THE MULTIPLIER AND A KEYNESIAN MODEL OF A MACROECONOMIC SYSTEM

advertisement

THE MULTIPLIER AND A KEYNESIAN MODEL OF A

MACROECONOMIC SYSTEM

definitional equations .......................................................................................... 1

identity ................................................................................................................ 1

causal relationships ............................................................................................. 2

consumption equation ......................................................................................... 2

autonomous consumption ................................................................................... 2

marginal propensity to consume ......................................................................... 2

import function.................................................................................................... 2

autonomous imports ............................................................................................ 2

marginal propensity to import ............................................................................. 2

A. The Reduced Form of a System ................................................................................ 2

dependent variable .............................................................................................. 2

endogenous” variable.......................................................................................... 2

independent variables.......................................................................................... 2

exogenous ........................................................................................................... 2

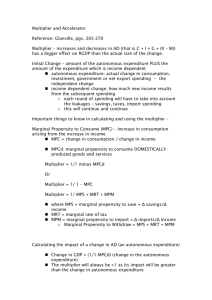

B. Multipliers and Policy Making ................................................................................. 3

sensitivity analysis .............................................................................................. 3

scenario planning ................................................................................................ 3

multiplier ............................................................................................................. 3

C. Diagrams of the System ............................................................................................ 4

Figure 9-1. Aggregate Expenditure........................................................................ 5

Figure 9-2. Shifts in Aggregate Expenditure ......................................................... 6

Figure 9-3. Multiplying Effects ............................................................................. 7

Table 1. Mulitplying Effects ............................................................................... 8

using EXCEL ...................................................................................................... 8

Table 9-1. Mulitplying Effects using EXCEL ........................................................ 8

The study of the economic effects of policy requires an economy to be modeled

so that all of the important interactions within the economy can be examined. The study

of government policy requires the key actions of government to be included in the

economic model. Inevitably such a task requires that a system of equations be defined

which specifies how the economy works.

The National Income and Product Accounts (NIPA) set out some of the major

definitional equations- equations that are true by definition- with which to build a

model of the macroeconomy. The most important definitional equation is the definitional

link between income and expenditure:

Y= C + I + G + net X

This equation is an identity. It must always be true by definition.

1

However, some equations define causal relationships that describe the behavior

of sectors of the economy. The most important one specified by economists is for

consumption, C:

C=a+b*Y

This consumption equation shows that consumption is affected by income, Y. Certain

behavioral constants have been found to apply to consumption through time:

autonomous consumption (“a”) and the marginal propensity to consume (“b”).

Autonomous consumption can be thought of as the consumption we must do regardless

of what happens to our income. The marginal propensity to consume represents how

much of each extra dollar we use for consumption; it should be positive and it should be

below 100%.

When the foreign sector is important to an economy then an “open economy”

model must be defined. Typically an open economy model includes an equation which

specifies an import function. Like the consumption equation the import equation is a

behavioral equation, showing how imports (IM) respond to income (Y):

IM= IMo +d*Y

Certain behavioral constants have been found to apply to imports through time:

autonomous imports (“IMo”) and the marginal propensity to import (“d”).

Autonomous imports are quite similar to autonomous consumption; can be thought of as

the imports we will import regardless of what happens to our income. The marginal

propensity to import represents how much of each extra dollar we use for imports; as in

the marginal propensity to consume, it should be positive and it should be below 100%.

However, for the duration of this reading, we will use a model of a “Closed economy” in

which imports are simply treated as exogenous, which means they are completely

determined outside of the model.

A. The Reduced Form of a System

Just these two equations define a system which acts very differently than when

the two equations are treated separately. To see how the system works we must find the

“reduced form” of the system. The reduced form equation shows one unknown

dependent variable on the left hand side (also referred to as the “endogenous” variable

because it is determined within the equation) and independent variables (“exogenous”)

and parameters on the right hand side. Let’s make income (Y) the endogenous variable

that is to be explained and the rest of the variables are exogenous. We can find the

reduced form by substituting the consumption function into the first equation as follows:

Y= C + I + G + net X

= (a + b*Y) + I + G + net X

Then we can subtract –b*Y from both sides so that it effectively appears only on the left

hand side:

2

Y - b*Y = a + I + G + net X

This simplifies to:

Y*(1-b) = { a + I + G + net X }

Which finally, when dividing through by (1-b), simplifies to the reduced form:

Y = (1/(1-b))* { a + I + G + net X }

We have one dependent variable and one equation. Only parameters and independent

variables are found on the right hand side in a reduced form equation.

B. Multipliers and Policy Making

Why should we go through the exercise of finding the reduced form equation?

Because it allows us to find the impact of policies and major events on our economy.

The reduced form equation provides information with which we can do sensitivity

analysis and scenario planning just as you can do in making a business plan for a firm.

Except that this kind of planning can also involve the entire economy.

Let’s see how we can use the above reduced form equation to examine the impact

of government expenditure on the economy. Suppose we increase government spending

by just $1.00. That means the new income for the economy (Ynew) would be:

Ynew =

(1/(1-b))* { a + I + (G+$1.00) + net X }

If we subtract the previous equation (without the $1.00) from this new equation, we can

find the change in income, Y:

Y = Ynew – Y

= (1/(1-b))* { a + I + (G+$1.00) + net X } - (1/(1-b))* { a + I + G + net X }

= (1/(1-b)) * $1.00

You should see that income (Y) would rise by the amount of $1*(1/(1-b)). The term,

(1/(1-b)), is called the multiplier. It shows how much income rises for every $1 of

government expenditure (or other exogenous expenditure).

To find the effect of government policy, the reduced form equation completely

eliminates the difficulty of finding out autonomous consumption (“a”), Investment (I),

the level of government expenditure (G), Consumption (C), income (Y), or net exports

(net X), even though all of those variables are in the equation. In this case the reduced

form equation has allowed us to focus only on the value of one parameter, the marginal

propensity to consume when we are trying to examine the effects of government policy.

In other words, finding the reduced form of a system enormously simplifies the problem

3

of determining the effects of government policy or, for that matter, any other policy or

event.

What is the numerical value of the multiplier? Generally the Marginal propensity

to consume (“b”) on which the multiplier depends is close to 1.0, but never exceeds 1.0.

Let’s say it is 0.9. In other words, for every $1 rise in income people spend $.90

consumption. Then the multiplier becomes:

Multiplier = (1/(1-b)) = (1/(1-.90)) =10

That means every $1 rise in government expenditure causes a $10 income in the income

of the economy.

C. Diagrams of the System

What’s happening here? Is the government pulling a rabbit out of a hat? Is it

creating money out of thin air? No. The additional income comes from the multiplying

effects of expenditures turning into income which generates more expenditure which

raises income, etc., etc. We can see how this multiplying process works by using a graph

of the income and expenditure process. The fundamental identity, Y=C + I + G + net X,

can be represented as a 45 degree line where income is on the X-axis and expenditure on

the Y-axis. The 45 degree line consists of the points where income equals expenditures.

4

Figure 1. Aggregate Expenditure

Expenditure

C+I+G+net X

equilibrium

C+I

C

=b= marginal propensity to consume

a

45o means Y=C+I+G+net X

income

In the same diagram the consumption function and the other expenditures can also

be represented. The consumption function, C = a + b*Y, is an upward sloping line which

starts at autonomous consumption, “a”, and has the slope, b, which is the marginal

propensity to consume (the consumption function is represented by the lowest upward

sloping line in the diagram). On top of the consumption function investment is added.

Since investment is not affected by income, it appears as a parallel upward shifting line.

On top of investment, government expenditures are added, which leads to the third line.

If government spends less with higher income, the third line may even be flatter than the

second line. In the diagram, net exports are presumed to be zero so that the third

represents total expenditures at every income level. This highest expenditure curve is

often referred to as aggregate expenditure.

Where aggregate expenditure intersects the 45 degree line, a macroeconomic

equilibrium occurs. Below the macroeconomic equilibrium the economy is spending too

much, inventories fall, and the attempt to produce more goods and services forces the

economy toward equilibrium and a higher income level. Above the equilibrium the

economy is spending too little, inventories start piling up, and production is curbed which

forces the economy downward to equilbrium. Equilibrium represents the point where

inventory levels are at a sustainable optimum.

5

Figure 2. Shifts in Aggregate Expenditure

Expenditure

New equilibrium

New

C+I+G+net X

$10 billion Old equilibrium

More

Govt

Expenditure

C+I+G+net X

45o

income

Suppose the government increases expenditures by $10 billion. Then aggregate

expenditure rises by the full $10 billion to a new aggregate expenditure curve (labeled

“New C+I+G+netX”). The equilibrium rises from the old equilibrium to the new

equilibrium. However, income rises by much more than $10 billion.

To see why it rises by more than $10 billion, we must follow the money trail. The

government spends the $10 billion, but the sellers from whom the government buys, see

the $10 billion as new income. With their new income they will save some and then

consume the rest. The marginal propensity to consume (MPC) tells us just how much of

the $10 billion will be consumed. Assuming an MPC of .9, the sellers will consume $9

billion (which equals $10 billion * 0.9). Of course, when the sellers consume, they are

buyers, not sellers. Their $9 billion of consumption adds to the total expenditure as

shown in the following diagram:

6

Figure 3. Multiplying Effects

Expenditure

$10 b.

More

Expenditure

45o

Etc.

$10 b.

Etc.

Means $9 b.

More income

More income

Means $9

b. more Expend

Means $10 b.

More income

New

C+I+G+net X

C+I+G+net X

INCOME RISES BY

$100 BILLION.

income

But the diagram also shows that the money trail keeps multiplying onward.. The

consumers spend the $9 billion, but the new sellers from whom the consumers buy, see

the $9 billion as new income. The MPC tells us just how much of the $9 billion will be

consumed: the new sellers will consume $8.1 billion (which equals $9 billion * 0.9). Of

course, when the new sellers consume, they are buyers, not sellers. Their $8.1 billion of

consumption adds to the total expenditure as shown in the above diagram. The logic of

this multiplying process can be taken an infinite number rounds. Here’s how an EXCEL

spreadsheet can be programmed to carry out the calculation:

7

Table 1. Mulitplying Effects

using EXCEL

A

B

1 Expenditure Income

2

10.0000 10.0000

3

9.0000 9.0000

4

8.1000 8.1000

5

7.2900 7.2900

6

6.5610 6.5610

7

5.9049 5.9049

8

5.3144 5.3144

9

4.7830 4.7830

10

4.3047 4.3047

11

3.8742 3.8742

12

3.4868 3.4868

13

3.1381 3.1381

14

2.8243 2.8243

…

…

…

sum

74.5813

Note: After labeling the columns, cell a2 shows the initial change in government

expenditure ($10 billion). Then cell b2 is set equal to a2 (in other words enter

“=a2”) because what is spent turns into someone else’s income by definition. But

that income gets spent, although not all of it. The marginal propensity to consume

(say it is .9) says that 90% of the income is spent on consumption. So in cell a3, the

marginal propensity to consume is multiplied by the income in cell b2 (i.e. enter

“=.9*b2” in cell a3). Then drag the formulas in both cells (cell b2 first and then

cell a3) as far down as you want and sum the columns as shown at the bottom of the

middle column. Each additional row that you add represents another round of

spending based on the extra income created by the previous round of spending.

Of course all of this work is unnecessary with an understanding of the multiplier.

When the MPC is .90, the multiplier on government expenditure is given as we saw

above by:

Multiplier = (1/(1-b)) = (1/(1-.90)) =10

Multiplying the multiplier by the $10 billion change in government expenditure gives us

the total increase of $100 billion. And we haven’t had to go through all of the rounds to

get there.

However for complicated systems of equations the reduced form may be very

difficult to find. The process of using EXCEL to solve for the rounds of equations may

prove a much easier task. Furthermore, the EXCEL approach helps us to visualize what

8

is happening in the economy, step-by-step, as policy works to stimulate or destimulate

the economy.

INDEX of terms

“endogenous” variable 2

45 degree line .............. 3

aggregate expenditure . 5

autonomous

consumption ............ 2

causal relationships ..... 1

consumption equation . 2

definitional equations .. 1

dependent variable ...... 2

exogenous ................... 2

identity ........................ 1

independent variables.. 2

macroeconomic

equilibrium .............. 5

marginal propensity to

consume .................. 2

multiplier ..................... 3

multiplying effects ...... 3

reduced form ............... 2

reduced form equation 2

scenario planning ........ 2

sensitivity analysis ...... 2

system of equations ..... 1

The Reduced Form of a

System ..................... 2

9