Elizabeth A. Grob Ahlers & Cooney, P.C. 100 Court Avenue, Suite 600

advertisement

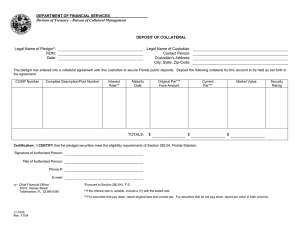

Elizabeth A. Grob Ahlers & Cooney, P.C. 100 Court Avenue, Suite 600 Des Moines, IA 50309-2231 Telephone: 515-243-7611 FAX: 515-243-2149 bgrob@ahlerslaw.com 663110 This material and the oral presentation of Beth Grob are intended merely to identify issues and are not intended to be a definitive analysis of the subjects discussed. It is not intended that reliance be placed upon these materials without confirming independent research by and consultation with an attorney licensed in the State of Iowa. • Iowa Code Chapter 12B: Security of the Revenue • • Standard of Care Required: . . . shall exercise the care, skill, prudence and diligence under the circumstances then prevailing that a prudent person acting in a like capacity familiar with such matters would use to attain the goals of this section. “This standard requires that when making investment decisions, a public entity shall consider the role that the investment or deposit plays within the portfolio of assets of the public entity and the goals of [investment prudence].” • Primary Goals of Investment Prudence, in the following order of priority: • • • Safety of the principal; Maintaining the necessary liquidity to match expected liabilities. Reasonable return. • Must have a written investment policy which shall address the Goals of Investment Prudence, compliance with state law, diversification, maturity, quality, and capability of investment management. The policy must be periodically reviewed. • The written investment policy must be delivered to: • • Governing Body/officer of entity to which the policy applies. • All depository institutions or fiduciaries for public funds of the public entity. • The auditor of the public entity. • Authorized investments: Obligations of the US Governments, its agencies and instrumentalities • Certificates of Deposit and other evidences of deposit at federally insured depository institutions approved pursuant to chapter 12C. • Prime Bankers Acceptances: vehicle created to facilitate commercial trade transaction similar to a Letter of Credit Guarantee payment of delivery of goods • • • • • Bank is issuer. Must mature within 270 days. Eligible for purchase by a Federal Reserve Bank. 10% portfolio; 5% single issuer. • Authorized investments: • Commercial Paper: Short-term, unsettled promissory note issued in the market by a company; Buy & Hold typically. • Mature within 270 days. • Rated within 2 highest classifications by at least one of the standard rating services approved by the Superintendent of Banking. • 10% portfolio; 5% single issuer; 5% rated in second highest classification • Authorized investments: • Repurchase Agreements: A sale of a security with a commitment by the seller to buy the securities back from the purchaser at a specified price on a designated date. • Must be collateralized with obligations of the US Government, its agencies or instrumentalities. • Possession of collateral must be directly by the governmental entity or through an authorized custodian. • Custodial Agreement must follow rules for Public Funds Custodial Agreements required by IA Cod Section 12B.10C (and rules of State Treasurer). • Authorized investments: • • Money Market Funds: SEC-registered fund that meets 2a-7 guidelines Joint Investment Trust Organized under Chapter 28E & meets 2a-7 guidelines • Registered with SEC; OR • Rated within the 2 highest classifications by at least one of the standard rating services approved by the Superintendent of Banking. • Manager/Investment Adviser must be registered with SEC under the Investment Advisor Act. • Authorized investments: • Warrants/or improvement certificates of a levee or drainage district. • Authorized investments: • Deposits or CDARS – Certificate of Deposit Account Registry Service • If public funds deposited in a depository, authorized by 12C.1, any uninsured portion in that depository may be invested in insured deposits or certificates of deposit arranged by the depository that are placed in or issued by one or more federally insured banks or savings associations regardless of location for the account of the public funds depositor if all of the following are satisfied: • Full amount of principal & any accrued interest on such public funds or each such certificate of deposit issued shall be covered by federal deposit insurance. • the depository, either directly or through an agent or subcustodian, shall act as custodian of the insured deposits or certificates of deposit. • On the sameday that the public funds deposits are placed or the certificates of deposit are issued, the depository shall have received deposits in an amount eligible for FDIC from, and with regard to certificates of deposit, shall have issued certificates of deposit to, customers of other financial institutions wherever located that are equal to or greater than the amount of public funds invested under this subsection by the public funds depositor through the depository. INVESTMENT OF PUBLIC FUNDS & PUBLIC FUNDS COLLATERALIZATION • Authorized investments for Bond Proceeds: • Governed by Iowa Code section12C.9 • 12B.10(4)(a)(1-9) - #8 is CDARS • 12B.10(5)(a)(1-7) • Guaranteed investment contract and/or tax-exempt bonds • Must be rated within the 2 highest classifications by at least 1 rating service approved by the superintendent of Banking • All investments must comply with section 148 of the Internal Revenue Code. • Unauthorized Investments • • • The trading of securities for the purpose of speculation and the realization of short term trading profits. Reverse Repurchase Agreements (The purchase of securities with the agreement to sell them at a higher price at a specific future date. For the party selling the security (and agreeing to repurchase it in the future) it is a repo for the party on the other end of the transaction (buying the security and agreeing to sell in the future) it is a reverse repurchase agreement.). Futures and Options Contracts. • Maturity and Procedural Limitations • • • • • “Operating Funds” must mature within 397 days or less and must be invested in investments authorized by law. If not a designated “operating fund” than invest in maturities longer than 397 days. If the use of a custodial agreement is required (i.e., repurchase agreements) the custodial agreement must comply with rules adopted by the Treasurer of the State and must include a statement that all investments be made in accordance with the laws of the State of Iowa. A contract for the investment or deposit of public funds shall not provide for compensation of agent based upon investment performance. All investment records are public documents and if third party fails to produce requested records in a reasonable time, public entity shall not make any new investments with third party or renew investments. Diversify portfolio to eliminate risk of loss resulting from overconcentration of assets in a specific maturity, a specific issuer, or a specific class of securities. • Public Funds Collateralization • Generally, how does the law work? • Under the new law, when a bank accepts a deposit of public funds, the bank agrees to pledge certain collateral in accordance with Iowa Code section 12C.22 to secure the public funds deposited. If collateral must be pledged, the bank is known as a "pledging bank". If the bank fails to pay a check, draft or warrant of a public officer, if the bank closes, or in other limited circumstances, the Treasurer of the State may liquidate the pledged collateral to pay the claims of the public entity. Now, when the Treasurer of the State pays claims of public entities, the claims will be paid from the following sources in the following order: • • • • • Any applicable insurance (i.e., first $250,000 on deposit is insured by the FDIC); Liquidation of any pledged collateral or funds received from a Letter of Credit used by a pledging bank to secure the public funds; Assets of the bank which are liquidated within 30 days of the closing of the bank; Funds in the State Sinking Fund; and Assessments against all remaining banks whose public funds deposits exceed FDIC insurance coverage. • Which banks have to pledge collateral? • • • Each bank that accepts public funds must determine if it must pledge collateral. A bank must pledge collateral, thus becoming a "pledging bank", if the total amount of public funds (i.e., all deposits by a city, county, school district, municipal utility, etc. must be included) on deposit in the bank exceeds the total capital of the bank. Iowa Code section 12C.22 sets out a specific calculation which each bank must make to determine its total capital. This means a bank may not be a pledging bank one day but may be a pledging bank the next day, depending on the total capital of the bank and the amount of public funds on deposit on that particular day. For example, a public entity maintains an account at Bank X and on approximately October 14 Bank X would not be a pledging bank under the statute because the total amount of public funds would not exceed the total capital of Bank X. However, when the public entity receives its property tax collections on approximately October 15, Bank X may be a pledging bank because the total amount of public funds on deposit would exceed the total capital of Bank X on that day. The Treasurer of the State's web page states that "[b]anks are required to determine if circumstances on any given day require them to pledge securities that day”. • Who holds the pledging bank's collateral? • The pledging bank must pledge collateral which will be held by an "approved custodian". Generally, an approved custodian may not be the pledging bank, an affiliate bank or subsidiary of the pledging bank or any bank in which the approved custodian or any affiliate has direct or indirect control of the pledging bank. The Treasurer of the State will develop a list of criteria which a bank must meet to be an approved custodian. • What type of securities are "eligible collateral"? • Iowa Code section 12C.22(6) lists specific securities and other forms of collateral which are acceptable. This includes cash and, in certain circumstances, a Letter of Credit. A Letter of Credit will be held in the Treasurer of the State's vault, not by an approved custodian. • May a pledging bank withdraw, substitute, or change the collateral? • Yes. The pledging bank must submit a Certificate and Approval for Withdrawal, Substitution, or Addition of Collateral to the approved custodian, along with a calculation that demonstrates once the transaction is complete, there is sufficient collateral pledged. Before completing the transaction or releasing any collateral, the approved custodian must verify that, after the transaction is complete, the total collateral market value is equal to or exceeds the total excess public funds. If the calculation is verified the approved custodian will then notify the Treasurer of the State and the pledging bank of the completion of the transaction. • What are the consequences if a pledging bank violates the law? • If a pledging bank violates any provision of the laws, rules, agreements proscribed by the Treasurer of the State, or fails to fulfill its duties, or applicable FDIC insurance coverage is suspended or terminated, the Treasurer of the State may suspend or terminate the bank's ability to accept uninsured public funds. The public entity will be notified of the suspension or termination of a bank's ability to accept uninsured public funds by notices included in the monthly rate-setting notice posted on the Treasurer of the State's Web site. If a public entity's funds are on deposit with a suspended or terminated pledging bank, the public entity may have an illegal investment and/or deposit under Iowa law and should consult with their attorney. • What are the consequences if an approved custodian violates the law? • If an approved custodian violates any provision of the laws, rules, agreements proscribed by the Treasurer of the State, or failed to fulfill its duties, the Treasurer of the State may suspend or terminate the bank's designation as an approved custodian. The Treasurer of the State will notify the pledging bank of the suspension or termination and the pledging bank must immediately secure the services of another approved custodian. • Municipal investment policies have been a statutory requirement for a number of years. However, some of the details are worth reviewing periodically. Test your knowledge on investment concepts and policy provisions required under the Code of Iowa with the following Iowa investment policy pop quiz. Good luck! 1. True or false. It is the responsibility of the city council to adopt the written investment policy required by the Code of Iowa? 1. True or false. It is the responsibility of the city council to adopt the written investment policy required by the Code of Iowa? True. The city council must approve a written investment policy. 2. True or false. A copy of the city investment policy must be given to the auditor performing the audit for the city. 2. True or false. A copy of the city investment policy must be given to the auditor performing the audit for the city. True. The written investment policy must be provided to the auditor. In addition, the city is required to maintain a copy, and provide a copy to the city treasurer and all depository institutions or fiduciaries for public funds of the city. 3. What type of agreement must a municipal finance officer have when investing in securities? • a. Deposit Agreement • b. Public Funds Custodial Agreement • c. Repurchase Agreement • d. None of the above 3. What type of agreement must a municipal finance officer have when investing in securities? • a. Deposit Agreement • b. Public Funds Custodial Agreement • c. Repurchase Agreement • d. None of the above The answer is b. and sometimes c. Code Section 12B.10A requires the city to have a public funds custodial agreement with any person or entity that is authorized by the city to act as a custodian of public funds investments. This custodial agreement must comply with rules established by the state treasurer's office and the Iowa attorney general. A public funds custodial agreement is not required for deposits made in an Iowa bank, credit union, savings and loan, investments in IPAIT or direct investments in a money market mutual fund. If a city is investing in securities through a repurchase agreement, the treasurer should have a public funds custodial agreement with the custodian of the securities and a repurchase agreement with the seller of the securities. 4. As defined in the Iowa public investment statutes, what is the difference between operating funds and non-operating funds? 4. As defined in the Iowa public investment statutes, what is the difference between operating funds and non-operating funds? As defined by Code Section 12B.10A, operating funds are funds reasonably expected to be expended during a current budget year or within 15 months of receipt. The law requires operating funds to be identified and invested in investments with maturities of 397 days or less. 5. Which of the following securities are appropriate investments for "municipal operating funds" as defined in the Code of Iowa? • a. A five year to maturity U.S. agency security callable in one year "with a coupon so high it has to be called." • b. "AAA" rated commercial paper equal to 10 percent of investment portfolio. • c. Uncollateralized repurchase agreement. • d. One year to maturity HUD note equal to 25 percent of investment portfolio. 5. Which of the following securities are appropriate investments for "municipal operating funds" as defined in the Code of Iowa? • a. A five year to maturity U.S. agency security callable in one year "with a coupon so high it has to be called." • b. "AAA" rated commercial paper equal to 10 percent of investment portfolio. • c. Uncollateralized repurchase agreement. • d. One year to maturity HUD note equal to 25 percent of investment portfolio. The answer is d. This U.S. agency security is backed by the full-faith-and-credit of the federal government, is less than 397 days to maturity and has no concentration limitation. 6. Yes or no. Can a city invest operating funds in a short-term bond mutual fund that invests solely in U.S. Treasuries or government agency securities? 6. Yes or no. Can a city invest operating funds in a short-term bond mutual fund that invests solely in U.S. Treasuries or government agency securities? No. A city may invest in a money market mutual fund, which is operated pursuant to Rule 2a-7, but not in a bond fund, even if the bond fund invests only in U.S. treasuries or government securities. 7. Yes or no. The local bank has suggested that you open a sweep account. The agreement will require the bank to "sweep" moneys in the account in excess of $50,000 into a repurchase agreement. Is the money that is swept out of the account insured by the Federal Deposit Insurance Corporation (FDIC)? Is a public funds custodial agreement required for the “sweep” account? 7. Yes or no. The local bank has suggested that you open a sweep account. The agreement will require the bank to "sweep" moneys in the account in excess of $50,000 into a repurchase agreement. Is the money that is swept out of the account insured by the Federal Deposit Insurance Corporation (FDIC)? Is a public funds custodial agreement required for the “sweep” account? No. Once the money is taken out of the bank account and invested in a repurchase agreement, it is no longer a deposit under Iowa or federal law. The funds swept out of the account are invested in securities, not in deposits. Therefore, neither FDIC insurance or the state's deposit protection program would cover the funds. Since the “sweep” account is a repurchase agreement, the city should have a public funds custodial agreement with the bank that is holding the securities on the city’s behalf. 8. Yes or no. Can bond proceeds be invested differently from operating funds? 8. Yes or no. Can bond proceeds be invested differently from operating funds? Yes. Code Section 12C.9 permits bond proceeds to be invested in all of the investments permitted for operating funds found in Code Section 12B.10 and investment contracts or tax-exempt bonds. The investment contract or tax-exempt bond must have a credit rating of at least AA from Moody's or Standard & Poor's. All bond proceed investments must be permitted under section 148 of the Internal Revenue Code and applicable regulations under that section. • 9. Which of the following securities are eligible collateral for a repurchase agreement? • • • "AAA" rated commercial paper U.S. T-Bill FHLB (Federal Home Loan Bank) security 9. Which of the following securities are eligible collateral for a repurchase agreement? "AAA" rated commercial paper • U.S. T-Bill • FHLB (Federal Home Loan Bank) security • The answer is b. or c. The Code of Iowa requires that repurchase agreements must be collateralized by obligations of the United States government, its agencies or instrumentalities. Further, the city must take possession of the securities directly or through an authorized custodian pursuant to a public funds custodial agreement. 10. True or False. Because the Federal Reserve has drastically reduced interest rates, the local bank may pay a lower interest rate on a certificate of deposit than the public funds investment rate set by the Code of Iowa. 10. True or False. Because the Federal Reserve has drastically reduced interest rates, the local bank may pay a lower interest rate on a certificate of deposit than the public funds investment rate set by the Code of Iowa. False. Code section 12C.6 requires a committee to meet monthly to establish the minimum rate to be earned on public funds invested in a certificate of deposit. For the current rate, visit http://www.treasurer.state.ia.us/rates/. 11.Yes or no. The local bank quotes an interest rate on a certificate of deposit for the city’s operating funds which is substantially higher than the other quotes received. However, the local bank indicates that the total amount invested will be divided up into certificates of deposit which are covered by Federal Deposit Insurance coverage limits (i.e., principal and accrued interest for each certificate issues is $100,000 or less) and which will be held by federally insured banks or savings associations throughout the country. Is this an authorized investment under Iowa law for operating funds? What about for bond proceeds? 11. Yes or no. The local bank quotes an interest rate on a certificate of deposit for the city’s operating funds which is substantially higher than the other quotes received. However, the local bank indicates that the total amount invested will be divided up into certificates of deposit which are covered by Federal Deposit Insurance coverage limits (i.e., principal and accrued interest for each certificate issues is $100,000 or less) and which will be held by federally insured banks or savings associations throughout the country. Is this an authorized investment under Iowa law for operating funds? What about for bond proceeds? Yes. Code section 12B.10(7) authorizes investment in the CDARS (Certificate of Account Registry Service) program for operating funds. This program allows a local institution to place the city’s deposit into other certificates of deposit at other federally insured banks or savings association throughout the country. If the city has more than one certificate of deposit placed through the CDARS program, the city should ensure that it has only one certificate of deposit at the other financial institutions throughout the country to ensure full FDIC coverage. For bond proceeds, Code section 12C.9 lists only those investments authorized in 12B.10(4)(a)(1-9) (includes CDARS) and 12B.10(5)(a)(1-7), along with guaranteed investment contracts and tax-exempt bonds, as authorized investments. • 12. Yes or no. A securities representative offers to sell the city commercial paper that is rated “AAA” and matures within 200 days. The purchase of the commercial paper will not violate the statutory limits of concentration for investing in commercial paper. However, upon reading the offering terms in a “private placement memorandum”, the city administrator notices that the commercial paper is not registered with the Securities and Exchange Commission (“SEC”) and may only be purchased by an “accredited investor”. Is the city authorized to purchase the commercial paper? 12.Yes or no. A securities representative offers to sell the city commercial paper that is rated “AAA” and matures within 200 days. The purchase of the commercial paper will not violate the statutory limits of concentration for investing in commercial paper. However, upon reading the offering terms in a “private placement memorandum”, the city administrator notices that the commercial paper is not registered with the Securities and Exchange Commission (“SEC”) and may only be purchased by an “accredited investor”. Is the city authorized to purchase the commercial paper? Maybe. Noting “some degree of uncertainty” under current law, the SEC recently proposed adding “governmental body” to the list of legal entities that can be an “accredited investor” under SEC Regulation D and Rule 144A. Until the SEC acts on the proposal it remains an open question. Unregistered securities, it should be noted, may present very different risks than more traditional investments.