Findings from Diagnostic Country Report (DCR) Ghana Maize Sector

advertisement

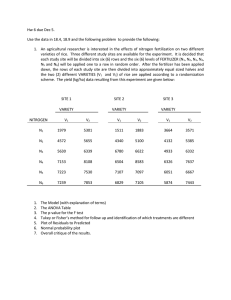

Findings from Diagnostic Country Report (DCR) Ghana Maize Sector Outline • National Seed Policy: Implication on Production/Farmers • National Food Buffer Stock Company(NAFCO) • Fertilizer sector reforms and implications for Farmers 2 Impact of National Seed Policy Access to Maize Seeds: 47.9% reported they have many options, 30.7 percent had few options and 21.4% indicated they have no option. (Nearly 80% of the responding farmers indicated having multiple options for obtaining maize seeds) 3 Impact of National Seed Policy • Access to maize seed – About 37.1% ranked the availability of maize seed as very good, 47.9% ranked it good, 11.4% and 3.6% ranked availability as neutral and bad respectively • Affordability of maize seed – 64.3% considered available maize seed as affordable while 35.7% considered it expensive. 4 Impact of National Seed Policy Impact on Seed Quality • Indicators of seed quality: (i) germination rate and (ii) yield • About 38.6% of the farmers ranked the quality of maize seed as very good, 45.7% rated it as good, 13.6% and 12.1% rated the quality as neutral and bad respectively. (Over 84% of the respondent farmers were happy with the quality of seeds obtained) 5 National Food Buffer Stock Company (NAFCO) NAFCO: state-owned-enterprise set up in 2010 to buy, preserve, store, sell, and distribute excess grains in warehouses across the country. Its part of the strategy to reduce post-harvest losses, ensure price and supply stability and establish emergency grain reserves. Given the difficulty of NAFCO to reach farmers in remote areas, 73 Licensed Buying Companies (LBCs) are contracted by NAFCO to purchase maize and rice from farmers in the various villages at a minimum purchasing price (i.e. floor price) 6 PROCUREMENT • Sales information, Sales pattern and payment terms • Average selling price of maize in 2014 is about GH₵ 100/120 Kg however prices of maize range between GH₵ 55/120 Kg to about GH₵ 130/120 Kg. Response of farmers Option of selling Yes (63.6%) No (36.4%) Rank option of buyer available Many option (42.4%) few option (42.4), very few option(12.4%) no option(3%) Source of selling Market queens(62.9%) local traders (21.4%),any available buyer(11.4%), agro-firms(2.1%) others source(2.2%) Place of selling Major market (65%), homes or farm gate(35%) Distance from home 21.4km Network entities of procurement Very good ( 25.7%), good(52.9%) neutral(13.6%), bad(7.8%) very bad(0.7%) Price determination Market price (90%), negotiation (10%) Observe Change in price Positive change(57.3%), change(18.6%) negative change(21.5%)7 no Impact of Fertilizer Sector Reforms • Sources: 24.3% of respondent obtained fertilizer from public source (MoFA), 75% respondents buy their fertilizer from private source, while 0.7% purchased from both Year •Increased importation of fertilizer made fertilizer better available to users Total 2003 92,807 2006 189,879 2009 335,186 2012 3,362,532 • The increased fertilizer usage can be attributed to a combination of subsidy (PFA, 2010) and private sector participation in the dealership. 8 Impact of Fertilizer Sector Reforms Availability of Fertilizer: • Fertilizer was available during the planting season. (Over 72% of respondent farmers got fertilizers on time, while 28% did not) • Challenges: prospects of subsidized fertilizer did not provide incentive to buy fertilizer from the open market and when the subsidized fertilizer was available, farmers did not receive relevant information on time. • About 14.3% of the respondents had shifted from public sources to private sources. 9 Impact of Fertilizer Sector Reforms Affordability of Fertilizer: • About 77.9% ranked fertilizers as very expensive, 21.4% ranked them as expensive while only 0.7% were neutral about price of fertilizer available to them. • In last five years, 72.9% respondents indicated fertilizers have become expensive while 9.2% responded affordability has increased, 17.9% indicated there was no change. 10 CONCLUDING OBSERVATIONS • Reforms has brought about increased private sector participation in the input (seed) sector. • The product market reforms has not impacted competition within the staple(maize) sector. • The extent to which inputs sector competition has led to consumer and producer welfare need time to be examined further. 11 THANK YOU FOR YOUR ATTENTION 12