Introduction to Grant Budgeting OFFICE OF SPONSORED PROGRAMS AND

advertisement

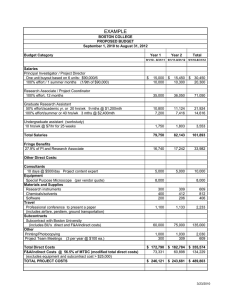

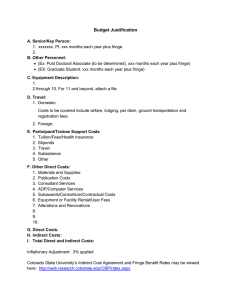

Introduction to Grant Budgeting OFFICE OF SPONSORED PROGRAMS AND UNIVERSITY ADVANCEMENT Questions to ask before preparing the budget: o What is the typical size of awards from this sponsor? o What are the real costs associated with conducting this project? o What items will the sponsor support/not support? o Does the sponsor provide flexibility to re-budget between categories once funds are awarded? o Is cost sharing mandatory/disallowed? o What can I do with a reduced award amount? The narrative/project description should drive the budget: o There should be no surprises for the reviewer familiar with the narrative/project description o Cost estimates should be credible o The requested budget should be consistent with the typical award given by the sponsor o Divide the projected costs by the number of participants to determine if your price per participant is reasonable An example of a recent grant awarded through the Walmart Foundation’s State Giving Program: The Foundation, based on a recommendation from the Virginia Advisory Council (Walmart State Giving Program), awarded a $40,000 grant to the Virginia Association of Free Clinics (VAFC). VAFC operates 33 clinics throughout Virginia and offers free dental care to qualifying individuals without healthcare coverage. This grant funded the cost of the equipment needed to cover three dental exams for 600 patients. An example of a recent grant awarded through the Andrew W. Mellon’s Higher Education and Scholarship Program: Franklin & Marshall College, Lancaster, Pennsylvania received a grant of $500,000 to support integration of the Phillips Museum of Art and the Franklin & Marshall curriculum. An example of a recent grant awarded from the Geraldine R. Dodge Foundation: The Rutgers-Camden Center for the Arts received $40,000 for general operating support of educational and community outreach programs in Camden including Pre/K-12 Arts-in-Education Programs, Arts Integrated Curriculum & Teacher Development Programs and Community Arts Programs. Cost of conducting the project: The formula for calculating the cost of conducting a project is: + + direct costs indirect costs (F & A) cost sharing total costs What are direct costs? o o o o o o o o o o o Salaries and wages Fringe benefits Consulting/stipends Travel Equipment Materials/supplies Subawards/subcontracts Publication Dissemination Participant support costs Other “Other” may include: o Student tuition & fees o Advertising fees o Rental fees FY14 fringe rates: •50.75% full-time new employees •7.65% overload, summer, course release, or part-time No fringe on student wages Fringe costs Rates are set by the State and change every year, usually around December-January. Pension 11.29% Health Benefits 30.06% Workers Comp 1.15% Unemployment Insurance .16% Temporary Disability Ins .27% Unused Sick Leave .17% FICA 6.20% Medicare 1.45% Hidden costs to be a university employee FY14 fringe: 50.75% FY15 estimate: 53% A copy of the current fringe rate agreement can be found linked to our home page: www.rowan.edu/grants What fringe rate do I use? Use 50.75% when you are budgeting for: A new, full-time employee or post-doc Use 7.65% when you are budgeting for: Existing, non grant funded employees Any part-time non student employee Overload/course release/buyout/summer No fringe on: undergrad or grad students What are indirect costs? Also referred to as overhead or Facilities & Administrative costs (F&A). These are costs associated with operating a project o Universities have a federally approved rate o Rowan’s current rate is 45% of Modified Total Direct Costs (MTDC) for on-campus projects. The off-campus rate (i.e. pay rent) is 17% MTDC. Industry-sponsored projects are 21% MTDC. o Many foundation/corporations do not allow indirect costs Current rate agreement covers period July 1, 2012-June 30, 2016. A copy can be found linked to our homepage: www.rowan.edu/grants “This is the easy part. The challenge will be figuring out the indirect costs for the grant proposal.” MTDC MTDC include all direct costs EXCEPT: Equipment over $5000/unit (anything under this value is considered “supplies”) Charges for patient care Student tuition remission Rental costs of off-site facilities Scholarships and fellowships The portion of each subaward in excess of $25,000 Determining MTDC Supplies $2000 Travel $1500 Graduate Assistant $15,000 Tuition remission $30,000 Subcontract $30,000 Giant calculator $6000 Total direct costs: $84,500 Which of these are included in the MTDC base? Supplies $2000 Travel $1500 Graduate Assistant $15,000 Subcontract $25,000 MTDC (45%) $43,500 Indirect $19,575 Other costs: Giant calculator $6,000 Tuition remission $30,000 Remainder of subcontract $5,000 TOTAL COSTS: $104,075 What is cost sharing? Defined as that portion of the project costs not borne by the sponsor and borne by the university or third-party o Can include: o Cash, supplies, or equipment donations o Use of space/facilities o Cost of renovating the space o Indirect costs (if sponsor has rate restriction) o Salaries/fringe o Volunteered time/services o Can be mandatory, voluntary, or disallowed o Must be approved by chair and dean o Must be verifiable Budget Appearance Counts o Use the budget format requested o If no format is provided, we can provide a template o Round figures to the nearest dollar o Consider including an annual increase for multi-year budgets Budget Draft Total Project Amount Requested Other Funding Costs from Sponsor Cost Share Super Principal Investigator (base $80,000/10 x 1 summer month) $8,000 $0 $8,000 Lab technician ($15/hr x 20 hrs x 15 weeks) $4,500 $4,500 $0 Five undergraduate students ($7/hr x 10 hrs x 5 weeks) $1,750 $1,750 $0 $14,250 $6,250 $8,000 $956 $344 $612 $956 $344 $612 Supplies/Materials $2,500 $2,500 $0 Domestic Travel $2,000 $2,000 $0 Publication costs $500 $500 $0 Server $5,000 $5,000 $0 MTDC $20,206 $11,594 $8,612 Indirect Costs (45% MTDC) $9,093 $5,217 $3,875 Total Costs $34,299 $21,811 $12,487 Personnel: Sub-Total Personnel Fringes: PI, Lab Technician Fringes (7.65%) Sub-Total Fringes Other Direct Costs: Don’t forget to include a budget justification! I received an award …. Now what? The Notice of Award: o Is a legal document issued to notify the grantee that an award has been made and details the terms and condition of the award. Typically includes information about: o o o o o Relevant regulations Amount of funding Project and budget period Restrictions on the expenditure of the funds Reporting requirements o Accepting the award- must be facilitated by OSP/CFR o Only the person authorized to legally represent Rowan may sign for an award Things to Remember: o Awardees are responsible for managing the day-to-day o o o o operations of their award and for submitting required narrative/technical reports during the life of the award OSP/CFR will work with you to submit proposals and reports A Banner fund number will be assigned to your award Need to know whether budget transfers/time extensions permitted or whether prior approval is required Any deviation of contract/work/timeline must be approved by OSP/CFR and the sponsor Questions? Office of University Advancement Deanne Farrell, Director of Corporate and Foundation Relations (x5418) farrelld@rowan.edu Wesley Allen, Associate Director of Corporate and Foundation Relations; (x2408); allen@rowan.edu Office of Sponsored Programs Stephanie Lezotte, Director (x4124) lezotte@rowan.edu Next Workshop: Oct. 16 9:30-10:30 Writing Winning Grant Proposals Shpeen Hall, Conference Room 204 Upcoming Workshops 10/16 & 11/11 Writing Winning Proposals 10/29: Effort Reporting 11/7: Creating Complex Grant Budgets 11/13: Promoting Your Project 11/21: Administering Your Award 12/1: Stewardship and Reporting Check the Rowan Announcer for locations and times!