Ray Massey Commercial Ag Program Crops Economist

advertisement

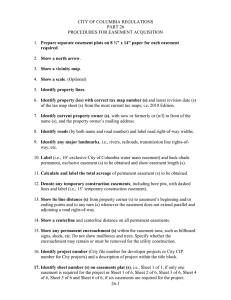

Ray Massey Commercial Ag Program Crops Economist 2009-2010 NCRMEC grant funded program Held five 3-hour meetings in Missouri; presented partial material in many more meetings. Results from post workshop surveys: Decided not to enter into a contract Pursued further information before contracting Decided to enter into a contract Agebb.missouri.edu/massey.htm Environmental Markets contains guides and powerpoint presentations http://www.agrisk.umn.edu/ Grant Received Educational Program Conducted General environmental market information General contract information Topic 1: GHG markets Topic 2: Energy markets Discussion/Activity regarding cooperative activities in new markets http://www.gallup.com/poll/117079/Water-Pollution-Americans-Top-Green-Concern.aspx Ag Involved Ag Involved Fair Amount Ag Involved Ag Involved Great Deal Ag Involved Percent responding very concerned or fairly concerned 90 80 70 60 50 40 30 20 10 0 Market Niches: Local foods Organic foods Natural foods Energy markets: Ethanol Biodiesel Biomass Wind energy Methane derived electricity Greenhouse Gas Markets: Soil carbon sequestration Forest carbon sequestration Methane destruction (from manure storages) Easements: Conservation Farmland Preservation Power line Pipeline Contracts are the most common way of participating in emerging markets. Participation in new markets uses contracts because the new responsibilities, rewards and risks are evolving. Contracts are a way of fostering the necessary dialogue. Policy involvement is also a method of opening or creating and participating in new markets. Contracts Opportunity for Return (Profit) Possibility of Risk (Loss) Assumption of Responsibilities Guide: Contracts in Agriculture Didn’t have a significant PowerPoint presentation Input based: Organic contract requires only that you follow certain steps. Soil carbon sequestration contract only requires that you use no-till production system. Output based: Wind energy contracts are based on kilowatt hours of electricity produced. Methane destruction contracts based on tons of methane destroyed. Assets that can do only one thing are more risky, and potentially rewarding, than an asset that can do multiple things Grain bin has high asset specificity Tractor has low asset specificity New contracts with high asset specificity Lagoon covers for methane destruction - risky Ridge tops with high wind speeds - rewarding Contracts cannot contain every possible outcome so they try to talk about the most likely outcomes or the most important outcomes. Where a contract does not specify an outcome, there is opportunity for reward or risk. Contractual incompleteness is often called loopholes. Guides Agriculture and Greenhouse Gas Emissions Introduction to Greenhouse Gas Markets and Cap- and-Trade Presentations Emerging Environmental Markets Greenhouse gas limitations have the Potential to profit agriculture Potential to regulate agriculture Which is the greatest potential and how will it impact agriculture? Is agriculture a source of offsets or a source of emissions? Stationary Coal Combustion Road Fuel Stationary Gas Combustion Stationary Oil Combustion Aviation Fuel Direct Fertilizers (N2O) Enteric Fermentation (CH4) Non-Energy Fuel Use Landfills Ozone Depleting Substances Natural Gas Systems Iron and Steel Production Coal Mining Marine Fuel Cement Manufacture Manure Management (CH4) Indirect Applied Nitrogen (N2O) 0 500 1000 1500 Source: EPA. Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2007 2000 2500 Agriculture Can Provide Environmental Benefits via: Carbon Sequestration in soils and forests Methane Capture and Destruction Renewable Fuels Increased Efficiency Permanent Additional Verifiable Enforceable http://www.chicagoclimatex.com/market/data/summary.jsf 1/12/10 Failure to comply with responsibilities results in fines and penalties. 5 year contract reduces flexibility in land management. Don’t know the price that you will receive. CCX Market is set to expire in 2010. Aggregators are not bonded. Land tenure changes do not nullify the contract. Receive money for offsets provided. May receive this for no additional work if already using conservation practices. 20% of offsets are held until the end to insure compliance Presentations Wind Energy Leasing – Shannon Ferrell Environmental Contracts – Shannon Ferrell 1. How will your current uses of the property be affected by the project? 2. How long will agreement last? 3. What are your obligations under the agreement? 4. How will you be compensated? 5. What happens when the project ends? $12.00 Dollars/bushel $10.00 Ethanol Revenue Max Corn Price Actual Corn Price Corn Production Cost $8.00 $6.00 $4.00 $2.00 Source: ISU AgDecisionMaker Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 Sep-06 May-06 Jan-06 Sep-05 May-05 Jan-05 $- Energy (gas, electricity, etc.) is a commodity. Agricultural inputs (corn, biomass) into energy are a commodity. Eventually all commodity prices tend to zero profit. New energy markets pose new profit opportunities new risk opportunities New markets are frequently fostered by legislation or regulation. Opportunity for profit in affected markets. Subsidies are political decisions: $1/gallon biodiesel subsidy ended Jan 1, 2010. Guide What Landowners Should Know When Considering Conservation Easements by Hoag, Marshall, Seidl and Mucklow. An easement is a legal agreement between a landowner and another party that permanently limits the use of the specified property. Examples business – power and pipe lines easements non-profit organization – conservation easements government agency – Grassland Reserve Program or public access to land Easements always limit land use and, therefore, almost always reduce the market value of the land. Easements can increase the value of surrounding land because it bestows some benefit Preserves the scene Creates a buffer from encroachment Missing Tax Benefits Requires a permanent easement Requires that the easement grants public interest values to the grantee (party receiving the grant) Costs associated with selling an easement can be significant and the easement might never materialize. You and the easement holder disagree on the interpretation of the property rights each of you possess. Does agricultural use only allow a horse boarding stable? A confined hog operation? Easement holders possess a property right – one that they can sell if they desire. If the value of the land becomes great enough the easement holder may allow it to be “developed” for a price. Presentation When Personal and Group Interests Conflict Ray Massey Commercial Ag Program Crops Economist