The Effect of Arizona’s Immigration Enforcement Legislation on Housing Prices and Rents

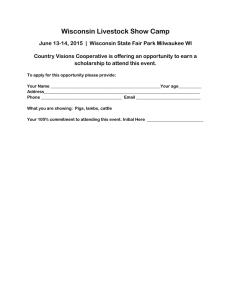

advertisement

The Effect of Arizona’s Immigration Enforcement Legislation on Housing Prices and Rents Christopher Fletcher UW-Milwaukee Wisconsin Economic Association 11-10-2012 Why Housing Matters • According to National Association of Home Builders: – Historically residential investment and housing services made up between 16 and 18% of GDP – 66% of households have more wealth in their houses than in stocks – Home ownership “forces savings” which can be realized later through additional mortgages or sale of the property • Consumption responds more to increases in housing wealth than financial wealth • Policies that negatively effect housing demand could have wide reaching economic consequences November 10, 2012 Wisconsin Economic Association 2 Summary • Use Arizona’s immigration enforcement legislation as a natural experiment affecting the housing and rental markets • “Difference-In-Difference” and FE regression estimates a treatment effect of 6% to 8% decline in Arizona rents • Housing prices declined around 10% to 12% • Results robust across several data sets, controls, and Newey-West and clustered standard errors • Welfare estimates: potentially a $48 billion loss of private wealth in owner-occupied houses, and $694 million in loss revenues to rental property owners for the first year November 10, 2012 Wisconsin Economic Association 3 Background • Two laws SB 1070 and HB 2162 – Illegal to transport or hire illegal aliens – Allows state agents to arrest persons with probable cause of offense that could result in deportation, etc. – Bills passed in March of 2010 and were scheduled to become active at end of July 29th 2010. • July 28th 2010, federal judge prevented much of the law from going into effect, debated in Supreme Court this year • Department of Homeland Security estimated 120,000 less undocumented immigrants in Arizona in 2011 November 10, 2012 Wisconsin Economic Association 4 Data • Fair Market Rate from HUD – Yearly and MSA level • Rent of Primary Residence from CPI – Yearly selection of large cities • Freddie Mac Housing Price Index – Monthly, MSA and State level • Time period from 2000 to 2011 • Controls include lagged unemployment and average weekly wage obtained from BLS • Everything in logs November 10, 2012 Wisconsin Economic Association 5 Table 1: Rental Rate Regressions CPI Lead Treatment I -0.006 (0.012) FMR II 0.000 (0.011) III -0.016 (0.038) IV -0.02 (0.033) -0.085 -0.073 -0.083 -0.10 (0.012)* (0.011)* (0.032)* (0.033)* Lag Ln(AWW) 0.845 (0.176)* 0.522 (0.082)* Lag Ln(Unemp) Yes No Yes Yes -0.017 (0.024) Yes No Yes Yes 27 270 27 216 0.064 (0.015)* No Yes Yes Yes 0.78 366 3660 Newey-West SE Clustered SE Year Effects Individual FE R² N NT No Yes Yes Yes 0.79 366 4026 * Implies significant at 1% November 10, 2012 Wisconsin Economic Association 6 Table 2: Housing Price Regressions Lead Effect 2009M12-2010M3 State Level I II -0.193 -0.146 (0.019)* (0.013)* MSA Level III IV -0.121 -0.101 (0.035)* (0.026)* Law Passed 2010M4-2010M7 -0.217 (0.021)* -0.158 (0.023)* -0.152 (0.036)* -0.12 (0.029)* Law Implemented 2010M8-2011M9 -0.313 (0.021)* -0.269 (0.019)* -0.228 (0.034)* -0.211 (0.026)* No Yes Yes Yes 0.752 (0.06)* -0.245 (0.013) No Yes Yes Yes 50 6350 50 6300 Yes No Yes Yes 0.509 366 46116 0.786 (0.090)* -0.227 (0.017)* Yes No Yes Yes 0.599 366 45750 Lag Ln(AWW) Lag Ln(Unemp) Clustered SE Newey West SE Month and Year FE R² N NT * Implies significant at 1% November 10, 2012 Wisconsin Economic Association 7 Further Remarks • Indicate declines more MSA’s with larger Hispanic populations • Results are not caused by aggregate changes population • According to US Census in 2010 Arizona had 1,877,387 Owner Occupied houses with median value of $215,000. A 12% drop in prices would result in $48 billion in lost wealth • In 2010 Arizona had about 790,488 rental properties with an estimate average monthly rental payment of $914. A 8% decrease in rents results in $58 million in lost rental income., or $694 million in lost income over the following year. November 10, 2012 Wisconsin Economic Association 8