Document 16038590

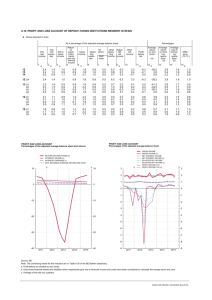

advertisement

PART 1 (OPEN TO THE PUBLIC) ITEM NO. REPORT OF THE STRATEGIC DIRECTOR OF CUSTOMER AND SUPPORT SERVICES TO THE BUDGET SCRUTINY COMMITTEE ON WEDNESDAY, 7th JUNE 2006 TITLE: REVENUE BUDGET 2006/07: BUDGET MONITORING RECOMMENDATION: Members are invited to comment on the contents of the report and to request the Strategic Director of Children’s Services to report back to the next meeting on plans to contain expenditure on outside placements for children in care within the directorate’s budget allocation. EXECUTIVE SUMMARY: The report provides details of the current position relating to budget monitoring for the revenue budget and the implementation of the agreed revenue budget savings for 2006 -2007. BACKGROUND DOCUMENTS: Various working papers and reports. (Available for public inspection) CONTACT OFFICERS: Chris Hesketh Tel. 793 2668 chris.hesketh@salford.gov.uk Colin Kay Tel. 793 3245 colin.kay@salford.gov.uk ASSESSMENT OF RISK: Key budgetary control risks will be identified in reports to this committee in July and September 2006. SOURCE OF FUNDING: Revenue Resources LEGAL ADVICE OBTAINED: Not applicable FINANCIAL ADVICE OBTAINED: This report concerns key aspects of the Council’s revenue finances and has been produced by the Finance Division of Customer and Support Services. WARD(S) TO WHICH REPORT RELATE(S): None specifically KEY COUNCIL POLICIES: 2006/07 Revenue Budget Report Detail 1 Introduction 1.1 In accordance with the ‘White Paper’ “Strong Local Leadership – Quality Public Services”, revised Accounts and Audit Regulations came into force on the 1st April 2003. These regulations amongst other things brought in the requirement to phase in the earlier signing, approval and publication of the statement of accounts. The phasing in process ended last year and for the current year and all future years the accounts need to be completed and approved by the Accounts Committee by the 30th June. 1.2 To try to ensure the revised regulations are adhered to an internal final accounts closure programme has been prepared which incorporates a target completion date of the 16th June 2006. 1.3 Budget monitoring reports are normally presented to members on a monthly basis commencing in the June cycle of meetings when expenditure and income covering the April period are reviewed. 1.4 At this time of year, work in the Accountancy Division is focused on the closure of the final accounts for the previous year and as a consequence of the pressures associated with the need to complete the accounts much earlier a number of accountants may not yet have formally produced reports to their lead member although they have examined their budgets. 1.5 At this early stage of the financial year there is very little indicative financial information available for budget monitoring requirements and reviews are in the main concentrated on salaries and wages and the implementation of agreed savings. 1.6 This report therefore concentrates on salaries and wages expenditure and the progress being made in meeting the agreed revenue budget savings proposals for the year. 2 Budgetary Control Reports 2.1 Issues have arisen with a few budget headings where investigations are currently in hand or new developments have arisen since the budget was determined, ie: Areas of Additional Cost Increase Gas contract renewals have now come in at a 100% increase. This is 40% higher than was originally included in the estimate. Also see paragraph 4.2 below. Children’s Services – The Children in Care budget is once again coming under severe pressure and the first monitoring report is projecting a year-end overspend between £1m and £1.5m assuming all existing children remain in care for the remainder of the year, but excluding new cases coming into care. This budget is currently under discussion between Lead Members for Children’s Services and Customer and Support Services. It should be noted that the Children in Care budget is due to be considered in detail at next month’s meeting. Budmonsep03 2 Areas of Potential Expenditure Reduction/Increased Income Capital Financing – Investment income is currently ahead of budget by £70,000 and debt rescheduling deals on debt of £53m has secured a revenue saving of £95,000 for 2006/07, £265,000 for 2007/08 and £192,000 for 2008/09. Council Tax Revenue The revenue budget assumes the collection of £87.350m in Council Tax revenue to fund the budget, and included an expectation that £1m of additional revenue would be generated from new dwellings. Council tax revenue expected to be collected based upon current bills issued amounts to £87.5m and is therefore on target. Further details will be reported on these issues should they result in a requirement for budget variations as monitoring progresses over the next few months. 3 Progress on agreed savings 3.1 The attached appendix provides details of the approved savings included in the 20062007 revenue budget. 3.2 The appendix will be updated during the year and it will be included as part of the regular monthly monitoring report until the savings have been implemented and achieved. 4 Other Issues 4.1 Members are reminded that the budget for the year includes a 2.95% pay award for local government staff as part of the final year of a three-year pay settlement. The teachers pay increase is met from the schools budget that is now wholly funded by the Dedicated Schools Grant. 4.2 Price inflation has again been limited to a 2.5% increase for charges outside the control of the City Council, whilst no inflationary increase has been allowed for general supplies. A 60% increase has been provided for a gas contract that is due to be renewed in the current year and 12.5% in respect of water. Increases in levies have been provided for at the levy approved by the appropriate bodies. 4.3 Inflationary increases during 2006/07 will require close monitoring and scrutiny, and where they exceed the assumptions will need to be contained within the budget allocations to directorates. The risk assessment of reserves makes allowance for the possibility of excessive inflationary costs being unable to be met by directorates. 5 Budget Risks 5.1 A full budget monitoring exercise will be undertaken each month by all directorates to ensure that any issues and corrective action are identified at an early stage. It is useful however, to identify areas that could represent risks in budgetary control and as a result will be subject to greater scrutiny. 5.2 The key risks identified by the various directorates are to be reported to members in July. Budmonsep03 3 6 Prudential Indicators 6.1 As was reported towards the end of the last financial year it is now a statutory duty under Section 3 of the Local Government Act 2003 for the council to determine its affordable borrowing limits. In determining its limits the council must have regard to the Prudential Code and ensure that total capital investment remains within sustainable limits, in particular that the impact upon its future council tax/rent levels is acceptable. 6.2 The Prudential Code requires the council to set a number of Prudential Indicators, certain of which replace the borrowing/variable interests limits previously determined as part of the Treasury Management Strategy Statement, but also extending the period covered from one to three years. These indicators were included in the 2006/07 Revenue Budget and in the Capital Programme approved by council in March 2006. 6.3 In summary the Prudential Indicators are as follows: a) b) c) d) e) Authorised Limit for External Debt Operational Boundary for External Debt Prudential Indicators for Treasury Management Comparison of Net Borrowing and CFR Maturity Profile The key indicators are detailed in Appendix 2 and have all been met through to 24th May 2006. 7 Summary 7.1 At this early stage in the financial year the budgetary control exercise has already highlighted a potentially large overspend within the Children’s Services directorate and this will be the subject of further investigation and report. Other directorates are not indicating that there are any potential problem areas, however close scrutiny will continue throughout the year to determine if any overspends are likely to occur. 7.2 Some progress has been made in respect of the agreed savings for the year and whilst many have not yet been fully achieved the budget has been adjusted accordingly. Close scrutiny will need to continue throughout the year to ensure that the full amount of savings is achieved. 7.3 The 2005/06 revenue outturn is currently being finalised and a provisional position will be reported separately at today’s meeting. This report has not taken into account any issues for 2006/07 that may arise from the 2005/06 outturn. 8 Recommendation 8.1 Members are invited to comment on the contents of the report and to request the Strategic Director of Children’s Services to report back to the next meeting on plans to contain expenditure on outside placements for children in care within the directorate’s budget allocation. Alan Westwood Strategic Director of Customer and Support Services Budmonsep03 4 Appendix 1 SAVINGS (SUMMARY) Achieved Budget Adjusted On Target Total £000 Budget Adjusted Behind Target £000 £000 CHIEF EXECUTIVE 0 150 0 150 CHILDREN’S SERVICES 0 385 0 385 COMMUNITY, HEALTH & SOCIAL CARE 0 734 0 734 CUSTOMER & SUPPORT SERVICES 0 1,078 0 1,078 ENVIRONMENTAL SERVICES 0 284 0 284 HOUSING & PLANNING 0 349 0 349 TOTAL 0 2,980 0 2,980 Budmonsep03 5 £000 Ref. Description £000 Comments Achieved Budget Adjusted On Target Budget Adjusted Behind Target Total Policy and Improvement – reduce supplies and services Scrutiny Support - reduce printing costs Regeneration and Improvement - reduce initiatives budget Strategy and Regeneration - identify external funding Community Safety - cost recovery of post Community Safety - amendment to structure Economic Development - Opportunities Centre income Economic Development - LABGI Executive Services - PAMIS and travel costs Marketing - re-profile of projects budget Staffing reductions linked to improved attendance management 0 8 0 8 Budget adjusted - being monitored 0 0 6 20 0 0 6 Budget adjusted - being monitored 20 Budget adjusted - being monitored 0 13 0 13 Budget adjusted - being monitored 0 0 0 35 7 4 0 0 0 35 Budget adjusted - being monitored 7 Budget adjusted - being monitored 4 Budget adjusted - being monitored 0 0 0 0 15 3 31 8 0 0 0 0 15 3 31 8 Total 0 150 0 150 Increase in School SLA charges Recharge EIC Director 67% Teacher Net – transfer costs to schools Youth Offending Service reduction in contribution Broadwalk Centre - increased charge rate General reductions Contingency and Development Provision Consortium - seek alternative course provider Staffing reductions linked to improved attendance management 0 0 0 0 30 46 27 40 0 0 0 0 30 46 27 40 Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored 0 0 0 0 50 30 100 30 0 0 0 0 50 30 100 30 Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored 0 32 0 Total 0 385 0 CHIEF EXECUTVE CE1 CE2 CE3 CE4 CE8 CE9 CE10 CE11 Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored SAVINGS (ANALYSIS) CE5 CE6 CE7 CHILDREN’S SERVICES CS5 CS6 CS7 CS8 CS9 6 32 Budget adjusted - being monitored 385 Appendix 1 Contd. CS1 CS2 CS3 CS4 Ref. Description £000 Comments Achieved Budget Adjusted On Target Budget Adjusted Behind Target Total Kenyon Way Community Centre – closure (July 05) SCL - increase rental for use of assets SCL - negotiate share of surplus 0 19 0 19 Budget adjusted - being monitored 0 0 20 47 0 0 20 Budget adjusted - being monitored 47 Budget adjusted - being monitored Domiciliary and Community Care - increase charges by 5% Training - use of grant funding to support budget Transport - review service and charging Staffing - raise casual vacancy rate Residential/Nursing Care – client contributions inflation increase Cleaning services - end subsidy by recovering cost from users Long-term Home Care - reconfigurement of service Staffing reductions linked to improved attendance management 0 45 0 45 Budget adjusted - being monitored 0 30 0 30 Budget adjusted - being monitored 0 0 0 25 180 160 0 0 0 25 Budget adjusted - being monitored 180 Budget adjusted - being monitored 160 Budget adjusted - being monitored 0 70 0 70 Budget adjusted - being monitored 0 50 0 50 Budget adjusted - being monitored 0 88 0 88 Budget adjusted - being monitored Total 0 734 0 734 0 178 0 178 Budget adjusted - being monitored 0 20 0 20 Budget adjusted - being monitored 0 40 0 40 Budget adjusted - being monitored 0 0 0 55 56 66 0 0 0 55 Budget adjusted - being monitored 56 Budget adjusted - being monitored 66 Budget adjusted - being monitored COMMUNITY, HEALTH AND SOCIAL CARE CH1 CH2 CH3 CH4 CH6 CH7 CH8 CH9 CH10 CH11 CU2 CU3 CU4 CU5 CU6 Finance - Financial Support Group - staffing reductions (8.5 FTEs) Finance - Financial Support Group reduction in transaction costs Finance - Computer Audit - staffing reduction (1 FTE) Human resources - reduce staffing (2 FTEs) ICT - reduce staffing (2 FTEs) Law and Administration - staffing reductions (2.5FTEs) 7 Appendix 1 Contd. CUSTOMER AND SUPPORT SERVICES CU1 SAVINGS (ANALYSIS) CH5 Ref. Description £000 Comments Achieved Budget Adjusted On Target Budget Adjusted Behind Target Total Law and Administration - supplies and services – reductions Law and Administration - conveyancing – increase fees Staffing reductions linked to improved attendance management Multi-functional devices Agency contract tender LAPP rebates Contract savings FYE of 2005/06 think efficiency saving proposals 0 21 0 21 Budget adjusted - being monitored 0 5 0 5 Budget adjusted - being monitored 0 52 0 52 Budget adjusted - being monitored 0 0 0 0 0 25 11 47 320 182 0 0 0 0 0 25 11 47 320 182 Total 0 1,078 0 1,078 Increase fees and charges by 4.5% Refuse Collection/Recycling Service – efficiencies Administration - revised work patterns Staffing reductions linked to improved attendance management 0 0 135 98 0 0 135 Budget adjusted - being monitored 98 Budget adjusted - being monitored 0 0 11 40 0 0 11 Budget adjusted - being monitored 40 Budget adjusted - being monitored Total 0 284 0 0 70 0 70 Budget adjusted - being monitored 0 40 0 40 Budget adjusted - being monitored 0 20 0 20 Budget adjusted - being monitored CUSTOMER AND SUPPORT SERVICES (CONTD.) CU7 CU8 CU9 Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored Budget adjusted - being monitored SAVINGS (ANALYSIS) CO10 CU11 CU12 CU13 CU14 ENVIRONMENTAL SERVICES EN1 EN2 284 HOUSING AND PLANNING HP1 HP2 HP3 Planning - Managed Budgets Highways Works - redeploy the night workers Planning - Managed Budgets - increase sponsorship income Planning - Client Income - increase building control income 8 Appendix 1 Contd. EN3 EN4 Ref. Description £000 Comments Achieved Budget Adjusted On Target Budget Adjusted Behind Target Total Planning - Client Income - increase development control income Planning - Client Budget - reduce UDP budget Planning - Managed Budgets Highways Works - efficiency on material costs Housing - Homelessness - reduce homelessness budget Housing - Administration - increased administration grant Staffing reductions linked to improved attendance management 0 20 0 20 Budget adjusted - being monitored 0 30 0 30 Budget adjusted - being monitored 0 94 0 94 Budget adjusted - being monitored 0 30 0 30 Budget adjusted - being monitored 0 15 0 15 Budget adjusted - being monitored 0 30 0 30 Budget adjusted - being monitored Total 0 349 0 349 Grand Total 0 2,980 0 2,980 HOUSING AND PLANNING (CONTD.) HP4 HP5 HP6 HP8 HP9 SAVINGS (ANALYSIS) HP7 Appendix 1 Contd. 9 Appendix 2 Prudential Indicators Authorised Limit for External Debt Forward Estimates Total Authorised Limit for External Debt Actual Gross External Debt as at 31/03/06 2006/07 £m 2007/08 £m 2008/09 £m 721 775 829 521 This limit represents the total level of external debt (and other long term liabilities, such as finance leases) the council is likely to need in each year to meet all possible eventualities that may arise in its treasury management activities. Operational Boundary for External Debt 2006/07 £m 2007/08 £m 2008/09 £m Total Operational Boundary for External debt 621 655 704 Actual Gross External Debt as at 31/03/06 521 This limit reflects the estimate of the most likely, prudent, but not worse case, scenario without the additional headroom included within the authorised limit. The operational boundary represents a key benchmark against which detailed monitoring is undertaken by treasury officers. 10 Prudential Indicators for Treasury Management Limits on Interest Rate Exposure Upper Limit on Fixed Interest Rate Exposure Upper Limit on Variable Interest Rate Exposure Current exposure to variable rate 2006/07 2007/08 2008/09 % 100 % 100 % 100 50 50 50 12.78 19.82 25.14 All Years Maturity structure for fixed rate borrowing Upper Limit Lower Limit % 50 50 50 50 100 % 0 0 0 0 40 Current Maturity Profile % 0.09 0.11 5.42 7.99 86.39 30 0 2.17 Under 12 months 12 and within 24 months 24 months and within 5 years 5 years and within 10 years 10 years and above In addition, the following local limits will apply: Variable rate debt maturing in any one year Limits on Long-Term Investments Upper limit for investments of more than 364 days Current total investment in excess of 364 days 2006/07 £m 2007/08 £m 2008/09 £m 15 15 15 10 10 10 Comparison of Net Borrowing and Capital Financing Requirement In order to ensure that, over the medium term, net borrowing will only be for a capital purpose, the council should ensure that the net external borrowing does not, except in the short term, exceed the total of the capital financing requirement in the preceding year plus the estimates of any additional capital financing requirement for the current and the next two financial years. This forms an acid test of the adequacy of the capital financing requirement and an early warning system of whether any of the above limits could be breached. To date this indicator has been met. The current capital financing requirement is £481.8m and the net borrowing requirement £436.4m. 11 Date 03/04/2006 04/04/2006 05/04/2006 06/04/2006 07/04/2006 10/04/2006 11/04/2006 12/04/2006 13/04/2006 14/04/2006 18/04/2006 19/04/2006 20/04/2006 21/04/2006 24/04/2006 25/04/2006 26/04/2006 27/04/2006 28/04/2006 02/05/2006 03/05/2006 04/05/2006 05/05/2006 08/05/2006 09/05/2006 10/05/2006 11/05/2006 12/05/2006 15/05/2006 16/05/2006 17/05/2006 18/05/2006 19/05/2006 22/05/2006 23/05/2006 24/05/2006 Debt Outstanding £'000 520,954 520,954 520,954 520,954 520,954 520,954 520,954 520,954 520,954 520,954 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 520,276 Comparison of Net Borrowing and CFR Temporary Net Investments Borrowing £'000 67,900 79,100 79,400 79,400 79,400 76,550 76,500 76,400 74,400 72,400 68,600 70,900 71,200 71,200 70,100 68,400 67,350 66,650 68,650 71,550 73,950 75,750 74,050 77,050 77,350 76,850 75,650 81,050 85,050 86,350 85,550 86,750 80,250 86,750 82,250 83,850 £'000 453,054 441,854 441,554 441,554 441,554 444,404 444,454 444,554 446,554 448,554 451,676 449,376 449,076 449,076 450,176 451,876 452,926 453,626 451,626 448,726 446,326 444,526 446,226 443,226 442,926 443,426 444,626 439,226 435,226 433,926 434,726 433,526 440,026 433,526 438,026 436,426 12 Capital Finance Requirement £'000 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 481,792 Headroom £'000 28,738 39,938 40,238 40,238 40,238 37,388 37,338 37,238 35,238 33,238 30,116 32,416 32,716 32,716 31,616 29,916 28,866 28,166 30,166 33,066 35,466 37,266 35,566 38,566 38,866 38,366 37,166 42,566 46,566 47,866 47,066 48,266 41,766 48,266 43,766 45,366 13