Chapter 4 Long-Term Financial Planning and Corporate Growth

advertisement

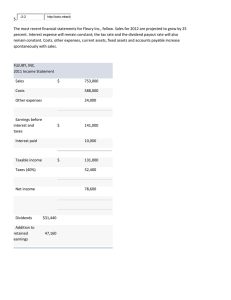

Chapter 4 Long-Term Financial Planning and Corporate Growth Chapter Outline - Financial Planning Financial Planning Models: A First Look The Percentage of Sales Approach External Financing and Growth Caveats on Financial Planning Models Basic Elements of Financial Planning 1234- Capital budgeting decision: investment in new assets Capital structure decision: degree of financial leverage Dividend policy decision: cash paid to shareholders as dividends Net working capital decision: the firm’s liquidity requirements What is Financial Planning? The financial plan identifies methods for achieving the firm’s financial goals. The appropriate goal for financial managers is maximize the shareholders’ value (i.e., maximize equity). Growth by itself is not an appropriate goal. Dimensions of Financial Planning 1- Planning horizon: divide decisions into short-term decisions (usually the next 12 months) and long-term decisions (usually 2-5 years). 2- Aggregation: combine capital budgeting decisions into one big project (i.e., combine smaller investments proposals into larger units). What can Financial Planning Accomplish? 1- Examining interactions: helps management see the interactions between decisions (i.e., the link between the investment proposals and the firm’s financing alternatives). 2- Exploring options: gives management a systematic framework for exploring its opportunities (i.e., allows the firm to evaluate different investment and financing options and their long-term impact on firm value). 3- Avoiding surprises: helps management identify possible outcomes and plan accordingly. 4- Ensuring feasibility and internal consistency: helps management determine if goals can be accomplished and if the various stated goals of the firm are consistent with one another. Financial Planning Model Ingredients 1- Sales forecast: many cash flows depend directly on the level of sales (often estimated using a growth rate in sales). 2- Pro forma statements: setting up the financial plan in the form of projected financial statements allows for consistency and ease of interpretation. 3- Assets requirements: how much additional fixed assets will be required to meet sales projections. 4- Financial requirements: how much financing will be needed to pay for the required assets. The firm’s debt policy and dividend policy are relevant here because of their impact on the required financing. 5- The “plug” variable: management decision about what type of financing (i.e., new debt and/or equity) will be used to make the balance sheet balance. 6- Economic assumptions: explicit economic assumptions about the future economic environment (such as interest rates and tax rates). Example: A Simple Financing Plan Model Gourmet Coffee Inc. Balance Sheet December 31, 2001 Assets 1000 Debt 400 Equity 600 Total 1000 Total 1000 Gourmet Coffee Inc. Income Statement For Year Ended December 31, 2001 Revenues 2000 Costs 1600 Net Income 400 Initial Assumptions - Revenues will grow at 15% (2000*1.15) - All items are tied directly to sales and the current relationships are optimal - Consequently, all other items will also grow at 15% Gourmet Coffee Inc. Pro Forma Income Statement For Year Ended 2002 Revenues 2,300 Costs 1,840 Net Income 460 Case I - Dividends are the plug variable, so debt and equity increase at 15% - Dividends = 460 NI – 90 increase in equity = 370 Gourmet Coffee Inc. Pro Forma Balance Sheet Case 1 Assets Total 1,150 1,150 Debt 460 Equity 690 Total 1,150 Case II - Debt is the plug variable and no dividends are paid - Debt = 1,150 – (600+460) = 90 - Repay 400 – 90 = 310 in debt Gourmet Coffee Inc. Pro Forma Balance Sheet Case 1 Assets Total 1,150 1,150 Debt 90 Equity 1,060 Total 1,150 This example shows the interaction between sales growth and financial policy. As sales increase, so do total assets. This occurs because the firm must invest in net working capital and fixed assets to support higher sales levels. Since assets are growing, total liabilities and equity, the right-hand side of the balance sheet, grow as well. The way the liabilities and equity change depends on the firm’s financing policy and its dividend policy. The growth in assets requires that the firm decide on how to finance that growth. This is strictly a managerial decision. Percentage of Sales Approach Some items tend to vary directly with sales, while others do not. Income Statements - Costs may vary directly with sales. If this is the case, then the profit margin is constant (PM=NI/Sales). - Dividends are a management decision and generally do not vary directly with sales- this affects the retained earnings that go on the balance sheet (NI=R/E + Div). Balance Sheet - Initially we assume that all assets, including fixed assets, vary directly with sales. Accounts payable will also vary directly with sales. Notes payable, long-term debt, and equity generally do not vary with sales because they depend on management decisions about capital structure. The change in the retained earnings portion of equity will come from the dividend decision. Example: Percentage of Sales Method Tasha’s Toy Emporium Income Statement, 2001 % of Sales Sales 5,000 Costs 3,000 60% EBT 2,000 40% Taxes (40%) 800 16% Net Income 1,200 24% Dividends 600 Add. To RE 600 Dividend Payout Rate= 50% Tasha’s Toy Emporium Pro Forma Income Statement, 2002 Sales 5,500 Costs 3,300 EBT 2,200 Taxes 880 Net Income 1,320 Dividends 660 Add. To RE 660 Assume Sales grow at 10% Tasha’s Toy Emporium – Balance Sheet Current % of Sales Pro Forma ASSETS Current Assets Current % of Pro Forma Sales LIABILITIES & OWNERS’ EQUITY Cash $500 10% $550 Current Liabilities A/P $900 A/R 2,000 40 2,200 N/P 2,500 n/a 2,500 Inventory 3,000 60 3,300 3,400 n/a 3,490 Total 5,500 110 6,050 Net PP&E 4,000 80 4,400 Total Assets 9,500 190 10,450 Fixed Assets 18% $990 Total LT 2,000 n/a Debt Owners’ Equity C 2,000 n/a Shares RE 2,100 n/a 4,100 n/a Total Total 9,500 L& OE 2,000 2,000 2,760 4,760 10,250 External Financing Needed The firm needs to come up with an additional $200 in debt or equity to make the balance sheet balance. TA-TL&OE = 10,450 – 10,250 = 200 Choosing plug variable: - Borrow more short-term (Notes Payable). Borrow more long-term (LT Debt). Sell more common shares (C Shares). Decrease dividend payout, which increases additions to R/E. Operating at Less than Full Capacity Suppose that the firm is currently operating at 80% capacity. - Full capacity sales = 5000/0.8 = 6,250 - (6,250-5,000)/5,000= 0.25, i.e., sales could increase by 25% before the firm needs to invest in new fixed assets Estimated sales = $5,500, so the firm would still be operating at 88% of full capacity Therefore, no additional fixed assets would be required since sales are only projected to rise to 5,500 which is less than full capacity (6,250) Pro Forma Total Assets = 6,050 + 4,000 = 10,050 Total Liabilities and Owners’ Equity = 10,250 TA-TL&OE = 10,050 – 10,250 = -200 Choosing plug variable - Repay some short-term debt (decrease Notes Payable) Repay some long-term debt (decrease LT Debt) Buy back shares (decrease C Shares) Pay more in dividends (reduce Additions to R/E) Increase cash account Growth and External Financing - At low growth levels, internal financing (retained earnings) may exceed the required investment in assets. As the growth rate increases, the internal financing will not be enough and the firm will have to go to the capital markets for money. Examining the relationship between growth and external financing required is a useful tool in long-range planning. The Internal Growth Rate The internal growth rate tells us how much the firm can grow assets using retained earnings as the only source of financing. ROA = Profit Margin x Total Asset Turnover = (NI/Sales) x (Sales/Total Assets) Retention Rate = R = (Addition to Retained Earnings/NI) Assume ROA = 0.1041 and Retention Rate = 0.6037 Internal Growth Rate = ROA x R 1-(ROA x R) = 0.1041 x 0.6037 = 0.0671 = 6.71% 1-(0.1041 x 0.6037) The Sustainable Growth Rate The sustainable growth rate tells us how much the firm can grow using internally generated funds and issuing debt to maintain a constant debt ratio. ROE = ROA x Equity Multiplier = PM x TAT x EM = (NI/Total Assets) x (Total Assets/ Common Equity) Assume ROE = 0.2517 Sustainable Growth Rate = ROE x R 1-(ROE x R) = 0.2517 x 0.6037 = 0.1792 = 17.92% 1-(0.2517 x 0.6037) Determinants of Growth - Profit margin: Operating efficiency (i.e., as PM increases there is more growth) - Total Asset Turnover: Asset use efficiency (i.e., as TAT increases there is more growth and more sales are produced for each dollar of total assets) - Financial policy: Choice of optimal debt/equity policy - Dividend policy: choice of how much to pay to shareholders versus reinvesting in the firm (i.e., as dividend payout ratio decreases there is more growth and more net income goes to retained earnings) Some Caveats It is important to remember that we are working with accounting numbers and ask ourselves some important questions as we go through the planning process. - How does our plan affect the timing and risk of our cash flows? Does the plan point out inconsistencies in our goals? If we follow this plan, will we maximize owners’ wealth?