Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

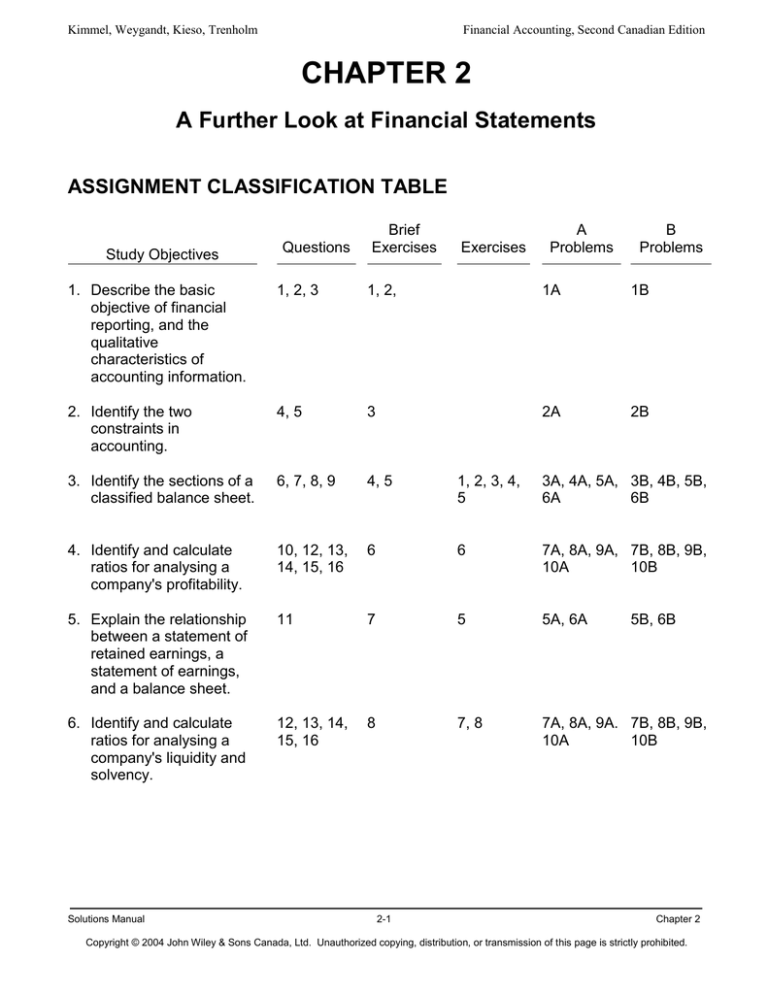

CHAPTER 2

A Further Look at Financial Statements

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

Exercises

A

Problems

B

Problems

1. Describe the basic

objective of financial

reporting, and the

qualitative

characteristics of

accounting information.

1, 2, 3

1, 2,

1A

1B

2. Identify the two

constraints in

accounting.

4, 5

3

2A

2B

3. Identify the sections of a

classified balance sheet.

6, 7, 8, 9

4, 5

1, 2, 3, 4,

5

3A, 4A, 5A, 3B, 4B, 5B,

6A

6B

4. Identify and calculate

ratios for analysing a

company's profitability.

10, 12, 13,

14, 15, 16

6

6

7A, 8A, 9A, 7B, 8B, 9B,

10A

10B

5. Explain the relationship

between a statement of

retained earnings, a

statement of earnings,

and a balance sheet.

11

7

5

5A, 6A

6. Identify and calculate

ratios for analysing a

company's liquidity and

solvency.

12, 13, 14,

15, 16

8

7, 8

7A, 8A, 9A. 7B, 8B, 9B,

10A

10B

Solutions Manual

2-1

5B, 6B

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

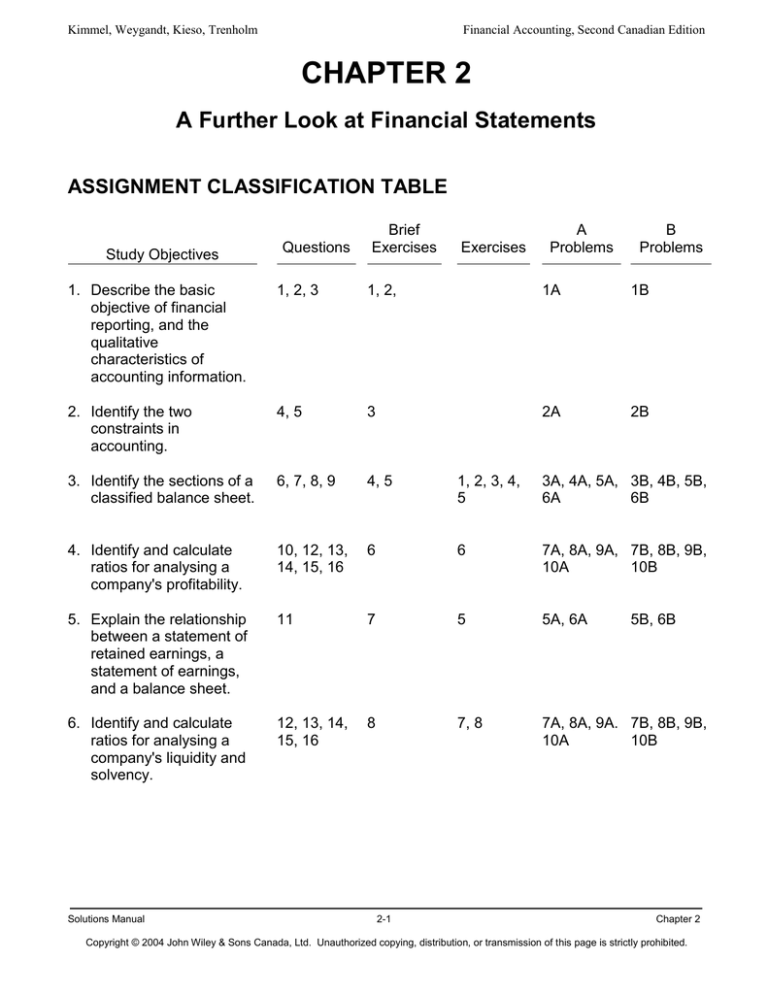

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

1A

Comment on objective and qualitative

characteristics of financial reporting.

Moderate

20-30

2A

Comment on the constraints of accounting.

Moderate

10-20

3A

Classify accounts.

Simple

10-20

4A

Prepare classified balance sheet.

Moderate

10-20

5A

Prepare financial statements.

Moderate

20-30

6A

Prepare financial statements and discuss

relationships.

Moderate

20-30

7A

Calculate ratios and comment on profitability,

liquidity, and solvency.

Moderate

20-30

8A

Calculate profitability, liquidity, and solvency ratios.

Simple

10-20

9A

Calculate profitability, liquidity, and solvency ratios

and discuss results.

Moderate

15-25

10A

Calculate profitability, liquidity, and solvency ratios

and discuss results.

Moderate

15-25

1B

Comment on the objective and qualitative

characteristics of accounting information.

Moderate

20-30

2B

Comment on the constraints of accounting.

Moderate

10-20

3B

Classify accounts.

Simple

10-20

4B

Prepare classified balance sheet

Moderate

10-20

5B

Prepare financial statements.

Moderate

20-30

6B

Prepare financial statements and discuss

relationships

Moderate

20-30

7B

Calculate ratios and comment on profitability,

liquidity, and solvency.

Moderate

20-30

Solutions Manual

2-2

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Description

Difficulty

Level

Time

Allotted (min.)

8B

Calculate profitability, liquidity, and solvency ratios.

Simple

10-20

9B

Calculate profitability, liquidity, and solvency ratios

and discuss results.

Moderate

15-25

10B

Calculate profitability, liquidity, and solvency ratios

and discuss results.

Moderate

15-25

Problem

Number

Solutions Manual

2-3

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

(a)

(b)

(c)

Generally accepted accounting principles (GAAP) are a set of rules and practices,

having substantial support, that are recognized as a general guide for financial

reporting purposes.

The primary objective of financial reporting is to provide information useful for

decision-making.

The qualitative characteristics are (1) understandability, (2) relevance,

(3) reliability, and (4) comparability.

2.

Erhardt is correct. Consistency means using the same accounting principles and

accounting methods from period to period within a company. Without consistency in the

application of accounting principles, it is difficult to determine whether a company is

better off, worse off, or in the same position from period to period. When a change is

made in accounting principles or methods a company is required to disclose information

about the change.

3.

Comparability results when different companies use the same accounting principles.

Consistency means using the same accounting principles and methods from year to year

within the same company.

4.

The two constraints are cost-benefit and materiality. The cost-benefit constraint means

that information will be presented only when the benefit associated with it exceeds the

cost of producing it. The materiality constraint means that an item may be so small that

failure to follow generally accepted accounting principles will not influence the decision of

a reasonably prudent investor or creditor.

5.

The accountant is correct in saying that the rounded financial figures provide useful

information to external users for decision making. This is supported by the concept of

materiality. When investors are making decisions they are not concerned with immaterial

dollar values or cents. In fact, presenting rounded information may make it easier for

investors to focus on the ‘big picture’.

6.

Current assets are cash and other resources that are reasonably expected to be realized

in cash or sold or consumed in the business within one year of the balance sheet date or

the company's operating cycle, whichever is longer. Current assets are listed in the order

of liquidity. That is, in the order in which they are expected to be converted into cash.

7.

Long-term investments are generally investments in debt and equity of other

corporations that are normally held for many years. They also include investments in

long-term assets such as land and buildings that are not currently being used in the

organization’s operating activities. Intangible assets are assets that do not have any

physical substance and yet add value to the company. Intangible assets include items

such as trademarks, copyrights and goodwill.

Solutions Manual

2-4

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

8.

The major differences between current liabilities and long-term liabilities are:

Difference

Source of

payment.

Current Liabilities

Existing current assets or

other current liabilities.

Long-term Liabilities

Other than existing

current assets or creating

current liabilities.

Time of expected

payment.

Within one year or the

operating cycle.

Beyond one year or the

operating cycle.

Nature of items.

Debts pertaining to the

operating cycle and other

short-term debts.

Mortgages, bonds and

other long-term liabilities.

9.

The two parts of shareholders' equity and the purpose of each are: (1) Share capital is

used to record investments of assets in the business by the owners (shareholders). If

there is only one class of shares it is known as common shares. (2) Retained earnings

is used to record net earnings retained in the business.

10.

Amod is correct. A single ratio by itself may not be very meaningful and is best

interpreted by comparison with (1) past ratios of the same enterprise, (2) ratios of other

enterprises, or (3) industry norms or predetermined standards. In addition, other ratios of

the enterprise are necessary to determine overall financial well being.

11.

The statement of retained earnings is interrelated with both the statement of earnings

and the balance sheet. The statement of earnings reports the net earnings for the

period. This figure is then used in the statement of retained earnings, along with

dividends to calculate the amount of retained earnings at the end of the period. The

retained earnings figure is used in the balance sheet to complete the accounting

equation.

12.

(a)

(b)

13.

(a)

(b)

(c)

Solutions Manual

Tia is not correct. There are three characteristics: liquidity, profitability, and

solvency.

The three parties are not primarily interested in the same characteristics of a

company. Short-term creditors are primarily interested in the liquidity of the

enterprise. In contrast, long-term creditors and shareholders are primarily

interested in the profitability and solvency of the company.

Liquidity ratios: Working capital, current ratio, and cash current debt coverage.

Solvency ratios: Debt to total assets and cash total debt coverage.

Profitability ratios: Earning per share and price-earnings ratio.

2-5

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

14.

(a)

(b)

(c)

15.

(a)

(b)

(c)

(d)

16.

(a)

(b)

(c)

Solutions Manual

Liquidity ratios measure the short-term ability of the enterprise to pay its maturing

obligations and to meet unexpected needs for cash.

Profitability ratios measure the earnings or operating success of an enterprise for

a given period of time.

Solvency ratios measure the company's ability to survive over a long period of

time.

An increase in earnings per share usually signals good new for the company

because higher EPS will generally indicate to investors that the company is

providing them with a higher return on their investment. This will cause the

company’s shares to become more attractive and hopefully increase in price.

An increase in the current ratio usually signals good news because the company

improved its ability to meet maturing short-term obligations. It can also mean that

some of the components of the current ratio (e.g. Accounts receivable, inventory)

are slow moving. Further investigation is usually necessary to ensure that this is

not the case.

The increase in the debt to total assets ratio is bad news because it means that

the company has increased its obligations to creditors and has lowered its equity

"buffer."

A decrease in the cash current debt coverage ratio usually signals bad news for

the company because it means the company has been able to generate less cash

to meet its short-term obligations.

The debt to total assets ratio and cash total debt coverage ratio which indicate the

company's ability to repay the face value of the debt at maturity and periodic

interest payments.

The current ratio, working capital, and cash current debt coverage, which indicate

a company's liquidity and short-term debt-paying ability.

The earnings per share ratio and the price-earnings ratio. The earnings per share

measures the net earnings earned on each common share and the price-earnings

ratio measures the relationship between the market price per share and the

earnings per share.

2-6

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 2-1

(a)

(b)

(c)

(d)

(e)

(f)

General business and economic conditions

Predictive value

Feedback value

Verifiable

Conservative

Different companies use similar accounting principles

BRIEF EXERCISE 2-2

(a)

(b)

(c)

(d)

1.

2.

3.

4.

Predictive value.

Neutral.

Verifiable.

Timely

BRIEF EXERCISE 2-3

(a) Cost-Benefit.

(b) Materiality.

(c) Materiality.

BRIEF EXERCISE 2-4

CL

CA

PPE

PPE

CA

IA

Accounts payable

Accounts receivable

Accumulated amortization

Building

Cash

Goodwill

Solutions Manual

CL

LT I

PPE

CA

IA

CA

2-7

Income tax payable

Investment in long-term bonds

Land

Merchandise inventory

Patent

Supplies

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 2-5

SWANN LIMITED

Balance Sheet (Partial)

Current assets

Cash

Short-term investments

Accounts receivable

Supplies

Prepaid insurance

Total current assets

$18,400

8,200

16,500

5,200

3,600

$51,900

BRIEF EXERCISE 2-6

(a)

2002

2001

Earnings per share:

Earnings per share:

$38,520

= $1.93 per share

19,956 shares

$36,323

= $1.82 per share

19,926 shares

Price-earnings ratio:

Price-earnings ratio:

$30.88

= 16 times

$1.93

$23.00

= 12.6 times

$1.82

(b)

Given that the number of common shares outstanding increased during the year, the increase

in earnings per share would indicate that profitability has improved in 2002. As well, investors

appear to have more confidence in Leon’s earnings as indicated by the increase in the priceearnings ratio in 2002.

Solutions Manual

2-8

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 2-7

Share Capital

a.

b.

c.

d.

e.

Issued common shares

Paid a cash dividend

Reported net earnings

Paid cash to creditors

Issued preferred shares

Retained Earnings

+

NE

NE

NE

+

NE

+

NE

NE

BRIEF EXERCISE 2-8

(a) Current ratio

$252,787

= 0.86:1

$293,625

(b) Debt to total assets

$376,002

= 85.5%

$439,832

(c) Cash current debt coverage

$(2,574)

= (0.009) times

$293,625 $240,819

2

SOLUTIONS TO EXERCISES

EXERCISE 2-1

CL

Accounts payable and

accrued liabilities

CA

Accounts receivable

PPE Accumulated amortization

PPE Buildings

CA

Cash and temporary investments

CL

Dividends payable

IA

Goodwill

Solutions Manual

CA

LTI

PPE

LTL

CA

PPE

SC

CA

2-9

Inventories

Investments

Land

Long-term debt

Materials and supplies

Office equipment and furniture

Preferred shares

Prepaid expenses and other

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

CA

Financial Accounting, Second Canadian Edition

Income taxes receivable

EXERCISE 2-2

JUMBO ENTERTAINMENT INC.

Balance Sheet

February 28, 2003

Assets

Current assets

Cash and short-term investments

Accounts and current notes receivable

Inventory

Prepaid expenses

Total current assets

Property, plant and equipment

DVD and video rental library

Capital assets

$1,001,640

Less: Accumulated amortization

429,241

Total property, plant, and equipment

Intangible assets

Trademarks, franchise licences and goodwill

Total assets

Solutions Manual

2-10

$ 878,012

415,373

1,231,307

47,396

2,572,088

$166,994

572,399

739,393

3,789,744

$7,101,225

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-3

(a) Net earnings

Retained earnings

=

=

=

Revenues – expenses

$18,180 – 780 – 5,360 – 2,600

$9,440

=

=

=

Beginning retained earnings + net earnings – dividends

$40,000 + 9,440 – 0

$49,440

(b)

SUMMIT’S BOWLING ALLEY LTD.

Balance Sheet

December 31, 2004

Assets

Current assets

Cash

Accounts receivable

Prepaid insurance

Total current assets

Property, plant and equipment

Land

Building

$105,800

Less: Accumulated

amortization

45,600

Equipment

$82,400

Less: Accumulated

amortization

18,720

Total property, plant and

equipment

Total assets

$20,840

14,520

4,680

$ 40,040

$61,200

60,200

63,680

185,080

$225,120

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

Interest payable

Current portion of long-term debt

Total current liabilities

Mortgage payable

Total liabilities

Shareholders' equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders' equity

Solutions Manual

2-11

$ 12,480

3,600

13,600

$ 29,680

80,000

109,680

66,000

0

49,440

115,440

$225,120

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-4

THE JEAN COUTU GROUP (PJC) INC.

Balance Sheet

May 31, 2002

Assets

Current assets

Accounts receivable

Inventories

Prepaid expenses

Other current assets

Total current assets

Investments

Property, plant and equipment

Less: Accumulated amortization

Total property, plant and equipment

Intangible assets

Less: Accumulated amortization

Other assets

Total assets

$231,142

515,483

8,493

23,323

$ 778,441

236,679

$572,712

157,217

415,495

$265,743

60,479

205,264

25,726

$1,661,605

Liabilities and Shareholders' Equity

Current liabilities

Bank overdraft and bank loans

Accounts payable

Income taxes payable

Current portion of long-term debt

Total current liabilities

Long-term debt

Other long-term debt

Total liabilities

Shareholders' equity

Capital stock

Other shareholders’ equity

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders' equity

Solutions Manual

2-12

$ 46,360

296,044

10,106

32,618

$ 385,128

324,083

6,335

715,546

$203,763

20,711

721,585

946,059

$1,661,605

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-5

(a)

BATRA CORPORATION

Statement of Earnings

Year Ended July 31, 2004

Revenues

Commission revenue

Rent revenue

Total revenues

Expenses

Salaries expense

Rent expense

Utilities expense

Amortization expense

Total expenses

Earnings before income taxes

Income tax expense

Net earnings

$73,100

18,300

91,400

48,700

10,800

4,900

3,975

68,375

23,025

8,000

$15,025

BATRA CORPORATION

Statement of Retained Earnings

Year Ended July 31, 2004

Retained earnings, August 1, 2003

Add: Net earnings

$25,200

15,025

40,225

4,000

Less: Dividends

Retained earnings, July 31, 2004 $36,225

EXERCISE 2-5 (Continued)

(b)

BATRA CORPORATION

Balance Sheet

July 31, 2004

Assets

Current assets

Cash

Short-term investments

Accounts receivable

Solutions Manual

$12,795

20,000

18,780

2-13

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Supplies

Total current assets

Property, plant and equipment

Equipment

Less: Accumulated amortization

Total property, plant and equipment

Total assets

1,500

$53,075

$19,875

7,950

11,925

$65,000

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

Long-term note payable

Total liabilities

Shareholders' equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders' equity

Solutions Manual

2-14

$ 6,220

2,555

8,775

$20,000

36,225

56,225

$65,000

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-6

(a) and (b)

2004

2003

Earnings per share:

Earnings per share:

$58,500 - $2,000

= $0.84 per share

67,000 shares

$81,000 - $2,000

= $1.15 per share

69,000 shares

Price-earnings ratio:

Price-earnings ratio:

$10.00

= 11.9 times

$0.84

$9.00

= 7.8 times

$1.15

(c)

The company was less profitable in 2004 than in 2003 as evidenced by its lower earnings

and earnings per share. However, given the increase in the price-earnings ratio, investors

still seemed to have a positive opinion about the future earnings prospects of the

company despite the decline in the earnings per share.

(d)

A potential investor may be more concerned about he decline in earnings per share and

wonder if the higher price-earnings ratio might mean that the share price is to high and

likely to fall in the near future.

Solutions Manual

2-15

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-7

(a)

2003

2002

Working capital

$30,483 $32,617

$(2,134)

$27,878 $27,282

$596

Current ratio

$30,483

= 0.93:1

$32,617

$27,878

= 1.02:1

$27,282

(b) The decline in the working capital and current ratio indicate that Wal-Mart’s liquidity

deteriorated in 2003.

(c) For 2002, Wal-Mart’s current ratio is lower than the current ratio of both Sears and The

Bay. Wal-Mart’s current ratio is also lower than the industry average. This would indicate

that Wal-Mart is less liquid than Sears, The Bay and the industry as a whole.

Solutions Manual

2-16

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 2-8

(a)

(b)

Debt to total assets =

Total debt

Total assets

2002

$564,821

34%

$1,656,248

2001

$466,017

30.4%

$1,532,557

Cash current debt coverage =

Cash provided from operating activities

Average current liabilities

$117,716

= 0.24 times

$551,540 $437,946

2

Cash total debt coverage =

Cash provided from operating activities

Average total liabilities

$117,716

= 0.23 times

$564,821 $466,017

2

(c) The Carnival’s solvency, a measure of its ability to survive over the long-term, has

deteriorated in 2002 versus 2001. Its debt to total assets ratio increased from 30.4% in

2001 to 34% in 2002. This means that in 2002, 34% of its assets were financed through

debt compared to 30.4% in 2001.

(d) In 2002, Carnival generated sufficient cash from its operating activities ($117,716) to

provide for the full amount of cash used in investing activities in the year ($107,393). Had

there been a deficiency, the deficiency could have been provided for out of cash the

organization had on hand at the beginning of the year. Alternatively, any deficiency could

have been covered through financing activities such as issuing debt.

Solutions Manual

2-17

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 2-1A

(a) Generally accepted accounting principles are the accounting rules that have

substantial authoritative support and are recognized as a general guide for

financial reporting in Canada. In Canada, the primary responsibility for the

development of the generally accepted accounting principles rests with the

Canadian Institute of Chartered Accountants and is codified in the CICA

Handbook.

(b) Financial reporting is the term used to describe all of the financial information

presented by a company – both in its financial statements and in additional

disclosures in the annual report. The basic objective of financial reporting is to

communicate information that is useful to investors, creditors and others in

making investment and lending decisions and in assessing management

performance.

(c) In order for information provided in financial statements to be useful, it must

be understood by the users. Many investors may not understand detailed

scientific findings. While scientific findings, knowledgeable employees and

good customer relationships are important to business, these are nonfinancial performance measures. As such, they are not part of the financial

report. The information is relevant to users, but may not necessarily be

capable of being reliably measured. The fourth qualitative characteristic,

comparability, is not specifically addressed here.

Solutions Manual

2-18

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-2A

(a) Sears may feel that reporting its cost of merchandise sold separately in its

financial statements may provide its competitors with useful information. The

lack of disclosure in this area makes it more difficult for users of the financial

statements to evaluate the company’s performance.

(b) The two constraints in accounting are:

1. the cost-benefit constraint, which ensures that the value of the information

exceeds the cost of providing it; and

2. materiality relates to a financial statement item’s impact on a company’s

overall financial condition and operations.

Neither of these constraints likely impact Sears’ reporting policy with respect

to cost of goods sold. Sears may round its financial statements to the nearest

thousand dollars based on the materiality constraint.

Sears could hire more security guards, put in more security monitors, count

inventory daily, etc. as ways to monitor and control inventory theft. While they

do some of these, at some point the cost exceeds the benefit.

PROBLEM 2-3A

Account

Financial Statement Classification

Accounts payable

Balance Sheet: current liabilities

Accounts receivable

Balance Sheet: current assets

Accum. amortization, building

Balance Sheet: property, plant and

equipment

Balance Sheet: property, plant and

equipment

Statement of Earnings: expense

Accum. amortization, equipment

Amortization expense

Building

Cash

Solutions Manual

Balance Sheet: property, plant and

equipment

Balance Sheet: current assets

2-19

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Common shares

Balance Sheet: shareholders' equity

Cost of goods sold

Statement of Earnings: expense

Current portion of long-term debt

Balance Sheet: current liabilities

Dividends

Statement of Retained Earnings

Equipment

Income tax expense

Balance Sheet: property, plant and

equipment

Statement of Earnings: expense

Income taxes payable

Balance Sheet: current liabilities

Interest expense

Statement of Earnings: expense

Inventories

Balance Sheet: current assets

Land

Long-term debt

Balance Sheet: property, plant and

equipment

Balance Sheet: long-term liability

Prepaid expenses

Balance Sheet: current assets

Retained earnings, beginning of year Statement of Retained Earnings

Sales

Statement of Earnings: revenue

Selling expenses

Statement of Earnings: expense

Short-term investments

Balance Sheet: current assets

Wages payable

Balance Sheet: current liabilities

Solutions Manual

2-20

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-4A

INTRAWEST CORPORATION

Balance Sheet

June 30, 2002

(thousands)

Assets

Current assets

Cash and cash equivalents

$ 76,689

Amounts receivable

109,948

Other current assets

495,170

Total current assets

$ 681,807

Investment properties

468,218

Property, plant and equipment

Ski and resort operations

$1,125,603

Less: Accumulated amortization,

Ski and resort operation

283,762

Total property, plant and equipment

841,841

Goodwill

15,985

Other noncurrent assets

159,066

Total assets

$2,166,917

Liabilities and Shareholders' Equity

Current liabilities

Bank and other indebtedness,

current portion

$282,047

Amounts payable

195,254

Other current liabilities

99,484

Total current liabilities

$ 576,785

Long-term liabilities

Long-term liabilities

$138,991

Bank and other indebtedness,

noncurrent portion

773,872

Total long-term liabilities

912,863

Total liabilities

1,489,648

Shareholders' equity

Capital stock

$466,899

Retained earnings

210,370

Total shareholders’ equity

677,269

Total liabilities and shareholders' equity

$2,166,917

Solutions Manual

2-21

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-5A

(a)

BEAULIEU LIMITED

Statement of Earnings

Year Ended December 31, 2004

Service revenue

Expenses

Repair expense

Salaries expense

Rent expense

Utilities expense

Insurance expense

Amortization expense

Total expenses

Earnings before income taxes

Income tax expense

Net earnings

$82,000

3,200

36,000

18,000

3,700

1,200

7,000

69,100

12,900

6,500

$ 6,400

BEAULIEU LIMITED

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1

Add: Net earnings

Less: Dividends

Retained earnings, December 31

$14,000

6,400

20,400

2,200

$18,200

PROBLEM 2-5A (Continued)

(b)

BEAULIEU CORPORATION

Balance Sheet

December 31, 2004

Solutions Manual

2-22

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Assets

Current assets

Cash

$ 8,200

Temporary investments

15,400

Accounts receivable

7,500

Prepaid insurance

1,800

Total current assets

Property, plant and equipment

Equipment

$32,000

Less: Accumulated amortization

10,500

Total property, plant and equipment

Total assets

$32,900

21,500

$54,400

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

$12,000

Salaries payable

3,000

Income taxes payable

1,200

Total current liabilities

$16,200

Shareholders' equity

Common shares

$20,000

Retained earnings

18,200

Total shareholders’ equity

38,200

Total liabilities and shareholders' equity

$54,400

Solutions Manual

2-23

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-6A

(a)

COMMERCE CRUSADERS INC.

Statement of Earnings

Year Ended April 30, 2004

Sales

Expenses

Cost of goods sold

Operating expense

Wages expense

Amortization expense

Interest expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

$34,000

9,900

4,400

7,000

4,000

4,000

29,300

4,700

1,350

$ 3,350

COMMERCE CRUSADERS INC.

Statement of Retained Earnings

Year Ended April 30, 2004

Retained earnings, May 1

Add: Net earnings

$10,150

3,350

13,500

3,250

$10,250

Less: Dividends

Retained earnings, April 30

Solutions Manual

2-24

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-6A (Continued)

(b)

COMMERCE CRUSADERS INC.

Balance Sheet

April 30, 2004

Assets

Current assets

Cash

$ 5,700

Short-term investments

12,000

Accounts receivable

8,100

Inventories

9,670

Prepaid expenses

120

Total current assets

Property, plant and equipment

Land

Building

$15,370

Less accumulated amortization, building

1,500

Equipment

$12,200

Less accumulated amortization, equipment

5,000

Total property, plant and equipment

Total assets

Solutions Manual

2-25

$35,590

14,000

13,870

7,200

35,070

$70,660

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-6A (Continued)

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

Wages payable

Income taxes payable

Current portion of long-term debt

Total current liabilities

Long-term liabilities

Notes payable

Total liabilities

Shareholders' equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders' equity

$8,340

2,220

1,350

4,500

$16,410

35,000

51,410

$ 9,000

10,250

19,250

$70,660

(c) The statement of earnings reports the net earnings for the period. This figure is

then used in the statement of retained earnings, along with dividends to

calculate the amount of retained earnings at the end of the period. The

retained earnings figure is used in the balance sheet to complete the

accounting equation.

Solutions Manual

2-26

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7A

(a) Earnings per share:

Net earnings - Preferred dividends

Average number of common shares

Belliveau

Shields

$36,000

$0.18 per share

200,000 shares

$173,000

= $0.43 per share

400,000 shares

Shields Corp. appears to be more profitable than Belliveau as it has higher

earnings per share.

Price-earnings Ratio:

Market price per share

Earnings per share

Belliveau

Shields

$7.00

= 16.28 times

$0.43

$2.50

13.89 times

$0.18

Investors appear to have more confidence in the earnings and profitability of

Shields Corp. since the company has a higher price-earnings ratio than

Belliveau Corp.

(b) Current Ratio:

Current assets

Current liabilities

Belliveau

Shields

$130,000

2.2 : 1

$60,000

$700,000

2.8 : 1

$250,000

Shields’ 2004 current ratio of 2.8:1 is higher than Belliveau’s current ratio of

2.2:1, which suggests that Shields is slightly more liquid than Belliveau.

Solutions Manual

2-27

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7A (Continued)

(b) (Continued)

Cash current debt coverage ratio:

Cash provided from operating activities

Average current liabilitie s

Belliveau

$20,000

= 0.4 times

$60,000 $52,000

2

Shields

$185,000

= 0.7 times

$250,000 $275,000

2

Shields’ ratio of 0.7 times versus Belliveau’s measure of 0.4 times suggests

that Shields is the more liquid of the two companies.

(c) Debt to total assets:

Total debt

Total assets

Belliveau

$110,000

25.3%

$435,000a

Shields

$450,000

30%

$1,500,000b

Belliveau appears to be more solvent. Belliveau’s 2004 debt to total assets

ratio of 25.3% is lower than Shields’ ratio of 30%. The lower the percentage of

debt to total assets, the lower the risk that a company may be unable to pay

its debts as they come due.

Solutions Manual

2-28

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7A (Continued)

(c) (Continued)

Cash total debt coverage ratio:

Cash provided from operating activities

Average total liabilitie s

Belliveau

$20,000

$110,000 $120,000c

2

= 0.2 times

Shields

$185,000

$450,000 $425,000d

2

= 0.4 times

Shields’ cash total debt coverage ratio of 0.4 times suggests that Shields is

more solvent than Belliveau, which has a ratio of 0.2 times.

a

Total liabilities: $110,000 ($60,000 + $50,000) is Belliveau’s 2004 total

liabilities.

Total assets: $435,000 ($130,000 + $305,000) is Belliveau’s 2004 total

assets.

b

Total liabilities: $450,000 ($250,000 + $200,000) is Shields’ 2004 total

liabilities.

Total assets: $1,500,000 ($700,000 + $800,000) is Shields’ 2004 total assets.

c

Total liabilities: $120,000 ($52,000 + $68,000) is Belliveau’s 2003 total

liabilities.

d

Total liabilities: $425,000 ($275,000 + $150,000) is Shields’ 2003 total

liabilities.

Solutions Manual

2-29

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-8A

(a) Current ratio =

$246,500

= 1.55:1

$159,500

(c) Cash current debt coverage =

(d) Debt to total assets =

$55,600

= 0.35 times

$159,500 $156,000

2

$291,500

= 35.9%

$811,800

(e) Cash total debt coverage =

$55,600

= 0.20 times

$291,500 $276,000

2

(f) Earnings per share =

$82,900

= $11.84

7,000 shares

(g) Price-earnings ratio =

$34.00

= 2.9 times

$11.84

Solutions Manual

2-30

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-9A

(a)

2004

1.

2.

3.

4.

5.

2003

Earnings per share:

Earnings per share:

$46,000

= $0.60 per share

76,000 shares

$163,000

= $3.26 per share

50,000 shares

Price-earnings ratio:

Price-earnings ratio:

$4.00

= 6.6 times

$0.60

$6.00

= 1.8 times

$3.26

Working capital:

Working capital:

($50,000 $90,000 $80,000)

$98,000 $122,000

($24,000 $65,000 $75,000)

$75,000 $89,000

Current ratio:

Current ratio:

$220,000

= 2.24:1

$98,000

$164,000

= 2.19:1

$75,000

Debt to total assets:

Debt to total assets:

$98,000 $105,000

= 23.6%

$860,000

$75,000 $75,000

= 22.9%

$654,000

Solutions Manual

2-31

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-9A (Continued)

(b) The underlying profitability of the corporation has declined as indicated by the

decline in earnings and earnings per share. However, the decline in earnings

per share can also be attributed to some extent to the increase in the average

number of common shares from 50,000 in 2003 to 76,000 in 2004. It seems

investors still have confidence in the earnings of the company as the priceearnings ratio has improved despite the decline in profitability. However, the

increase in the P/E ratio may just be indicative of the fact that the shares are

overvalued and may decline in the future.

Despite the decline in earnings, the company’s liquidity position improved in

2004. Working capital increased by $33,000 ($122,000 - $89,000) and the

working capital ratio increased from 2.19:1 to 2.24:1. This means the

company now has more current assets on hand to repay its currently maturing

obligations.

Finally, Giasson Corporation’s solvency also appears to have remained fairly

constant in 2004, as total assets are financed only 23.6% by debt in 2004

versus 22.9% in 2003.

Solutions Manual

2-32

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-10A

(a) ($ in millions)

Abitibi

Working

Capital

Tembec

$1,640 - $1,415 $225

$1,273.5- $504.1 $769.4

$1,640

= 1.16:1

$1,415

$1,273.5

= 2.52:1

$ 504.1

Debt to

Total

Assets

$8,442

= 72.1%

$11,707

$2,771.2

= 67%

$4,138.8

Cash total

debt

coverage

$1,037

= 0.125 times

$8,301

$173.6

= 0.08 times

$2,303.8

$289

= $0.66 per share

440 shares

$77.9

= $0.95 per share

82 shares

$11.63

= 17.6 times

$0.66

$10.10

= 10.6 times

$0.95

Current

Ratio

Earnings

per share

Price earnings

ratio

Solutions Manual

2-33

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-10A (Continued)

(b) (Continued)

Liquidity

With a current ratio of 1.16 Abitibi appears to be less liquid then both Tembec

and the industry. Tembec’s current ratio of 2.52:1 is better than the industry

average of 1.23:1. Overall, Tembec is more liquid than both Abitibi and the

industry.

Profitability

Tembec is more profitable than Abitibi in that it has higher earnings per share.

Also, both companies have higher earnings per share than the industry.

However, investors appear to have more confidence in the earnings of Abitibi

as evidenced by Abitibi’s price-earnings ratio. However, a high price-earnings

ratio may indicate that Abitibi’s shares are overpriced. Both companies have

a lower price-earnings ratio than the industry.

Solvency

When looking at the debt to total asset ratio, Tembec appears to be more

solvent than Abitibi as less of Tembec’s assets are financed by debt.

However, Abitibi seems to be able to generate more cash form operations that

can be used to repay their liabilities as evidenced by Abitibi’s higher cash total

debt coverage ratio.

PROBLEM 2-1B

(a) The primary objective of financial reporting is to provide information for

decision making. In reporting the financial results of the company the financial

statements meet some of the investor’s need. There is other information that

investors need that is not part of the financial reporting package such as plans

for future growth and the experience of the management team.

Solutions Manual

2-34

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

(b) Investors buy Net Nanny’s shares despite the losses because they expect the

company to do well in the long-term. This does not mean that the information

in the financial statements is not reliable or relevant. It does confirm that there

is additional information, not contained in a company’s financial statements,

that investors use when making investment decisions.

(c) The change in reporting currency will make the information easier for some

investors to use. It will be easier to compare Net Nanny’s results to similar US

companies. It will be necessary for Net Nanny to restate its previous years

statements for comparability.

Solutions Manual

2-35

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-2B

The two constraints in accounting are:

1. the cost-benefit constraint, which ensures that the value of the information

exceeds the cost of providing it; and

2. materiality relates to a financial statement item’s impact on a company’s

overall financial condition and operations.

The Empire Company Limited has almost ten billion dollars in revenue. The type

of information that Ryan is looking for, such as sales and cost data by various

categories, is generally not disclosed in external financial statements. It would be

prohibitively expensive to present such information to external users, and have it

verified by external auditors. The company quite likely has internal reports with

data on various ticket and concession sales. However, the information used by

management is not always material to external users. As well, companies like to

guard against disclosure of information if doing so would weaken their competitive

position.

Solutions Manual

2-36

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-3B

Account

Balance Sheet Category

Accounts payable and accrued liabilities

Accounts receivable

Buildings

Cash and cash equivalents

Common shares

Customers’ deposits

Dividends payable

Future income tax liabilities

Current liabilities

Current assets

Property, plant and equipment

Current assets

Shareholders’ equity

Current liabilities

Current liabilities

Current liabilities or long-term

liabilities

Current assets

Current assets

Property, plant and equipment

Property, plant and equipment

Long-term liabilities

Current assets

Shareholders’ equity

Property, plant and equipment

Income taxes recoverable

Inventory

Land

Leasehold improvements

Long-term liabilities

Marketable securities

Retained earnings

Vehicles

Solutions Manual

2-37

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-4B

YAHOO! INC.

Balance Sheet

December 31, 2002

Assets

Current assets

Cash and cash equivalents

Short-term investments

Accounts receivable

Prepaid expenses and

other current assets

Total current assets

Long-term investments

Property and equipment, net

Intangible assets, net

Goodwill

Other assets

Total assets

$310,972

463,204

113,612

82,216

$ 970,004

763,408

371,272

96,252

415,225

174,020

$2,790,181

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable

$ 18,738

Deferred revenue—current

135,501

Accrued expenses and

other current liabilities

257,575

Total current liabilities

$ 411,814

Other liabilities

116,097

Total liabilities

527,911

Shareholders’ equity

Common stock

$2,270,845

Other shareholders’ equity

(1,082)

Deficit

(7,493)

Total shareholders’ equity

2,262,270

Total liabilities and shareholders’ equity

$ 2,790,181

Solutions Manual

2-38

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-5B

(a)

MBONG CORPORATION

Statement of Earnings

Year Ended December 31, 2004

Service revenue

Expenses

Repair expense

Salaries expense

Rent expense

Utilities expense

Insurance expense

Amortization expense

Supplies expense

Total expenses

Earnings before income taxes

Income tax expense

Net earnings

$65,000

1,800

35,000

12,000

1,700

2,200

2,600

700

56,000

9,000

3,000

$ 6,000

MBONG CORPORATION

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1

Add: Net earnings

Less, Dividends

Retained earnings, December 31

$16,000

6,000

22,000

2,000

$20,000

PROBLEM 2-5B (Continued)

(b)

MBONG CORPORATION

Solutions Manual

2-39

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Balance Sheet

December 31, 2004

Assets

Current assets

Cash

$13,600

Accounts receivable

13,500

Supplies

1,000

Prepaid insurance

3,500

Total current assets

Investments

Property, plant and equipment

Equipment

$13,000

Less: Accumulated amortization

5,600

Total property, plant and equipment

Total assets

$31,600

22,300

7,400

$61,300

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

$13,300

Salaries payable

3,000

Total current liabilities

$16,300

Note payable

5,000

Total liabilities

21,300

Shareholders' equity

Common shares

$20,000

Retained earnings

20,000

Total shareholders’ equity

40,000

Total liabilities and shareholders' equity

$61,300

Solutions Manual

2-40

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-6B

(a)

CHEUNG CORPORATION

Statement of Earnings

Year Ended April 30, 2004

Fee revenue

Expenses

Salaries expense

Rent expense

Interest expense

Amortization expense

Total expenses

Earnings before income taxes

Income tax expense

Net earnings

$32,590

6,840

6,000

342

4,610

17,792

14,798

4,500

$10,298

CHEUNG CORPORATION

Statement of Retained Earnings

Year Ended April 30, 2004

Retained earnings, May 1, 2003

Add: Net earnings

Less: Dividends

Retained earnings, April 30, 2004

$13,960

10,298

24,258

3,650

$20,608

PROBLEM 2-6B (Continued)

(b)

CHEUNG CORPORATION

Balance Sheet

April 30, 2004

Assets

Solutions Manual

2-41

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Current assets

Cash

$20,263

Short-term investments

11,000

Accounts receivable

7,840

Prepaid rent

500

Total current assets

Property, plant and equipment

Equipment

$23,050

Less: Accumulated amortization

9,220

Total property, plant and equipment

Total assets

$39,603

13,830

$53,433

Liabilities and Shareholders' Equity

Current liabilities

Accounts payable

$5,972

Interest payable

28

Income taxes payable

1,125

Total current liabilities

$ 7,125

Notes payable

5,700

Total liabilities

12,825

Shareholders' equity

Common shares

$20,000

Retained earnings

20,608

Total shareholders’ equity

40,608

Total liabilities and shareholders' equity

$53,433

(c) The statement of earnings reports the net earnings for the period. This figure

is then used in the statement of retained earnings, along with dividends to

calculate the amount of retained earnings at the end of the period. The

retained earnings figure is used in the balance sheet to complete the

accounting equation.

Solutions Manual

2-42

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7B

(a) Earnings per share:

Net earnings - Preferred dividends

Average number of common shares

Chen

Cassie

$311,630

=$3.12 per share

100,000shares

$113,040

= $2.26 per share

50,000 shares

Chen Corporation appears to be more profitable than Cassie as it has higher

earnings per share.

Price-Earnings Ratio:

Market price per share

Earnings per share

Chen

Cassie

$25.00

8.0 times

$3.12

$14.00

= 6.2 times

$2.26

Investors appear to have more confidence in the earnings and profitability of

Chen Corporation since the company has a higher price-earnings ratio than

Cassie Corporation.

(b) Working Capital:

Current assets – current liabilities

Chen

Cassie

$425,975 $66,325 $359,650

Solutions Manual

2-43

$190,336 $35,458 $154,878

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7B (Continued)

(b) (Continued)

Current Ratio:

Current assets

Current liabilities

Chen

Cassie

$190,336

5.4 : 1

$35,458

$425,975

6.4 : 1

$66,325

Chen’s 2004 current ratio of 6.4:1 is higher than Cassie’s current ratio of

5.4:1, which suggests that Chen is slightly more liquid than Cassie.

Cash current debt coverage ratio:

Cash provided from operating activities

Average current liabilitie s

Chen

Cassie

$162,594

$24,211

= 2.3

= 0.7

$35,458 $30,281

$66,325 $75,815

2

2

Chen’s cash current debt coverage ratio of 2.3 times is 3 times that of Cassie,

showing that Chen is more liquid.

(c)

Debt to total assets:

Total liabilitie s

Total assets

Chen

Cassie

$65,078

19.7%

$330,064b

$174,825

18.5%

$947,285a

Solutions Manual

2-44

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-7B (Continued)

(c) (Continued)

Chen appears to be slightly more solvent. Chen’s 2004 debt to total assets

ratio of 18.5% is lower than Cassie’s ratio of 19.7%. The lower the percentage

of debt to total assets, the lower the risk that a company may be unable to pay

its debts as they come due.

Cash total debt coverage ratio:

Cash provided from operating activities

Average total liabilitie s

Chen

$162,594

= 0.95

$174,825 $165,815c

2

Cassie

$24,211

= 0.4

$65,078 $55,281d

2

Chen’s cash total debt coverage ratio of 0.95 times also suggests that Chen is

more solvent than Cassie, which has a ratio of 0.4 times.

a

Total liabilities: $174,825 ($66,325 + $108,500) is Chen’s 2004 total liabilities.

Total assets: $947,285 ($425,975 + $521,310) is Chen’s 2004 total assets.

b

Total liabilities: $65,078 ($35,458 + $29,620) is Cassie’s 2004 total liabilities.

Total assets: $330,064 ($190,336 + $139,728) is Cassie’s 2004 total assets.

c

Total liabilities: $165,815 ($75,815 + $90,000) is Chen’s 2003 total liabilities.

d

Total liabilities: $55,281 ($30,281 + $25,000) is Cassie’s 2003 total liabilities.

PROBLEM 2-8B

Solutions Manual

2-45

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

(a) Working capital = $444,900 $142,500 $302,400

(b) Current ratio =

$444,900

= 3.1:1

$142,500

(c) Cash current debt coverage =

(d) Debt to total assets =

$74,900

= 0.60 times

$142,500 $107,400

2

$452,500

= 42.3%

$1,070,200

(e) Cash total debt coverage =

$74,900

= 0.20 times

$452,500 $307,400

2

(f) Earnings per share =

$122,300

= $2.45

50,000 shares

(g) Price-earnings ratio =

$7.00

= 2.9 times

$2.45

Solutions Manual

2-46

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-9B

(a)

2004

1.

2.

3.

4.

5.

2003

Earnings per share:

Earnings per share:

$94,000

= $1.15 per share

82,000 shares

$52,000

= $0.65 per share

80,000 shares

Price-earnings ratio:

Price-earnings ratio:

$66.00

= 57.4 times

$1.15

$44.00

= 67.7 times

$0.65

Working capital:

Working capital:

$(25,000 $70,000 $90,000)

- $75,000 $110,000

$(20,000 $65,000 $70,000)

- $80,000 $75,000

Current ratio:

Current ratio:

$185,000

= 2.46:1

$75,000

$155,000

= 1.94:1

$80,000

Debt to total assets:

Debt to total assets:

$75,000 $86,000

= 21.2%

$760,000

$80,000 $110,000

= 27.7%

$685,000

Solutions Manual

2-47

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-9B (Continued)

(b) The underlying profitability of the corporation has improved as evidenced by

the improvement in earnings and earnings per share. However, it seems

investors have less confidence in the future earnings of the company as the

price-earnings ratio has declined despite the increase in profitability.

The company’s liquidity position improved in 2004. Working capital increased

by $35,000 ($110,000 - $75,000) and the current ratio increased from 1:94:1

to 2.46:1. This means the company now has more current assets on hand to

repay its currently maturing obligations.

Finally, Pitka Corporation’s solvency also appears to have improved in 2004,

as total assets are financed only 21.2% by debt in 2004 versus 27.7% in 2003.

The lower the percentage of debt to total assets, the lower the risk that a

company may be unable to pay its debts as they come due.

Solutions Manual

2-48

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-10B

(a) ($ in thousands)

Big Rock

Working

capital

Current

ratio

Debt to

total

assets

Cash

current

debt

coverage

Cash total

debt

coverage

Earnings

per share

Price

earnings

ratio

Solutions Manual

Sleeman

$6,492.3- $5,357.9 $1,134.4 $44,511- $46,315 $1,804

$6,492.3

= 1.21:1

$5,357.9

$44,511

= 0.96:1

$46,315

$11,276.6

= 34.1%

$33,060.7

$124,554

= 63%

$197,642

$2,580.5

= 0.52 times

$4,916.8

$18,984

= 0.44 times

$43,044.5

$2,580.5

= 0.22 times

$11,792.3

$18,984

= 0.15 times

$122,089.5

$1,217.8

5,167.7 shares

$9,765

15,223 shares

= $0.24 per share

= $0.64 per share

$5.50

= 22.9 times

$0.24

$9.73

= 15.2 times

$0.64

2-49

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 2-10B (Continued)

(b) Liquidity

With a current ratio of 1.21 Big Rock appears to be more liquid than both

Sleeman and the industry. Sleeman’s current ratio of 0.96 is even less than

the industry average of 1.18:1. As well, Big Rock has been able to generate

more cash to repay it current liabilities as indicated by Big Rock’s higher cash

current debt coverage ratio. Overall, it appears that Big Rock is more liquid

than both Sleeman and the industry.

Profitability

Sleeman is more profitable than Big Rock in that it has a higher earnings per

share. However, investors appear to have more confidence in the earnings of

Big Rock as evidenced by Big Rock’s higher price-earnings ratio. Both

companies have higher earnings per share than the industry. However, both

companies have a much lower price-earnings ratio than the industry.

Solvency

Big Rock appears more solvent than Sleeman. It betters Sleeman in the debt

to total assets ratio and in the cash total debt coverage ratio.

Solutions Manual

2-50

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 2-1 FINANCIAL REPORTING PROBLEM

(a) Total current assets were $3,526,000,000 at December 28, 2002, and $3,086,000,000 at

December 29, 2001.

(b) Current assets are properly listed in the order of liquidity. As you will learn in a later chapter,

inventories are considered to be less liquid than receivables. They are listed below

receivables and before prepaid expenses.

(c) The asset classifications are similar to the text: current assets, followed by non-current

assets such as fixed assets, goodwill, future income taxes and other assets.

(c) Total current liabilities were $3,154,000,000 at December 28, 2002, and $2,796,000,000 at

December 29, 2001.

Solutions Manual

2-51

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 2-2 COMPARATIVE ANALYSIS PROBLEM

(a)

Loblaw (millions)

Sobeys (millions)

1. Working capital

$3,526 - $3,154 $372

$1,094 - $1,180.5 $86.1

2. Current ratio

$3,526

1.12 :1

$1,094.4

63%

$1,755.7

$3,154

3. Debt to total

assets

4. Earnings per

share

$6,986

$11,110

$728

276.2 shares

5. Price-earnings

ratio

$1,180.5

$3,192.5

0.93 : 1

55%

$179.0

$2.64

65.9 shares

$36.75

$54.00

= 20.5 times

$2.64

$2.72

$2.72

= 13.5 times

(b) Sobeys has a negative working capital and a current ratio of less than one. Loblaw has a

positive working capital and a current ratio which indicates the company has sufficient

assets to cover its current liabilities. Using these ratios it appears that Sobeys is in worse

condition based on relative liquidity.

Based on the debt to total assets ratio it appears that Loblaw is less solvent than Sobeys.

Because Sobeys’ debt to total assets ratio is lower than Loblaw’s, Sobeys would be

considered better able to pay its debts as they come due.

Based on earnings per share Sobeys appears to be more profitable than Loblaw. Sobeys

has been able to generate $2.72 in earnings for each common share while Loblaw has

only generated $2.64. However, as indicated by the higher price earnings ratio, investors

appear to have more confidence in Loblaw’s earnings and relatively seem to be willing to

pay more for Loblaw’s shares.

Solutions Manual

2-52

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 2-3 RESEARCH CASE

The students' answers depend on the company and article selected.

Solutions Manual

2-53

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 2-4 INTERPRETING FINANCIAL STATEMENTS

(a) The percentage increase in The Gap’s total assets during this period is calculated as:

$9,902 – $3,964

= 150%

$3,964

The average increase per year can be approximated as:

150%

= 37.5% per year

4 years

(b) The Gap’s working capital increased significantly during this period, while

its current ratio also improved. The improvement in the current ratio would suggest that

The Gap’s liquidity improved. The current ratio is a better measure of liquidity because it

provides a relative measure; that is, current assets compared to current liabilities. Working

capital only tells us the net amount of current assets and current liabilities. It is hard to say

whether a given amount of working capital is adequate or inadequate without knowing the

size of the company. Another problem with interpreting The Gap’s working capital is that it

fluctuated considerably during the period. The Gap’s current ratio may have improved

because the clothing chain expanded rapidly during this period. With expansion comes the

need to carry additional inventories which is a significant component of current assets.

(c) The debt to total assets ratio suggests that The Gap’s solvency declined during the period,

as the percentage of debt used to finance its assets increased. However, this could be

due to the additional funds required to finance the company’s growth over the past several

years.

(d) The company’s earnings per share have decreased over the past several years. The

average earnings per share from 1998 to 2002 was:

[$0.55 $(0.01) $1.03 $1.32 $0.95]

$0.77

5

On the average, earnings per share has declined which might cause some investors to

have concerns about the company’s future prospects. However, investors would need

information concerning the change in the number of common shares outstanding to fully

assess the earnings per share, as the decline in EPS could be related to increases in the

number of shares rather than decreases in profitability.

Solutions Manual

2-54

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 2-5 A GLOBAL FOCUS

(a) By switching to US reporting standards, a company’s statements would be more relevant

to the company’s US investors (present and potential). This may make it easier for them to

raise funds in the US, a much larger capital base than Canada. It will make it easier for US

investors to understand the statements because they will use standards that they are

familiar with and it will be easier for them to make comparisons with US companies. Many

non-US companies use US standards. The disadvantages associated with such a change

include making it more difficult for Canadian investors to understand the statements and

make comparisons to company’s using Canadian standards. It will also increase the

financial reporting costs—the company will be required to reconcile the statement prepared

using the different standards. The impact of the switch on a company’s net earnings could

be either an advantage or disadvantage depending on the individual circumstance of the

company.

(b) The use of country specific accounting policies may hinder my comparison. When different

standards are used the impact on reported earnings and financial performance can be

significant. In order to compare apples and apples, a conversion of one of the sets of

statements may be required. This may require significant time and expertise. Many

Canadian companies include a reconciliation to US GAAP in their financial statements to

help with this.

(c) Comparison of Canadian companies that use different accounting policies would be difficult

as the use of different policies can have a significant impact on reported earnings and

financial performance.

(d) There is no significant distinction between comparing statements prepared in different

countries and statements prepared in the same country using different accounting policies.

In either case the policies will have to be reconciled in order to make valid comparisons.

Solutions Manual

2-55

Chapter 2

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.