Chapter 25 Contemporary Issues in Portfolio Management 1

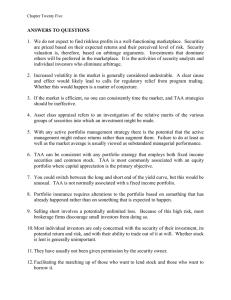

advertisement

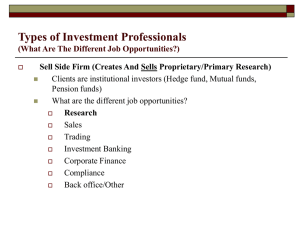

Chapter 25 Contemporary Issues in Portfolio Management 1 Life is my college; may I graduate well and earn some honors. - Louisa May Alcott 2 Outline Introduction Tactical asset allocation Stock lending Program trading Role of derivative assets The chartered financial analyst program Regulation Fair Disclosure Security analyst independence 3 Introduction Some emerging areas are controversial: • Tactical asset allocation contradicts the EMH • Stock lending and program trading have image problems • Derivatives are not permitted in some portfolios 4 Tactical Asset Allocation What is tactical asset allocation? How TAA can benefit a portfolio Designing a TAA program Caveats regarding TAA performance 5 What Is Tactical Asset Allocation? Definition Intuitive versus quantitative techniques Overview of the technique Policy decisions Strategy 6 Definition Tactical asset allocation (TAA) managers: • Seek to improve the performance of their funds • By shifting the relative proportion of their investments into and out of asset classes • As the relative prospects of those asset classes change For example, shift to stocks if stocks are expected to outperform bonds 7 Definition (cont’d) TAA attempts to take advantage of shortterm deviations from long-term trends The most difficult part of TAA is asset class appraisal • The process of determining the relative merits of the various asset classes given current economic conditions 8 Intuitive Versus Quantitative Techniques In the intuitive approach, decisions are based on personal opinion and gut feeling • Suffers from hindsight bias – Portfolio managers remember the times they were correct 9 Intuitive Versus Quantitative Techniques (cont’d) In the quantitative approach, managers use an analytical assessment and a system for implementing precise portfolio changes • E.g., use the gap between the S&P 500 dividend yield and the average yield on AAA corporate bonds 10 Overview of the Technique 11 Policy Decisions Policy decisions involve: • Deciding to use a TAA program in the first place • Establishing the extent to which the program will be employed • Determining the number of asset classes to employ 12 Strategy There are three alternative strategic functions: • Static strategy maintains a static portfolio mix • Reactive strategy involves decisions based on events that have already occurred • Anticipatory strategy involves shifting funds before the markets move 13 How TAA Can Benefit A Portfolio The goal of an anticipatory strategy is to outperform the portfolio without TAA • The potential gains to a clairvoyant manager from TAA are enormous (see next slide) The portfolio manager must assess return within a risk/return framework 14 How TAA Can Benefit A Portfolio (cont’d) 15 Designing A TAA Program Before implementing a TAA program, a fund manager must establish: • The normal mix – The benchmark proportion each asset class constitutes in the portfolio • The mix (exposure) range – Specifies how much the current mix can deviate from the normal mix 16 Designing A TAA Program (cont’d) Before implementing a TAA program, a fund manager must establish (cont’d): • The swing component – The percentage of the total portfolio whose composition by asset class may change – The key element of TAA is properly investing the swing component 17 Caveats Regarding TAA Performance Efficient market implications Impact of transaction costs 18 Efficient Market Implications TAA program implicitly assume it is possible to outperform a buy-and-hold strategy by shifting asset classes • Inconsistent with the efficient market hypothesis Some fund managers have good records with TAA programs • Might be skill or luck 19 Impact of Transaction Costs The portfolio incurs trading fees each time a trade occurs If the marginal gains from TAA switching do not exceed transaction costs, the program is not effective 20 Stock Lending Definition Mechanics of a short sale How a stock lending transaction works Stock lending’s lucrative nature Regulatory concerns Long/short portfolios Certificateless trading 21 Definition Stock lending: • Is the practice by which one institution loans stock to another institution • Is often used to support short-selling by customers of the second institution • Can earn substantial income with very little risk 22 Definition (cont’d) Stock lending is similar to a repurchase agreement: • The institution wanting to borrow stock – Puts up collateral (about 102 percent of the securities lent) – Agrees to return the securities at a later date • The lender can earn interest on the cash collateral 23 Mechanics of A Short Sale A short sale: • Involves borrowing securities from someone • Selling the securities to another market participant • Eventually purchasing shares from another market participant and • Returning the substitute shares to the original lender 24 Mechanics of A Short Sale (cont’d) A short sale is normally motivated by a bearish sentiment The actual lender in a short sale is normally an unknowing participant • A hypothecation agreement gives the broker the right to lend shares to someone else – The investor can still trade the shares and continues to earn dividends 25 Mechanics of A Short Sale (cont’d) The short seller: • Has an obligation to return what was borrowed at some point in the future • Must pay dividends to the lender • Eventually covers short by repurchasing shares to replace the shares borrowed earlier – If the purchase price is below the selling price, the short seller makes a profit 26 27 How A Stock Lending Transaction Works If the customer wants to short sell: • The brokerage firm first checks if other customers have the stock in a margin account • The brokerage firm may use a stock loan finder to locate another firm with the needed shares • The first firm deposits collateral with the second firm (T-bills or cash) – Part of the interest is used to pay a finder’s fee to the stock loan finder 28 Stock Lending’s Lucrative Nature Advantages of stock lending Disadvantages of stock lending 29 Advantages of Stock Lending Stock lending is very lucrative • In 1999, the total income to stock lenders approached $1 billion Stock lending is popular when markets see increased merger and acquisition activity: • Merger arbitrage involves buying shares of likely takeover candidates and short selling shares of the anticipated acquirer 30 Advantages of Stock Lending (cont’d) Stock lending can be used by brokerage firms to finance the margin purchases of their customers 31 Disadvantages of Stock Lending A customer potentially gives up the right to vote: • The short seller is essentially a negative owner Some risk is associated with the possibility that the stock borrower might not return the securities • Stock loans are “marked to market” 32 Regulatory Concerns Stock lending does technically not fall under SEC jurisdiction • Does not involve the purchase or sale of securities A possible area of abuse lies in the lending of shares in cash accounts • Cash account holders do not sign hypothecation agreements 33 Long/Short Portfolios Short selling is an element of a hedging strategy called building a long/short portfolio: • Combines elements of speculation, fundamental stock analysis, and hedging to reduce risk – Sells overvalued shares and buys undervalued shares 34 Certificateless Trading The difference in settlement procedures across countries can cause significant problems • E.g., U.S. settlement takes 3 business days versus 6 weeks in France Computer automation makes it possible to process some types of transactions almost immediately • E.g., newly issued U.S. government bonds are registered in book entry form only 35 Program Trading Program trading: • Is not easy to define • Can be used to mean any computer-aided buying or selling activity in the stock market 36 Program Trading (cont’d) The Wall Street Journal defines program trading as the simultaneous purchase or sale of at least 15 different securities with a total value of $1 million or more 37 Program Trading (cont’d) Stoll and Whaley elements of program trading: • Portfolio trading • Computerized trading • Computer decision making 38 Program Trading (cont’d) Program trading is also the generic term used to describe any strategy that instantaneously recommends buy or sell order because of apparent arbitrage • E.g., buy futures and sell stock if the basis is theoretically too small • E.g., buy stock and sell futures if the basis is theoretically too wide 39 Program Trading (cont’d) Program traders fall into one of two groups: • Institutions that buy stock index futures and Tbills to create the equivalent of an index portfolio • Institutions that combine a well-diversified stock portfolio with short position in stock index futures to create synthetic T-bills 40 Program Trading (cont’d) Program trading has a bad name as it may increase security price volatility Many professional traders and investment managers believe that program trading benefits the public • Helps reduce commission costs 41 Role of Derivative Assets Process of education Getting board approval 42 Process of Education People think derivatives are speculative Various exchanges offer seminars on ways in which derivative assets can be used in conservative portfolios • E.g., risk management conferences by CBOE, CBOT, CME, LIFFE • Derivative asset education is designed to give people more choices 43 Getting Board Approval Once the portfolio manager is convinced of futures and/or options, he must convince: • Boards of trustees • Supervisors or • Fund beneficiaries The manager should be able to explain the merits of derivatives using everyday language 44 The Chartered Financial Analyst Program History The CFA program exams CFA program themes 45 History The CFA program began in 1959 when the Institute of Chartered Financial Analysts (ICFA) was formed – Promotes investment education and ethical behavior – Awarded the first charter in 1963 The Financial Analysts Federation (FAF) merged with the ICFA in 1990 to form the Association for Investment Management and Research (AIMR) 46 The CFA Program Exams To earn the CFA designation, candidates must pass three separate exams taken at least a year apart • Each CFA exam is given only once per year 47 The CFA Program Exams (cont’d) Level I is multiple choice: • Covers basic tools and inputs to the investment valuation process Level II is essay, valuation, analysis, and problem sets • Emphasizes security valuation and specialized topics 48 The CFA Program Exams (cont’d) Level III is essay, valuation, analysis, and problem sets • Covers portfolio management 49 CFA Program Enrollment 50 CFA Program Themes Competence Presentation standards Fiduciary duties Ethics 51 Competence People who complete the CFA program are technically very competent and are likely to keep their noses clean during their professional careers 52 Presentation Standards CFA candidates learn state-of-the-art standards and may prepare their own reports in accordance with AIMR requirements From a fiduciary perspective, compliance with AIMR requirements is on its way to being mandatory 53 Fiduciary Duties Fiduciary duties require conduct that: • Is in the individual client’s best interest • Is fair to the collective group of all clients Research reports are an important part of fiduciary dutues 54 Ethics The coverage of ethics in the CFA program is very useful: • For example: – Analysts must distinguish between fact and opinion – Research reports should be objective, unbiased, and have a reasonable basis – Bigger clients should not be given preferential treatment 55 Regulation Fair Disclosure Introduction The SEC position The industry position AIMR response The future of the regulation 56 Introduction Regulation FD was approved by the SEC in August 2000 The key provision: • Prevents companies from giving material information to security analysts, mutual funds, or institutional investors • Unless the company simultaneously issues the same information to the general public 57 The SEC Position The purpose of Regulation FD is: • To increase the quantity and quality of available information to investors • To eliminate what some perceive as an unfair advantage enjoyed by Wall Street’s big guns 58 The Industry Position Evidence indicates that less information is available to the public: • Companies are reluctant to answer questions not publicly answered before • Companies have begun to provide less information between quarterly reports • Quarterly conference calls between firms and the brokerage industry have become scripted 59 AIMR Response AIMR study when Regulation FD was first announced: • “To avoid any possible SEC enforcement actions, corporations will reduce their communications to ‘sound bites’ and ‘boilerplate’ disclosures” 60 AIMR Response AIMR study one year later: • “While the overall goal of providing small investors and investment professionals with the same information is being achieved, it has been at the cost of less information in terms of quantity and quality” 61 The Future of the Regulation SEC Commissioner Laura Unger’s recommendations regarding Regulation FD: • The SEC should provide more guidance on materiality • The SEC should make it easier for issuers to use technology to comply with Regulation FD • The SEC should analyze what issuers are saying post-FD 62 Security Analyst Independence Introduction Analyst ratings Bullish ratings as the ship sinks Separation of research and investment banking 63 Introduction Some aspects of the security analyst business have long needed improvement The Enron collapse brought the issue of security analyst independence in the spotlight 64 Analyst Ratings A high proportion of analyst stock ratings are positive • Firms have little incentive to begin coverage of a firm that is unlikely to be an attractive investment – “Buy” recommendations bring in more business than “sell” recommendations 65 Analyst Ratings (cont’d) Efforts are beginning to standardize language used in assigning ratings • E.g., “accumulate” and “market perform” ratings 66 Analyst Ratings (cont’d) NASD proposals in early 2002 require analysts to: • Better explain their rating system • Disclose banking relationship with companies they cover • Not earn a bonus from attracting underwriting business from the firms they cover 67 Bullish Ratings as the Ship Sinks Sudden adverse news that hits a company is difference from a gradual accumulation of negative events coupled with an analyst’s hope that things will improve • E.g., dot.coms in 1999 and 2000 – Some analysts maintained “buy” recommendations four days before the firm went into bankruptcy 68 Separation of Research and Investment Banking The opinion of a security analyst should not be biased by activities elsewhere in the firm The Security Industries Association list of best practices states: • “Research should not report to investment banking; it should also not report to any other business unit in a way that compromises its integrity” 69