Findings from Diagnostic Country Report (DCR) Ghana Maize Sector

advertisement

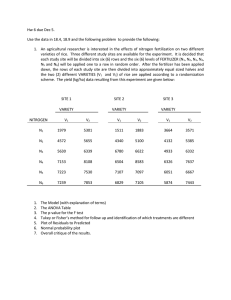

Findings from Diagnostic Country Report (DCR) Ghana Maize Sector Outline • Policy Environment– Agriculture Sector Reforms and Objectives • National Seed Policy: Implication on Production/Farmers • Fertilizer sector reforms and implications for Farmers • National Food Buffer Stock Company(NAFCO) 2 1. Policy Environment- Agriculture Sector Reforms and Objectives • Medium Term Agricultural Development Programme (MTADP) • Accelerated Agricultural Development Strategy (AAGDS) • Food and Agriculture Sector Development Policy (FASDEP I&II) • Access to Agricultural Inputs • Plants and Fertilizer Act, 2010 (Act 803) • National Seed Policy, 2013 3 National Seed Policy -Salient Features Objective: Development & establishment of well-coordinated, comprehensive & sustainable private sector-driven seed industry. • Applicable to all priority crops: ⁻ Cereals: Maize, Rice, Sorghum, Millet ⁻ Legumes: Groundnut, Cowpeas, Soybean ⁻ Roots and Tubers: Cassava, Yam, Cocoyam, sweet potato ⁻ Tree Crops: Mango, Orange, ⁻ Fruits and Vegetables: Pineapple, Plantain, Pawpaw, Banana • Earlier strategy: Heavily based on public sector investments and subsidized seed supplies to the farmers • Long-run: impact difficult to monitor and costly, leading to closure of publicly owned Ghana Seed Company 4 National Seed Policy- Salient Features Current situation: • Private sector involvement encouraged and supported • Gov. does not interfere with prices, which is determined based on cost of production and packaging. • Gov. only regulates the activities in this sector Seed Import: • Private sector imported hybrid maize seed stocks • Govt to prevent dumping of untested seeds - Plants and Fertilizer Act 2010 (Act 803) • Govt and private sector to develop in-country production of hybrid varieties to substitute imports. 5 Impact of National Seed Policy Access to Maize Seeds: 47.9% reported they have many options, 30.7 percent had few options and 21.4% indicated they have no option. (Nearly 80% of the responding farmers indicated having multiple options for obtaining maize seeds) 6 Impact of National Seed Policy • Access to maize seed – About 37.1% ranked the availability of maize seed as very good, 47.9% ranked it good, 11.4% and 3.6% ranked availability as neutral and bad respectively • Affordability of maize seed – 64.3% considered available maize seed as affordable while 35.7% considered it expensive. 7 Impact of National Seed Policy Impact on Seed Quality • Indicators of seed quality: (i) germination rate and (ii) yield • About 38.6% of the farmers ranked the quality of maize seed as very good, 45.7% rated it as good, 13.6% and 12.1% rated the quality as neutral and bad respectively. (Over 84% of the respondent farmers were happy with the quality of seeds obtained) 8 Fertilizer Sector Reform -Salient Features • Early 1990s, Ghana liberalized fertilizer sector, abolishing Gov’t monopoly of imports and distribution • Since 2006, the country’s fertilizer imports have been increasing • Observed increase in fertilizer prices began in 2007, however, fertilizer consumption has increased in Ghana primarily due to the fertilizer subsidy scheme • In 2010, the Plants and Fertilizer Act was enacted. • The Act seeks to regulate the importation (particularly quality), sale and production of fertilizers 9 Subsidy Program: • In response to rise in global fertilizer prices, Gov’t reintroduced subsidy program in partnership with the country’s importers • It started with a voucher system, which was disbanded after 2 years due to operational deficiencies and delays in payment to importers. • Subsidized fertilizer was not always reaching the target - smallholder farmers • In 2010, Gov’t and importers negotiated a discounted price for selling fertilizer. • The price difference was paid by Gov’t 10 Impact of Fertilizer Sector Reforms • Sources: 24.3% of respondent obtained fertilizer from public source (MoFA), 75% respondents buy their fertilizer from private source, while 0.7% purchased from both Year •Increased importation of fertilizer made fertilizer better available to users Total 2003 92,807 2006 189,879 2009 335,186 2012 3,362,532 • The increased fertilizer usage can be attributed to a combination of subsidy (PFA, 2010) and private sector participation in the dealership. 11 Impact of Fertilizer Sector Reforms Availability of Fertilizer: • Fertilizer was available during the planting season. (Over 72% of respondent farmers got fertilizers on time, while 28% did not) • Challenges: prospects of subsidized fertilizer did not provide incentive to buy fertilizer from the open market and when the subsidized fertilizer was available, farmers did not receive relevant information on time. • About 14.3% of the respondents had shifted from public sources to private sources. 12 Impact of Fertilizer Sector Reforms Affordability of Fertilizer: • About 77.9% ranked fertilizers as very expensive, 21.4% ranked them as expensive while only 0.7% were neutral about price of fertilizer available to them. • In last five years, 72.9% respondents indicated fertilizers have become expensive while 9.2% responded affordability has increased, 17.9% indicated there was no change. 13 National Food Buffer Stock Company (NAFCO) NAFCO: state-owned-enterprise set up in 2010 to buy, preserve, store, sell, and distribute grains in warehouses across the country. Its part of the Gov’t strategy to reduce post-harvest losses, ensure price and supply stability and establish emergency grain reserves. NAFCO faced difficulties to reach farmers in remote areas, 73 Licensed Buying Companies (LBCs) have been contracted by NAFCO to purchase maize and rice from farmers at a minimum purchasing price (i.e. floor price) NAFCO activities have not impacted the market in terms of quantity managed, price stabilization, post-harvest losses and emergency requirements 14 CONCLUDING OBSERVATIONS • Reforms has brought about increased private sector participation in the input (seed) sector. • The product market reforms has not impacted competition within the staple(maize) sector. • The extent to which inputs sector competition has led to consumer and producer welfare need time to be examined further. 15 THANK YOU FOR YOUR ATTENTION 16