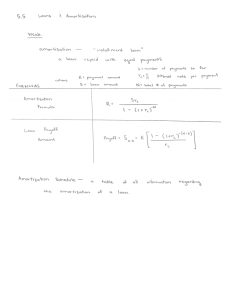

Present & Future Values: Annuities & Perpetuities Chapter Six

advertisement

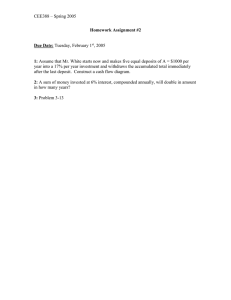

Present & Future Values: Annuities & Perpetuities Chapter Six Problem Set – Present & Future Values: Annuities & Perpetuities 1. 2. 3. 4. A good friend has offered to let you purchase a new investment instrument. The deal is you pay $5,000 today. In return, he will give you back payments of $1,000 one year from today, $2,000 two years from today and $3,000 three years from today. If your opportunity cost of capital is 10%, should you accept the deal? (Reject – NPV is -$184.07) You currently have $2,500 on deposit at your local bank. You intend to make deposits of $1,000 one year from today, $2,500 two years from today and $4,000 four years from today. How much will you have five years from today, given that you are earning 4%? ($11,183.66) You intend to save $1,000 per year for five years, beginning immediately. If you can earn 6%, how much will you have on deposit 8 years from today? ($7,116.70) You began contributing $1,000 per year to an RRSP. You intend to continue this pattern for the next 30 years. If you are earning 6%, compounded annually, how much will you have at the end of the 30 years? ($79,058.19) 2 Problem Set – Present & Future Values: Annuities & Perpetuities 5. 6. 7. 8. 9. GMC is currently offering car loans at 1% interest per month. If the car you want costs $30,000 and you intend to repay the loan over 6 years, how much are your monthly payments? ($586.51) Winners of a recent couples version of “Fear Factor” were told that they would win $1,000,000. However, what they really won was $25,000 per year paid annually for 40 years. If an appropriate discount rate is 10%, what is the present value of their winnings? ($244,476.27) You have invested $5,000 in a security which will pay you $1,000 per year for 7 years. What is your annually compounded rate of return? (9.20%) You borrowed $20,000 from your parents to help fund your education. If you can afford to make payments of $250 per month and they are charging interest of 6%, compounded monthly, how many months will it take to pay off the loan? (102.4 months) You have decided to lease a new car, rather than purchase it. If the lease payments are $300 per month for 48 months, paid at the start of each month, what is the present value of the lease, given a discount rate of 7%? ($12,601.14) 3 Problem Set – Present & Future Values: Annuities & Perpetuities 10. A consol bond pays a fixed coupon forever. If you can purchase a $1,000 consol bond paying a 4% coupon when market interest rates are 6%, how much would you expect to pay for the bond? ($666.67) 11. You have made your fortune and decided to fund a scholarship for worthy finance students at the University of Lethbridge. You want the scholarship to start at $2,500 per year and grow at 3% per year, to offset inflation. If interest rates are currently 7%, how much money must you contribute today to fund the scholarship? ($62,500) 4 Problem Set – Present & Future Values: Annuities & Perpetuities 10. Natural gas has just been discovered on your parent’s farm. If the well is expected to produce royalties of $50,000 in year one and then decrease by 5% annually forever, how much would you sell your interest for, if you use a discount rate of 10%? ($333,333.33) 11. TransAlta is expected to pay a dividend of $1.00 per share at the end of the year. If the dividend is then expected to grow at 5% per year, how much would you pay for one share of TransAlta, given that you require a return of 12%? ($14.29) 5 Problem Set – Present & Future Values: Annuities & Perpetuities 12. You want to retire with $2,000,000 of liquid assets in 40 years. If you can earn 8% compounded monthly, how much should you save every month to meet your goals? ($572.90) 13. Jill intends to save $4,000 per year for the next ten years. At the end of ten years, she is going to purchase a BMW for $50,000. She will then save money for the next 25 years, at which time she will retire. During her 30 years of retirement, she wants a yearly income of $45,000. If she can earn 7% on her money, how much does Jill need to save every year during the 25 years prior to her retirement? ($8,376.84) 6 Problem Set – Present & Future Values: Annuities & Perpetuities 14. Bank A is offering GICs at 6%, compounded quarterly. Bank B is offering GICs at 5.85% compounded monthly. Which bank is offering the highest effective annual interest rate? (Bank A – 6.14%; Bank B – 6.01%) 15. If the effective annual interest rate is 10%, compounded monthly, what is the nominal rate? (9.57%) 16. You want to obtain a $100,000 Canadian residential mortgage. If the bank is currently offering mortgages at 6%, compounded semiannually and repaid monthly over 25 years, how much are your monthly payments? ($639.81) 17. How much are the total interest payments on the mortgage in Question 16? ($91,941.99) 18. If you shorten the term of the mortgage in Question 16 to 15 years, what happens to your monthly payments? What about the total amount of interest paid over the life of the loan? ($839.88; $51,178.90) 7