Agenda Plug WCAG Meeting Tests Prospectus

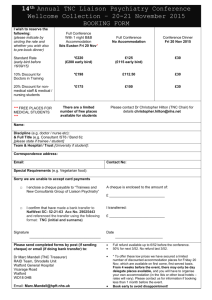

advertisement

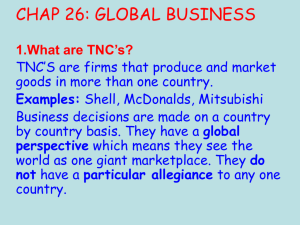

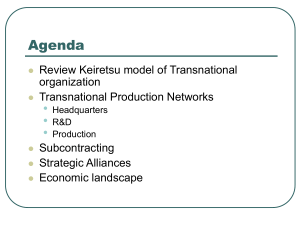

Agenda Plug WCAG Meeting Field Trip Tests 60-83: Mean of 70.4 Prospectus Topics roll-call TNC The Transnational Corporation TNC=MNC=MNE Significance Macro-Level Theory: Circuits of Capital Micro-Level Theory: Thursday Models of TNC development In what sense “global corporations”? Webs of enterprise – internal organization Organization structures Restructuring and rationalization Geographical organization of production Webs of enterprise – external relationships Japanese keiretsu structures Supplier links and subcontracting Explaining the TNC Is explaining FDI tantamount to explaining the TNC? No! FDI is one measure, asset ownership TNC operations are significant for other reasons: Strategic alliances Coordinate and control transactions with other firms and governments Characteristics of the TNC Coordinate and control transactions within production networks Domestically Globally Capacity to exploit geographical differences in factor costs and in state regulatory policies Geographical flexibility – ability to switch operations between locations at a global scale Circuits of Capital Macro-scale model Interconnection of trade in: Finance Production Commodity M–C…P…C’-M’ Let’s unpack this Circuits of Capital M–C…P…C’-M’ ’ increase in value – transaction … interruption in circulation during transformatio M is money capital C is commodity capital P is Process of production Productive capital Around and around we go accumulating capital Developmental Models MNC Growth Graphic description Sequential process Flow chart from domestic firm to TNC Except that there are no true prerequisite steps! Source: Dicken 1998: 191 Schematic Model Iconic model Emphasizing spatial/ regional expansion Stages of growth Trade barriers Hakanson (1979) Grid model A way of conceptualizing two fundamental dimensions Static typology or classification OR Dynamic model showing development pathway? Eclectic Paradigm of TNC Growth & Development Microlevel model Stephen Hymer and John Dunning Firms will internationalize when three conditions are met: Ownership-specific advantages Internalization Location specific advantages Eclectic Paradigm: Ownership-specific advantages O-S A are ‘assets’ internal to the firm Information or knowledge-based Legally protected, proprietary Brand and reputation Organization Human skills Size and market power Eclectic Paradigm: Internalization Why internalize (DiY)? After all: Could export goods Could license technology Market imperfections Uncertainty about export access and foreign exchange Uncertainty about control over proprietary technology and quality Internalization also driven to gain control over Quality/cost/availability of critical inputs Eclectic Paradigm: Location-specific advantages Locational advantages available on the same terms to all firms whatever their size or nationality (??) Access to: Markets Resources Production costs Political stability/cultural affinity A Critique of the Global Firm Concept… A Typology of Enterprise: From Domestic to Global I Domestic Company: Most revenues in home market Products and processes are primarily for serving domestic customers International Company: Significant percentage of revenues in international activities but domestic market is dominant Overseas operations seen as appendage to domestic ops. May have separate international division Significant distinctions in products and processes made between domestic and foreign customers A Typology of Enterprise: From Domestic to Global II Multinational or Multidomestic Company: Extensive international revenues and activities Strong country organizations and many value chain activities duplicated around world Decisions focused on local customer and local markets Limited coordination across borders Global Company: Makes key strategic decisions on globally integrated basis Value chain is geographically specialized and networked Products and processes are designed to be global with capability for local adaptation at minimal cost A Typology of Enterprise: From Domestic to Global III What kind of model is this? Source: "The Challenge of Global Customer Management" Marketing Management; Chicago; Winter 2000; David B. Montgomery, George S. Yip. Are TNCs Truly Global and Stateless”? Criteria for Identifying Global Firms Where are the bulk of assets? Where are most employees? Where is the parent company owned and controlled? What is the nationality of the senior executives? What is the nationality of subsidiary managers? Where would firm turn for diplomatic protection? Where are worldwide earnings taxable? Source: Hu 1992 California Management Review Measuring Global Scope Rank by Ri Ri Index of transnationality: average of three ratios (proportions) Foreign assets/total assets Foreign sales/total sales Foreign employment/total employment Let’s look at how they rank! (Table 7.2) Ranked by TNI What do we learn from this data? Largest TNC (GE) in foreign assets, ranks 75 in TNI 4th largest TNC (GM) in foreign assets ranks 83 6th largest TNC (Toyota) in foreign assets ranks 82 Can they be really global? What do we learn from this data? Largest TNCs are national corporations with international operations They remain distinctively tied to home base They retain a local ‘embeddedness’ Local origins influence how firms develop and behave Webs of enterprise – internal organization Organization structures Functional Product Regional Restructuring and rationalization Geographical organization of production Organization structures of TNCs Internal networks Locational adjustment & rationalization in a multiproduct TNC Organizing production in space Organizing production in space + trade links Exported finished product External Networks Transactions between firms Supplier linkages Parts, components, subassemblies Subcontractors Local to global scale linkages Web of trade, transactions, relationships Deep integration Keiretsu – Japanese Style of Interfirm Alliances Vertical Keiretsu Horizontal Keiretsu Keiretsu Stable, long term, exclusive affiliations which form identifiable groups Families of related companies based on mutual obligations Ties are based on familial relationships, friendship, interlocking directorships, financial links Reminiscent of Japanese feudalism Keiretsu Schematic Diagram Horizontal keiretsu Diversified Groups centred on banks manufacturing trading companies - sogo shosha life insurance other financial Horizontal keiretsu, some with origins to the pre 1945 zaibatsu Vertical keiretsu Centred on large parent firm in one industry e.g. Toyota (automotive) Sony (electronics) Kirin (brewing) Suppliers have suppliers which have suppliers a nested hierarchy of progressively smaller firms Satellite firm can supply only one larger firm Sub-contractors: shitauke Vertical keiretsu, focused on industries and vertically linked to satellite firms (not shown) Combining horizontal and vertical keiretsu, we get… Webs of Enterprise! Links between horizontally and vertically structured keiretsu Focus on major automobile producers as vertical keiretsu: Note mainly exclusive links to banks, hence to other manufacturing industries and suppliers