ITEM NO. 9

advertisement

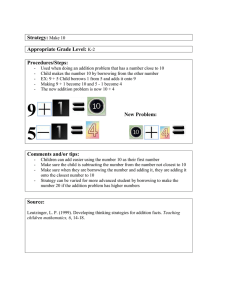

PART 1 (OPEN TO THE PUBLIC) ITEM NO. 9 REPORT OF THE LEAD MEMBER FOR CORPORATE SERVICES TO: THE QUALITY AND PERFORMANCE SCRUTINY COMMITTEE 27th OCTOBER 2003 AND THE COUNCIL 19TH NOVEMBER 2003 TITLE: TREASURY MANAGEMENT ANNUAL REPORT 2002/2003 AND BORROWING AND INVESTMENT STRATEGY REVIEW 2003/2004 RECOMMENDATIONS: Part 1 - Treasury Management Annual Report 2002/2003 It is recommended that members note the treasury management performance in 2002/2003. Part 2 - Borrowing and Investment Strategy Review 2003/2004 It is recommended that members note the recent activity and current position for 2003/2004 with regard to the Treasury Management function. EXECUTIVE SUMMARY: - The report provides details of Treasury Management activity in 2002/2003 and also a review of the borrowing and investment strategy for 2003/2004. BACKGROUND DOCUMENTS: - Various working papers in the Finance Division CONTACT OFFICER: - John Bilsborough Tel No. 793 3224 ASSESSMENT OF RISK: - The monitoring and control of risk underpins all treasury management activities. The main risks are of adverse or unforeseen fluctuations in interest rates and security of capital sums. SOURCE OF FUNDING: - Revenue Budget LEGAL ADVICE OBTAINED: - Not applicable FINANCIAL ADVICE OBTAINED: - This report has been prepared by the Finance Division of Corporate Services. WARD(S) TO WHICH REPORT RELATE(S): None specifically KEY COUNCIL POLICIES: Treasury Management and Budget Strategy. 1 REPORT DETAIL OVERVIEW On 20th March 2002, the Council adopted CIPFA’s code of practice for Treasury Management in the Public Services. Two of the key requirements of the Code are that the Council receives: a) an annual strategy and plan at the start of the year, and b) an annual report on the previous years activities after its close. The Treasury Management Strategy report for 2002/03 was approved by Council on 20th March 2002, satisfying requirement a). Part 1 satisfies requirement b). It is also felt that members will be interested in an update of the Treasury Management Strategy for the current year, approved by Council on 19th March 2003. Part 2 following reviews the strategy in the light of borrowing and investment activity to date. This report is therefore set out in two parts as follows:- PART 1 Treasury Management Annual Report 2002/2003 PART 2 Borrowing and Investment Strategy Review 2003/2004. Members are asked to note the content of the report. A. WESTWOOD Director of Corporate Services J. SPINK Head of Finance 2 PART 1 ANNUAL REPORT ON TREASURY MANAGEMENT 2002/2003 1. INTRODUCTION 1.1 The Treasury Management Strategy for 2002/2003 was approved by Council on 20th March 2002. The strategy was reviewed and a report was presented to the Quality and Performance Scrutiny Committee on 23rd September 2002. . 1.2 The CIPFA Treasury Management in the Public Services : Code of Practice 2001 adopted by the City Council on the 20th March 2002 requires that an Annual Report on Treasury Management be presented to Council. 1.3 This report provides a review of 2002/03 and highlights the major issues arising during the year. 1.4 Members should be aware that the Council has fully complied with the CIPFA Code recommendations. 2. BORROWING LIMITS 2.1 In accordance with the requirements of section 45 of the Local Government and Housing Act 1989, the following limits on borrowing in 2002/03 were set by the City Council at the meeting of 20th March 2002: an Aggregate Credit Limit (ACL), representing the maximum long and short term borrowing by the Council of £543.523m. a maximum short term borrowing limit (loans of less than one year) of 20% of the ACL i.e. £108.705m; and a maximum amount of variable rate loans of 50% of the total loans outstanding. 2.2 These limits were not exceeded during 2002/03. The maximum long term borrowing during the year was £466.329m and there was no short term borrowing during the year. 3. BORROWING REQUIREMENT AND SOURCES OF FUNDING 3.1 At the time of preparation of the 2002/2003 Revenue Budget it was estimated that the borrowing requirement for the year would be £13.016m. 3.2 The estimate has been reviewed during the year and the actual borrowing requirement was revised to £31.266m. The increase in the borrowing requirement was mainly due to an underborrowing arising from additional borrowing approvals not exercised in 2001/2002, and also the premature repayment of a PWLB loans totalling £12.255m as part of the rescheduling activity undertaken during the year. 3 3.3 The actual funding of the borrowing requirement and the rescheduling exercise compared to the budget assumption is shown below:- Budget Assumption Borrowing requirement FUNDING PWLB – Lower quota £m 13.016 % £m 31.266 13.016 5.5 12.255 4.3125 13/06/02 5,000 6.200 6.000 29.455 1.811 31.266 24/07/02 29/07/02 25/09/02 Market (lobo loans) Underborrowing b/f Actual _____ 13.016 % 2.50 2.40 3.60 Date Years 1.0 variable 40.0 (1) 40.0 (2) 40.0 (3) Note (1) £5m @ 2.50% first 2 years thereafter 4.99% subject to lobo. (2) £6.2m @ 2.40% first 2 years thereafter 4.99% subject to lobo. (3) £6m @3.60% first 3 years thereafter 4.625% subject to lobo ‘Lobo’ loans are loans where the interest rate is fixed for the initial term but thereafter the lender can amend the interest rate on the rollover date and the borrower is free to accept the new terms or reject them and repay the loan without penalty. 4 MATURITY PROFILE 4.1 The parameters approved by members in November 1992 set an absolute limit of no more than 15% of the City Council’s loan debt to fall due in any one year. The current intention is to work within a limit of 7.5%. 4.2 The maturity profile at 31st March 2003, attached at Appendix 1, indicates that the working limit (though not the absolute limit) will be slightly exceeded in 2015/16, and also 2041/2042 when the market loans taken in 2001/2002 mature, whilst the absolute limit will be exceeded when the stock issue made in 1993/94 and 1994/95 mature in 2018/19. 4.3 As reported previously action, in accordance with proper treasury management practices, will be taken to reduce these excesses to within the working limits as the opportunities arise to reschedule the loans. 4 5. RESCHEDULING DISCOUNTS 5.1 On 13th June 2002 taking advantage of the favourable yield curve a long term PWLB loan for £12.255m was converted from a fixed to a variable rate loan with a three month roll over period in order to secure a discount. The total discount received was £0.717m shared £0.444m to HRA and £0.273m to the General Fund. 5.2 This discount was accounted for over the period of the variable rate loan, ie 12 months, and has benefited the General Fund revenue budget . Discounts generated by the HRA are effectively returned to the Government through reduced housing subsidy. 6. INVESTMENT ACTIVITY 6.1 The revenue budget assumed an average interest rate of 4.12% would be obtained on investments which would average £48.67m during 2002/2003 giving investment income of £2.005m. The approximate updated the forecast of interest earned on investments to £2.279m and the actual interest earned was £2.410m. 6.2 As members are aware £20m was placed with the external fund manager Hambros (since taken over by Investec), on 5th July 1996. The value of the portfolio as at 31st March 2003 was £23.943m as a result of accrued interest being permitted to be held by Investec. Accrued interest can be recalled when required, with the last occasion being in 1999/2000 when £5.2m was recalled. 6.3 Over the period 1st April 2002 to 31st March 2003 Investec exceeded the local authority 7 day rate against which their performance is measured and their overall performance has exceeded the 7 day rate since their appointment commenced on 5th July 1996 as shown below:- Actual rate of return (net) Compound 7 day local authority rate 6.4 1st April 2002 to 31st March 2003 % 5.34 3.74 5th July 1996 to 31st March 2003 % 6.28 5.52 Following the disappointing return in the final months of 2001/2002 there has been the expected improvement in performance this year. This was largely due to the gilts that had been held in the portfolio from the previous year and also investments in the longer dated Certificates of Deposits, taking advantage of changing market expectations. In the last quarter of the year the fund was positioned conservatively in anticipation of market volatility ahead of military action in the Gulf. Exposure to the gilt market was increased in January reflecting the increased risks to the economy and then in March just before the dramatic fall in bonds (later to be substantially reversed) gilt exposure was reduced. Overall, bond and money market yields fell over the quarter but the fund outperformed cash rates by a substantial margin. . 5 6.5 The annual average rate of interest received on internally managed investments was 3.81%. The average level of total investments was £30.7m and investments held at 31st March 2003 totalled £37.7m. The lower return than that achieved by Investec is due to the investment in short term cash deposits, which are of a less volatile nature than gilts. 7. LEASING 7.1 The Council holds capital assets, mainly motor vehicles, I.T. equipment and wheeled bins under operating leases. Operating leases do not provide for the asset to transfer to the Council and are exempt from classification as a credit arrangement. The length of the leases reflect the expected life of the asset and are generally for a period of 5 years for motor vehicles, 3 years for I.T. equipment and 7 years for wheeled bins. 7.2 Leases entered into during 2002/2003 amounted to £0.658m in capital value and £0.129m in annual rentals. Details of the leases are as follows :Leasing Co. Key Finance Sovereign Key Finance Sovereign Asset Capital Value £m 0.109 0.035 0.082 0.432 0.658 Wheeled Bins Cash Receipting Telephone Systems Education ICT Period of rental Years 7 5 5 5 7.3 Total rentals payable for all leases held by services from their 2002/2003 revenue budgets were £2.355m. 7.4 At 31st March 2003 the Council had a commitment to meet the following leasing charges, which have been built into the appropriate services/DSO’s budget plans:- 2003/2004 2004/2005 2005/2009 £m 1.551 0.938 0.730 6 8. CAPITAL FINANCING 8.1 The outturn position for the Capital Financing costs compared to the estimate and approximate is summarized below:- CAPITAL FINANCING 2002-2003 Borrowing Costs HRA GFund Investment Income HRA GFund Net borrowing costs Estimate £m Approximate £m Outturn £m Variance £m 25.929 19.635 45.564 25.223 19.489 44.712 25.464 19.432 44.896 0.241 (0.057) 0.184 (0.427) (1.597) (2.024) 43.540 (0.429) (1.847) (2.276) 42.436 (0.422) (1.984) (2.406) 42.490 0.007 (0.137) (0.130) 0.054 It should be noted that the HRA borrowing costs are financed by housing subsidy from the Government. 9. RECOMMENDATION 9.1 It is recommended that members note the Treasury Management performance in 2002/2003. 7 PART 2 TREASURY MANAGEMENT POLICY AND STRATEGY REVIEW 2003/04 1. INTRODUCTION 1.1 The Treasury Management Policy and Strategy for 2003/2004 was considered at the meeting of Cabinet held on 11th March 2003 and approved at the meeting of the City Council on 19th March 2003. 1.2 This report reviews the strategy in the light of the borrowing and investment activity to date. 2. BORROWING LIMITS 2.1 In accordance with the requirements of Section 45 of the Local Government and Housing Act 1989 the following limits on borrowing in 2003/2004 were set by the City Council at the meeting of 19th March 2003. an Aggregate Credit Limit (ACL), representing the maximum long and short term borrowing by the City Council, of £576.708m. a maximum short term borrowing limit (loans of less than one year) of 20% of the ACL, i.e. £115.342m; and a maximum amount of variable rate loans of 50% of the total loans outstanding 2.2 These limits have not been exceeded during 2003/04 to date. The maximum long term borrowing during the year is £500.603m and there has been no short term borrowing during the year. 3. BORROWING ACTIVITY 3.1 The initial assumption with regard to the borrowing requirement for 2003/04 as determined for the revenue budget was that the City Council would need to borrow £22.566m and that this would be taken from the PWLB at the beginning of the year at an interest rate of 4.75% based upon estimated long term interest rates at the time of preparing the budget. 3.2 The latest estimate of the borrowing requirement for 2003/04 has increased to £25.563m to take account of an estimated increase in the basic credit approval (BCA) and supplementary credit approvals (SCA) made available to the authority and also the underborrowing of £1.811m in 2002/2003. 8 3.3 The PWLB is the major source of local authority borrowing as it traditionally offers more competitive rates than the money market. Based upon current estimates, the 2003/04 PWLB quota entitlement which the City Council is allowed to borrow from this source is as follows:- BCA/SCA PWLB repayments Entitlement b/fwd Total PWLB quota 2002/2003 Lower rate Higher rate £ 20.328 12.576 3.817 36.721 14.144 22.577 36.721 3.4 Appendix 2 shows the latest interest rates for all types and period of PWLB loan, whilst Appendix 3 illustrates the latest interest rate forecasts together with the 25 year PWLB lower quota historic rates. 3.5 Under the Local Government and Housing Act 1989. local authorities are required to set aside a proportion of their capital receipts as Provision for Credit Liabilities to be used to repay debt. In 1997/1998 £33m of set aside receipts were formally applied in debt redemption. There is £22.5m of receipts set aside as at 31st March 2003 awaiting the appropriate opportunity to be used for debt redemption. In 2003/2004 this option is being considered. Furthermore while investment rates remain lower than borrowing rates there has been no new borrowing. This has the beneficial effect of funding new borrowing at the lower investment rate. Members should be aware that the variable rate PWLB loan totaling £12.255m repaid on 13th June 2003 has not been replaced but has been met by internal investments. 3.6 As can be seen from Appendix 3 long term PWLB interest rates have fluctuated within an extremely narrow margin during the first six months of 2003/2004. Rates have varied between 4.5% and 4.85% peaking at 4.95% early to mid September. Current forecasts are that long term interest rates will remain steady for the remainder of the year. 4. INVESTMENTS 4.1 The revenue budget assumed that an average interest rate of 4.23% would be obtained on investments which would average £55.91m during 2003/2004, giving investment income of £2.365m. 4.2 Investment income earned to 30th September compared to the revenue budget assumption is detailed below. 9 INVESTMENT INCOME Budget Assumption Internally Managed Externally Managed Full Year £m 1.275 1.090 2,365 Actual to 30th Sept £m 0.649 0.547 1.196 To30th Sept £m 0.579 0.325 0.904 £m (0.070) (0.222) (0.292) 4.3 At the time the revenue budget was set it was not expected that interest rates would fall so soon after the 1st April and hence the shortfall in the internally managed funds. 5. EXTERNAL CASH FUND MANAGERS 5.1 Investec (formerly Hambros Bank) was appointed as external fund managers on 5th July 1996 for an initial period of two years, with an option to extend subject to their satisfactory performance. Approval has been given to extend the period of appointment to 4th July 2003. 5.2 Over the period 1st April 2003 to 30th September 2003 Investec has failed to exceed the local authority 7 day rate against which their performance is measured by 0.39% However their overall performance has exceeded the 7 day rate since their employment commenced on 5th July 1996 as shown below:- Actual rate of return Compound 7 day local authority rate 1st April 2003 to 30th September2003 % 1.32% 1.71% 5th July 1996 to 30th September 2003 % 6.02% 5.38% 5.3 The recent performance of the funds has been disappointing due to rising yields in gilts at a time when they were predicted to fall, and the markets continue to be very volatile. However Investec anticipates that the market will stabilize and improve in the medium term and the performance of the fund should benefit from this. 5.4 In view of Investec’s overall satisfactory performance it is to be recommended to the Lead Member for Corporate Services that their appointment be rolled forward on a month to month basis, but that when quarterly comparative data with regard to the performance of all fund managers as at 30th September and, if necessary, 31st December, is available then the retention of Investec as fund managers over a longer period is reviewed. 10 6. MONEY MARKET FUNDS (MMF) 6.1 An MMF is a triple A rated open ended investment fund that represents a diversified portfolio of short term, high quality debt instruments. The size of the liquidity pool means that the investor can be offered the flexibility of overnight and call money combined with the attractive returns of longer dated deposits. 6.2 Members approved the addition of MMFs to the approved list of investments as part of the 2002/2003 Treasury Management Policy and Strategy Statement reported to Council on 20th March 2002. As part of the treasury management strategy, investments can be made with AAA/P1 rated MMFs, for a maximum of £10m for up to 3 months. To date accounts have been opened with Aim Global and Barclays Global Investors. 6.3 MMFs are regarded as an additional instrument to manage short term cash flows, up to 30days and they have been particularly attractive when overnight investment rates have been weak. 7. LEASING 7.1 The following operating lease has been arranged to date:Leasing Company Lombard N.C. Asset Mobile-Library Vehicles (2) Capital Value £m 0.139 Period of Rental Years 7 8. TREASURY MANAGEMENT PRACTICES 8.1 The Council formally adopted the CIPFA Treasury Management in the Public Services: Code of Practice 2001 and reported to the Council with full details of the code on 20th March 2002. 8.2 As part of the code it was necessary for the Director of Corporate Services to prepare the following Treasury Management Practices (TMP’s) to which schedules will be attached, to specify the systems and routines to be employed and the records to be maintained. The twelve schedules have been reviewed in preparation for the CPA assessment. The full list of TMPs and schedules is set out below:- 11 TMP 1 Treasury Risk Management TMP 2 Best Value and Performance Measurement TMP 3 Decision Making Analysis TMP 4 Approved Instruments , Methods and Techniques TMP 5 Organisation , Segregation of Responsibilities, and Dealing Responsibilities TMP 6 Reporting Requirements and Management Information TMP 7 Budgeting , Accounting and Audit Arrangements TMP 8 Cash and Cash Flow Management TMP 9 Money Laundering TMP 10 Staff Training and Qualifications TMP 11 Use of External Service Providers TMP 12 Corporate Governance 9. RECOMMENDATIONS It is recommended that members note the recent activity and current position for 2003/2004 with regard to the Treasury Management function. 12