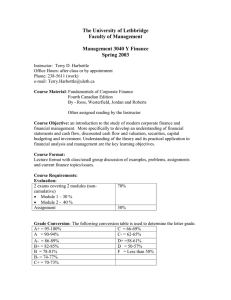

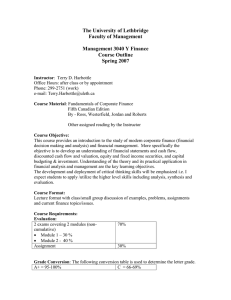

The University of Lethbridge Faculty of Management Management 3040 Y Finance)

advertisement

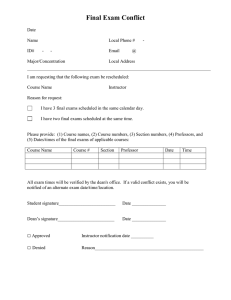

The University of Lethbridge Faculty of Management Management 3040 Y Finance) Spring 2002 Instructor: Terry D. Harbottle Office Hours: after class or by appointment Phone: 238-5611 (work) e-mail: Terry.Harbottle@uleth.ca Course Material: Fundamentals of Corporate Finance Fourth Canadian Edition By - Ross,Westerfield,Jordan and Roberts Other assigned reading by the Instructor Course Objective: an introduction to the study of modern corporate finance and financial management. More specifically to develop an understanding of financial statements and cash flow, valuation, securities, capital budgeting and investment. Understanding of the theory and its practical application in financial analysis and management are the key learning objectives. Course Format: Lecture format with class/small group discussion of examples, problems, assignments and current finance topics/issues . Course Requirements: Evaluation: 3 exams covering 3 modules (noncumulative) Module 1 – 20% Module 2 – 25 % Module 3 – 25% Assignment 70% 30% Grade Conversion: The following conversion table is used to determine the letter grade. A+ = 95-100% C = 66-69% A = 90-94% C- = 62-65% A- = 86-89% D+ =58-61% B+ = 82-85% D = 50-57% B = 78-81% F = Less than 50% B- = 74-77% C+ = 70-73% Other Expectations: Students should be familiar with the University of Lethbridge regulations, policies and requirement. Refer to the University of Lethbridge Calendar. Exams: All exams are closed book with calculators and a one page (8 by 11) formulae sheet allowed. Missed exams receive a mark of zero unless the student has a legitimate reason. The instructor should be contacted beforehand for approval and to make alternative arrangements. Three exams with a total weighting of 70%. Each exam will be non-cumulative. Class preparation – students are expected to read the assigned chapters and other assigned readings before class. Students should have completed the assigned concept/end of chapter questions and be prepared to discuss them in class. Students are responsible for all material covered in class, the assigned chapters in the textbook and any other assigned readings. The project assignment is expected to be handed in on time. Late assignments will receive zero marks: The assignment will involve a company analysis (group reports encouraged). Full details will be provided in class. Course Schedule:* Module 1 (Jan. 11 - Feb 1) Chapter 1 – Introduction to Corporate Finance Chapter 2 - Financial Statements, Taxes and Cash Flow Chapter 3 – Working with Financial Statements Chapter 4 – Long Term Financial Planning and Corporate Growth Module 1 Exam – Feb1 Module 2 (Feb. 8 – March 15) Chapter 5 – Introduction To Valuation Chapter 6 – Discounted Cash Flow Valuation Chapter 7 – Interest Rates and Bond Valuation Chapter 8 – Stock Valuation Module 2 Exam – March 15 Module 3 (March 29– April 16) Chapter 9 – Net Present Value and Other Investment Criteria Chapter 10 – Making Capital Investment Decisions Chapter 11 – Project Analysis and Evaluation Chapter 14 – Cost of Capital Module 3 Final Exam – April 26 * Preliminary Schedule - subject to change