Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

CHAPTER 8

Reporting and Analysing Receivables

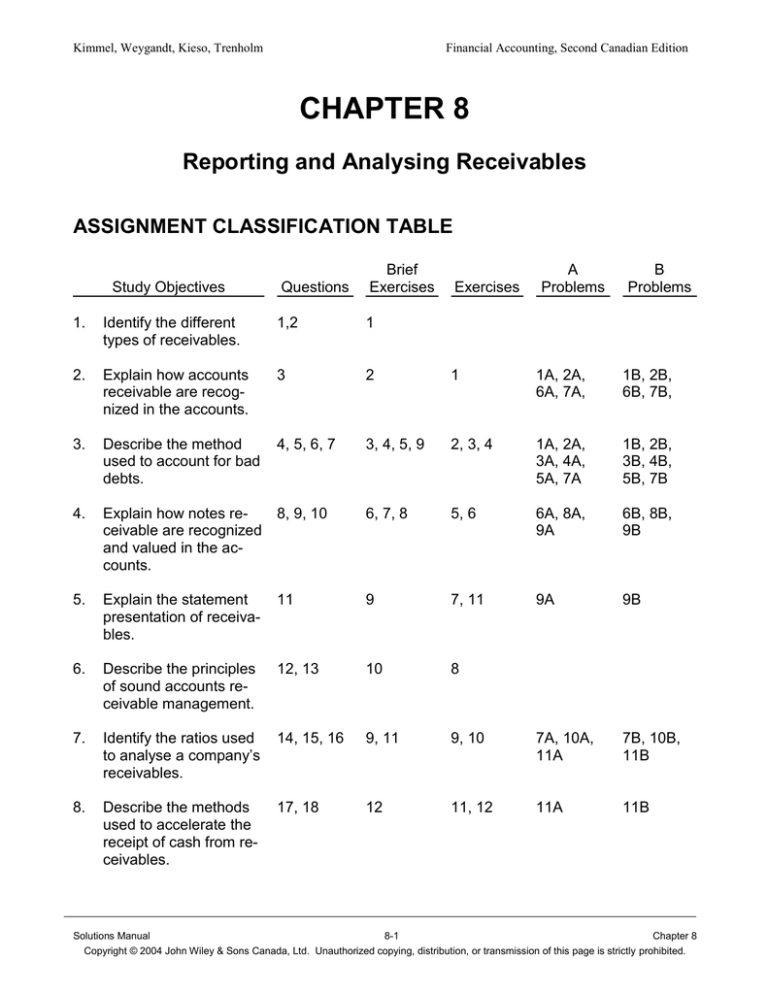

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

Exercises

A

Problems

B

Problems

1.

Identify the different

types of receivables.

1,2

1

2.

Explain how accounts

receivable are recognized in the accounts.

3

2

1

1A, 2A,

6A, 7A,

1B, 2B,

6B, 7B,

3.

Describe the method

used to account for bad

debts.

4, 5, 6, 7

3, 4, 5, 9

2, 3, 4

1A, 2A,

3A, 4A,

5A, 7A

1B, 2B,

3B, 4B,

5B, 7B

4.

Explain how notes re8, 9, 10

ceivable are recognized

and valued in the accounts.

6, 7, 8

5, 6

6A, 8A,

9A

6B, 8B,

9B

5.

Explain the statement

presentation of receivables.

11

9

7, 11

9A

9B

6.

Describe the principles

of sound accounts receivable management.

12, 13

10

8

7.

Identify the ratios used

to analyse a company’s

receivables.

14, 15, 16

9, 11

9, 10

7A, 10A,

11A

7B, 10B,

11B

8.

Describe the methods

used to accelerate the

receipt of cash from receivables.

17, 18

12

11, 12

11A

11B

Solutions Manual

8-1

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

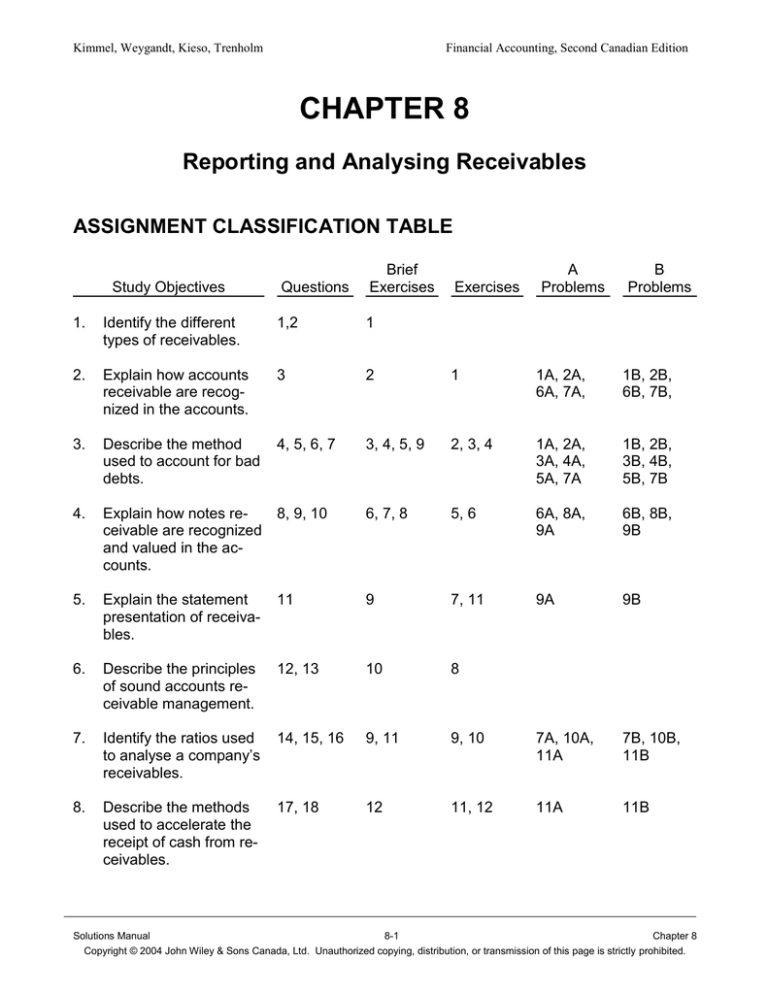

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

1A

Journalize receivables transactions.

Moderate

20-30

2A

Determine missing amounts.

Complex

15-20

3A

Journalize bad debts transactions.

Moderate

20-30

4A

Journalize bad debts transactions

Moderate

20-30

5A

Calculate bad debt amounts.

Moderate

20-30

6A

Journalize receivables transactions.

Moderate

20-30

7A

Journalize receivables transactions and calculate ratios.

Moderate

30-40

8A

Journalize notes receivables transactions.

Moderate

20-30

9A

Journalize credit card and notes receivable transactions; show balance sheet presentation.

Moderate

15-20

10A

Calculate and interpret ratios.

Moderate

15-20

11A

Evaluate liquidity.

Moderate

15-20

1B

Journalize receivables transactions.

Moderate

20-30

2B

Determine missing amounts.

Complex

15-20

3B

Journalize bad debts transactions.

Moderate

20-30

4B

Journalize and post bad debts transactions

Moderate

20-30

5B

Calculate bad debt amounts.

Moderate

20-30

6B

Journalize receivables transactions.

Moderate

20-30

7B

Journalize receivables transactions and calculate ratios.

Moderate

30-40

8B

Journalize notes receivables transactions.

Moderate

20-30

9B

Journalize credit card and notes receivable transac-

Moderate

15-20

Solutions Manual

8-2

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

Description

tions; show balance sheet presentation.

Financial Accounting, Second Canadian Edition

Difficulty

Level

Time

Allotted (min.)

10B

Calculate and interpret ratios.

Moderate

15-20

11B

Evaluate liquidity.

Moderate

15-20

Solutions Manual

8-3

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

Accounts receivable are amounts owed by customers on account. They result from the

sale of goods and services in the normal course of business operations (i.e., in trade).

Notes receivable represent claims that are evidenced by formal instruments of credit.

Notes normally extend for periods longer than an account and have a specified interest

rate attached.

2.

Other receivables include nontrade receivables such as interest receivables, loans to

company officers, advances to employees, and income taxes refundable.

3.

The sale should be recorded at $10,000 on December 29. If the customer takes the discount it will be recorded on January 8 as a sales discount. If sales discounts covering

more than one period of time are material for a company, they should be estimated and

recorded in the proper period similar to the allowance for doubtful accounts.

4.

The purpose of the allowance for doubtful accounts is to show an estimate of the accounts receivable expected to become uncollectible. The allowance account is used because the amount is only an estimate and we do not know for certain which customers will

not pay. The account can be in a debit balance if the amount of actual write-offs exceeds

previous provisions for bad debts.

5.

Soo Eng should realize that the decrease in net realizable value occurs when estimated

uncollectibles are recognized in an adjusting entry. The write-off of an uncollectible account reduces both accounts receivable and the allowance for doubtful accounts by the

same amount. Thus, net realizable value does not change.

6.

A company should write off an account when all methods of attempting to collect it have

failed. Therefore once an account is written off the company should no longer actively attempt collection.

7.

Two journal entries are required because the first journal entry has to restore the previously written off accounts receivable and the second journal entry records the actual receipt of payment on the account. This way there is a record that the person did eventually

pay for the purpose of future credit decisions.

8.

Notes are not recorded at their maturity value because the interest on the note is earned

over time. According to the revenue recognition principle, interest is recorded as earned.

9.

In total the note will earn $1,250 interest ($30,000 x 5% x 10/12). $1,000 will be recorded

for the year ended December 31 – 8 months interest ($30,000 x 5% x 8/12).

Solutions Manual

8-4

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

10.

Payee:

Accounts Receivable ..............................................................

Notes Receivable ..............................................................

Interest Revenue ...............................................................

Maker (May Ltd.):

Notes Payable.........................................................................

Interest Expense .....................................................................

Accounts Payable ..............................................................

11.

Receivables

Accounts receivable

Less: Allowance for doubtful accounts

Net realizable value

Notes receivable

Less: Allowance for doubtful accounts

Net realizable value

xxx

xxx

xxx

xxx

xxx

xxx

$xxx

xx

xxx

$xxx

xx

xxx

12.

The steps involved in receivables management are:

(1) Determine to whom to extend credit

(2) Establish a payment period

(3) Monitor collections

(4) Evaluate the liquidity of receivables

(5) Accelerate cash receipts from receivables when necessary

13.

A concentration of credit risk exists when a material threat of nonpayment exists, from either a single customer or class of customers, that could adversely affect the company’s financial health.

14.

An increase in the receivables turnover ratio indicates a faster collection of receivables.

The higher the turnover ratio the fewer days it takes to collect the accounts receivable. An

increase in the collection period means that it is taking longer for the company to convert

sales in to cash.

15.

Sales for the period

16.

An increase in the current ratio normally indicates an improvement in short-term liquidity.

This may not always be the case because the composition of current assets may vary. In

order to determine if the increase is an improvement in financial health other ratios that

should be considered include: the receivables turnover, average collection period, inventory turnover and days in inventory ratios.

= Receivables Turnover X Average Accounts Receivable

=

11.6 X $1,762.5 million

=

$20,445 million

Solutions Manual

8-5

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

17.

Bombardier may sell its receivables to accelerate the receipt of cash. The proceeds from

the sale of the receivables could be used to finance operations and reduce the need for the

company to rely on other sources of financing such as operating lines of credit. As well, the

company may not want to dedicate resources to the time consuming responsibility of billing

and collecting from customers. By selling the receivables and passing this responsibility to

others, Bombardier is free to concentrate on its core business activities.

18.

From its own credit cards, Sears may realize interest revenue from customers who do not

pay the balance due within a specified grace period. To account for these transactions the

company records a debit to accounts receivable and a credit to sales revenue.

Bank credit cards offer the following advantages:

(1) The credit card issuer makes the credit card investigation of the customer.

(2) The issuer maintains individual customer accounts.

(3) The issuer undertakes the collection process and absorbs any losses from uncollectible accounts.

(4) The retailer receives cash more quickly from the credit card issuer than it would from

individual customers.

To record a bank credit card transaction, the seller normally records a debit to cash for the

amount of the sale less the service charge required by the credit card company. A debit

is made to the service charge expense and a credit is made to sales revenue for the gross

amount of the sale.

The advantage of the debit card is that the cash is deducted immediately from the customers account. There are no credit checks or collection concerns so the service charges

are normally lower than for a bank credit card.

The entries to record a debit card sale are the same as the entry to record a bank credit

card sale.

By using its own credit cards, bank credit cards and debit cards Sears provides more

options to its customers, increases its revenue, and reduces its risk.

Solutions Manual

8-6

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 8-1

(a)

(b)

(c)

(d)

Nontrade receivables

Notes receivable

Accounts receivable

Nontrade receivables

BRIEF EXERCISE 8-2

(a)

(b)

(c)

Accounts Receivable ................................................................

Sales ..............................................................................

14,000

Cost of Goods Sold ..................................................................

Inventory ..........................................................................

10,000

Sales Returns and Allowances .................................................

Accounts Receivable ......................................................

2,400

Inventory...................................................................................

Cost of Goods Sold ........................................................

1,440

Cash ($11,600 - $232) .............................................................

Sales Discounts ($11,600 X 2%) ..............................................

Accounts Receivable ($14,000 – $2,400) .......................

11,368

232

14,000

10,000

2,400

1,440

11,600

BRIEF EXERCISE 8-3

(a)

(b)

Bad Debt Expense ...................................................................

Allowance for Doubtful Accounts ....................................

4,500

4,500

The amount to be reported as bad debts expense would be $800 + $7,500 = $8,300.

Solutions Manual

8-7

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 8-4

(a)

Allowance for Doubtful Accounts .......................................................

Accounts Receivable ...............................................................

(b)

(1)

Accounts receivable

Allowance for doubtful accounts

Net realizable value

Before Write-Off

$700,000

54,000

$646,000

18,000

18,000

(2)

After Write-Off

$682,000

36,000

$646,000

BRIEF EXERCISE 8-5

Accounts Receivable .........................................................................

Allowance for Doubtful Accounts .............................................

18,000

Cash ..................................................................................................

Accounts Receivable ...............................................................

18,000

18,000

18,000

BRIEF EXERCISE 8-6

Annual Interest Rate

10%

(a) 8%

12%

Total Interest

(b) $1,500.00

$400.00

(c) $1,680.00

BRIEF EXERCISE 8-7

Jan.

Feb.

10

9

Accounts Receivable ......................................................

Sales ....................................................................

12,000

Cost of Goods Sold ........................................................

Inventory ...........................................................

8,000

Notes Receivable ...........................................................

Accounts Receivable ...........................................

12,000

12,000

8,000

12,000

Solutions Manual

8-8

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 8-8

(a)

Apr.

July

(b)

Apr.

July

1

1

1

1

Notes Receivable ....................................................................

Accounts Receivable .....................................................

10,000

Cash .......................................................................................

Notes Receivable ...........................................................

Interest Revenue ($10,000 x 7% x 3/12) ........................

10,175

Notes Receivable ....................................................................

Accounts Receivable .....................................................

10,000

Accounts Receivable ..............................................................

Notes Receivable ...........................................................

Interest Revenue ($10,000 x 7% x 3/12) ........................

10,175

10,000

10,000

175

10,000

10,000

175

BRIEF EXERCISE 8-9

(a)

(b)

Bad Debts Expense ..................................................................

Allowance for Doubtful Accounts .....................................

Current assets

Cash ................................................................................

Accounts receivable ........................................................

Less: Allowance for doubtful accounts ...........................

Merchandise inventory ....................................................

Prepaid expenses ............................................................

35,000

35,000

$ 90,000

$600,000

35,000

565,000

130,000

13,000

$798,000

(c)

Receivables turnover =

Average collection period =

$3,000,000

5 times

$600,000

365 days

73 days

5

Solutions Manual

8-9

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 8-10

(a)

(b)

(c)

(d)

(e)

2.

3.

4.

5.

1.

Review company credit ratings

Collect information about competitors’ payment period policies

Prepare accounts receivable aging schedule

Calculate the receivables turnover and average collection period

Accept bank credit cards

BRIEF EXERCISE 8-11

Receivables Turnover ($ in millions):

$5,075.9

20.7 times

($248.1 + $243.1) 2

Average Collection Period:

365 days

18 days

20.7 times

BRIEF EXERCISE 8-12

Visa card

Cash ($100 – $3)......................................................................

Service Charge Expense ($100 X 3%) .....................................

Sales ...............................................................................

97

3

Nonbank card

Credit Card Receivables...........................................................

Sales ...............................................................................

100

Debit card

Cash ($100 – $3)......................................................................

Service Charge Expense ($100 X 3%) .....................................

Sales ...............................................................................

97

3

100

100

100

Solutions Manual

8-10

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 8-1

Nicklaus Corp.

Jan.

6

16

Account Receivable—Watson Inc. .................................

Sales ......................................................................

6,000

Cost of Goods Sold ........................................................

Inventory .................................................................

3,600

Cash ($6,000 – $120) .....................................................

Sales Discounts (2% X $6,000) ......................................

Accounts Receivable—Watson Inc.........................

5,880

120

6,000

3,600

6,000

Watson Inc.

Jan.

6

16

Merchandise Inventory. ..................................................

Accounts Payable ...................................................

6,000

Accounts Payable ...........................................................

Merchandise Inventory ...........................................

Cash. ......................................................................

6,000

6,000

120

5,880

EXERCISE 8-2

(a)

(b)

Dec. 31

Dec. 31

Bad Debts Expense .............................................

Allowance for Doubtful Accounts .................

8,200

Bad Debts Expense .............................................

Allowance for Doubtful Accounts .................

7,500

8,200

7,500

Solutions Manual

8-11

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 8-3

(a)

Age of Accounts

0-30 days

31-60 days

61-90 days

Over 90 days

(b)

Mar. 31

(c)

Amount

$65,000

12,600

8,500

6,400

%

2

7

30

50

Estimated Uncollectible

$1,300

882

2,550

3,200

$7,932

Bad Debts Expense .............................................

Allowance for Doubtful Accounts .................

($7,932 – $2,200)

5,732

5,732

The total balance of receivables increased from 2003 to 2004. However, of concern is the

fact that each of the three categories of older accounts increased substantially during

2004. That is, customers are taking longer to pay and bad debts are likely to increase.

Management needs to investigate the causes of this change.

EXERCISE 8-4

2004

Dec. 31

Bad Debts Expense ........................................................

Allowance for Doubtful Accounts ....................................

($8,400 + $1,000)

9,400

9,400

2005

May 11

June 12

Allowance for Doubtful Accounts ....................................

Accounts Receivable—Worthy ................................

900

Accounts Receivable—Worthy .......................................

Allowance for Doubtful Accounts .............................

900

Cash ...............................................................................

Accounts Receivable—Worthy ................................

900

900

900

900

Solutions Manual

8-12

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 8-5

Nov.

Dec.

1

1

15

31

Notes Receivable ...........................................................

Cash .......................................................................

24,000

Notes Receivable ...........................................................

Sales ......................................................................

3,600

Cost of Goods Sold ........................................................

Inventory .................................................................

2,500

Notes Receivable ...........................................................

Accounts Receivable—B. Barnes ...........................

8,000

Interest Receivable .........................................................

Interest Revenue* ...................................................

361

*Calculation of interest revenue:

Bouchard’s note:

Wright’s note:

Barnes’ note:

Total accrued interest

$24,000 X 8% X 2/12

$3,600 X 6% X 1/12

$8,000 X 7% X 15/365

=

=

=.

24,000

3,600

2,500

8,000

361

$320

.18

23

$361

Note: Some students may also calculate interest using part months, rather than days.

EXERCISE 8-6

May

1

June 30

July

Oct.

Nov.

31

31

1

Notes Receivable ...........................................................

Accounts Receivable – Jioux Company .................

6,000

Interest Receivable ($6,000 X 5% X 2/12)......................

Interest Revenue ....................................................

50

Notes Receivable ...........................................................

Cash .......................................................................

10,000

Cash ...............................................................................

Note Receivable ............................................................

Interest Revenue ($10,000 X 7% X 3/12) ...............

10,175

Allowance for Doubtful Accounts ....................................

Note Receivable .....................................................

Interest Receivable ................................................

6,050

6,000

50

10,000

10,000

175

6,000

50

Solutions Manual

8-13

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 8-7

DEERE AND COMPANY

Balance Sheet (partial)

October 31, 2002

(in U.S. millions)

Receivables

Trade accounts and notes receivable .........................................................

Financing receivable

(net of allowance for doubtful accounts $136) ............................................

Other receivables .......................................................................................

Total receivables .......................................................................................

Less: Allowance for doubtful accounts* .............................................................

Net receivables..................................................................................................

$ 2,779.0

9,068.0

426.4

12,273.4

45.0

$12,228.4

* This presentation assumes that the allowance relates for all receivables. Some students may

also assume that it relates solely to accounts receivable.

EXERCISE 8-8

Bombardier has industry risk in that a significant amount of its receivables are concentrated in

the transportations and aerospace industry. However, due to the note disclosure, users are now

aware of this risk. So long as sales are being made to a variety of customers in the industry, users should not be concerned.

Solutions Manual

8-14

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 8-9

(a)

2002

Current ratio =

$1,163

0.55 : 1

$2,134

2001

Current ratio =

$1,164

0.71 : 1

$1,638

(b)

2002

Receivables turnover =

Average collection period =

2001

Receivables turnover =

Average collection period =

$6,110

8.1 times

($781 + $726) 2

365 days

45 days

8.1

$5,652

7.4 times

($726 + $800) 2

365 days

49 days

7.4

(c)

The accounts receivable represented 62.1% ($722 $1,163) of the company’s current

assets and 11.8% ($722 $6,110) of the company’s revenue in 2002. It represented

55.4% ($645 $1,164) of the company’s current assets and 11.4% ($645 $5,652) of the

company’s revenue in 2001. This is a significant portion of the company’s liquid assets

and its revenue and thus clearly deserves close monitoring.

(d)

The receivables turnover ratio and the average collection period seem to indicate that the

company’s management of receivables has improved. The turnover has improved from

7.4 times in 2001 to 8.1 times in 2002. The average collection period has decreased from

49 days in 2001 to 45 days in 2002. However it appears that overall liquidity has deteriorated as evidenced by the decline in the current ratio from 0.71:1 in 2001 to 0.55:1 in

2002.

Solutions Manual

8-15

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 8-10

(a)

(b)

(c)

(d)

Decrease

Increase

No effect

Increase

EXERCISE 8-11

(a)

Jan. 15

Jan. 20

Jan. 30

Feb. 10

Feb. 15

Credit Card Receivables .................................................

Sales ......................................................................

15,000

Cash ...............................................................................

Service Charge Expense ($4,500 X 2%) ........................

Sales ......................................................................

4,410

90

Cash ...............................................................................

Service Charge Expense ($1,000 X 3%) ........................

Sales ......................................................................

970

30

Cash ...............................................................................

Credit Card Receivables .........................................

12,000

Interest Receivable ($15,000 - $12,000 X 18% X 1/12)..

Interest Revenue ....................................................

45

15,000

4,500

1,000

12,000

45

(b) Service charge expense and interest revenue would be shown in the non–operating revenues and expense section of the Statement of Earnings

EXERCISE 8-12

One possible reason CN chose to sell may have been to improve its financial ratios. Other reasons include not wanting to deal with the administration of collecting accounts or the desire to

accelerate cash receipts.

Solutions Manual

8-16

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 8-1A

(a) Accounts Receivable ........................................

Sales .............................................................

800,000

Cash .................................................................

Accounts Receivable .....................................

743,000

(b) Allowance for Doubtful Accounts .......................

Accounts Receivable .....................................

7,000

(c) Accounts Receivable ........................................

Allowance for Doubtful Accounts ...................

4,000

Cash .................................................................

Accounts Receivable .....................................

4,000

(d) Bad Debt Expense ............................................

Allowance for Doubtful Accounts ...................

19,000

800,000

743,000

7,000

4,000

4,000

19,000

Allowance for Doubtful Accounts

Beg. Bal.

9,000

W/O

7,000 Recovery

4,000

Bad Debts 19,000

End Bal.

25,000

Solutions Manual

8-17

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-1A (Continued)

(e)

Accounts Receivable

Beg. Bal. 200,000 Collections 743,000

Sales

800,000 W/O

7,000

Recovery

4,000 Collections

4,000

End Bal.

250,000

Allowance for Doubtful Accounts

Beg. Bal.

9,000

W/O

7,000 Recovery

4,000

Bad Debts 19,000

End Bal.

25,000

(f)

Net realizable value of receivables is $225,000 ($250,000 - $25,000)

Solutions Manual

8-18

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-2A

(a)

Allowance for doubtful accounts = $425 (given)

(b)

$350 - $150 – (b) = $425

(b) = $225

(c)

Bad debt expense = Adjustment to allowance for doubtful accounts =

$225 (from (b))

(d)

Addition to Accounts Receivable = $45,000

(e)

Amounts written off = Reductions in the allowance account = $150

(f)

(f) + $45,000 - $46,350 - $150 = $4,500

(f) = $6,000

Solutions Manual

8-19

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-3A

(a) Total estimated bad debts

Total

Accounts

receivable

% uncollectible

Estimated

bad debts

0-30

Number of Days Outstanding

31-60

61-90

91-120

$375,000

$220,000

1%

$90,000

4%

$40,000

8%

$10,000

16%

$15,000

30%

$15,100

$2,200

$3,600

$3,200

$1,600

$4,500

(b) Bad Debts Expense ...................................................

Allowance for Doubtful Accounts .........................

($15,100 + $10,000)

25,100

(c) Allowance for Doubtful Accounts ...............................

Accounts Receivable ...........................................

5,000

(d) Accounts Receivable .................................................

Allowance for Doubtful Accounts .........................

5,000

Cash ..........................................................................

Accounts Receivable ...........................................

5,000

(e)

Over 120

25,100

5,000

5,000

5,000

If Image.com used 4% of total accounts receivable rather than aging the individual accounts the allowance at year end, the bad debt expense adjustment

would be $25,000 [$15,000 ($375,000 x 4%) + $10,000]. The answers to (c)

– (d) would not change.

Aging the individual accounts rather than applying a percentage to the total

accounts receivable should produce a more accurate allowance and bad

debt expense.

Solutions Manual

8-20

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-4A

(a)

Dec. 31 Bad Debts Expense ..............................

Allowance for Doubtful Accounts ..

($38,610 – $20,000)

(b)

18,610

18,610

2005

1.

2.

Mar. 31 Allowance for Doubtful Accounts ..........

Accounts Receivable ....................

800

May 31 Accounts Receivable ............................

Allowance for Doubtful Accounts ..

800

31 Cash .....................................................

Accounts Receivable ....................

800

(c)

800

800

800

2005

Dec. 31

Bad Debts Expense....................................

Allowance for Doubtful Accounts ..........

($38,610 – $45,000)

6,390

6,390

Solutions Manual

8-21

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-5A

(a)

$36,000

(b)

$32,000 - $3,000 = $29,000

(c)

$32,000 + $3,000 = $35,000

(d)

Using the allowance method of reporting bad debt expense provides a better

balance sheet valuation for accounts receivable and better matches expenses to the period in which the sale occurs.

Solutions Manual

8-22

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-6A

Jan. 5

20

Feb.18

Apr. 20

30

May 25

Aug. 18

25

Sept. 1

Accounts Receivable—George Company .........

Sales ..........................................................

16,000

Cost of Goods Sold ...........................................

Inventory ....................................................

9,600

Notes Receivable ..............................................

Accounts Receivable—George Company ..

16,000

Notes Receivable ..............................................

Sales ..........................................................

8,000

Cost of Goods Sold ...........................................

Inventory ....................................................

5,000

Cash ($16,000 + $360) .....................................

Notes Receivable .......................................

Interest Revenue ($16,000 X 9% X 3/12) ...

16,360

Cash ($11,000 + $293) .....................................

Notes Receivable .......................................

Interest Revenue ($11,000 X 8% X 4/12) ...

11,293

Notes Receivable ..............................................

Accounts Receivable—Avery Inc................

6,000

Cash ($8,000 + $200) .......................................

Notes Receivable .......................................

Interest Revenue ($8,000 X 5% X 6/12) .....

8,200

Accounts Receivable—Avery Inc. .....................

($6,000 + $120)

Notes Receivable .................................

Interest Revenue ($6,000 X 8% X 3/12)

6,120

Notes Receivable ..............................................

Sales ..........................................................

10,000

Cost of Goods Sold ...........................................

Inventory ....................................................

6,000

16,000

9,600

16,000

8,000

5,000

16,000

360

11,000

293

6,000

8,000

200

6,000

120

10,000

6,000

Solutions Manual

8-23

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-7A

(a)

1.

Accounts Receivable .................................... 3,200,000

Sales .....................................................

3,200,000

2.

Sales Returns and Allowances ......................

Accounts Receivable.............................

50,000

50,000

3.

Cash ............................................................. 3,000,000

Accounts Receivable .............................

3,000,000

4.

Allowance for Doubtful Accounts ...................

Accounts Receivable .............................

90,000

Accounts Receivable.....................................

Allowance for Doubtful Accounts ...........

40,000

Cash .............................................................

Accounts Receivable .............................

40,000

5.

90,000

40,000

40,000

(b)

Accounts Receivable

Bal.

(1)

(5)

960,000 (2)

3,200,000 (3)

40,000 (4)

(5)

Bal. 1,020,000

(c)

50,000

3,000,000

90,000

40,000

Allowance for Doubtful Accounts

(4)

90,000 Bal.

(5)

70,000

40,000

Bal.

20,000

Balance before adjustment [see (b)] ....................

Balance needed ...................................................

Adjustment required .............................................

$ 20,000

110,000

$ 90,000

The journal entry would therefore be as follows:

Bad Debts Expense ......................................

Allowance for Doubtful Accounts ...........

90,000

90,000

Solutions Manual

8-24

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-7A (Continued)

(d)

Receivables Turnover

$3,200,000 $50,000

3.2 times

$960,000 $1,020,000

2

Average Collection Period

Its average collection period is:

365 days

= 114 days

3.2

Solutions Manual

8-25

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-8A

(a)

July 31

Aug. 31

Sept. 30

(b)

Sept. 30

30

Notes Receivable ........................ 50,000

Accounts Receivable ............

Interest Receivable .....................

Interest Revenue ..................

($50,000 x 5% x 1/12)

208

208

Cash ........................................... 50,416

Interest Receivable ...............

Interest Revenue

(50,000 X 5% X 1/12) ...........

Notes Receivable .................

Interest Receivable .....................

Interest Revenue ..................

($50,000 x 5% x 1/12)

50,000

208

208

50,000

208

Accounts Receivable ................... 50,416

Interest Receivable

($208 + $208) .......................

Notes Receivable .................

208

416

50,000

Solutions Manual

8-26

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-9A

(a)

Oct. 1

7

12

21

31

31

Cash......................................................... . 8,093.33

Interest Receivable

($8,000 X 7% X 2/12) .........................

93.33

Notes Receivable ...............................

8,000.00

Accounts Receivable ................................

Sales ..................................................

6,900.00

Cash ($750 – $15)....................................

Service Charge Expense ($750 X 2%) .....

Sales ..........................................

735.00

15.00

Cash ($1,500 – $30).................................

Service Charge Expense ($1,500 X 2%) ..

Sales ..........................................

1,470.00

30.00

Accounts Receivable ...............................

Notes Receivable ...............................

Interest Receivable

($5,200 X 7% X 1/12) .........................

Interest Revenue

($5,200 X 7% X 1/12) .........................

5,260.66

Interest Receivable ..................................

Interest Revenue ................................

($10,200 X 9% X 1/12)

76.50

6,900.00

750.00

1,500.00

5,200.00

30.33

30.33

76.50

Solutions Manual

8-27

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-9A (Continued)

(b)

Oct.1

Notes Receivable

Bal. 23,400.00 Oct. 15 8,000.00

Oct. 25 5,200.00

Oct. 31 Bal. 10,200.00

Interest Receivable

Oct. 1 Bal. 123.66 Oct. 1 93.33

Oct. 31

76.50 Oct. 31 30.33

Oct. 31 Bal. 76.50

Accounts Receivable

Oct. 7

6,900.00

Oct. 31

5,260.66

Oct. 31 Bal. 12,160.66

(c) Current assets

Notes receivable .......................................................

Accounts receivable. .................................................

Interest receivable. ....................................................

Total receivables .................................................

$10,200

12,161

77

$22,438

Solutions Manual

8-28

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-10A

Rogers

Shaw

($ in millions)

Receivables turnover

$4,323

($558.8 $577.6) 2

Average collection period

$1,888.6

($208.8+ $206.8) 2

$4,323

= 7.6 times

$568.2

$1,888.6

9.1 times

$207.8

365 days

= 48 days

7.6

365 days

= 40 days

9.1

Shaw’s receivables turnover was almost 20% higher than Rogers’, which

means Shaw was more efficient than Rogers in collecting its receivables.

However, both companies are still collecting their accounts receivables slower

than the industry average of 38 days.

Solutions Manual

8-29

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-11A

(a)

At first glance it appears that Tianjin’s liquidity had deteriorated over the past

year since the company’s current ratio has fallen from 1:5:1 to 1:3:1. However, it is taking the company less time to collect its accounts receivable as

evidenced by the higher receivables turnover ratio. As well, the company appears to be moving its inventory more quickly as evidenced by the higher inventory turnover ratio. It is possible that the lower current ratio is due to the

fact that with improved collections and inventory turnover, the company is

carrying fewer current assets and not because the company’s liquidity has

deteriorated.

(b)

Changes in the turnover ratios do not directly affect profitability. However,

improvements in turnover generally indicate that the company is better able

to convert sales to cash. Improved liquidity could allow the company to better manage it cash flows and therefore, indirectly improve profitability.

(c)

There are several steps that Tianjin might have taken to improve its receivables and inventory turnover:

Receivables

-

The company could limit credit to only the best customers, however,

this could negatively affect sales.

-

The company could initiate the use of a cash discount to encourage

early payment of receivables.

-

The company could more aggressively monitor collections to encourage customers to pay on time.

-

The company could sell or factor its receivables to accelerate cash receipts.

Solutions Manual

8-30

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-11A (Continued)

(c) (Continued)

Inventory

-

The company could limit the amount of inventory by improving its purchasing relationships with suppliers. If inventory could be purchased

more frequently, required inventory levels could be reduced.

-

Improvements in production processes could reduce the amount of

work in process and thereby reducing inventory and improving the

turnover ratio.

-

Moving to a system whereby inventory is only produced as needed, will

reduce the amount of finished goods inventory and improve the turnover ratio. However, there is some risk to this option as sales could be

lost if stock-outs occur.

Solutions Manual

8-31

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-1B

(a) Accounts Receivable ........................................

Sales .............................................................

900,000

900,000

Cash ................................................................. 1,069,000

Accounts Receivable .....................................

1,069,000

(b) Allowance for Doubtful Accounts .......................

Accounts Receivable .....................................

6,000

(c) Accounts Receivable ........................................

Allowance for Doubtful Accounts ...................

3,000

Cash .................................................................

Accounts Receivable .....................................

3,000

(d) Bad Debt Expense ............................................

Allowance for Doubtful Accounts ...................

11,000

6,000

3,000

3,000

11,000

Allowance for Doubtful Accounts

10,000 Beg. Bal.

W/O

6,000 3,000 Recovery

11,000 Bad Debts

18,000 End. Bal.

Solutions Manual

8-32

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-1B (Continued)

(e)

Beg. Bal.

Sales

Recovery

End Bal.

W/O

(f)

Accounts Receivable

400,000 Collections

900,000 W/O

3,000 Collections

225,000

1,069,000

6,000

3,000

Allowance for Doubtful Accounts

10,000

Beg. Bal.

6,000

3,000

Recovery

11,000

Bad Debts

18,000

End Bal.

Net realizable value of receivables is $207,000 ($225,000 - $18,000)

Solutions Manual

8-33

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-2B

(a)

Allowance for doubtful accounts = $930 (given)

(b)

$930 - $750 + $105 = $285

(c)

Bad debt expense = Adjustment to allowance for doubtful accounts =

$285 [from (b)]

(d)

Addition to accounts receivable = Sales = $30,000

(e)

Amounts written off = Reductions in the allowance account = $105

(f)

$8,300 + $30,000 (d) - $32,000 - $105 (e) = $6,195

Solutions Manual

8-34

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-3B

(a) Total estimated bad debts

Total

Accounts

receivable

% uncollectible

Estimated

bad debts

0-30

Number of Days Outstanding

31-60

61-90

91-120 Over 120

$260,000 $100,000 $60,000 $50,000 $30,000

1%

5%

10%

20%

$21,000

$1,000

$3,000

$5,000

$6,000

(b) Bad Debts Expense ...................................................

Allowance for Doubtful Accounts .........................

[$21,000 - $15,000]

6,000

(c) Allowance for Doubtful Accounts ...............................

Accounts Receivable ...........................................

2,000

(d) Accounts Receivable .................................................

Allowance for Doubtful Accounts .........................

1,000

Cash ..........................................................................

Accounts Receivable ...........................................

1,000

(e)

$20,000

30%

$6,000

6,000

2,000

1,000

1,000

By establishing an allowance at the end of each accounting period the bad

debt expense is recorded in the period in which the sales occur. This satisfies the matching principle.

Solutions Manual

8-35

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-4B

(a)

Dec. 31 Bad Debts Expense ..............................

Allowance for Doubtful Accounts ..

($35,660 – $19,000)

(b)

16,660

16,660

2005

1.

2.

Mar. 1

May 1

1

(c)

Allowance for Doubtful Accounts ..........

Accounts Receivable ....................

800

Accounts Receivable ............................

Allowance for Doubtful Accounts ..

800

Cash .....................................................

Accounts Receivable ....................

800

800

800

800

2005

Dec. 31

Bad Debts Expense....................................

Allowance for Doubtful Accounts ..........

($35,660 – $40,000)

4,340

4,340

Solutions Manual

8-36

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-5B

(a)

Bad debts written off

=

$28,000

(b)

$20,000 - $4,000 =

$16,000

(c)

$20,000 + $2,000 =

$22,000

(d)

The advantages of the allowance method are:

1.

It attempts to match bad debt expense related to uncollectible accounts

receivable with sales revenues on the statement of earnings.

2.

It attempts to show the net realizable value of the accounts receivable

on the balance sheet.

Solutions Manual

8-37

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-6B

Jan.

5

Feb. 2

12

26

Apr.

5

12

Accounts Receivable—Brooks Company ...........

Sales ......................................................

6,000

Cost of Goods Sold ...........................................

Inventory ....................................................

4,000

Notes Receivable ..............................................

Accounts Receivable—Brooks Company ...

6,000

Notes Receivable ..............................................

Sales ..........................................................

7,800

Cost of Goods Sold ...........................................

Inventory ....................................................

5,000

Accounts Receivable—Mathias Co. ..................

Sales ..........................................................

5,000

Cost of Goods Sold ...........................................

Inventory ....................................................

3,750

Notes Receivable. .............................................

Accounts Receivable—Mathias Co. ...........

5,000

Cash ($7,800 + $78) .........................................

Notes Receivable .......................................

Interest Revenue ($7,800 X 6% X 2/12) .....

7,878

6,000

4,000

6,000

7,800

5,000

5,000

3,750

5,000

7,800

78

Solutions Manual

8-38

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-6B (Continued)

June 2

July

5

July 15

Oct. 15

Cash ($6,000 + $80) .........................................

Notes Receivable .......................................

Interest Revenue ($6,000 X 6% X 4/12) .....

Accounts Receivable—Mathias Co.

($5,000 + $88) ..................................................

Notes Receivable .......................................

Interest Revenue ($5,000 X 7% X 3/12) .....

6,120

6,000

120

5,088

5,000

88

Notes Receivable ..............................................

Sales ..........................................................

2,000

Cost of Goods Sold ...........................................

Inventory ....................................................

1,500

Cash ($2,000 + $35) .........................................

Notes Receivable .......................................

Interest Revenue ($2,000 X 7% X 3/12) .....

2,035

2,000

1,500

2,000

35

Solutions Manual

8-39

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-7B

(a)

1.

Accounts Receivable ......................................... 2,600,000

Sales .........................................................

2,600,000

2.

Sales Returns and Allowances .........................

Accounts Receivable .................................

40,000

40,000

3.

Cash................................................................. 2,200,000

Accounts Receivable .................................

2,200,000

4.

Allowance for Doubtful Accounts ......................

Accounts Receivable .................................

80,000

Accounts Receivable ........................................

Allowance for Doubtful Accounts ...............

25,000

Cash.................................................................

Accounts Receivable .................................

25,000

5.

80,000

25,000

25,000

(b)

Accounts Receivable

Bal.

(1)

(5)

Bal.

1,000,000 (2)

2,600,000 (3)

25,000 (4)

(5)

1,280,000

40,000

2,200,000

80,000

25,000

Allowance for Doubtful Accounts

(4)

Bal.

80,000 Bal.

(5)

50,000

25,000

5,000

Solutions Manual

8-40

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-7B (Continued)

(c)

Balance before adjustment [see (b)] .........................

Balance needed .......................................................

Adjustment required .................................................

$ 5,000 dr.

70,000 cr.

$75,000 cr.

The journal entry would therefore be as follows:

Bad Debts Expense .................................................

Allowance for Doubtful Accounts....................

(d)

75,000

75,000

Receivables Turnover:

$2,600,000– $40,000

$2,560,000

=

= 2.25 times

($1,000,000 + $1,280,000) 2 $1,140,000

The average collection period is:

365 days

162 days

2.25

Solutions Manual

8-41

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-8B

(a)

Nov. 1

30

Dec. 31

Jan. 31

Feb. 1

(b)

Feb. 1

Notes Receivable ............................

Accounts Receivable ................

Interest Receivable

($20,000 X 7% X 1/12) ....................

Interest Revenue ......................

20,000

20,000

117

117

Interest Receivable..........................

Interest Revenue ......................

117

Interest Receivable..........................

Interest Revenue ......................

116

Cash................................................

Interest Receivable ...................

Notes Receivable .....................

20,350

Accounts Receivable .......................

Interest Receivable ...................

Notes Receivable .....................

20,350

117

116

350

20,000

350

20,000

Solutions Manual

8-42

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-9B

(a) July 1

Cash ........................................................ 6,060.00

Notes Receivable ...............................

Interest Receivable

($6,000 X 6% X 2/12) ....................

5

14

31

31

Accounts Receivable ................................ 7,800.00

Sales ..................................................

Cash ($700 – $21)....................................

Service Charge Expense ($700 X 3%) .....

Sales ..................................................

60.00

7,800.00

679.00

21.00

700.00

Allowance For Doubtful Accounts ............ 4,824.00

Notes Receivable ...............................

Interest Receivable

($4,800 X 6% x 1/12) ....................

Interest Receivable ..................................

Interest Revenue

($9,000 X 5% X 1/12) ....................

6,000.00

4,800.00

24.00

37.50

37.50

Solutions Manual

8-43

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-9B (Continued)

(b)

Notes Receivable

Jul. 1 Bal. 19,800 Jul. 1

Jul. 31

Jul. 31 Bal.

Jul. 1

Jul. 3

Jul. 5

9,000

Interest Receivable

84.00 Jul. 1 Bal.

37.50 Jul. 31

Jul. 31 Bal.

6,000

4,800

60.00

24.00

37.50

Accounts Receivable

7,800

Jul. 31 Bal.

7,800

(c) Current assets

Notes receivable ................................................

Accounts receivable ...........................................

Interest receivable ..............................................

Total receivables ..........................................

$ 9,000

7,800

38

$16,838

Solutions Manual

8-44

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-10B

(a)

Nike

Reebok

($ in U.S. millions)

Receivables turnover

$9,893.0

$3,127.9

($1,693.5 $1,884.5 ) 2 ($438.6 $482.7 ) 2

$9,893.0

= 5.53 times

$1,789

Average collection period 365 = 66 days

5.53

$3,127.9

6.79 times

$460.65

365

= 54 days

6.79

Reebok’s receivables turnover ratio was higher than Nike’s, which means that

Reebok was more efficient than Nike in turning receivables into cash. However, both companies are below the industry average in receivables turnover and

average collection period.

Solutions Manual

8-45

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-11B

(a)

At first glance it appears that Hawryluk’s liquidity had improved over the past

year since the company’s current ratio has increased from 1:5:1 to 1:8:1.

However, it is taking the company more time to collect its accounts receivable as evidenced by the lower accounts receivable turnover ratio. As well,

the company appears to be moving its inventory less quickly as evidenced by

the lower inventory turnover ratio. The cause for these declines should be investigated as part of assessing the companies’ liquidity.

(b)

Changes in the turnover ratios directly affect cash flow. Improvements in the

receivables turnover and inventory turnover speed up the cash cycle which

provides the company with better cash flow and less need for outside financing.

(c)

There are several steps that Hawryluk could consider to improve its receivables and inventory turnover:

Receivables

-

The company could limit credit to only the best customers, however,

this could negatively affect sales.

-

The company could initiate the use of a cash discount to encourage

early payment of receivables

-

The company could more aggressively monitor collections to encourage customers to pay on time.

-

The company could sell or factor its receivables to accelerate cash receipts

Solutions Manual

8-46

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 8-11B (Continued)

(c) Continued

Inventory

-

The company could limit the amount of inventory by improving its purchasing relationships with suppliers. If inventory could be purchased

more frequently, required inventory levels could be reduced.

-

Improvements in production processes could reduce the amount of

work in process and thereby reducing inventory and improving the

turnover ratio.

-

Moving to a system whereby inventory is only produced as needed will

reduce the amount of finished goods inventory and improve the turnover ratio. However, there is some risk to this option as sales could be

lost if stock-outs occur.

Solutions Manual

8-47

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 8-1 FINANCIAL REPORTING PROBLEM

(a)

($ in millions)

Receivables turnover

$23,082

42.9 times

($605 $472) 2

Average collection period

365

8.5 days

42.9

Loblaw has very few credit sales. Given its average collection period of 8.5 days, one

can assume that the majority of its sales are cash sales.

(b)

Loblaw has a policy of writing off any credit card receivables that has a payment in arrears of greater than 180 days or where the likelihood of collection is considered remote.

(c)

Loblaw (through PC Bank) sells a portion of its credit card receivables to an independent

Trust through a process called securitization.

(d)

Loblaw seems to have a policy of quickly converting its receivables to cash. The company has very few receivables; therefore most of its sales must be on a cash basis. The

few receivables owned by the company are quickly sold through securitization allowing

the company to quickly turn the receivables into cash.

Solutions Manual

8-48

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 8-2 COMPARATIVE ANALYSIS PROBLEM

(a)

Most of the receivables owned by the two companies are credit card receivables. However, Sobeys does have some mortgage and loans receivable representing long-term financing to franchisees.

(b)

($ in millions)

Loblaw

1.

Current ratio

$3,526

1.12 : 1

$3,154

2.

= 42.9 times

$10,414.5

($285.4 + $251.0) 2

= 38.8 times

Average collection period

365

8.5 days

42.9

(c)

$1,094.4

0.92 : 1

$1,180.5

Receivables turnover

$23,082

($605 $472) 2

3.

Sobeys

365

= 9.4 days

38.8

Overall working capital management appear on par with the industry for both Loblaw and

Sobeys. The current ratio for Loblaws is around the industry average of 1:1 while Sobeys’

current ratio is less than the industry average. It appears that Loblaw manages it receivables better than the industry average. Its turnover rate is 42.9 times compared to the average of 40.4. Its average collection period of 8.5 days is slightly better than the industry average of 9 days. Sobeys’ ratios indicate that it is slightly below the industry average, at 38.8

times for its turnover ratio and 9.4 days for the average collection period.

Solutions Manual

8-49

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 8-3 RESEARCH CASE

(a)

On the average, Canadians pay off 33% of their credit card balances monthly.

(b)

2.6% of balances are overdue by more than 30 days.

(c)

3% of uncollectible accounts were written off in the first quarter of 2002

(d)

In comparison to Canadians, Americans only pay off 15% of their balances monthly, delinquent accounts (accounts over 30 days) average 5.4% and in the first quarter of 2002

6.4% of uncollectible accounts were written off.

Solutions Manual

8-50

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 8-4 INTERPRETING FINANCIAL STATEMENTS

(a)

($ in millions)

2002

2001

Current ratio

$722

0.91 : 1

$797

$622

0.80 : 1

$773

Receivables turnover

$4,902

($406 + $309) 2

$4,194

($309 $410) 2

= 13.7 times

= 11.7 times

Average collection period

365

26.6 days

13.7

365

= 31.2 days

11.7

Suncor’s liquidity has improved over the past year. Its current ratio has increased to 0.91:1

from 0.80:1 and it is collecting its accounts receivables almost 5 days faster in 2002 versus

2001. The company’s current ratio is still under the industry average but they are collecting

receivables much faster than the average company in the industry.

(b)

By keeping the dollar amount of its allowance for doubtful accounts unchanged over the

past few years, the company had a much higher percentage of receivables recognized as

doubtful in 2001 versus 2002. It may be more relevant for the company to determine a percentage of receivables that it deems doubtful each year and adjust the balance in the

doubtful accounts by recognizing a bad debt expense annually. However, the company

may have identified specific accounts that are doubtful, which may be the reason why the

balance has not changed from year to year.

(c)

By regularly selling its accounts receivable Suncor is able to more quickly convert receivables into cash. The company may have determined that the fees associated with selling the

receivables are less than the cost of having to use short –term borrowings to finance operations. As well, the company may also not want to bother with the cost and effort required to

bill and collect the receivables and would rather sell the receivables and let another company deal with these issues.

Solutions Manual

8-51

Chapter 8

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 8-5 A GLOBAL FOCUS

(a)

Sears sold $8.1 billion of its receivables. This represents 20% ($8.1 ÷ ($32.595 + $8.1)) of

Sears’ total receivables. Thus, the sale of receivables by Sears is obviously significant.

Companies sell receivables to raise funds to meet cash needs. As well, Sears may not

have wanted to devote resources to the time consuming job of billing and collecting its receivables.

One concern that an investor would have is whether Sears is responsible for these receivables if the receivables go bad. That is, Sears may have to make up any deficiency to

the party it sold the receivables to if that party is not able to collect.

(b)

The receivables turnover ratio is calculated as net credit sales divided by average gross

accounts receivable.

($ in U.S. millions)

2002

$35,698

($32,595 + $29,321) 2

= 1.15 times

2001

$35,755

($29,321 + $18,003) 2

= 1.51 times

The average collection period is calculated as 365 (the number of days in a year) divided

by the receivables turnover ratio. For 2002 and 2001 this is calculated as:

2002

365

317 days

1.15

2001

365

242 days

1.51