May 19, 2005 Dear Mayor:

advertisement

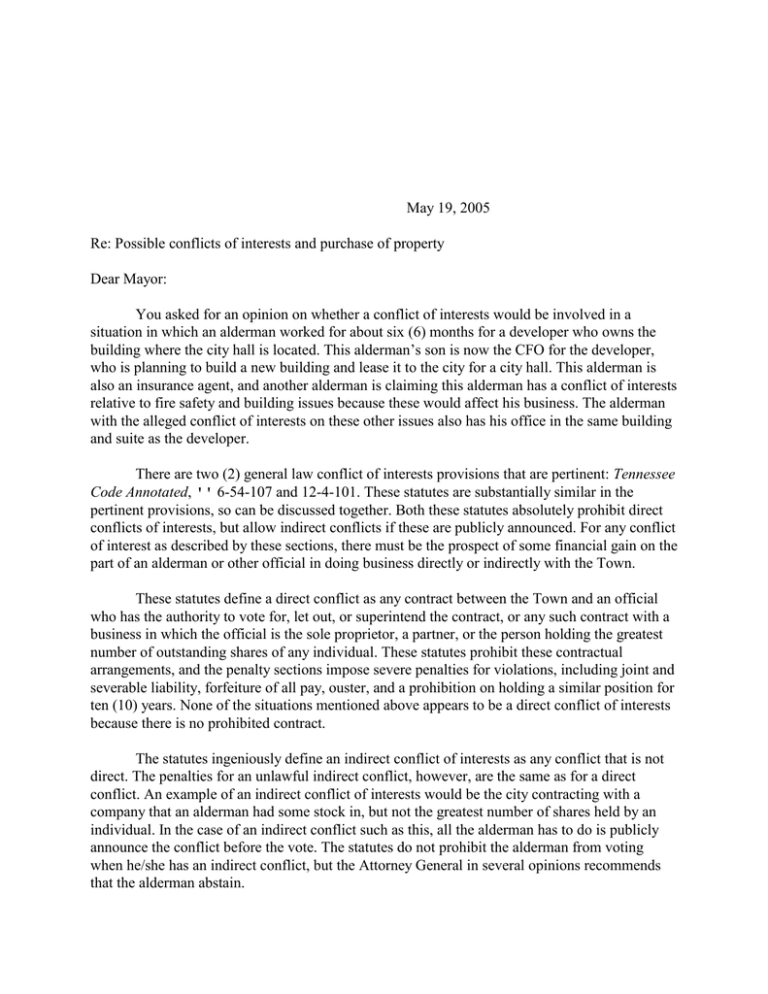

May 19, 2005 Re: Possible conflicts of interests and purchase of property Dear Mayor: You asked for an opinion on whether a conflict of interests would be involved in a situation in which an alderman worked for about six (6) months for a developer who owns the building where the city hall is located. This alderman’s son is now the CFO for the developer, who is planning to build a new building and lease it to the city for a city hall. This alderman is also an insurance agent, and another alderman is claiming this alderman has a conflict of interests relative to fire safety and building issues because these would affect his business. The alderman with the alleged conflict of interests on these other issues also has his office in the same building and suite as the developer. There are two (2) general law conflict of interests provisions that are pertinent: Tennessee Code Annotated, '' 6-54-107 and 12-4-101. These statutes are substantially similar in the pertinent provisions, so can be discussed together. Both these statutes absolutely prohibit direct conflicts of interests, but allow indirect conflicts if these are publicly announced. For any conflict of interest as described by these sections, there must be the prospect of some financial gain on the part of an alderman or other official in doing business directly or indirectly with the Town. These statutes define a direct conflict as any contract between the Town and an official who has the authority to vote for, let out, or superintend the contract, or any such contract with a business in which the official is the sole proprietor, a partner, or the person holding the greatest number of outstanding shares of any individual. These statutes prohibit these contractual arrangements, and the penalty sections impose severe penalties for violations, including joint and severable liability, forfeiture of all pay, ouster, and a prohibition on holding a similar position for ten (10) years. None of the situations mentioned above appears to be a direct conflict of interests because there is no prohibited contract. The statutes ingeniously define an indirect conflict of interests as any conflict that is not direct. The penalties for an unlawful indirect conflict, however, are the same as for a direct conflict. An example of an indirect conflict of interests would be the city contracting with a company that an alderman had some stock in, but not the greatest number of shares held by an individual. In the case of an indirect conflict such as this, all the alderman has to do is publicly announce the conflict before the vote. The statutes do not prohibit the alderman from voting when he/she has an indirect conflict, but the Attorney General in several opinions recommends that the alderman abstain. Since a direct conflict requires a contract between the Town and an alderman or a business the alderman has an interest in as mentioned above, an indirect conflict must also involve a contract between the Town and a business an alderman is associated with that could involve pecuniary gain by the alderman. The first situation listed above in which the alderman was employed by a developer who had a lease with the Town for the building in which the city hall is located could be an indirect conflict. The contract would be the lease between the Town and the alderman’s employer. As I understand the facts, however, the alderman worked for the owner of the city hall building only about six (6) months. It is likely, therefore, that the lease was made before the alderman worked for the developer. The alderman, if charged with a conflict, could argue that the conflict of interests statutes operate prospectively and not retroactively. See City of Kingsport v. Lay, 459 S.W.2d 786 (Tenn. 1970). In other words, there is, it could be argued, no conflict if the alderman did not vote on the lease at all because he was not on the board at the time or did not vote on it while employed by the building owner. If there were a renewal of the lease during the time the alderman worked for the building owner, however, the alderman should have publicly acknowledged the conflict before the vote. Failure to do so could be considered an unlawful indirect conflict. The alderman’s son being the CFO for the developer who owns the present city hall building and who is building a new building that will be leased to the city for a city hall would not be a direct conflict and in most circumstances would not be an indirect conflict. Only if the alderman and his son commingle their personal funds would this constitute an indirect conflict of interests. See Op. Tenn. Atty. Gen. 00-064 (April 3, 2000). If the alderman benefits pecuniarily by having access to funds earned by his son and partially derived from the lease or other contract with the Town, the alderman should publicly acknowledge this interest before any vote on any such contract, lease, or lease renewal. The alderman being an insurance agent and having to deal with building and safety issues is not a prohibited conflict of interests B either direct or indirect B because there is no contract with the Town involved. Neither is the situation in which the alderman has his office in the same suite as the developer. You also ask whether the Town can buy real property from an employee for an amount above the appraised value. In my opinion the Town can pay a reasonable amount above appraised value as long as the Town can make a good case the property is worth to the Town the amount paid by the Town. The appraised value of real property is supposed to be the amount that a willing seller and a willing buyer would agree to as the purchase price of the land. As you know, some sellers are more or less willing to sell than others. The same goes for buyers. It could be that the appraised value is too low. The value of any property is so subjective and affected by so many different factors that there is no hard and fast rule at arriving at value when a purchase is actually made. The appraised value is a guideline, but the law affords it no magic as a standard. I think you could successfully argue that the value set by the governing body is its value to the Town as long as this is not excessive. The wrinkle you might have to deal with since you are dealing with an employee is the appearance of favoritism if the purchase price greatly exceeds the appraised value. This could cause bad publicity for the Town. This is more of a political problem than a legal one, however, and you have more expertise at that than I do. I hope this is helpful. If you have further questions, please contact us. Sincerely, Dennis Huffer Legal Consultant