liabilities for $80,000,000 c. Debit Leased Assets for $53,000,000 and Credit Lease Liabilities for $53,000,000 d. Debit Leased Assets for $125,000,000 and Credit Lease Liabilities for $125,000,000 e. Debit Lease Liabilities for $53,000,000 and Credit Leased Assets for $53,000,000 28. Adjust ABC’s books to reflect the lease as being capitalized. liabilities after the first payment is: a. $373,797 b. $716,699 c. $4,283,301 d. $4,626,203 e. $5,000,000 29. Adjust ABC’s books to reflect the lease as being capitalized. charge for interest expense in the second year. a. $4,626,603 b. $4,283,301 c. $4,280,350 d. $4,225,392 e. $3,960,354 The reduction in lease Compute the appropriate 30. Compute the overall effect on Net Income in the second year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax). a. $6,345,838 Lower b. $6,345,838 Higher c. $1,345,838 Lower d. $874,795 Higher e. $874,795 Lower -6- Exam 1 FSA3321 (Moore)-1 Fall 2007 Problem 1 – Overs and Unders (10 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) Assets 1 The company failed to write down a 50% impairment of inventory 2 The company used too small a discount rate to estimate the present value of future service costs on a defined benefit pension plan 3 The company used too high a rate in estimating account receivable defaults 4 The initial impact of using a capital lease when a operating lease recognition is appropriate -7- Liabilities Equity Revenues Expenses Net Income