Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

CHAPTER 1

Introduction to Financial Statements

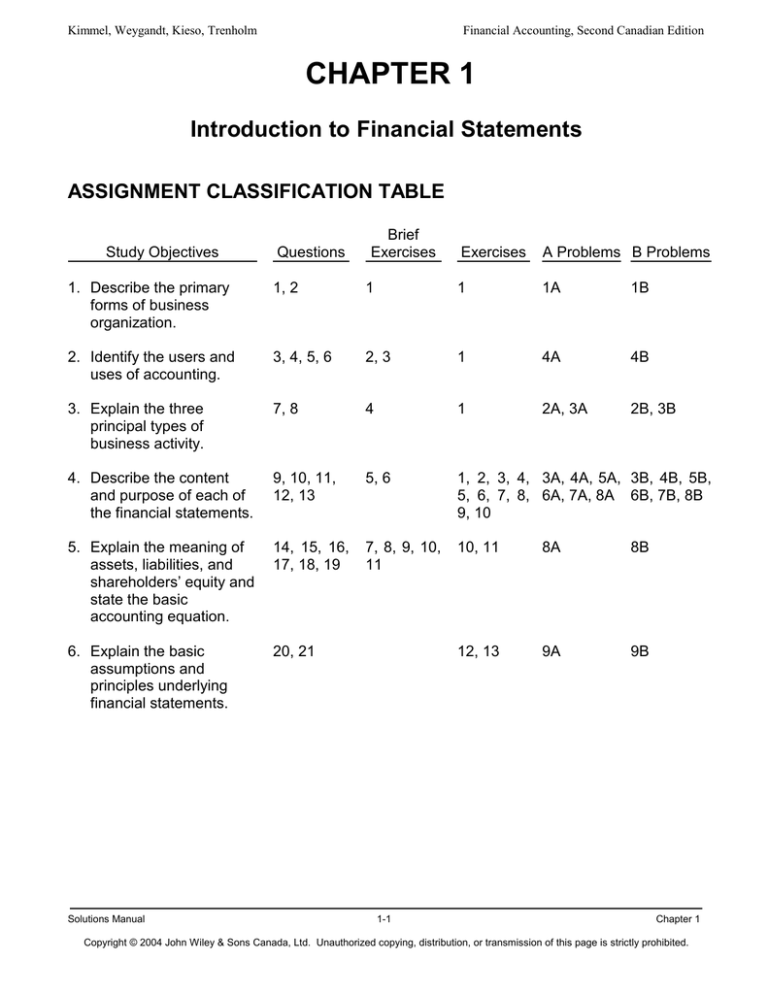

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

Exercises

A Problems B Problems

1. Describe the primary

forms of business

organization.

1, 2

1

1

1A

1B

2. Identify the users and

uses of accounting.

3, 4, 5, 6

2, 3

1

4A

4B

3. Explain the three

principal types of

business activity.

7, 8

4

1

2A, 3A

2B, 3B

4. Describe the content

and purpose of each of

the financial statements.

9, 10, 11,

12, 13

5, 6

1, 2, 3, 4, 3A, 4A, 5A, 3B, 4B, 5B,

5, 6, 7, 8, 6A, 7A, 8A 6B, 7B, 8B

9, 10

5. Explain the meaning of

assets, liabilities, and

shareholders’ equity and

state the basic

accounting equation.

14, 15, 16,

17, 18, 19

7, 8, 9, 10,

11

10, 11

8A

8B

6. Explain the basic

assumptions and

principles underlying

financial statements.

20, 21

12, 13

9A

9B

Solutions Manual

1-1

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

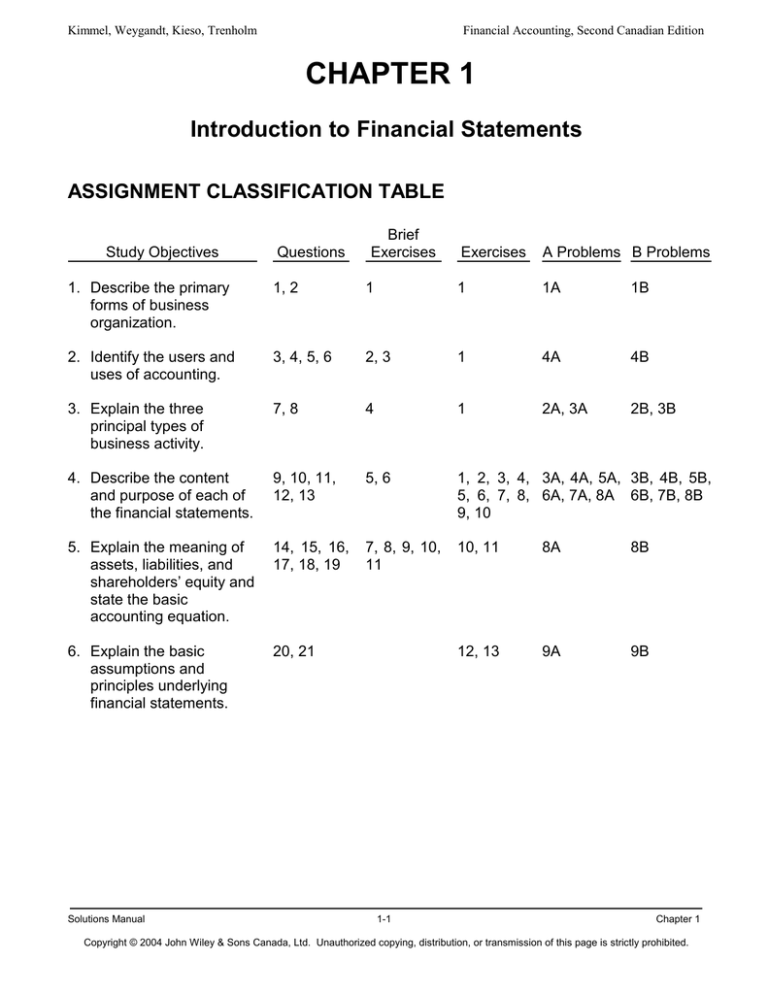

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

Moderate

25-30

Simple

25-30

1A

Determine forms of business organization.

2A

Identify business activities.

3A

Classify accounts.

Moderate

25-30

4A

Identify users and uses of financial statements.

Complex

40-50

5A

Prepare statements of earnings and retained

earnings and balance sheet.

Moderate

40-50

6A

Prepare cash flow statement.

Moderate

30-40

7A

Comment on proper accounting treatment and

prepare a corrected statement of earnings.

Moderate

40-50

8A

Use financial statement relationships to calculate

missing amounts.

Moderate

20-30

9A

Identify the assumption or principle violated.

Moderate

20-30

1B

Determine forms of business organization.

Moderate

25-30

2B

Identify business activities.

Simple

25-30

3B

Classify accounts.

Moderate

25-30

4B

Identify users and uses of financial statements.

Complex

40-50

5B

Prepare statements of earnings and retained

earnings and balance sheet.

Moderate

40-50

6B

Prepare cash flow statement.

Moderate

30-40

7B

Comment on proper accounting treatment and

prepare corrected balance sheet.

Moderate

40-50

8B

Use financial statement relationships to calculate

missing amounts.

Moderate

20-30

9B

Identify the assumption or principle violated.

Moderate

20-30

Solutions Manual

1-2

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

The three basic forms of business organizations are (1) proprietorship, (2) partnership,

and (3) corporation.

2.

Advantages of a corporation are limited liability (shareholders not being personally liable

for corporate debts) and easy transferability of ownership. Disadvantages of a

corporation are increased government regulations and the fact that corporations are

taxed as a separate legal entity. Corporations may receive more favourable tax

treatment than other forms of business organizations. Partnerships and proprietorships

are easier to form (and dissolve) than corporations. Proprietorships and partnerships are

not taxed as separate entities. The partners and proprietors pay personal income tax on

their share of profits. Depending on the circumstances this may be an advantage or

disadvantage. Disadvantages of proprietorships and partnerships are unlimited liability

(proprietors/partners are personally liable for all debts) and difficulty in obtaining

financing compared to corporations.

3.

A person cannot earn a living, spend money, buy on credit, make an investment, or pay

taxes without receiving, using, or dispensing financial information. Accounting provides

financial information to interested users through the preparation and distribution of

financial statements.

4.

Internal users are those who manage the business and therefore are officers and other

decision-makers. To assist management, accounting provides internal reports.

Examples include financial comparisons of operating alternatives, projections of

earnings from new sales campaigns, and forecasts of cash needs for the next year.

5.

External users are those outside the business who have either a present or potential

direct financial interest (investors and creditors) or an indirect financial interest (taxing

authorities, regulatory agencies, labour unions, customers, and economic planners).

6.

Ethics are important because without the expectation of ethical behaviour, the

information presented in the financial statements would have no credibility for the

accounting profession. It would therefore be useless to financial statement users.

7.

Two primary kinds of financing activities for a corporation are borrowing money (debt)

and selling shares (equity).

8.

A bank would want to ensure that the company has sufficient cash available to repay

any loans owed to the bank. If the company paid out all its cash in the form of dividends

there would be no funds available to repay this debt.

Solutions Manual

1-3

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

9.

The balance sheet is prepared as at a specific point in time because it shows what the

business owns (its assets) and what it owes (its liabilities). These items are constantly

changing. In order to present them it is necessary to select one point in time. The other

statements (earnings, retained earnings and cash flow) cover a period of time as they

report activities and measure performance that takes place over time.

10.

Retained earnings are the cumulative earnings retained in a corporation. Retained

earnings are increased by net earnings and are decreased by dividends and a net loss.

11.

The primary purpose of the cash flow statement is to provide financial information about

the cash receipts and cash payments of an enterprise for a specific period of time.

12.

The three categories of the cash flow statement are operating activities, investing

activities, and financing activities. The categories were chosen because they represent

the three principal types of business activity.

13.

(a)

(b)

(c)

The statement of earnings reports net earnings for the period. The net earnings

figure from the statement of earnings is shown on the statement of retained

earnings as an addition to beginning retained earnings. If there is a loss it is

deducted from the opening balance in retained earnings.

The statement of retained earnings explains the change in the retained earnings

section of the balance sheet from one period to the next.

The cash flow statement explains the change in the cash balance from one

balance sheet to the next.

14.

The basic accounting equation is Assets = Liabilities + Shareholders’ Equity.

15.

Cost is used as a basis for accounting treatment and reporting because it is both

relevant and reliable. Cost is relevant because it represents the price paid, the assets

sacrificed, or the commitment made at the date of acquisition. It is the amount for which

someone or some entity should be accountable. Cost is reliable because it is objectively

measurable, factual, and verifiable. It is the result of an arm's-length exchange

transaction. As a result, cost is the basis used in preparing financial statements.

16.

(a)

(b)

Solutions Manual

Assets are resources owned by a business. Liabilities are claims of creditors

against assets. Put more simply, liabilities are existing debts and obligations.

Shareholders’ equity is the ownership claim on total assets.

The items that affect shareholders’ equity are common shares (investment by

shareholders) and retained earnings (through dividends, revenues, and

expenses).

1-4

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

17.

The liabilities are (b) Accounts payable and (g) Salaries payable.

18.

(a)

(b)

(c)

(d)

19.

One possible complication is that the number of days included in each fiscal year will

vary, thus causing reported sales to vary from year to year simply because the number

of days varies.

20.

The economic entity assumption states the economic events can be identified with a

particular unit of accountability. This assumption requires that the activities of the entity

be kept separate and distinct from (1) the activities of its owners (the shareholders) and

(2) all other economic entities. A shareholder of a company charging personal living

costs as expenses of the company is an example of a violation of the economic entity

assumption.

21.

The going concern assumption lends credibility to the cost principle because it is

assumed that the assets will be used in the business and what you gave up to acquire

these assets is more relevant than what the assets could be sold for. If the company

was not a going concern, items would be reported at liquidation value.

Solutions Manual

Statement of earnings

Balance sheet (assets)

Statement of earnings

Balance sheet (assets)

(e)

(f)

(g)

(h)

1-5

Balance sheet (shareholders’ equity)

Balance sheet (liabilities)

Cash flow statement

Statement of retained earnings

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 1-1

BRIEF EXERCISE 1-2

(a)

(b)

(c)

(a)

(b)

(c)

(d)

(e)

P

PP

C

4

3

2

5

1

BRIEF EXERCISE 1-3

(a) The accountant’s behaviour is very unethical. The correct action would have been to adjust

the accounting records so that they agreed to the physical inventory count. Taking home

the extra supplies is theft. If the company accountant feels that she should be

compensated for her extra work, she should address her concerns by discussing the

matter with her employer.

(b) To ensure all employees adhere to appropriate ethical behaviour, the company should

implement clear policies outlining expectations of ethical behaviour. As well, top

management must illustrate, through their own actions, that ethical behaviour is expected

of all employees.

BRIEF EXERCISE 1-4

(a)

(b)

(c)

(d)

(e)

O

F

F

F

I

BRIEF EXERCISE 1-5

(a)

(b)

(c)

(d)

(e)

(f)

BS

BS

SE

BS

BS

SE

Solutions Manual

(g)

(h)

(i)

(j)

(k)

(l)

SE

BS

BS

SE

SE

BS

1-6

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 1-6

SE

BS

CF

BS

(a)

(b)

(c)

(d)

Revenue during the period

Supplies on hand at the end of the year

Cash received from borrowing money during the period

Total debt at the end of the period

BRIEF EXERCISE 1-7

(a)

(b)

(c)

$90,000 – $50,000 = $40,000 (Shareholders’ equity)

$48,000 + $70,000 = $118,000 (Assets)

$94,000 – $72,000 = $22,000 (Liabilities)

BRIEF EXERCISE 1-8

(a)

Total assets

=

=

=

Total liabilities + Shareholders’ equity

$100,000 + $240,000

$340,000

(b)

Total liabilities

=

=

=

Total assets – Shareholders’ equity

$170,000 – $100,000

$70,000

(c)

Shareholders’ equity

=

=

=

Total assets – Total liabilities

$700,000 – ($700,000/2)

$350,000

BRIEF EXERCISE 1-9

(a)

($800,000 + $150,000) – ($500,000 – $80,000) = $530,000

(Shareholders’ equity)

(b)

($500,000 + $100,000) + ($800,000 – $500,000 – $70,000) = $830,000

(Assets)

(c)

($800,000 – $90,000) – ($800,000 – $500,000 + $110,000) = $300,000

(Liabilities)

Solutions Manual

1-7

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 1-10

(a)

(b)

(c)

A

L

A

(d)

(e)

(f)

A

SE

L

BRIEF EXERCISE 1-11

(a)

(b)

(c)

(d)

(e)

(f)

(g)

NE

C

R

E

E

D

R

SOLUTIONS TO EXERCISES

EXERCISE 1-1

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

8

5

6

1

7

2

3

4

Ethics

Corporation

Common shares

Accounts payable

Accounts receivable

Creditor

Financing activities

Retained earnings

EXERCISE 1-2

KON INC.

Statement of Earnings

Year Ended December 31, 2004

Revenues

Service revenue

Expenses

Salaries expense

Rent expense

Solutions Manual

1-8

$61,000

$28,000

10,400

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Utilities expense

Advertising expense

Total expenses0

Earnings before income tax

Income tax expense

Net earnings

2,400

1,800

42,600

18,400

6,000

$12,400

KON INC.

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1

Add: Net earnings

Less: Dividends

Retained earnings, December 31

Solutions Manual

1-9

$57,000

12,400

69,400

7,000

$62,400

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-3

AURORA LTD.

Balance Sheet

December 31, 2004

Assets

Cash

Accounts receivable

Supplies

Equipment

Total assets

$18,500

10,000

8,000

0 44,000

$80,500

Liabilities and Shareholders’ Equity

Liabilities

Accounts payable

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

$20,000

40,000

20,500*

60,500

$80,500

*$27,500 – $7,000 = $20,500

Solutions Manual

1-10

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-4

(a)

Camping fee revenue

General store revenue

Total revenue

Expenses ($142,000 + $6,000)

Net earnings

$137,000

20,000

157,000

148,000

$ 9,000

(b)

SEA SURF CAMPGROUND, INC.

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1

Add: Net earnings

Less: Dividends

Retained earnings, December 31

$17,000

9,000

26,000

4,000

$22,000

SEA SURF CAMPGROUND, INC.

Balance Sheet

December 31, 2004

Assets

Cash

Supplies

Equipment

Total assets

$ 10,500

2,500

0 110,000

$123,000

Liabilities and Shareholders’ Equity

Liabilities

Accounts payable

Notes payable

Total liabilities

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

Solutions Manual

1-11

$ 11,000

50,000

61,000

40,000

22,000

62,000

$123,000

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-5

LANGILLE PROFESSIONAL CORPORATION

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1

Add: Net earnings

Less: Dividends

Retained earnings, December 31

*Total revenue

Total expenses

Net earnings

Solutions Manual

$150,000

190,000*

340,000

76,000

$264,000

$395,000

205,000

$190,000

1-12

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-6

(a)

Assets - Liabilities = Shareholders’ equity

$90,000 - $80,000 = $10,000

(b)

Total liabilities + Shareholders’ equity = Total assets

$120,000 + $40,000 = $160,000

(c)

Ending balance – Beginning balance = Change in shareholders’ equity

$40,000 - $10,000 = $30,000

Revenue – Expenses = Net earnings

$215,000 - $165,000 = $50,000

Total change in shareholders’ equity – Net earnings = Dividends

$30,000 - $50,000 = $20,000

(d)

Total Assets - Shareholders’ equity = Total liabilities

$130,000 - $95,000 = $35,000

(e)

Assets - Liabilities = Shareholders’ equity

$180,000 - $55,000 = $125,000

(f)

Ending balance - Beginning balance = Change in shareholders’ equity

$125,000 - $95,000 = $30,000

Change in shareholders’ equity + Dividends = Net earnings

$30,000 + $5,000 = $35,000

Net earnings + Expenses = Revenue

$35,000 + $80,000 = $115,000

Solutions Manual

1-13

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-7

(a)

Yu Corporation is distributing nearly all of this year's net earnings as dividends. This

suggests that Yu is not pursuing rapid growth. Companies that have a lot of

opportunities for growth normally retain their earnings and pay low dividends.

(b)

Surya Corporation is not generating sufficient cash from operating activities to fund its

investing activities. This is common for companies in their early years of existence.

(c)

Naguib is financing its assets mainly through equity. The company has $400,000

($150,000 + $250,000) of total assets, which are funded 37.5% ($150,000/$400,000) by

liabilities and 62.5% ($250,000/$400,000) by equity. Since equity does not have to be

repaid and does not require interest payments, the company appears to be in a healthy

financial position.

EXERCISE 1-8

VAN TRAN CORPORATION

Cash Flow Statement

Year Ended December 31, 2004

Operating activities

Cash received from customers

Cash paid to suppliers

Cash provided by operating activities

Investing activities

Cash paid for new equipment

Cash used by investing activities

Financing activities

Cash received from lenders

Cash dividends paid

Cash provided by financing activities

Net increase in cash

Cash, January 1, 2004

Cash, December 31, 2004

Solutions Manual

1-14

$50,000

(30,000)

$20,000

$(25,000)

(25,000)

$20,000

(6,000)

14,000

9,000

10,000

$19,000

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-9

LANDS’ END

Cash Flow Statement

Year Ended February 1, 2002

Operating activities

Cash received from customers

Cash paid for goods and services

Cash provided by operating activities

Investing activities

Cash paid for new buildings and equipment

Cash used by investing activities

Financing activities

Cash paid for repayment of debt

Cash received from issue of common shares

Cash provided by financing activities

Net increase in cash

Cash, January 27, 2001

Cash, February 1, 2002

Solutions Manual

1-15

$1,575,573

(1,502,068)

$ 73,505

$(40,514)

(40,514)

$ (771)

14,520

13,749

46,740

75,351

$122,091

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-10

(a)

A

SE

E

E

A

A

A

Cash and short-term investments

Retained earnings

Cost of goods sold

Selling, general and administrative expenses

Prepaid expenses

Inventories

Receivables

E

R

L

L

R

R

E

Income tax expense

Sales

Income taxes payable

Accounts payable

Franchising revenues

Rental and other income

Interest expense

(b)

COOLBRANDS INTERNATIONAL INC.

Statement of Earnings

Year Ended August 31, 2002

Revenues

Sales

Franchising revenues

Rental and other income

Total revenues

Expenses

Cost of goods sold

Selling, general and administrative expenses

Interest expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

Solutions Manual

1-16

$236,028

5,187

1,007

242,222

129,246

77,558

2,544

209,348

32,874

11,890

$ 20,984

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-11

(a)

L

A

A

A

A

A

L

A

L

A

SE

SE

Accounts payable and accrued liabilities

Accounts receivable

Capital assets

Cash

Goodwill and other intangibles

Inventory

Long-term debt

Other assets

Other liabilities

Prepaid and other expenses

Retained earnings

Share capital

(b)

Assets

Cash

Accounts receivable

Inventory

Prepaid and other expenses

Capital assets

Goodwill and other intangibles

Other assets

Total assets

$

523

38,275

268,519

11,123

142,236

38,684

7,452

$506,812

Liabilities

Accounts payable and accrued liabilities

Other liabilities

Long-term debt

Total liabilities

$209,873

57,516

35,700

$303,089

Shareholders’ equity

Share capital

Retained earnings

Total shareholders’ equity

$124,866

78,857

$203,723

0

Total assets = Total liabilities + Shareholders’ equity

$506,812

= $303,089 + $203,723

Solutions Manual

1-17

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 1-12

(a)

(b)

(c)

(d)

(e)

(f)

5

6

3

4

2

1

Going concern assumption

Economic entity assumption

Monetary unit assumption

Time period assumption

Cost principle

Full disclosure principle

EXERCISE 1-13

(a)

This is a violation of the cost principle. The inventory was written up to its market value

when it should have remained at cost.

(b)

This is a violation of the economic entity assumption. The treatment of the transaction

treats Deanna Durnford and Marietta Corp. as one entity when they are two separate

entities.

(c)

This is a violation of the time period assumption. This assumption states that the

economic life of a business can be divided into artificial time periods (months, quarters

or a year). By adding two more weeks to the year, Marietta Corp. would be misleading

financial statement readers. In addition, 2004 results would not be comparable to

previous years' results.

SOLUTIONS TO PROBLEMS

PROBLEM 1-1A

(a)

Dawn will likely operate her vegetable stand as a proprietorship because

she is planning on operating it for a short time period and a proprietorship is

the simplest and least costly to form and dissolve.

(b)

Joseph and Sabra should form a corporation when they combine their

operations. This is the best form of business for them to choose because

they expect to raise significant funds in the coming year. It is easier to raise

funds in a corporation. A corporation may also receive more favourable tax

treatment.

Solutions Manual

1-18

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

(c)

The professors should incorporate their business because of their concerns

about the legal liabilities. A corporation is the only form of business that

provides limited liability to its owners.

(d)

Abdur would likely form a corporation because he needs to raise funds to

invest in inventories and property, plant, and equipment. He has no savings

or personal assets and it is normally easier to raise funds through a

corporation.

(e)

A partnership would be the most likely form of business for Mary and

Richard to choose. It is simpler to form than a corporation and less costly.

Solutions Manual

1-19

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-2A

(a)

Abitibi

Consolidated Inc.

Students’ Society

of McGill

University

Corel Corporation

Sportsco

Investments

Grant Thornton

LLP

WestJet Airlines

Ltd.

Financing

Sale of shares

Borrow money

from a bank

Sale of bonds

Investing

Purchase longterm investments

Purchase office

equipment

Operating

Sale of newsprint

Purchase other

companies

Purchase hockey

equipment

Payment of

research expenses

Payment for rink

rentals

Purchase

airplanes

Bill clients for

professional

services

Payment for jet

fuel

Payment of

dividends to

shareholders

Distribute earnings Purchase

to partners

computers

Sale of shares

Payment of wages

and benefits

(b)

Financing

Sale of shares is common to all corporations. Borrowing from a bank is common

to all businesses. Payment of dividends is common to all corporations. Sale of

bonds is common to large corporations.

Investing

Purchase and sale of property, plant, and equipment would be common to all

businesses—the types of assets would vary according to the type of business

and some types of businesses require a larger investment in long-lived assets. A

new business or expanding business would be more apt to acquire assets.

Operating

The general activities identified would be common to most businesses, although

the service or product might change.

Solutions Manual

1-20

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-3A

Accounts payable and accrued liabilities

Accounts receivable

Bank overdraft

Capital assets

Food and beverage operations revenue

Golf course operations revenue

Inventory

Long-term debt

Office and general expense

Professional fees expense

Wage and benefits expense

(a)

L

A

L

A

R

R

A

L

E

E

E

(b)

O

O

*

I

O

O

O

F

O

O

O

* Bank overdrafts are usually considered to be part of the cash balance on

the cash flow statement.

PROBLEM 1-4A

(a)

In making an investment in common shares the Ontario investor is

becoming a partial owner of the company. In this case, the investment will

be held for three years. The information that will be most relevant to him will

be on the statement of earnings. The statement of earnings reports the past

performance of the company in terms of its revenue, expenses and net

earnings. This is the best indicator of the company’s future potential.

(b)

In deciding to extend credit to a new customer, Comeau Ltée would focus

its attention on the balance sheet. The terms of credit they are extending

require repayment in a short period of time. Funds to repay the credit would

come from cash on hand. The balance sheet will show if the company has

enough cash to meet its obligations.

Solutions Manual

1-21

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

(c)

In order to determine whether the company is generating enough cash to

increase the amount of dividends paid to investors, the CEO of Hilfiger

Corporation needs information on the amount of cash generated and used

in various activities of his business. The cash flow statement is the most

useful statement for this purpose. This statement presents the amount of

cash flow at the beginning and end of the period as well as the details of

the amount of cash generated by operating activities and the amount spent

on expanding operations (investment activities).

(d)

In deciding whether to extend a loan, the Laurentian Bank is interested in

two things: the ability of the company to make interest payments on an

annual basis for the next five years and the ability to repay the principal

amount at the end of five years. In order to evaluate both of these factors

the focus should be on the cash flow statement. This statement provides

information on the cash the company generates from its operating activities

on an ongoing basis. This will be the most important factor in determining if

the company will survive and be able to repay the loan.

Note to instructor: Other answers may be valid provided they are properly

supported.

PROBLEM 1-5A

AERO FLYING SCHOOL LTD.

Statement of Earnings

Month Ended May 31, 2004

Revenues

Service revenue

Expenses

Fuel expense

Rent expense

Advertising expense

Insurance expense

Repair expense

Total expenses

Earnings before income tax

Income tax expense

Solutions Manual

$9,600

3,400

1,200

900

400

700

0 6,600

3,000

1,100

1-22

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Net earnings

$1,900

AERO FLYING SCHOOL LTD.

Statement of Retained Earnings

Month Ended May 31, 2004

Retained earnings, May 1

Add: Net earnings

$0,000

0 1,900

1,900

1,000

$ 900

Less: Dividends

Retained earnings, May 31

Solutions Manual

1-23

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-5A (Continued)

AERO FLYING SCHOOL LTD.

Balance Sheet

May 31, 2004

Assets

Cash

Accounts receivable

Equipment

Total assets

$07,800

11,200

60,300

$79,300

Liabilities and Shareholders’ Equity

Liabilities

Notes payable

Accounts payable

Total liabilities

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

$29,200

2,400

31,600

46,800*

900

47,700

$79,300

* $45,000 + $1,800 = $46,800

Solutions Manual

1-24

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-6A

Frenette Corporation should include the following items in its cash flow

statement:

Cash, July 1, 2003

Cash paid to suppliers

Cash paid for income tax

Cash dividends paid

Cash paid to buy equipment

Cash received from customers

FRENETTE CORPORATION

Cash Flow Statement

Year Ended June 30, 2004

Operating activities

Cash received from customers

$165,000

Cash paid to suppliers

(95,000)

Cash paid for income tax

(20,000)

Cash provided by operating activities

50,000

Investing activities

Cash paid to purchase equipment

(15,000)

Financing activities

Cash dividends paid

(8,000)

Increase in cash

27,000

Cash, July 1, 2003

30,000

Cash, June 30, 2004

$ 57,000

Solutions Manual

1-25

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-7A

(a)

1.

The $7,000 of revenue that the company earned in 2003 should not

be included in the 2004 revenues. Including the $7,000 in the current

year's statement of earnings would violate the time period

assumption. Instead, the $7,000 should be added to the beginning

balance of retained earnings.

2.

In order to properly calculate the net earnings for the year all

expenses must be included in the statement of earnings. Although

payment is not due until 2005, the expense relates to 2004.

3.

Since the corporation did not incur or pay the $15,000 of rent

expense, it should not be included in the statement of earnings.

Including the $15,000 as an expense misstates the corporation's net

earnings and presents misleading results.

4.

Including the $2,000 as vacation expense misstates the corporation's

net earnings. It would also be a violation of the economic entity

assumption.

(b)

KETTLE CORPORATION

Statement of Earnings

Year Ended December 31, 2004

Revenue ($60,000 - $7,000)

Expenses

Insurance expense

Earnings before income tax

Income tax expense

Net earnings

$53,000

5,000

48,000

12,000

$36,000

PROBLEM 1-8A

Solutions Manual

1-26

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

(a)

i.

Financial Accounting, Second Canadian Edition

Total assets = Total liabilities and shareholders’ equity

Total assets = $85,000

ii.

Cash = Total assets – (Accounts receivable + Land + Buildings and

equipment)

Cash = $85,000 - ($20,000 + $15,000 + $40,000)

Cash = $10,000

iii.

Operating expenses = Service revenue - Earnings before income tax

Operating expenses = $75,000 - $30,000

Operating expenses = $45,000

iv.

Net earnings = Earnings before income tax – Income tax expense

Net earnings = $30,000 - $15,000

Net earnings = $15,000

v.

Net earnings = $15,000 (same as (iv))

vi.

Retained earnings = $20,000 (as per statement of retained earnings)

vii.

Common shares = Total liabilities and shareholders’ equity - (Liabilities +

Retained earnings)

Common shares = $85,000 - ($15,000 + $20,000)

Common shares = $50,000

(b)

In preparing the financial statements the first statement to be prepared is

the statement of earnings. The net earnings figure is used in the statement

of retained earnings to calculate the ending balance of retained earnings.

The balance sheet is then completed using the balance of retained

earnings as calculated in the statement of retained earnings. Finally the

cash flow statement is completed using information from the statement of

earnings (e.g., net earnings) and balance sheet (e.g., cash balance).

PROBLEM 1-9A

Solutions Manual

1-27

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

1.

Karim Corporation has violated the monetary unit assumption. Although the

death of the company’s president will have an impact on the company it

cannot be measured in monetary terms and therefore cannot be recorded.

2.

In order to comply with the full disclosure principle, Topilynyckyj Ltd. must

adhere to generally accepted accounting principles. Even though the

company is small, investors, creditors and other financial statements users

still require information on which to base their decisions.

3.

If the shipyard chooses to report its financial results only once every two

years, it will be violating the time period assumption. This assumption

states that the life of a business can be divided into artificial time periods

and that useful reports can be generated covering those periods. As a

minimum, reports should be produced annually.

4.

Paradis Inc. has violated the economic entity assumption. In order to

properly report the financial condition and performance of the company,

Marc Paradis’ personal assets must not be recorded in the company’s

accounts. The boat is being used primarily for personal pleasure and

should not be recorded as an asset of the business.

5.

Bourque Corporation is violating the cost principle by recording equipment

at an amount higher than they actually paid for it. The amount that the

company would have paid for it if there had not been a “flood sale” is

irrelevant.

Solutions Manual

1-28

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-1B

(a)

The professors should incorporate their business because of their concerns

about the legal liabilities. A corporation is the only form of business that

provides limited liability to it owners.

(b)

Joseph should run his bait shop as a proprietorship because this is the

simplest form of business to establish. It is also the least expensive. He is

the only person involved in the business and is planning to operate for a

limited time.

(c)

Robert and Tom should form a corporation when they combine their

operations. This is the best form of business for them to choose because

they expect to raise significant funds in the coming year and it is easier to

raise funds in a corporation. A corporation may also receive more

favourable income tax treatment.

(d)

A partnership would be the most likely form of business for Darcy, Ellen and

Meg to choose. It is simpler to form than a corporation and less costly.

(e)

Hervé is most likely to select to operate his business as a proprietorship.

He wants to maintain control of the business. Operating as a proprietorship

will allow him to do this. He has no savings or personal assets, therefore

will not require a corporation to protect his personal assets.

Solutions Manual

1-29

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-2B

(a)

Indigo Books &

Music

High Liner Foods

Incorporated

Financing

Sale of shares

Royal Bank

Issue debt

securities to

investors

Borrow money

from a bank

Payment of

dividends to

shareholders

Sale of bonds

The Gap, Inc.

Sale of shares

Mountain

Equipment Co-op

Ganong Bros.

Limited

Investing

Purchase of longterm investments

Purchase of

production

equipment

Purchase of store

fixtures

Purchase of

production

equipment

Purchase office

equipment

Purchase of store

fixtures

Operating

Sale of books

Payment for fish

Payment for

inventory

Payment of utility

bill

Payment of

interest on savings

accounts

Payment of wages

and benefits

(b)

Financing

Sale of shares is common to all corporations. Issue of debt is common to all

corporations. Borrowing from a bank is common to all businesses. Payment of

dividends is common to all corporations. Sale of bonds is common to large

corporations

Investing

Purchase and sale of property, plant, and equipment would be common to all

businesses—the types of assets would vary according to the nature of the

business. Some types of businesses require a larger investment in long-lived

assets. A new business or expanding business would be more apt to be acquiring

assets.

Solutions Manual

1-30

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-2B (Continued)

(b) (Continued)

Operating

The activities identified would be common to most businesses with the exception

of the payment of interest on savings accounts. The source of the cash receipt

(e.g., sale of books) and cash payment (e.g., payment for fish) would vary by the

nature of the business.

Solutions Manual

1-31

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-3B

Accounts payable and accrued charges

Accounts receivable

Common shares

Income and other taxes payable

Interest expense

Inventories

Long-term debt

Property and equipment

Sales

Solutions Manual

1-32

(a)

L

A

SE

L

E

A

L

A

R

(b)

O

O

F

O

O

O

F

I

O

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Solutions Manual

Financial Accounting, Second Canadian Edition

1-33

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-4B

(a)

In deciding to extend credit to a new customer, The North Face Inc. would

focus its attention on the balance sheet. The terms of credit they are

extending require repayment in a short period of time. Funds to repay the

credit would come from cash on hand. The balance sheet will show if the

company has enough cash to meet its obligations.

(b)

An investor purchasing common shares of Books Online that they intend to

hold for a long period of time, 5 years, should focus on the company’s

statement of earnings. The statement of earnings reports the company’s

past performance in terms of revenues, expenses and net earnings. This is

generally regarded as a good indicator of the company’s future

performance.

(c)

In deciding whether to extend a loan the Caisse D’Economie Base Montréal

is interested in two things—the ability of the company to make interest

payments on an annual basis for the next five years and the ability to repay

the principal amount at the end of five years. In order to evaluate both of

these factors the focus should be on the cash flow statement. This

statement provides information on the cash the company generates from its

operations on an ongoing basis. This will be the most important factor in

determining if the company will survive and be able to repay the loan.

(d)

The CEO should focus on the cash flow statement as this statement clearly

sets out the cash generated from operating activities and the amount the

company has spent in the past on purchasing equipment and paying

dividends.

Note to instructor: Other answers may be valid provided they are properly

supported.

Solutions Manual

1-34

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-5B

ONE PLANET COSMETICS CORP.

Statement of Earnings

Month Ended June 30, 2004

Revenues

Service revenue

Expenses

Supplies expense

Gas and oil expense

Advertising expense

Utilities expense

Total expenses

Earnings before income taxes

Income tax expense

Net earnings

$8,000

1,200

900

500

0 300

2,900

5,100

1,500

$3,600

ONE PLANET COSMETICS CORP.

Statement of Retained Earnings

Month Ended June 30, 2004

Retained earnings, June 1

Add: Net earnings

000$

0

0 3,600

3,600

Less: Dividends

1,700

Retained earnings, June 30

$1,900

Solutions Manual

1-35

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-5B (Continued)

ONE PLANET COSMETICS CORP.

Balance Sheet

June 30, 2004

Assets

Cash

Accounts receivable

Cosmetic supplies

Equipment

Total assets

$ 6,000

4,000

2,400

30,000

$42,400

Liabilities and Shareholders’ Equity

Liabilities

Notes payable

Accounts payable

Total liabilities

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

Solutions Manual

1-36

$13,000

1,300

14,300

26,200

1,900

28,100

$42,400

0

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-6B

Maison Corporation should include the following items in its cash flow statement:

Cash, January 1, 2004

Cash paid to suppliers

Cash dividends paid

Cash paid to purchase equipment

Cash received from customers

MAISON CORPORATION

Cash Flow Statement

Year Ended December 31, 2004

Operating activities

Cash received from customers

$120,000

Cash paid to suppliers

(90,000)

Cash provided by operating activities

$30,000

Investing activities

Cash paid to purchase equipment

$(15,000)

Cash used by investing activities

(15,000)

Financing activities

Cash dividends paid

Cash used by financing activities

(11,000)

Increase in cash

Cash, January 1, 2004

Cash, December 31, 2004

Solutions Manual

1-37

$(11,000)

4,000

50,000

$54,000

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-7B

(a)

1.

The economic entity assumption states that economic events can be

identified with a particular unit of accountability. Since the boat actually

belongs to Guy Gélinas—not to GG Corporation—it should not be reported

on the corporation's balance sheet. Likewise, the boat loan is a personal

loan of Guy's—not a liability of GG Corporation.

2.

The cost principle dictates that assets are recorded at their original cost.

Therefore, reporting the inventory at $30,000 would be improper and

violates the cost principle. The inventory should be reported at $15,000.

3.

Including the personal loan Guy made to his brother would be a violation of

the economic entity assumption. The $5,000 is not an asset of GG

Corporation—it is a personal asset of Guy Gélinas.

(b)

GG CORPORATION

Balance Sheet

December 31, 2004

Assets

Cash

Accounts receivable

Inventory

Total assets

$20,000

45,000

15,000

$80,000

Liabilities and Shareholders’ Equity

Liabilities

Accounts payable

Notes payable

Total liabilities

Shareholders’ equity

Total liabilities and shareholders’ equity

$40,000

15,000

55,000

25,000*

$80,000

*$80,000 – $55,000 = $25,000

Solutions Manual

1-38

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-8B

(a)

(b)

i.

Common shares = Total liabilities and Shareholders’ equity –

(Liabilities + Retained earnings)

Common shares = $65,000 - ($7,000 + $25,000)

Common shares = $33,000

ii.

Retained earnings = $25,000 (from statement of retained earnings)

iii.

Operating expenses = Revenue - Earnings before income tax

Operating expenses = $80,000 - $30,000

Operating expenses = $50,000

iv.

Net earnings = Earnings before income tax - Income tax expense

Net earnings = $30,000 - $10,000

Net earnings = $20,000

v.

Net earnings (from (iv)) = $20,000

In preparing the financial statements, the first statement to be prepared is

the statement of earnings. The net earnings figure is used in the statement

of retained earnings to calculate the ending balance of retained earnings.

The balance sheet is then completed using the balance of retained

earnings as calculated in the statement of retained earnings. Finally the

cash flow statement is completed using information from the statement of

earnings (e.g. net earnings) and balance sheet (e.g. cash balance).

Solutions Manual

1-39

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 1-9B

(a)

Seco Corporation has violated the full disclosure principle. The information

on the lawsuit could have a significant effect on its financial results and

condition and would be important to users of its financial statements.

(b)

By recording the ‘value’ of its people, Dot.com Corporation is violating the

monetary unit assumption. It is estimating and recording the value of the

‘assets’ but at the present time there is no method to measure this value in

monetary terms.

(c)

Barton, Inc. is violating the cost principle by increasing the amount recorded

for its inventory. The inventory must be recorded at its cost to the

company—that is, the amount the company paid to acquire it.

(d)

Bonilla Corp. is violating the time period assumption. This assumption

states that the life of a business can be divided into artificial time periods

and that useful reports can be generated covering those periods. As a

minimum, reports should be produced annually.

(e)

Steph Wolfson has violated the economic entity assumption. In order to

properly report the financial condition and performance of the company, her

personal assets must not be recorded in the company’s accounts. She

should have recorded payment of company funds for the purchase of a

personal asset as an amount owing by her to the company.

Solutions Manual

1-40

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-1 FINANCIAL REPORTING PROBLEM

(a)

Loblaw’s financial statements cover a 52-week period. Its fiscal year end is 52 weeks

after the start. It will fall on the closest Saturday to December 31.

(b)

Loblaw’s total assets at December 28, 2002 were $11,110 million and its total liabilities

and shareholders’ equity were the same amount of $11,110 million.

(c)

Loblaw’s had cash of $823 million and short-term investments of $304 million for a total

of $1,127 million on December 28, 2002.

(d)

Loblaw’s had accounts payable and accrued liabilities totalling $2,336 million at the end

of their 2002 fiscal year and $2,291 million at the end of their 2001 fiscal year.

(e)

Loblaw reports net sales for two consecutive years as follows:

2002

2001

(f)

$23,082 million

$21,486 million

From 2001 to 2002, Loblaw’s net earnings increased $165 million ($728 - $563).

Solutions Manual

1-41

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-2 COMPARATIVE ANALYSIS PROBLEM

(a)

1.

2.

3.

4.

(b)

Total assets

Receivables

Net sales

Net earnings

Loblaw

(amounts in millions)

$11,110

605

23,082

728

Sobeys

(amounts in millions)

$ 3,192.5

285.4

10,414.5

179.0

Loblaw's total assets were approximately 3.5 times greater ($11,110 vs. $3,192.5) than

Sobeys’ total assets. Loblaw's accounts receivable were approximately 212% more than

Sobeys’ and represent 2.6% ($605 ÷ $23,085) of its net sales. Sobeys’ accounts

receivable amounted to 2.7% ($285 ÷ $10,414.5) of its net sales. Loblaw’s net sales

were approximately 2.2 times as large as Sobeys’ net sales. In addition, Loblaw's net

earnings were almost 4.0 times more than Sobeys.

It can be seen from this information that both companies appear profitable but that

Loblaws is a much larger business.

Solutions Manual

1-42

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

BYP 1-3

(a)

Financial Accounting, Second Canadian Edition

RESEARCH CASE

The ten red flags that investors should look for to ensure that the statement of earnings

reflects the company’s bottom line are:

Companies taking a “Big Bath”

Highlighting everything but the bad stuff

Companies attempting to move debt off the balance sheet

Revisions to the company’s pension plan

Turning expenses into assets

Earnings that are not from operations and not expected to recur

The accounting treatment of stock option plans

“Channel-stuffing” or moving inventory to distributors to improve performance

Companies which change accounting standards from US to Canadian GAAP or

vice versa

10. Information in the notes to the financial statement such as the addition of a going

concern note.

1.

2.

3.

4.

5.

6.

7.

8.

9.

(b)

A shareholder should read the notes to the financial statements. According to Al Rosen,

“the footnotes to the financial statements are a treasure trove of information," He

suggests that users "Read the footnotes first. After seeing all the ways a company

has bent, spindled and mutilated its earnings, you may have an entirely

different outlook on the company."

(c)

According to the research article, Toronto-based e-commerce company Microforum Inc.

was involved in a scandal in September 2000.

Solutions Manual

1-43

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-4 INTREPRETING FINANCIAL STATEMENTS

(a)

A creditor might be concerned about the decline in the amount of cash and short-term

deposits. They may feel that the ability of the company to meet its debt obligations is

reduced. In particular they may be concerned that the company spent more on investing

and financing activities than they generated from operating activities. They may be

concerned that the company is financing property, plant, and equipment from operating

funds. Creditors may want to look at the company’s balance sheet to examine the

overall debt position of the company.

(b)

An investor would be concerned about the fact that the auditors are questioning the

continued viability of this company. The inability of the company to generate cash from

operations and the fact that the company is disposing of significant assets to raise cash

world cause them to reconsider whether they want to continue to invest in this company.

(c)

I would be interested in seeing their projections for future sales growth and profitability. I

would also want to see their interim financial statements to see how the company is

performing in the current year.

Solutions Manual

1-44

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-5 INTERPRETING FINANCIAL STATEMENTS

(a)

Its most important economic resources are its human resources—skills, talent and

knowledge of it staff and its customer base. These assets are not currently reported on

the balance sheet.

(b)

The balance sheet does not tell you what the company is worth. It does give you limited

information on the value of the company. Cash and accounts receivable are reported at

their realizable values. And, if the market value of assets such as inventory, investments

or goodwill are lower than their cost, they are written down to market value rather than

cost. This is a subject we will study in later chapters.

Generally, however, the value of the assets reported on the balance sheet does not

indicate the market value of the company’s assets (e.g., capital assets) nor does it

include the value of unrecorded assets as discussed in (a).

(c)

The most likely reason for the company preparing its statements in US dollars is that

most of the users of the statements (e.g. investors and creditors) are in the United

States or in other countries where US dollars are the standard currency.

Solutions Manual

1-45

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-6 A GLOBAL FOCUS

Nestlé follows the standards issued by the International Accounting Standards Committee.

Ganong’s is a Canadian company and therefore follows the standards issued by the Canadian

Institute of Chartered Accountants. To the extent that these standards differ, then comparison

may be difficult.

There are at least two issues here. First, Nestlé’s financial reports are prepared under the

historical cost convention. As noted in the chapter, the cost principle underlies Canadian

accounting standards. Thus, this would assist comparison. The second issue relates to the full

disclosure principle discussed in the chapter. It is noted that Nestlé provides disclosures as

required by the “4th and 7th European Union company law directives.” To the extent that these

disclosure requirements differ from Canadian disclosure requirements comparison may be

impeded.

There is also a concern related to the monetary unit assumption. In the Canadian financial

statements are prepared in terms of Canadian dollars. Nestlé prepares its statements in terms

of Swiss francs. While conversion from francs to dollars is possible, it will not necessarily

capture the full economic situation.

Solutions Manual

1-46

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-7 FINANCIAL ANALYSIS ON THE WEB

Due to the frequency of change with regard to information available on the World Wide Web,

the Accounting on the Web cases are updated as required. Their suggested solutions are also

updated whenever necessary, and can be found online in the Instructor Resources section of

our home page <www.wiley.com/canada/kimmel>.

Solutions Manual

1-47

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

BYP 1-8

(a)

(b)

Financial Accounting, Second Canadian Edition

COLLABORATIVE LEARNING ACTIVITY

1.

The donation of materials is clearly an expense of the business. The donations of

temporary help are also likely an expense of the business, since the donation of

the employees' time is made by Kelly Services. The employees still receive their

pay, but the employer is not required to pay Kelly. Of course, if the employees

donated their own time, these would be personal expenses. However, that is not

likely.

2.

The donation of the gladiolas was an expense of the business; the planting of the

gardens was likely on the employees' own time and therefore any costs incurred

were personal expenses of the employees.

3.

Clearly a business expense, since the payment is made by Kelly Services to the

charity.

4.

This may be either a personal expense or a corporate expense. Executives are

not paid on an hourly basis and this may not be part of their corporate

responsibilities, in which case this would not be a corporate expense. However

companies are increasingly encouraging or requiring this type of activity on the

part of their executives’ responsibilities, in which case it would be a corporate

expense.

1.

For the materials, Advertising Expense is the most likely category of those listed

because the company's name was on all the gifts. It might be a Charitable

Contribution Expense, but since the gifts were of a general nature and contained

the name of the donor, rather than the recipient, it is not as likely. The most likely

category for the donation of temporary help is Employee Wages Expense,

although it might be categorized as Charitable Contribution Expense since the

time was donated.

2.

Charitable Contribution Expense is the most likely. It is not Grounds Maintenance

Expense because the grounds maintained are not those of the company. The

employees' time is not recorded in the company records, of course, since the time

was volunteered.

3.

Clearly Charitable Contribution Expense.

4.

No additional cost was incurred over and above the executives’ regular

remuneration. Therefore it is not recorded in the company's records.

Solutions Manual

1-48

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-9 COMMUNICATION ACTIVITY

To:

Karen Staudinger

From:

Student

I have received the balance sheet of Vermon Company, Inc. as of December 31, 2004.

The purpose of the balance sheet is to report, at a specific point in time, the assets of the

business and any claims to those assets.

A number of items in this balance sheet are not properly reported. They are:

1.

The balance sheet should be dated as at a specific date, not for a period of time.

Therefore, it should be dated "December 31, 2004."

2.

On the balance sheet the assets are listed in terms of liquidity, with the most liquid

assets being shown first. Therefore, Equipment should be below Supplies on the

balance sheet.

3.

Accounts receivable should be shown as an asset and reported between Cash and

Supplies on the balance sheet.

4.

Accounts payable should be shown as a liability, not an asset. The notes payable is also

a liability and should be reported in the liability section.

5.

Liabilities and shareholders’ equity should be shown separately on the balance sheet.

Common Shares, Retained Earnings, and Dividends are not liabilities.

6.

Common Shares, Retained Earnings, and Dividends are part of shareholders’ equity.

The Dividends account is not reported on the balance sheet but is subtracted from

Retained Earnings to arrive at the ending balance for Retained Earnings.

Solutions Manual

1-49

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-9 (Continued)

A correct balance sheet is as follows:

VERMON COMPANY, INC.

Balance Sheet

December 31, 2004

Assets

Cash

Accounts receivable

Supplies

Equipment

Total assets

$10,500

3,000

2,000

20,500

$36,000

Liabilities and Shareholders’ Equity

Liabilities

Notes payable

Accounts payable

Total liabilities

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

*Retained earnings

Less: Dividends

Ending retained earnings

Solutions Manual

1-50

$12,000

5,000

17,000

11,000

8,000*

19,000

$36,000

$10,000

2,000

$ 8,000

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BYP 1-10

ETHICS CASE

(a)

The stakeholders in this situation are the new CEO and CFO, and the creditors and

investors who rely on the financial statements to make business decisions.

(b)

The CEO and CFO should not sign the certification until they have taken steps to assure

themselves that the most recent reports accurately reflect the activities of the business.

However, as the current management of the company, they cannot refuse to sign the

certification just because they are new. They are the management team now and must

accept the responsibility that goes with these positions.

(c)

The CEO and CFO have no alternative other than to take the steps necessary to assure

themselves of the accuracy of the financial information, and, if accurate, sign the

certification. If the information is not accurate, they need to make the required

corrections to the financial information.

Solutions Manual

1-51

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Legal Notice

Copyright

Copyright © 2004 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved.

The data contained in these files are protected by copyright. This manual is furnished under licence and may be

used only in accordance with the terms of such licence.

The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made

available on a network, used to create derivative works, or transmitted in any form or by any means, electronic,

mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley &

Sons Canada, Ltd.

Solutions Manual

1-52

Chapter 1

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.