Freshman Experience: Managing Your Finances Georgia Gwinnett College

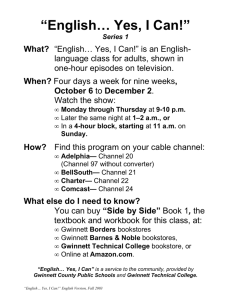

advertisement

Freshman Experience: Managing Your Finances Georgia Gwinnett College October 15 & 17, 2007 Table of Contents I. Money Management II. Banking III. Credit: Managing Debt IV. Identity Theft Georgia Gwinnett College 2 Money Management Georgia Gwinnett College 3 Money Management Importance of Budgeting The #1 Money Trap Not knowing what you have to spend Ignoring bills coming up next week or next month Are you managing your money or is it managing you? Results: Living paycheck-to-paycheck Coming up short when the big bills come in Budgets Help You To: Know where you spend your money Reach your long and short term goals Keep your focus Show where you need additional help and if you have a borrowing need Include your spouse and/or family in money management issues Georgia Gwinnett College 4 Money Management Step-by Step Budgeting Step 1 Estimate Your Income Step 2 Estimate Your Fixed Expenses Step 3 Determine Amount Available for Variable Expenses Step 4 Estimate Your Variable Expenses Step 5 Determine Your Surplus or Deficit Budget Guidelines and Suggestions Keep it simple Tailor your budget to specific goals Be consistent Restrict debt payments to no more than 20% of your income Try to save 10% of your income Establish an emergency fund equal to 6 months of expenses Georgia Gwinnett College 5 Money Management Budget Example Budget January Actual Budget February Actual Budget March Actual Income 1. Money from Mom & Dad/ Family 2. Financial Aid 3. Part/ Full-Time Job Salary 4. Total Income Fixed Expenses 5. Savings 6. Mortgage/ Rent 7. Auto Loan(s) 8. Other Loan(s) 9. Gas 10. Credit 11. Utilities 12. Insurance 13. Books & School Supplies 14. Medical 15. Parking 16. Total Fixed Expenses 17. Available for Variable Expenses Variable Expenses 18. Food 19. Concerts 20. Road Trips 21. Spring Break 22. Clothing 23. Beverage Fund 24. Personal Care 25. Gym Membership 26. Taxes 27. Miscellaneous 28. Total Variable Expenses Monthly Result 29. Monthly Surplus/ (Deficit) Georgia Gwinnett College 6 Money Management Follow Through With Your Budgeting Plan Set Your Budget Every Year Review your budget every month Are you over or under on your budget items? Are your variable expenses in line? What are your “budget busters”? Are any expenses out of control? Will you make your planned surplus by year end? Now that you have created your budget, stick with it! 10 Leading Causes of Overspending – Beware of These Habits! 1. The “latest and greatest” syndrome 6. Being unaware of how much you have to spend 2. Using credit instead of cash 7. Money “burning a hole in your pocket” 3. Eating out every night 8. Buying impulsively 4. Borrowing from the future 9. Rationalizing spending = “need it because” 5. Keeping up with the Joneses 10. Not knowing on what or where you are spending your money Georgia Gwinnett College 7 Money Management Stay on Track With These Money Management Tips Saving Tips! Saving Tip #1 Focus on number of dollars per day to save Saving Tip #9 Avoid impulse buys Saving Tip #2 Pay yourself first Saving Tip #10 Use public transportation or carpool Saving Tip #3 Save money from coupons and sales Saving Tip #11 Collect loose change Saving Tip #4 Look at lower-cost alternatives Saving Tip #12 Break a habit Saving Tip #5 Shop around for the best price Saving Tip #13 Dine in more than out Saving Tip #6 Organize your bills and financial records Saving Tip #13 Borrow books and movies, instead of buying Saving Tip #7 Pay installments to your savings account Saving Tip #15 Have a “Buy Nothing” week Saving Tip #8 Live with roommates Georgia Gwinnett College 8 Banking Georgia Gwinnett College 9 Banking Think of Banking as a Journey Checking Account Payments made via check, online banking and debit card Low or no interest High transaction volume Keeping your money in a bank will provide you with: Savings Account Withdrawal Slip Low transaction volume Minimal interest earnings Safety Convenience Security Financial Future Money Market Account Checks Limited withdrawals Higher interest earnings Asset Management Account High transaction volume High interest earnings Stocks Georgia Gwinnett College 10 Banking What Do I Need to Know About My Checking Account? Spending Money I Don’t Have Reconciling My Account Using Online Banking Reading a Check Only 10% of high school students graduate with any kind of instruction in personal finance Endorsing a Check Getting Help Routing Transit Number Account Number Check Number Georgia Gwinnett College 11 Banking Reconciling Your Account Georgia Gwinnett College 12 Banking An Account Statement Georgia Gwinnett College 13 Banking Different Ways You Can Bank Phone In today’s virtual world, you can manage your finances almost anywhere, anytime Check your account Transfer money Obtain account history Stop payment on check Obtain branch hours and locations Report a lost, stolen or damaged card ATM Access cash Check account balances Make deposits Online Check your account Transfer money between accounts within your bank Obtain account history Stop payment on check Obtain branch hours and locations Set up balance alerts Pay bills online Branch All of the above! Georgia Gwinnett College 14 Banking Debit Card vs. Credit Card Debit Cards Purchase amounts are automatically deducted from your checking account May approve into overdraft May also be used as an ATM card to access cash Do you know the difference? Usually VISA or MasterCard Credit Cards Buy now, pay later Interest charges on unpaid balances May incur late fees if the minimum payment is not paid on time If establishing credit: Pay on time, in full each month branded Georgia Gwinnett College 15 Credit: Managing Debt Georgia Gwinnett College 16 Credit: Managing Debt Importance of Credit Your credit score will be the single most important factor in determining your approval for a mortgage, car loan, credit card and insurance You have a file with a credit bureau if you have ever applied for a credit card, loan, or a job Lenders use your credit score and the following factors to decide whether to lend you money your income your other debts job stability Students and Debt 1 in 3 college students has 4 or more credit cards! College students mostly use credit cards on lifestyle purchases 76% of all undergraduate college students have at least one credit card and carry an average balance of $2,169 10% of college card holders owe $7,000 or more, and most do not pay off the balances each month For every $1,000 you charge and do not pay off, you will be charged $180 to $210 a year Best Practice: charge no more than you can pay off each month Georgia Gwinnett College 17 Credit: Managing Debt Your Credit Record To determine how likely it is that you will repay a loan and make How Do Creditors Use Your Credit Report? Like it or not, potential employers and lending institutions view your credit as an extension of your character – are you a responsible person? What Is a Credit Score? payments on time based on information contained in your credit report, including the following: bill paying history (late payments, collections, outstanding debt) income (and amount of debt you have) types of credit accounts arrests Numeric score (3 digits) that summarizes your credit history Provided to lenders by credit reporting companies Also known as your “FICO” score, or Fair Isaac (company that created the credit score) Scores range from 300’s to 800’s, and you should aim for a 720 or higher You can order free credit reports online annually from Equifax, Checking Your Credit Reports Experian and Transunion by accessing www.annualcreditreport.com It is important to know your credit score and check it annually Unexpected change in your credit score may be a sign of identity theft Georgia Gwinnett College 18 Credit: Managing Debt Tips for Good Credit Pay your bills on time and in full Credit card companies are now checking your report every month Under new “universal default” clauses, if you’re late on 1 card payment, another credit company can hike your interest rate on their card by up to 30%! Establish credit history – keep only 3 cards; short credit history can negatively affect credit score Reduce your total amount of credit card debt, and watch your debt in relation to your credit limit Close unneeded accounts; excessive credit card accounts may have a negative effect on your credit score Apply for new credit cautiously; too many credit inquiries can negatively affect your score Reduce the urge to sign up for new cards: Stop 90% of mail solicitations by calling the national OPT OUT number (888-5-OPT-OUT) Get copies of all three credit reports every year Equifax Experion Transunion Pay online if possible, that way you have proof that you paid on time Georgia Gwinnett College 19 Identity Theft Georgia Gwinnett College 20 Identity Theft Definition Identity Theft is when someone uses your personal information to assume your identity and open accounts with the intent of committing theft, fraud or crime Fraud occurs when someone steals information to transact on an account that is already open and the owner of the account is unaware of these transactions Identity Theft Facts “Every 79 seconds, a thief steals someone’s identity, opens accounts and goes on a buying spree” - CBSnews.com What is identity theft? What is fraud? Identity theft is one of the fastest growing crimes in the United States According to the Federal Trade Commission (FTC), 10 million people became victims of identity theft in 2006 FTC predicts 1 in 3 people will be identity theft victims sometime in their lives A typical victim spends $500-$1,500 and 30-170 hours to repair the damage of theft to existing accounts Nearly 75% of victims who discover the theft in the first month spend no money and less than 10 hours to resolve the issues Georgia Gwinnett College 21 Identity Theft What Identity Theft Means to Me File a police report Contact your bank to cancel debit cards and close bank accounts Call your credit card company to report fraudulent charges and close credit card accounts Report fraudulent use of your identification information to the Social Security Administration’s Fraud Assistance Hotline Change all electronic deposits and payments, credit cards and checking accounts What do I do if a become a victim? Contact all credit reporting agencies Recover over 18 month time period Explain, explain, explain Georgia Gwinnett College 22 Identity Theft Ways Your Identity Can Be Stolen Phishing emails Obtaining personal info from the internet Stolen purse or wallet How could your identity be stolen? Pretending to be a reputable company and ask for personal info Dumpster Diving Obtaining credit report by posing as a legitimate person Account numbers stolen as cards are processed Stolen mail Shoulder Surfing Georgia Gwinnett College 23 Identity Theft Uses of a Stolen Identity Make counterfeit identification, checks and bank cards and use them to drain your bank accounts Purchase larger items, including cars, boats and homes, by obtaining loans in your name Establish phone or wireless service in your name Call your bank or creditors pretending to be you and request an address change and another credit or debit card on your account The imposter then makes charges using the card sent to the incorrect address How could someone use my identity? Intercept a check written to you, forge your endorsement and cash it File for bankruptcy under your name to avoid paying debts they have incurred under your name, or to avoid eviction Commit crimes in your name Georgia Gwinnett College 24 Identity Theft Watch Out for Signs of Identity Theft Unexplained charges to or withdrawals from your financial accounts Receipt of credit cards for which you did not apply Credit denial for no apparent reason Unexplained negative credit score Calls or letters from debt collectors or businesses about merchandise or services you did not purchase How do I know if I have been a victim of identity theft? Georgia Gwinnett College 25 Identity Theft Strategies to Prevent Becoming a Victim Prevent Becoming a Victim Buy a cross cut shedder and use it! Shed unsolicited credit card and loan applications, account statements and receipts Destroy all cancelled checks, old statements, excess checks and deposit slips for closed accounts and credit card receipts Avoid printing your driver’s license number or your social security number on your checks – only supply information to reputable companies Review your credit report at least once a year from various credit bureaus – it may be months How can I prevent being a victim? before you become aware of unauthorized activity, and it can take years to clear up! Know with whom you are sharing your personal, confidential information Are they reputable? Do they truly need the information? Protect – do not write down or share – account information, pin numbers or passwords with others Run anti-virus software on your computer and avoid storing personal information on your laptop Access secure browsers and exit online applications as soon as you finish using them – If doing business over the internet, only use https:// Use debit card in place of checks Keep pin number separate from debit card Georgia Gwinnett College 26