EUROPEAN PARLIAMENT DRAFT OPINION 1999 2004

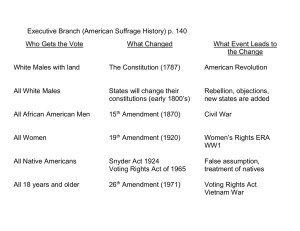

advertisement

EUROPEAN PARLIAMENT 1999 2004 Committee on Economic and Monetary Affairs PROVISIONAL 2002/240(COD) 28 March 2003 DRAFT OPINION of the Committee on Economic and Monetary Affairs for the Committee on Legal Affairs and the Internal Market on the proposal for a directive of the European Parliament and of the Council on take-over bids (COM(2002) 534 – C5-0481/2002 – 2002/0240 (COD)) Draftsman: Christopher Huhne PA\493753EN.doc TR PE 323.107/REV TR PE 323.107/REV TR 2/33 PA\493753EN.doc PROCEDURE The Committee on Economic and Monetary Affairs appointed Christopher Huhne, draftsman at its meeting of .... It considered the draft opinion at its meeting(s) of .... At the latter/last meeting it adopted the following conclusions by ... votes to ..., with ... abstention(s)/unanimously. The following were present for the vote: ..., chairman/acting chairman; ... (and ...), vicechairman/vice-chairmen/; ..., draftsman; ..., ... (for ...), ... (for ... , pursuant to Rule 153(2)), ... and .... PA\493753EN.doc 3/33 PE 323.107/REV TR SHORT JUSTIFICATION Background The European Commission's first proposal on company law concerning take-over bids was tabled as long ago as 1989. On 8 February 1996 the Commission presented another proposal for a directive on take-over bids1, which the Commission amended in 1997. On 4 July 2001 the European Parliament rejected the Conciliation Committee text2 of this take-over bids proposal, in a tied vote of 273 to 273. A Group of High-Level Company Law Experts was subsequently set up under the Chairmanship of Professor Jaap Winter and it produced a report3 in January 2002. The European Commission produced the current new proposal for a directive on 2 October 2002, taking on board recommendations contained in the Winter Report. The importance of the proposal This proposal is a key priority of the Financial Services Action Plan, as specified by the Lisbon European Council. Without it, many of the potential gains of the Euro will not be realised. It is an essential measure required in order to reach the objective of fully integrated and efficient capital markets in the EU, which can raise returns to savers and provide cheaper capital to investors. Cross-border company take-overs also allow economies of scale and hence facilitate the restructuring and increases of productivity that can flow from the euro. Objectives of the proposal The proposal will create a legal framework and hence level playing field for corporate takeovers in Europe. By ensuring an adequate level of protection for shareholders (and in particular minority shareholders), it will remove a source of investor concern and encourage more cross-border ownership. The proposal will also provide for welcome and long-overdue openness about key shareholdings and control of companies, which will contribute to the rebuilding of confidence in financial markets. The current proposal therefore forms part of a package of EU policy measures currently under negotiation which will lead to increased standards of integrity and efficiency in the EU's financial markets. Economic consequences At present the degree of integration of company ownership varies enormously from Member State to Member State. Corporate ownership is not blind to nationality as it should be within the EU, as is shown by the dramatic differences in foreign ownership revealed by the table below. Moreover, the lowest levels of economic integration exist in some of the member states that are theoretically most in favour of it. The first column of the table shows a broad measure of foreign ownership of the economy, namely the stock of equity capital liabilities by foreign direct investors as a percentage of GDP. Germany’s foreign ownership is just 12.1 per cent of GDP, and France’s only 11.9 per cent. This is much lower than the figures for a number of smaller member states such as 104.9 per cent in Ireland, 33.6 per cent in the Netherlands, 28.3 per cent in Denmark and 24.7 per cent in Sweden. Even more strikingly, it falls well short of the levels of foreign ownership found in two big member states: 21.3 per cent in Spain and 24 per cent in the UK. (Figures for Italy are not available). The apparent resistance to economic integration is particularly clear in more politically sensitive sectors of the economy such as finance. For example, the share of the assets of credit 1 OJ C 162, 6.6.1996, p. 5 OJ C 065E, 14.3.2002, p. 57 3 http://europa.eu.int/comm/internal_market/en/company/company/news/hlg01-2002.pdf 2 PE 323.107/REV TR 4/33 PA\493753EN.doc institutions (i.e. loans) that are in foreign-controlled financial institutions is just 4.74 per cent in Germany compared with 51.18 per cent in the UK. It should be noted that these figures apply purely to foreign ownership of companies in the country concerned, and are usually paralleled by an equally pronounced ownership of overseas companies and securities. The very wide differences in foreign ownership are principally a product of differing social and political attitudes to foreign companies and to the differing legal and institutional impediments to foreign purchase. Some apologists have sought to explain the large difference between Germany and France on one hand, and Britain, Scandinavia and the Netherlands on the other by arguing that the position is not so different when debt is taken into account. Because of the greater reliance on debt to finance investment in the German model, the argument is that cross-border equity stakes understate the German openness to foreign ownership. However, the figures including debt tell the same story as the equity figures. For example, Germany’s total stock of foreign direct investment liabilities (equity and debt) amounted to 23.8 per cent of gdp in 2000 compared with 30 per cent in Britain, 34.4 per cent in Sweden, 39.8 per cent in Denmark and 63.7 per cent in the Netherlands. France was even more closed than Germany with FDI liabilities of just 19.6 per cent, while Italy is extraordinarily low at 10.4 per cent of GDP MEASURES OF ECONOMIC INTEGRATION BE Belgium DK Denmark DE Federal Republic of Germany GR Greece ES Spain FR France IE Ireland IT Italy LU Luxembourg NL Netherlands AT Austria PT Portugal FI Finland SE Sweden UK United Kingdom n.a.= not available ______________ Stock of FDI equity capital liabilities (% of GDP)1 Foreign owner: total world Total stock of FDI liabilities (% of GDP)1 Foreign owner: total world Year 2000 Year 2000 Proportion of bank assets which are foreign controlled2 n.a. 28,3% 12,1% n.a. 39,8 23,8 Year 2001 25,20% n.a. 4,74% n.a. 21,3% 11,9% 104,9% n.a. n.a. 33,6% 15,0% 22,8% 14,5% 24,7% 24,0% n.a. 25,5 19,6 126,0 10,4 n.a. 63,7 15,8 26,3 19,9 34,4 30,0 n.a. 9,49% n.a. n.a. n.a. 93,78% 11,31% n.a. n.a. 5,65% n.a. 51,18% 1 Source: Response to Written question E-3637/02 by Christopher Huhne to the Commission ECB or authorities represented in the BSC, as published in the ECB "Structural analysis of the EU banking sector" November 20 2 Source: PA\493753EN.doc 5/33 PE 323.107/REV TR The importance of FDI flows in spreading best practice, stimulating competition and providing better-paid jobs than home employers is well documented. The trend increase in FDI flows is also part of the phenomenon called globalisation. This is highlighted in the Commission's recent Report published on 23 December 2002 'Economic Reform: report on the functioning of community product and capital markets'1. It points out that foreign direct investment is the main driver of integration in the EU but that "intra-EU FDI flows increased by a factor of 15 between 1995 and 2000 and was seriously hit by events in 2001, falling below 1999 levels".2 The rapid adoption of the take-over directive could help to alleviate this cyclical downturn while reinforcing the trend towards specialisation and scale economies. A major advantage of increased cross-border mergers is the potential for restructuring to take advantage of the single market, which has now been created by the Euro. Unless businesses can locate in the most advantageous position within the market, a major benefit of EMU will not be realised. Many studies have shown how regions tend to be more specialised by type of business in the US than in Europe. A key problem with cross-border take-overs is the complexity of obstacles that management can put in their way. This is a difficulty for a company that wishes to buy a significant part or the whole of another company. But it also inhibits cross-border investment by pension funds and insurance companies if they feel that they may be deprived of a full return on their shareholding by an arbitrary set of defences against a bid (so-called "poison pills"). This therefore reduces the rate of return for the savings of pensioners who rely on investments for their retirement provision. It is true that hostile bids are a very small proportion of the total merger activity. Moreover, the economic evidence for some years has shown that there are relatively few if any gains from hostile – i.e. contested – bids for the bidding company’s shareholders. But these points do not take account of the important role of a potential hostile bid in encouraging managements to negotiate. If hostile bids are made more difficult, the first casualty is likely to be negotiated or agreed bids. An important incentive to talk and agree will have been removed. A general reduction in pressure on management to perform efficiently – and the merger process is one of the few checks and balances on managements - is likely to reduce the return on capital and the efficiency of the economy. It is vital that common ground be sought on the take-over proposal, in order for the directive to quickly become part of the 'acquis communautaire'. Although there are a number of remaining issues in the proposed directive, the issue of "multiple voting rights" (MVRs) is one of significant importance to several Member States and negotiations on the directive will be blocked unless the issue is tackled. In particular, Germany has already introduced national legislation to abolish multiple voting rights, and many German MEPs and industrialists feel that the continued existence of multiple voting rights in other member states would put Germany at some disadvantage. (Your Draftsman does not believe this position to be correct: Germany would benefit from more foreign investment, not be disadvantaged by it. Moreover, as we have seen above, the Nordic countries with the most multiple voting rights are substantially more open to foreign ownership than Germany. But the actual rights and wrongs of this issue seem less important in the German debate than the perception). In order to facilitate the agreement between the Committee on Legal Affairs and the Internal Market 1 2 COM 2002/743 See figures 13, 14, 15 in Annex I PE 323.107/REV TR 6/33 PA\493753EN.doc (JURI) and the Committee on Economic and Monetary Affairs (ECON) I have highlighted the amendments taken on board in my draft opinion which take account of amendments in the Lehne draft report and amendments tabled so far by ECON members. Inclusion of MVRs in directive In this context ECON should adopt the amendments of Klaus-Heiner Lehne, the draftsman of JURI (which form part of the Council compromise) which bring MVRs within the scope of Article 11, with the effect of neutralising them in a take-over situation. An exception could be French-style shares with double votes, which do not hinder take-over operations and which are awarded as a loyalty premium to any shareholders of more than two years standing. Double votes are allocated purely on the basis of duration of holding and they can promote the existence of a stable shareholder base. In France, there have been a number of high profile hostile take-over bids (e.g. BNP for Paribas and SocGen) and in practice such loyalty votes have not been an impediment. Once the bidder has a controlling stake or a majority of the equity – even if not yet all the voting rights – there is a general realisation that a change of control is only a matter of time, and this triggers negotiation. Double votes are non-transferable and do not lead to an increase in the value of the security. To give effect to this inclusion of MVRs in the directive, a package of amendments would have to be introduced: ECON Amendment 35 (Amendment 18 of the draft Lehne Report). ECON Amendment 11 (Amendment 5 in the draft Lehne Report) Amendment 14 of the draft Lehne report Amendment 26 in the draft Lehne Report Amendments 28 of the draft Lehne Report Amendment 29 of the draft Lehne Report ECON Amendment 35 (Amendment 18 of the draft Lehne Report) ECON Amendment 104 (Amendment 34 of the draft Lehne Report). Amendment 30 of the draft Lehne Report. The loss of MVRs should not be compensated for as proposed by Lehne's recital (that Member States should be able to provide redeeming mechanisms such as a higher bid price and commitment to subsequent acceptance of an offer of sale or compensation) as this is too vague a provision and would not amount to adequate or appropriate compensation. ECON should adopt one of the following two options in addition to the Lehne amendments on MVRs listed above. The options are presented in order of radicalism, with the less radical option presented first. Your Draftsman has a strong preference for the grandfathering option given the strength of feeling in the three Nordic Member States regarding MVRs, it is the more sensitive option and does not intrude on private arrangements. The grandfathering option would not, given the evidence presented above, damage the creation of a level playing field, to which we all aspire. 1. Longer Transitional period for removal of MVRs PA\493753EN.doc 7/33 PE 323.107/REV TR The principal problem with the removal of multiple voting rights in the context of a takeover (as proposed in option one) is the question of compensation to owners since this is a retrospective application of company law. Owners of MVR shares clearly undergo a loss, and in cases where there is actually a loss of control of the company this could be significant. Nor is there any easy way to assess such compensation. One solution would be to lengthen the transitional period for the application of the breakthrough clause to MVRs exclusively (while not delaying other aspects of the directive). This has the economic effect of reducing the loss that they suffer. A transitional period that captured most of the economic benefit of the ownership rights – say twenty years - could be implemented in order to take account of the potential loss suffered by the invalidation of MVTS and to reduce the loss suffered in "net present value"1 terms. This necessitates a change in Amendment 38 of the draft Lehne Report, which provides for delayed implementation of Articles 9 and 11 until 1 January 2010 at the latest. 2. Grandfathering clause for MVRs Some MEPs feel that any retrospective application of the law to existing MVRs is an excessive infringement on private bargains freely entered into by willing sellers and willing buyers under the law of the time. In order to avoid retrospective legislation, which is generally in all the member states held to be unsound, a safer course of action might be to ‘grandfather’ (or continue to allow) existing MVRs. In this case, the directive should apply only to MVRs which are accorded subsequent to the implementation date of the directive This necessitates the creation of a new paragraph 5a in article 11. Your Draftsman also proposes the following changes to the Commission's proposal: Exemptions for certain special shares If a general grandfathering of existing property rights is not acceptable, it may nevertheless be sensible for the parliament to allow for the continuation of special shares designed to guarantee some public interest of a non-economic kind (for example, a commitment to high levels of medical research, or to the editorial independence of a news-gathering operation). This necessitates a new paragraph 5b in article 11. Company law The directive does not aim to harmonise national company law and will therefore not affect the rules of Member States on this aspect. Amendment 1 of EMPL (Committee on Employment and Social Affairs) should therefore be supported. Employee rights 1 "net present value" (NPV) is the present value of expected future cash flows minus the cost. A given amount of cash in ten years is worth less than a given amount of cash today, and the difference in value is given by the interest that would be payable on today’s cash if held for ten years. PE 323.107/REV TR 8/33 PA\493753EN.doc The proposal introduces a new Article which stresses the importance of applying existing policy measures concerning the protection of employees such as the European Works Council1 Directive, the Directive on collective redundancies2 and the Directive on information and consultation of employees3. With regard to protection of employees, it is essential that companies continue to respect the company law in force in the country where they are based, regardless of who controls the company. This will continue to be the case under the Commission proposal - companies subject to a take-over will continue to be subject to the labour law and company law of the company of their home Member State. Employees will continue to be protected by national legislation in place to protect employees in the event of a take-over and to safeguard their existing rights when businesses are transferred. However, the proposal needs to be amended in order to strengthen its provisions on information, consultation and co-determination. It is essential that employees be provided in a timely manner with information concerning the terms of the bid, in order to ensure adequate provision of information and to ensure that the consultation of employees is carried out with the appropriate level of information, thereby ensuring an accurate response from employees. It is also important that not only the employees (and their representatives) of the offeree company, but also the employees and their representatives of the offeror company be offered consultation and the opportunity to express their views. In addition, employees of both companies should be able to express their views not only on employment aspects but on other aspects which will affect their interests. ECON amendment 14 (Amendment 6 of the draft Lehne Report) should be supported. ECON 101 should be supported. EMPL 14 should be supported. ECON Amendment 30 should be supported. Amendment 3 of the draft Lehne Report should be supported. Amendment 23 of the draft Lehne Report should be supported. Amendment 31 of the draft Lehne Report should be supported, and part of EMPL 18. Shareholder to shareholder agreements The Commission proposal currently includes agreements between shareholders in the list of corporate defence mechanisms (such as limitations and restrictions) which are considered as hindering bids and which are therefore banned. The Commission's aim according to the explanatory memorandum4 is to prevent "management entrenchment". However, agreements made between shareholders on a contractual basis are in fact often employed with the specific aim of facilitating the making of an offer, and should therefore be permitted. ECON Amendment 82 and ECON Amendment 90 should be supported. International reciprocity 1 94/45/EC 98/59/EC 3 2002/14 4 Page 9 2 PA\493753EN.doc 9/33 PE 323.107/REV TR The Commission's text does not deal with the need for reciprocal take-over legislation in third countries. In principle, however, EU companies should be afforded the same advantages that the directive will bestow on companies from third countries wishing to invest in Europe. This issue is especially important with regard to investment from economies in a position to take full advantage of the potentially liberalising effect of the take-over directive. The United States, for example, has certain sectoral provisions relating to media and defence industries that are an obstacle to any take-over by an EU-registered firm. However, the amount of takeover activity from EU bidders in the US shows that this is not a generalised problem, and any countervailing measures should be both proportionate and compatible with our international obligations. Amendment 10 of the draft Lehne report provides for a recital specifying that Member States may ban take-overs from third countries or make them subject to prior approval, for as long as access to those third country markets is hindered. Due to potential complications with WTO arrangements, it is not appropriate to place a provision on reciprocity in the articles of the directive. Shared jurisdiction The Commission proposal provides in Article 4 for shared jurisdiction where the target company is not listed in its country of origin. However, shared jurisdiction causes practical complications and entails significant risk, in particular in relation to take-overs. A clear provision is therefore necessary regarding applicable law. In addition to the principle of shared jurisdiction being problematic, the Commission's text causes implementation difficulties by employing the use of undefined terminology such as "bid procedure" and "company law". In order to bring clarity to the issue of jurisdiction, your Draftsman proposes that the competent authority should be solely that of the Member State where the offeree company has its registered office. This therefore necessitates support for Amendments 27 and 28 of ECON (Amendment 15 of the draft Lehne Report) Additionally, Member States should not be permitted to provide derogations to the general principles to be respected by national implementing measures. Amendment 29 should therefore be supported. State-guaranteed monopolies The aim of the directive is to create a level playing field between market operators. Since state guaranteed monopolies still exist within the EU, the directive should be careful not to perpetuate advantages enjoyed by wholly state-owned monopoly structures. Amendment 19 (Amendment 11 of the draft Lehne Report) should therefore be supported which provides that where the offeror is a state owned company, the supervisory authority may subject the takeover to a discretionary approvals procedure. Cash alternative PE 323.107/REV TR 10/33 PA\493753EN.doc Member States should oblige offerors to provide a cash offer, at least as an alternative. ECON Amendments 40, 44, 43 and 45 should be supported. Comitology The take-over proposal is a major plank of the Financial Services Action Plan, and as such it should be subject to the agreed provisions regarding implementing measures. There should be a "sunset clause" which will lead to the expiry of the powers four years after entry into force of the directive unless voted anew by the parliament, and recitals concerning the commitments undertaken by the Commission and the Council in setting out implementing measures. Clarifications to the text Recital 16 should be amended as in Amendment 8 (Amendment 4 of the draft Lehne Report) so that it reflects the obligation in Article 6, paragraph 3, point (h) that the board of the offeree company is required to publish a document setting out its opinion on the bid, including effects on employment. Recital 2 and recital 10 should be amended (as proposed in ECON Amendment 2 and 4 and Amendments 1 and 2 of the draft Lehne Report) so that it is clear, as it is in Article 2, paragraph 1, point (e), that the directive includes in its scope shares carrying voting rights. Similarly, the adoption of part of Amendment 11 is also required to ensure this (Amendment 5 in the draft Lehne Report). A drafting amendment (ECON Amendment 90) is necessary to ensure that Article 11 applies only to securities as defined in Article 1, paragraph 2, point (e). AMENDMENTS The Committee on Economic and Monetary Affairs calls on the Committee on Legal Affairs and the Internal Market, as the committee responsible, to incorporate the following amendments in its report: Text proposed by the Commission1 Amendments by Parliament Amendment 111 Recital 2 (2) It is necessary to protect the interests of holders of securities of companies governed by the law of a Member State when these companies are subject to a take1 (2) It is necessary to protect the interests of holders of securities of companies governed by the law of a Member State when these companies are subject to a take- Not yet published in OJ. PA\493753EN.doc 11/33 PE 323.107/REV TR over bid or to a change of control and at least some of their securities are admitted to trading on a regulated market. over bid or to a change of control and at least some of their securities carrying voting rights are admitted to trading on a regulated market. Justification This classification is required in order to be coherent with the definition of securities in Article 2 (e). Amendment 112 Recital 10 (10) The obligation to launch a bid should not apply in the case of the acquisition of securities which do not carry voting rights at ordinary general meetings. Member States should, however, be able to provide that the obligation to make a bid to all holders of securities relates not only to securities carrying voting rights but also to securities which carry voting rights only in specific circumstances or which do not carry voting rights. (10) The obligation to launch a bid should not apply in the case of the acquisition of securities which do not carry voting rights at ordinary general meetings and where the relinquishment of voting rights is offset by pecuniary advantages. Member States should, however, be able to provide that the obligation to make a bid to all holders of securities relates not only to securities carrying voting rights but also to securities which carry voting rights only in specific circumstances or which do not carry voting rights. Justification It is necessary to clarify that the directive does not apply to securities carrying voting rights which carry pecuniary advantages.Amendment 113 Recital 12 (12) The holders of securities should be properly informed of the terms of the bid by means of an offer document. Appropriate information should also be given to the representatives of the company's employees or, failing that, to the employees directly. PE 323.107/REV TR (12) The holders of securities should be properly informed of the terms of the bid by means of an offer document. Information about all details of the terms of the bid should also be given to the representatives of the company's employees. Where there are no employee representatives in the company, the employees should be informed directly in as detailed a manner as necessary. 12/33 PA\493753EN.doc Justification Employees, or their representatives should be provided with information on all of the terms of the bid. Amendment 114 Recital 16 The board of the offeree company should be required to make public a document setting out its opinion on the bid and the reasons on which it is based, including its views on the effects of implementation on all the interests of the company and specifically on employment. The board of the offeree company is required to make public a document setting out its opinion on the bid and the reasons on which it is based, including its views on the effects of implementation on all the interests of the company and specifically on employment. Justification The board has an absolute obligation to provide a public document, rather than merely an optional duty. Amendment 115 Recital 18 (18) Member States should take the necessary measures to afford any offeror the possibility of purchasing the securities of the offeree company, by neutralising provisions placing restrictions on the transfer of securities and on voting rights, and to render ineffective any restrictions on the transfer of securities and on voting rights which may prevent an offeror who holds sufficient securities of the offeree company from exercising the corresponding voting rights in order to amend the company’s articles of association, by neutralising restrictions on the voting rights and special appointment rights held by shareholders at the first general meeting following closure of the bid. PA\493753EN.doc (18) Member States should afford any offeror the possibility of purchasing securities admitted to trading on a regulated market and carrying voting rights by neutralising provisions placing restrictions on the transfer of such securities and on the attached voting rights, and to render ineffective any restrictions on the transfer of securities and on voting rights which may prevent an offeror who holds sufficient securities of the offeree company from exercising the corresponding voting rights in order to amend the company’s articles of association, by neutralising restrictions on the voting rights, multiple voting rights and special appointment rights held by shareholders at the first general meeting 13/33 PE 323.107/REV TR following closure of the bid. Justification See justification to amendment to Article 5.4.1 and Article 11. Amendment 116 Recital 18a (new) This Directive does not seek to override rights or restrictions whose sole purpose is to safeguard or uphold moral, ethical or cultural qualities or standards of a noneconomic nature which are in the public interest and compatible with the general provisions and other principles of Community law. Justification See justification to amendment to Article 11, paragraph 5b new. Amendment 117 Recital 20 (20) The provision of information to and consultation of representatives of the employees of the offeror and the offeree company must be governed by the relevant national provisions, and in particular those adopted pursuant to Council Directive 94/45/EC of 22 September 1994 on the establishment of a European Works Council or a procedure in Community-scale undertakings and Community-scale groups of undertakings for the purposes of informing and consulting employees, Council Directive 98/59/EC of 20 July 1998 on the approximation of the laws of the Member States relating to collective redundancies1 and Directive 2002/14/EC of the European Parliament and of the 1 2 OJ L 225, 12.8.1998, p. 16. OJ L 225, 12.8.1998, p. 16. PE 323.107/REV TR (20)The provision of information to and consultation of representatives of the employees of the offeror and the offeree company must be detailed and be governed by the relevant national provisions, and in particular those adopted pursuant to Council Directive 94/45/EC of 22 September 1994 on the establishment of a European Works Council or a procedure in Community-scale undertakings and Community-scale groups of undertakings for the purposes of informing and consulting employees, Council Directive 98/59/EC of 20 July 1998 on the approximation of the laws of the Member States relating to collective redundancies2 and Directive 2002/14/EC of the European Parliament and of the 14/33 PA\493753EN.doc Council of 11 March 2002 establishing a general framework for informing and consulting employees in the European Community. The employees of the offeree company, or their representatives, should nevertheless be afforded the opportunity of giving their views on the foreseeable effects of the bid on employment. Council of 11 March 2002 establishing a general framework for informing and consulting employees in the European Community. The employees of the offeree company, or their representatives, should nevertheless be afforded the opportunity of giving their views on the foreseeable effects of the bid on employment. Where there are no employee representatives, the employees must be informed directly in as detailed a manner as necessary and be given an opportunity to express their opinion. Justification Employee representatives must be provided with detailed information. If there are no representatives of employees, the employees themselves must be informed in a detailed fashion and must be provided with the opportunity to express their opinion. Amendment 118 Recital 25b (new) The European Parliament should be given a period of three months from the first transmission of draft implementing measures to allow it to examine them and to give its opinion. However, in urgent and duly justified cases, this period may be shortened. If, within that period, a resolution is passed by the European Parliament, the Commission should re-examine the draft measures. Justification It is necessary to take into account the agreement between the Commission and Parliament on the implementation of financial services legislation. Amendment 119 Recital 25c (new) In exercising its implementing powers in PA\493753EN.doc 15/33 PE 323.107/REV TR accordance with this Directive, the Commission should respect the following principles: – the need to ensure confidence in financial markets among investors by promoting high standards of transparency in financial markets; – the need to provide investors with a wide range of competing investments and a level of disclosure and protection tailored to their circumstances; – the need to ensure that independent regulatory authorities enforce the rules consistently, especially as regards the fight against economic crime; – the need for high levels of transparency and consultation with all market participants and with the European Parliament and the Council; – the need to encourage innovation in financial markets if they are to be dynamic and efficient; – the need to ensure market integrity by close and reactive monitoring of financial innovation; – the importance of reducing the cost of, and increasing access to, capital; – the balance of costs and benefits to market participants on a long-term basis (including small and medium-sized businesses and small investors) in any implementing measures; – the need to foster the international competitiveness of EU financial markets without prejudice to a much-needed extension of international cooperation; – the need to achieve a level playing field for all market participants by establishing EU-wide regulations every time it is appropriate; – the need to respect differences in national markets where these do not unduly impinge on the coherence of the single market; – the need to ensure coherence with other EU legislation in this area, as PE 323.107/REV TR 16/33 PA\493753EN.doc imbalances in information and a lack of transparency may jeopardise the operation of the markets and above all harm consumers and small investors. Justification This sets out principles to guide the Commission when exercising its implementing powers Amendment 120 Recital 25d (new) The Resolution of the European Parliament of 5 February 2002 on the implementation of financial services legislation also endorsed the Committee of Wise Men's report, on the basis of the solemn declaration made before Parliament the same day by the Commission and the letter of 2 October 2001 addressed by the Internal Market Commissioner to the chairman of Parliament's Committee on Economic and Monetary Affairs with regard to the safeguards for the European Parliament's role in this process. Justification It is necessary to take into account the agreement between the Commission and Parliament on the implementation of financial services legislation Amendment 121 Recital 26 a (new) (26a) The general conditions governing corporate take-overs currently differ at international level. Member States may therefore take proportionate action to prohibit take-overs originating in third countries for as long as access for offerors from the European Union to such markets is hampered inappropriately PA\493753EN.doc 17/33 PE 323.107/REV TR on account of legal obstacles to takeovers. Justification It is essential to ensure that there is a level playing field between EU law and US law and that EU operators are able to gain access to investment in US markets since the directive will provide access to European markets for third countries. Amendment 122 Recital 26 b (new) (26b) Where the offeror is a company that derives the bulk of its turnover from a market with monopoly structures enjoying state protection, the Member State in which the offeree company is based may impose restrictive conditions on, or prohibit, the take-over. Justification Monopoly structures should not be permitted to enjoy advantages which are not permitted to other market operators. Amendment 123 Recital 26 d (new) (26d) Where national provisions stipulate special rights on the part of the State or private individuals that are designed to hinder the acquisition of the offeree company such as golden shares, restrictions on voting rights and multiple voting rights, the Member States must make appropriate notification to the Commission. Justification The Commission rightly proposes – in keeping with the case law of the European Court – that the problem of the golden share should be resolved by means of primary Community law. It also appears to make sense to provide for an appropriate notification requirement PE 323.107/REV TR 18/33 PA\493753EN.doc particularly since golden shares are in some cases considered admissible by this case law subject to stringent conditions. Amendment 124 Article 2, paragraph 1, point (g) (new) (g) ‘multiple voting shares’ means shares included in a distinct and separate class and carrying a vote of higher weight than other shares. Justification In accordance with amendments to Article 11, a definition of "multiple voting rights" is required within the directive for the sake of clarity. Amendment 125 Article 4, paragraph 2 (a) The authority competent for supervising the bid shall be those of the Member State in which the offeree company has its registered office if the securities of that company are admitted to trading on a regulated market in that Member State. The authority competent and the law applicable for supervising the bid shall be those of the Member State in which the offeree company has its registered office. (b) If the securities of the offeree company are not admitted to trading on a regulated market in the Member State in which the company has its registered office, the authority competent for supervising the bid shall be that of the Member State on whose regulated market the securities of the company are admitted to trading. If the securities of the company are admitted to trading on regulated markets in more than one Member State, the authority competent for supervising the bid shall be that of the Member State on whose regulated market the securities were first admitted. (c) If the securities of the offeree company are first admitted to trading on regulated markets within more than one PA\493753EN.doc 19/33 PE 323.107/REV TR Member State simultaneously, the offeree company shall determine which of the supervisory authorities of those Member States is the competent authority for supervising the bid by notifying these regulated markets and their supervisory authorities on the first trading day. (d) Member States shall ensure that the decisions referred to in point (c) are made public. (e) In the cases referred to in points (b) and (c), matters relating to the consideration offered in the case of a bid, in particular the price, and matters relating to the bid procedure, in particular the information on the offeror's decision to make a bid, the contents of the offer document and the disclosure of the bid, shall be dealt with in accordance with the rules of the Member State of the competent authority. In matters relating to the information to be provided to the employees of the offeree company and in matters relating to company law, in particular the percentage of voting rights which confers control and any derogation from the obligation to launch a bid, as well as the conditions under which the board of the offeree company may undertake any action which might result in the frustration of the bid, the applicable rules and the competent authority shall be those of the Member State in which the offeree company has its registered office. Justification The provisions on applicable law are overly complex. The supervisory authority of the country where the offeree has its registered office should be the sole supervisory authority. Amendment 126 Article 4, paragraph 5, subparagraph 2 PE 323.107/REV TR 20/33 PA\493753EN.doc Provided that the general principles set out in Article 3(1) are respected, Member States may provide in their rules made or introduced pursuant to this Directive that their supervisory authorities may, in certain types of cases determined at national level and/or in other special cases, grant derogations from these rules on the basis of a reasoned decision. deleted Justification In the interests of creating a level playing field within Europe, Member States should not be permitted to allow derogations from the directive. Amendment by Christa Randzio-Plath Amendment 127 Article 5, paragraph 1 Where a natural or legal person who, as a result of his own acquisition or the acquisition by persons acting in concert with him, holds securities of a company referred to in Article 1(1) which, added to any existing holdings and the holdings of persons acting in concert with him, directly or indirectly give him a specified percentage of voting rights in that company, conferring on him the control of that company, Member States shall ensure that this person is required to make a bid as a means of protecting the minority shareholders of that company. This bid shall be addressed at the earliest opportunity to all holders of securities for all their holdings at an equitable price. Where a natural or legal person who, as a result of his own acquisition or the acquisition by persons acting in concert with him, holds securities of a company referred to in Article 1(1) which, added to any existing holdings and the holdings of persons acting in concert with him, directly or indirectly give him a specified percentage of voting rights in that company, conferring on him the control of that company, Member States shall ensure that this person is required to make a bid as a means of protecting the minority shareholders of that company and of creating transparency for the offeree company, and in particular for its employees. This bid shall be addressed at the earliest opportunity to all holders of securities for all their holdings at an equitable price. Or. de Justification The purpose of the take-overs directive must not be confined to investor protection but must PA\493753EN.doc 21/33 PE 323.107/REV TR also include protection of the interests of the offeree company's employees. Amendment 128 Article 5, paragraph 1 1. Where a natural or legal person who, as a result of his own acquisition or the acquisition by persons acting in concert with him, holds securities of a company referred to in Article 1(1) which, added to any existing holdings and the holdings of persons acting in concert with him, directly or indirectly give him a specified percentage of voting rights in that company, conferring on him the control of that company, Member States shall ensure that this person is required to make a bid as a means of protecting the minority shareholders of that company. This bid shall be addressed at the earliest opportunity to all holders of securities for all their holdings at an equitable price. 1. Where a natural or legal person who, as a result of his own acquisition or the acquisition by persons acting in concert with him, holds securities of a company referred to in Article 1(1) which, added to any existing holdings and the holdings of persons acting in concert with him, directly or indirectly give him 30% of the shares carrying most voting rights pursuant to Article (3) and (4), Member States shall ensure that this person is required to make a bid as a means of protecting the minority shareholders of that company. This bid shall be addressed at the earliest opportunity to all holders of securities for all their holdings at an equitable price. Justification A threshold for the triggering a bid should be incorporated into the directive, in order to provide uniformity across the EU . Amendment 129 Article 5(3) 3. The percentage of voting rights which confers control for the purposes of paragraph 1 and the method of its calculation shall be determined by the rules of the Member State in which the company has its registered office. deleted Justification Article 5(3) lapses as a result of the amendment to paragraph 1. Amendment 130 PE 323.107/REV TR 22/33 PA\493753EN.doc Article 5, paragraph 4, subparagraph 1 The highest price paid for the same securities by the offeror, or by persons acting in concert with him, over a period of between six and twelve months prior to the bid referred to in paragraph 1 shall be regarded as an equitable price. The highest price paid for the same securities by the offeror, or by persons acting in concert with him, over a period of between six and twelve months prior to the bid referred to in paragraph 1 shall be regarded as an equitable price. Where in the case of shares carrying multiple voting rights the equitable price cannot be determined in accordance with the provisions of this paragraph because these shares are not traded on any market, the equitable price for securities of this nature shall be calculated in accordance with provisions adopted by the Member States pursuant to the respective ownership and constitutional requirements. Justification The equitable price should be determined by Member States where it cannot be determined by the first part of subparagraph 1. Amendment 131 Article 5, paragraph 4, subparagraph 2 and 3 Member States may authorise their supervisory authorities to adjust the price referred to in the first subparagraph in circumstances and according to criteria that are clearly determined. To that end, they shall draw up a list of circumstances in which the highest price may be adjusted either upwards or downwards, for example where the highest price was set by agreement between the purchaser and a seller, where the market prices of the securities in question have been manipulated, where market prices in general or certain market prices in particular have been affected by exceptional occurrences, or in order to enable a firm in difficulty to be rescued. They may also determine the criteria to be applied in such cases, for example the average market value over a particular period, the break-up value of the company PA\493753EN.doc Delete 23/33 PE 323.107/REV TR or other objective valuation criteria generally used in financial analysis. Any decision by a supervisory authority to adjust the equitable price shall be substantiated and made public. Justification The proposed derogation powers of the Commission with regard to the equitable price should be deleted since they are vague and impractical. Derogation powers are already granted in Article 4, paragraph 5. Amendment 132 Article 5, paragraph 5, subparagraph 1 The consideration offered by the offeror may consist exclusively of liquid securities. The offeror may offer as consideration securities or cash or a combination of them, unless Member States stipulate that the consideration has to include a cash consideration at least as an alternative Justification Member States should be able to require that a cash offer is provided as an alternative to an offer of only listed securities. This would provide for flexibility in the interests of minority shareholders. Amendment 133 Article 5, paragraph 5, subparagraph 2 Where the consideration offered by the offeror does not consist of liquid securities admitted to trading on a regulated market, Member States may stipulate that such consideration has to include a cash consideration at least as an alternative. However, Where the consideration offered by the offeror does not consist of liquid securities admitted to trading on a regulated market, Member States shall stipulate that such consideration has to include a cash consideration. Justification See justification to amendments to Article 5, paragraph 5, subparagraph 1 PE 323.107/REV TR 24/33 PA\493753EN.doc Amendment 134 Article 5, paragraph 5, subparagraph 3 In any event, the offeror shall offer a cash consideration at least as an alternative where, either individually or together with persons acting in concert with him, over a period beginning at least three months before his bid is made pursuant to Article 6(1) and ending before expiry of the period for acceptance of the bid, he has purchased in cash more than 5% of the securities or voting rights of the offeree company. In any event, the offeror shall offer a cash consideration at least as an alternative where, either individually or together with persons acting in concert with him, over a period beginning at least three months before his bid is made public pursuant to Article 6(1) and ending on expiry of the period for acceptance of the bid, he has purchased in cash securities carrying more than 5% of the voting rights of the offeree company. Justification "Public" should be inserted to be consistent with Article 6 (1). "Before" should be placed before "on" to make the expiry date clear. The 5% test should be clarified so that the obligation to offer a cash consideration is determined by the purchase of securities carrying more than 5% of the voting rights of the offeree company. This is necessary to be consistent with Article 5 (1) which relates only to the acquisition of "securities" as defined in Article 2 (1) e and not to voting rights 1 Amendment 135 Article 9, paragraph 3. 3. As regards decisions taken before the beginning of the period referred to in the second subparagraph of paragraph 2 and not yet partly or fully implemented, the general meeting of the shareholders shall approve or confirm any decision which does not form part of the normal course of the company's business and whose implementation may result in the frustration of the bid. PA\493753EN.doc 3. Member States may provide that as regards decisions taken before the beginning of the period referred to in the second subparagraph of paragraph 2 and not yet partly or fully implemented, the general meeting of the shareholders and the supervisory board in those Member States where that is determined by national law shall approve or confirm any decision which does not form part of the normal course of the company's business and whose implementation may result in the frustration of the bid. 25/33 PE 323.107/REV TR Justification The proposal needs to take account of the different systems of national law. Amendment 136 Article 10, paragraph 3 3. Member States shall ensure that, in the case of companies whose securities are admitted to trading on a regulated market in a Member State, the general meeting of shareholders takes a decision at least every two years on the structural aspects and defensive mechanisms referred to in paragraph 1. They shall require the board to state the reasons for those structural aspects and defensive mechanisms. 3. Member States shall ensure that, in the case of companies whose securities are admitted to trading on a regulated market in a Member State, the general meeting of shareholders takes a decision each year on the structural aspects and defensive mechanisms referred to in paragraph 1. They shall require the board to state the reasons for those structural aspects and defensive mechanisms. Justification The decision should be taken every years, in order to ensure that it is up to date. A decision every two years is not sufficient. Amendment 137 Article 10, paragraph 3a (new) 4. Where the legislation of a Member State grants special rights to, or imposes restrictions on, that Member State or third parties that are designed to obstruct the acquisition of the offeree company by the offeror, such Member States shall be required to notify the matter to the Commission. The Commission shall examine the justification for these special provisions on the basis of the Treaty. Justification The Commission should be supported so as not to settle the issue of golden shares in this directive but to resolve it on the basis of primary Community law in accordance with the PE 323.107/REV TR 26/33 PA\493753EN.doc decisions of the European Court of Justice. However, Member States should at least be required to notify the Commission of provisions.. Amendment 138 Article 11, Title Unenforceability of restrictions on the transfer of securities and voting rights Breakthrough Justification The title should be amended in order to be more transparency and clear about the provision of Article 11. Amendment 139 Article 11, paragraph 2, subparagraph 2 Any restrictions on the transfer of securities provided for in contractual agreements between the offeree company and holders of its securities or between holders of securities of the offeree company shall be unenforceable against the offeror during the period for acceptance of the bid. Any restrictions on the transfer of securities provided for in contractual agreements between the offeree company and holders of its securities shall be unenforceable against the offeror during the period for acceptance of the bid Justification Shareholders should be able to enter freely into agreements between themselves, and the prohibition on shareholder agreements should be deleted. Amendment 140 Article 11, paragraph 3 Any restrictions on voting rights provided for in the articles of association of the offeree company shall cease to have effect when the general meeting decides on any defensive measures in accordance with Article 9. Any restrictions on voting rights of securities provided for in the articles of association of the offeree company shall cease to have effect when the general meeting decides on any defensive measures in accordance with Article 9. Any restrictions on voting rights provided Any restrictions on voting rights of PA\493753EN.doc 27/33 PE 323.107/REV TR for in contractual agreements between the offeree company and holders of its securities or between holders of securities of the offeree company shall cease to have effect when the general meeting decides on any defensive measures in accordance with Article 9. securities provided for in contractual agreements between the offeree company and holders of its securities shall cease to have effect when the general meeting decides on any defensive measures in accordance with Article 9. Justification See justification to amendment to 11.2. The term "of securities" has been added in order to clarify. . Amendment 140 Article 11, paragraph 3a (new) 3a. Multiple voting shares shall not carry a vote of a higher weight than other shares at the general meeting which decides on any defensive measures in accordance with Article 9. Justification Multiple voting rights should be included in the breakthrough rule, in accordance with the view of the High Level Group of Company Law Experts ("Winter Group"). Amendment 141 Article 11, paragraph 4 4. Where, following a bid, the offeror holds a number of securities of the offeree company which, under the applicable national law, would enable him to amend the company's articles of association, any restrictions on the transfer of securities and on voting rights referred to in paragraphs 2 and 3 and any special rights of shareholders concerning the appointment or removal of board members shall cease to have effect at the first general meeting following closure of the bid. PE 323.107/REV TR 4. Where, following a bid, the offeror holds 75% of the securities of the offeree company which, under the applicable national law, would enable him to amend the company's articles of association, any restrictions on the transfer of securities and on voting rights referred to in paragraphs 2 and 3 and any special rights of shareholders concerning the appointment or removal of board members shall not apply and multiple voting rights shall carry one vote only at the first general meeting following closure of the bid. 28/33 PA\493753EN.doc Justification Multiple voting rights should be included in the breakthrough rule, as well as a harmonised threshold. Amendment 142 Article 11, paragraph 5a (new) (a) Paragraphs 2, 3 and 4 shall not apply to: (i) restrictions on the transfer of securities; (ii) restrictions on voting rights (iii) special rights of shareholders concerning the appointment or removal of board members; and (iv) multiple voting shares; which were in existence and in the public domain on 1 January 2003 (b) Member States shall cause to be maintained, in respect of companies incorporated under the laws of that Member State, a register of such rights and restrictions which shall be available for public inspection. Failure to register such any such right or restriction in the relevant register by 1 January 2010 shall remove the protection afforded by this paragraph. Justification The Directive should not interfere with private contractual rights and constitutional mechanisms freely entered into, or accepted on investment, by shareholders in the past and which were perfectly legal at the time. The principal purpose of the Directive is the provision of safeguards for shareholders (Recital 1), to protect the interests of shareholders (Recital 2), and to create “community-wide clarity and transparency in respect of legal issues to be settled in the event of take-over bids and to prevent patterns of corporate restructuring…………. from being distorted……….”. The purpose is not to eliminate existing property rights, nor to eliminate other rights and structures the purpose of which is neither to entrench management nor to protect economic rights or benefits. Article 11 [in its likely amended form] will achieve both, giving rise to a need for a compensation mechanism which PA\493753EN.doc 29/33 PE 323.107/REV TR will be both complicated and, in some cases, arbitrary. In any event, certain rights may not be capable of compensation by economic means. Assessing compensation in a take-over situation may therefore be difficult or in some cases impossible, leading to market uncertainty and prejudice to companies and their shareholders. Amendment 143 Article 11, paragraph 5a (new) 6. The provisions of Article 11 shall not apply to take-overs of offeree companies admitted to the stock market less than 5 years ago. Justification Start-up companies and young companies should be provided with a derogation in order to encourage their development. Amendment 144 Article 11, paragraph 5b (new) Paragraphs 2, 3 and 4 shall not apply to rights and restrictions whose sole purpose is to safeguard or uphold moral, ethical or cultural qualities or standards of a noneconomic nature which are in the public interest and compatible with the general provisions and other principles of Community law. The shareholder exercising such special powers shall be independent in terms of legal structure and economic interests of the board of directors and of other shareholders. Justification Amendment 145 Article 13 Information for and consultation of PE 323.107/REV TR Information for and consultation of 30/33 PA\493753EN.doc employees' representatives employees' representatives Without prejudice to the provisions of this Directive, the provision of information to and consultation of representatives of the employees of the offeror and the offeree company shall be governed by the relevant national provisions, and in particular those adopted pursuant to Directives 94/45/EC, 98/59/EC and 2002/14/EC. The provisions of this Directive are without prejudice to the rules relating to the provision of information to and consultation and codetermination of representatives of the employees of the offeror and the offeree company governed by the relevant national provisions, and in particular those adopted pursuant to Directives 94/45/EC, 98/59/EC and 2002/14/EC. Justification Employees are involved not only via information and consultation but via codetermination. The boards of the offeror and offeree company must consult the employees and their representatives during the take-over process. See also justification to amendment to Article 9, paragraph 5. Amendment 146 Article 15a (new) Article 15a Sell-out right in the case of multiple voting rights 1. Member States shall provide that holders of shares carrying multiple voting rights that have been set aside by a decision of the general meeting of the offeree company pursuant to Article 11(4) may require the offeror to acquire such securities at an equitable price. The equitable price shall be determined in accordance with the provisions of Article 5. Justification See justification to amendment to 11.3 a new PA\493753EN.doc 31/33 PE 323.107/REV TR Amendment 148 Article 17, paragraph 3a (new) Without prejudice to the implementing measures already adopted, on the expiry of a four-year period following its entry into force of this Directive, the application of its provisions requiring the adoption of technical rules and decisions in accordance with paragraph 2 shall be suspended. On a proposal from the Commission, the European Parliament and the Council may renew the provisions concerned in accordance with the procedure laid down in Article 251 of the EC Treaty and, to that end, they shall review them prior to the expiry of the period referred to above' Or. de Justification In the absence of a permanent procedure for democratic oversight of Commission implementing measures, including a legally binding call-back mechanism, the Parliament must protect its prerogatives by setting a time limit on the powers accorded to the Commission and the Securities Committee. This amendment will ensure that the Commission takes due account of the Parliament's position on implementing measures, since it will know that its powers to adopt new implementing measures will not be renewed by the Parliament unless it does. Any potential for a legal vacuum is minimised, first because existing legislation and implementing rules will not be repealed, and second because the amendment requires the Council and Parliament to review the provisions on the basis of a Commission proposal prior to the expiry of the 4 year period. This amendment is taken from conclusion 17 of the von Wogau report on the implementation of financial services legislation (A5-0011/2002). It is necessary to take into account the agreement between the Commission and Parliament on the implementation of financial services legislation. Amendment 149 Article 19 Transitional period Transitional periods Member States are authorised to postpone application of Article 9 for a period of not more than three years after the date laid down in Article 20(1), provided that they PE 323.107/REV TR Notwithstanding Article 20(12), member states shall promulgate by no later than 1 January 2010 the necessary legal and 32/33 PA\493753EN.doc inform the Commission thereof not later than that date. administrative provisions for implementation of Articles 9 and 11. Member States may, however, extend the transitional period for the application of Article 11 paragraphs 2,3 and 4 to multiple voting rights, restrictions on voting rights, restrictions on the transfer of securities and special rights of shareholders concerning the appointment or removal of board members for a period not exceeding twenty years from the entry into force of the directive. Justification Member States must enact by 1 January 2010 Articles 9 and 11, and for paragraphs 2, 3, 4, they may delay implementation until 20 years from the entry into force of the directive. PA\493753EN.doc 33/33 PE 323.107/REV TR