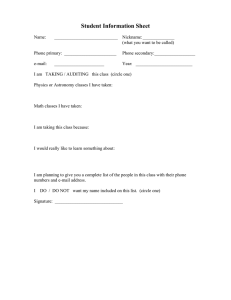

Figure 1. Shifts of Supply and Demand Ec 4550-Tansey

advertisement

1 Ec 4550-Tansey Supply and Demand Practice July 17, 2016 Figure 1. Shifts of Supply and Demand (A) (B) SUPPLY SHIFTS: LEFTWARD (up) (up) P Supply Q I. (C) (D) RIGHTWARD (down) DEMAND SHIFTS: LEFTWARD (down) RIGHTWARD P P P Supply Q Demand Q Demand Q (60 pts) Following are several articles. For each article answer the questions that follow: ARTICLE 1. New Report Argues for Tax on Soft Drinks WSJ. By BETSY MCKAY And VALERIE BAUERLEIN A report published online by the New England Journal of Medicine on Wednesday amplified calls for a tax on sugar-sweetened beverages, arguing that there is evidence such a measure would help to reduce rates of diet-related diseases and health-care costs. The paper, by seven experts in nutrition, public health and economics, called for an excise tax of a penny per ounce on caloric soft drinks and other beverages that contain added sweeteners such as sucrose, high-fructose corn syrup or fruit-juice concentrates. Such a tax could reduce calorie consumption from sweetened beverages by … [10% ] and generate revenue that governments could use to fund health programs, the authors said. "The science base linking the consumption of sugar-sweetened beverages to the risk of chronic diseases is clear," the authors wrote. "Escalating health-care costs, and the rising burden of diseases related to poor diet, create an urgent need for solutions, thus justifying government's right to recoup costs." 2 Beverage-industry executives vehemently oppose the idea, which experts say would result in significant price increases. Coca-Cola Co. Chairman and Chief Executive Muhtar Kent called the proposed tax "outrageous" in a speech Monday in Atlanta, saying it reminded him of his days as a Coke executive in the former Soviet Union, when he watched the government dictate consumers' choices by stocking only one type of fruit in a store at a time. "I have never seen it work where a government tells people what to eat and what to drink," he said. "If it worked, the Soviet Union would still be around." "A penny per ounce would have a seriously negative impact on the industry, as it could …[ 50%,]" said John Sicher, editor and potentially raise prices on key packages by publisher of Beverage Digest, an industry publication. PepsiCo Inc. and Coke referred questions on Wednesday's report to the American Beverage Association, a trade organization. Spokesman Kevin Keane said a federally funded study, also published earlier this year in the NEJM, supports the notion that all calories count, and the key to a healthy lifestyle is balancing consumption with exercise. Source : http://online.wsj.com/article/SB10001424052970204518504574417380680508354.html Assume the government intervention suggested in the first paragraph becomes law 1. Figure 1 (circle one) A B C D (2ND TO LAST PARAGRAPH; PRICES RISE) 2. Determinant that is changing (write only one) ___INCOME or TAXES____ 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. (e) None of the above because there is only a movement along the demand curve, not a shift. 4. 5. Market failure:____EXTERNALITIES Government Intervention TAXES 6. Government Failurec COMPLIANCE COST (see underlined above) or Admin Cost (circled above) 3 ARTICLE 2. Let recession, not just vows, drive decision on aid to Big 3 Section: News, Pg. 10a This time, the heads of the Big Three automakers left their private jets at home. And this time, they agreed to work for just $1 per year. After their disastrous appearances before Congress last month, this much could be said of Chrysler's Robert Nardelli, GM's Rick Wagoner and Ford's Alan Mulally: They've mastered the etiquette and showmanship of asking taxpayers for $25 billion. What is less clear is whether they can provide a deeper rationale for such generosity. Detroit came back to Washington on Tuesday with more refined plans. General Motors has what looks like the most dramatic one, which includes eliminating 1,750 dealerships and focusing its efforts on four of its seven domestic brands -- Buick, Cadillac, Chevrolet and GMC. Those are encouraging steps. But for all the changes they promise, the automakers have much to prove. They have made substantial cuts but not enough to get their companies even with the likes of Honda and Toyota in productivity. It costs the Big Three $20-$30 an hour more in wages and benefits to make a car -- a massive disadvantage that translates into $600 per car. Suppose “four of its seven domestic brands” are terminated. Answer the following questions. 1. Figure 1 (circle one) A B C D 2. Determinant that is changing (write only one) # of sellers 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. 4. 5. Market failure Dynamic (“Recession”). Remember; bankruptcy is not a market failure Government Interventionsubsidy 6. Government Failure Inequities (“too big to fail” iimplicitly), Efficiency cost (implicitylywhy not let more efficient producers survive? And article hints that $25 billion is given to firms that have to prove nothing but talk) 4 ARTICLE 3. Regulators seize 2 banks; 94 failures this year By Stephen Bernard, AP Business Writer NEW YORK — Regulators shut down two banking units of Irwin Financial on Friday, marking the 93rd and 94th failures this year of federally insured banks. The Federal Deposit Insurance Corp. was appointed receiver of Louisville-based Irwin Union Bank FSB and Columbus, Ind.-based Irwin Union Bank and Trust. The FDIC estimates the failure of the two banks will cost its insurance fund about $850 million. Hundreds more banks are expected to fail in the next few years largely because of souring loans for commercial real estate. The number of banks on the FDIC's confidential "problem list" jumped to 416 at the end of June from 305 in the first quarter. That's the highest number since June 1994, during the savings-and-loan crisis. What happens to the banking services market if the two banks are shut down? 1. Figure 1 (circle one) A B C D 2. Determinant that is changing (write only one) # of sellers 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. (e) None of the above because there is only a movement along the demand curve, not a shift. 4. 5. Market failureDynamic (cannot sustain rate 416 “problem list” banks) Government InterventionSubsidy, Regulation 6. Government FailureDynamnic ($850 per year is not a sustainable equilibrium) 5 ARTICLE 4. Google under tech attack for its 'monopolizing' techniques 22 August 2009 @ 04:24 pm ET Amazon, Microsoft and Yahoo have joined an alliance in a bid to fight Google over the search giant's plans to commercialize a huge digital library of books. The Open Book Alliance is a distinct organization from the Open Content Alliance, a group with similar goals created by Yahoo, the Internet Archive, and many universities. In their first united response to the growing force of Google, they want to challenge Google's 2005 classaction settlement with authors and publishers. In October last year, Google reached a settlement with the Authors Guild and Association of American Publishers on a copyright infringement lawsuit that they filed in 2005 over Google's plan to scan millions of books and put them online. As part of the settlement, Google agreed to establish an independent "Book Rights Registry", which will provide revenue from sales and advertising to authors and publishers who agree to digitize their books. The settlement, which Google has agreed to pay $125 million, is still waiting for approval but is already facing … scrutiny from the Justice Department and awaiting court approval. A fairness hearing to consider approval of the settlement is scheduled for October 7. The deadline for objections to the settlement is September 4. The Internet Archive, which is spearheading the anti-settlement effort, is also against Google. Its founder, Brewster Kahle, told the BBC: "Google is trying to monopolize the library system. If this deal goes ahead, they're making a real shot at being 'the' library and the only library." http://www.ibtimes.com/articles/20090822/google-under-tech-attack-its-monopolizing-techniques.htm Suppose google succeeds in becoming “the” library? There are two possible answers: In the short run: 6 1. Figure 1 (circle one) A B C D 2. Determinant that is changing (write only one) 1 new seller (google) 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. In the long run: 1. Figure 1 (circle one) A B C D 2. Determinant that is changing (write only one) # of sellers; all other companies go bankrupt except google 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. 4. 5. Market failure Market power (“monopolizing” in the title) Government Intervention Antitrust 6. Government FailureFailure to define property rights over who has right to determine rights to books. ARTICLE 5. Obama Calls for Finance Reform By DARRELL A. HUGHES WASHINGTON -- U.S. President Barack Obama, in his weekly radio address Saturday, focused on the need for a consumer protection agency and continued his push for more Wall Street reforms. The rules governing financial the 21st century, Mr. Obama said. firms and markets have to be retooled to align with 7 "We cannot allow the thirst for reckless schemes that produce quick profits and fat executive bonuses to override the security of our entire financial system and leave taxpayers on the hook for cleaning up the mess," he said. Mr. Obama maintained that his proposed Consumer Financial Protection Agency is key to achieving consumer protection initiatives and retooling how Wall Street conducts business. "While many folks took on more than they knew they could afford, too often folks signed contracts they didn't fully understand, offered by lenders who didn't always tell the truth. That's why we need clear rules, clearly enforced," he said. Mr. Obama's remarks on financial reform come before he's due to blitz five TV talk shows on Sunday. Looking forward into next week, Mr. Obama said he plans discuss with G-20 leaders ways "to safeguard our global financial system and close gaps in regulation around the world." Suppose the Obama administration succeeds in bringing about reform for the financial sector: Answer the following questions: 1. Figure 1 (circle one) A B C D 2. Determinant that is changing (write only one) # of sellers 3. What will occur as a result of this shift alone (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. (e) None of the above because there is only a movement along the demand curve, not a shift. Market failure:Dynamic ( “to align with the 21st century” i.e. no stable equilibrium between 20th and 21st century) or Externalities (taxpayers who are not buyers or sellers of financial securities are nevertheless on the hook for “cleaning up the mess”) or Indivisibilities (“security of our entire financial system”- the financial system as a whole is affected by what any part of it does) 4. 5. 6. Government Intervention:_Regulation (last paragraph) Government Failure Regulatory Lag (speech occurs after the crisis)