A MANUAL FOR THE PREPARATION OF INDIRECT COST RATE PROPOSALS

advertisement

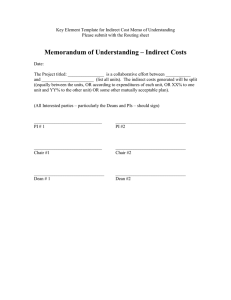

A MANUAL FOR THE PREPARATION OF INDIRECT COST RATE PROPOSALS BY IOWA COUNTY AGRICULTURAL EXTENSION OFFICES SPONSORED BY THE IOWA STATE UNIVERSITY EXTENSION SERVICE PREPARED BY MAXIMUS, Inc. May 2005 A MANUAL FOR THE PREPARATION OF INDIRECT COST RATE PROPOSALS BY IOWA COUNTY AGRICULTURAL EXTENSION OFFICES Table of Contents Introduction Background Stages of Grant Assistance and the Applicability of Circular A-87 Important Provisions of A-87 Composition of Cost Direct Costs Indirect Costs Indirect Cost Rate Proposals Instructions for Preparing Indirect Cost Rate Proposals Overview of the Indirect Cost Rate Proposal Salaries and Wages County Director Office Assistants Program Assistants Employee Benefits Travel Expenses Building Occupancy Costs Other Expenditures Communications, Office Supplies, Equipment and Repairs, Insurance, and Legal and Bonds Project Activity Expense Post Amounts from Worksheet 2 Building Use Allowance Equipment Use Allowance Final Steps in Completing the Indirect Cost Rate Proposal Considerations for Implementation of Indirect Cost Rates Type of Rate to Be Used Time Frames for Fixed Rate Implementation Carry-forward Computation Procedures Gaining Approval of Indirect Costs Applying the Indirect Cost Rate Effect of Rate Changes from Year to Year i Page 1 1 2 3 5 5 6 7 11 11 13 13 13 15 15 16 16 18 19 20 20 21 22 24 24 25 25 26 26 27 Table of Contents – Continued APPENDICES: EXHIBIT 1 Sample County Indirect Cost Rate Proposal (ICRP) EXHIBIT 2 Certification Statement ATTACHMENT 1 Personnel Activity Reports WORKSHEET 1 Summary of Annual Expenditures WORKSHEET 2 Allocation of Costs to ISU Personnel WORKSHEET 3 Summary of Employee Benefits WORKSHEET 4 Summary of Travel Expenses WORKSHEET 5 Summary of Communications Expenses WORKSHEET 6 Summary of Office Supplies Expense WORKSHEET 7 Summary of Equipment, Repairs and Maintenance WORKSHEET 8 Summary of Insurance, Legal and Bonds Expenses WORKSHEET 9 Carry-forward and Fixed Rate Computation Procedures Explanation of Carryforward and Fixed Rate Computation ii INTRODUCTION The Iowa State University (ISU) Extension Service contracted with the firm of MAXIMUS, Inc. to review and update the methodologies and procedures necessary to enable Iowa County Agricultural Extension Districts (County Extension Offices) to prepare annual Indirect Cost Rate Proposals. The intent is to assist and encourage the County Extension Offices in recovering indirect costs incurred on behalf of outside funding sources. Additional primary considerations in undertaking this project were: To develop an approach that fully satisfies the requirements of the Federal Government, To establish a uniform approach that could be used by each of the 100 Iowa county offices, and To promote ease of computation and implementation for the local offices. In April 1998 the predecessor firm of MAXIMUS, Inc. (David M. Griffith and Associates) developed the original Manual for the Preparation of Indirect Cost Rate Proposals by Iowa County Agricultural Extension Offices. This Manual, with minor updates in May of 2005, is intended to satisfy all of the stated objectives. The Manual begins with a general discussion of applicable Federal regulations, proceeds to specific instructions for the county offices and concludes with various implementation guidance and suggestions. Exhibits, Attachments and Worksheets are appended to the Manual to (1) illustrate the process of developing an Indirect Cost Rate Proposal and (2) provide the individual county offices with the necessary framework to construct their own rate proposals in the future. BACKGROUND OMB Circular A-87 – Cost Principles for State, Local and Indian Tribal Governments Federal Office of Management and Budget (OMB) Circular A-87 provides the cost principles and procedures for determining both direct and indirect costs applicable to Federal cost-based awards to state and local governmental units. The Circular addresses the key concept of cost as it relates to federal grant reimbursement. It discusses and provides guidance for determining allowable cost and unallowable cost. It elaborates on the distinction between direct cost and indirect cost. Finally, 1 it discusses methods for assignment of joint cost to specific cost objectives. One of the recommended cost assignment methods is an indirect cost rate. OMB first issued A-87 in 1968. It was reissued in 1974 as Federal Management Circular 74-4 and was then redesignated as A-87 in 1981. An extensive update to the Circular was issued in May 1995. The most recent revision of the A-87 Circular was issued on May 4, 2004, and supersedes the Circular A-87 issued in 1995. The primary objective of the most recent version was to provide consistency between the State and Local Government cost principles in OMB A-87 and other cost principles established from Colleges and Universities, and Non-Profit Organizations. In particular, the task force studied the “Selected Items of Cost” sections of the three Circulars. Relatively minor revisions were made to the “Selected Items of Cost” in the A-87 Circular. ASMB C-10 (Guide published by U. S. DHHS) OMB mandated in A-87 that the U.S. Department of Health and Human Services issue implementing material for the Circular on behalf of the entire Federal Government. That was accomplished in an implementation guide named Cost Principles and Procedures for Establishing Cost Allocation Plans and Indirect Cost Rates for Agreements with the Federal Government. The guide, dated April 8, 1997, is also referred to as ASMB C-10 (or C-10) and replaces a previous guide called OASC–10 that was issued in 1976. Both A-87 and C-10 can be accessed through the internet via the U.S. Government Printing Office: OMB Circular “http://www.whitehouse.gov/omb/circulars/a087/a87_2004.pdf” ASMB C-10: “http://www.hhs.gov/grantsnet/state/asmbc10.pdf” A-87: The documents may be downloaded and reproduced without restriction. STAGES of GRANT ASSISTANCE and the APPLICABLILITY of CIRCULAR A-87 How does OMB A-87 tie in with the administration of grant awards? The A-87 cost principles have a role to play at most stages of the assistance award or contract life cycle. Typical stages of the “cost reimbursement process” for grant awards 2 Soliciting Proposals. Awarding agency solicits applications and announces the applicability of the A-87 cost principles as a condition of reimbursement. Preparing Proposals. The applicant governmental unit prepares a plan for the use of funds, and includes only costs allocable, reasonable and allowable under Circular A-87. Notification. The recipient of the assistance award is notified and the award documents cite the applicability of Circular A-87. Expending Funds. The government unit incurs costs for expenditures that are eligible under applicable program legislation and allowable under Circular A-87. Documentation. The government unit generates and retains documentation consistent with any specific requirements of A-87, and consistent with that generated for its own-source revenue (local “costshare”) Claims for Cost Reimbursement. The government unit prepares claims for direct and indirect costs in accordance with OMB Circular A-87. The governmental unit is permitted to apply its indirect cost rate to those object class categories of expenditures to which the federal funding agency has agreed it should be applied. Auditing Awards. Through test procedures, independent auditors or auditors representing awarding agencies review claims to determine whether incurred costs are appropriate under Circular A-87. Discrepancies are reported to awarding agencies as questioned costs. IMPORTANT PROVISIONS OF A-87 The principles contained in the Circular (A-87) are for the purpose of cost determination and are not intended to identify the circumstances or dictate the extent of Federal or governmental unit participation in the financing of a particular program or project. The Circular is intended to achieve more efficient and uniform administration of federal awards, and to foster better relationships between the Federal government and states, local governments. It provides the foundation for greater uniformity in the costing procedures of nonfederal governments and in the reimbursement practices of Federal agencies. The principles are applicable for Federal cost-based awards, where cost is an important factor for determining the federal participation. The Circular does not allow profit as an allowable cost. The Circular provides the basis for uniformity in costing procedures and in the reimbursement practices of Federal agencies. It is equally applicable to grants and contracts awarded directly to governmental units by Federal agencies and to governmental units that are a subrecipient of Federal awards. A-87 applies to awards to states and localities unless specifically excepted 3 by statute or where OMB has granted an exception. Additionally, most state agencies accept, and often require, adherence to A-87 in the administration of their own grant programs. Circular A-87 provides principles and standards for determining both direct and indirect costs applicable to Federal cost-based awards. Parties using the A-87 cost principles include budget preparers, recipient personnel responsible for tracking costs charged against federal awards, independent auditors, and Federal awarding agency personnel reviewing budget requests and charges to the award. While we will not address the complete contents of A-87 herein, there are certain basic guidelines affecting the allowability of costs under Federal awards that deserve to be emphasized. Factors affecting the allowability of cost The A-87 allowable cost provisions include requirements that: Costs be necessary and reasonable for proper and efficient performance and administration of Federal awards. In general, costs are deemed reasonable if they do not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost. Costs be allocable to Federal awards under the provisions of the Circular. A cost is allocable to a particular grant or program if the goods or services involved are chargeable or assignable to that activity in accordance with relative benefits derived. Further, all activities that benefit from the governmental unit’s indirect costs, including unallowable activities and services donated to the governmental unit by third parties, will receive an appropriate allocation of indirect costs. This is an especially important consideration for County Agricultural Extension Districts due to the funding support provided by the ISU Extension Service. Costs must be authorized or not prohibited under State or local laws or regulations. Costs must conform to any limitations or exclusions set forth in A-87, Federal laws, terms and conditions of Federal awards, or other governing regulations as to types or amounts of cost items. 4 Costs must be consistent with policies, regulations, and procedures that apply uniformly to both Federal awards and other activities of the governmental unit. Costs must be accorded consistent treatment. A cost may not be assigned to a Federal award as a direct cost if any other cost incurred for the same purpose in like circumstances has been allocated to the Federal award as an indirect cost. Costs, except as otherwise provided for in A-87, must be determined in accordance with generally accepted accounting principles. Costs must not be included as a cost or used to meet cost sharing or matching requirements of any other Federal award in either the current or a prior period, except as specifically provided by Federal law or regulation. Costs must be net of all applicable credits. This refers to those receipts or reduction of expenditure-type transactions that offset or reduce expense items allocable to Federal awards as direct or indirect costs. This would include any expenditure reimbursements received from the ISU Extension Service. Costs must be adequately documented. COMPOSITION OF COST The total cost of Federal awards consists of the allowable direct cost of the program, plus its allocable share of allowable indirect costs, less applicable credits. A-87 recognizes that there is no universal rule for classifying specific costs as either direct or indirect. A cost may be direct with respect to a specific service or function, but indirect with respect to the Federal award or other final cost objective. Therefore, A-87 emphasizes that it is essential that each item of cost be treated consistently in like circumstances either as a direct or an indirect cost. The Circular provides the following guidelines for determining direct and indirect costs charged to Federal awards. Direct Costs In general, direct costs are those that can be readily or easily identified with a final cost objective. A final cost objective refers to a single grant, program or activity. Typical direct cost items include: (1) compensation of employees for the time devoted and identified specifically to the performance of a Federal award (2) the cost of materials acquired, consumed, or expended specifically for the purpose of an award 5 (3) travel expenses incurred specifically to carry out the purposes of an award (4) equipment and other capital expenditures devoted to a specific award. With respect to “minor items,” A-87 states that any direct cost of a minor amount may be treated as an indirect cost for reasons of practicality where such accounting treatment for that item of cost is consistently applied to all cost objectives. In this context, the definition of minor items is not specifically stated but is presumed to involve the normal meaning of materiality in the circumstance. Indirect Costs Indirect costs are generally defined by A-87 as those costs that are not as readily identified but are: (1) incurred for a common or joint purpose benefiting more than one final cost objective, and (2) not readily or easily assignable to cost objectives that are specifically benefited without effort disproportionate to the results achieved. It is important to note that the term indirect cost is not always synonymous with administrative cost. An administrative cost that benefits a single final cost objective is appropriately classified as a direct cost. However, the term “overhead” is generally interchangeable with indirect cost. Salaries and Wages General Comments: A-87 contains strict requirements for documenting personal service costs where employees split their time between indirect and direct activities. Specific provisions of the circular include: 1. Charges to Federal awards for salaries and wages, whether treated as direct or indirect costs, will be based on payrolls documented in accordance with generally accepted practice of the governmental unit and approved by a responsible official(s) of the governmental unit. 2. No further documentation is required for the salaries and wages of employees who work in a single indirect cost activity. This applies to individuals who are classified 100 percent to the indirect cost column. 3. Where employees work solely on a single Federal award, charges for their salaries and wages will be supported by periodic (at least semi-annual) certifications that the employees worked solely on that program for the period covered by the certification. 6 4. Where employees work on multiple activities or cost objectives (including indirect and direct activities or more than one direct Federal award), a distribution of their salaries and wages must, at a minimum, be supported by “Personnel Activity Reports” or equivalent documentation. 5. Personnel Activity Reports must meet the following standards: They must reflect an after-the-fact distribution of the actual activity of each employee. They must account for the total compensated activity of the employee. They must be prepared at least monthly. The employee must sign them. MAXIMUS, Inc. has designed a simplified Personnel Activity Report that may be used by the County. This form is included as Attachment 1 and is further discussed in the Instructions section of the Manual. INDIRECT COST RATE PROPOSALS Local units of government are not required to prepare indirect cost rate proposals (ICRP’s). However, an ICRP must be prepared in accordance with the provisions of A-87 and ASMB C-10 and placed on file before indirect costs may be charged to Federal programs. An indirect cost rate must ordinarily be computed before an indirect cost line item may be requested for approval under eligible grant programs. Other important considerations are: (1) An ICRP is based upon costs incurred for the governmental unit’s fiscal year. (2) A documented indirect cost rate provides a ceiling up to which a governmental unit may recover a portion or all of its allowable indirect costs. (3) Indirect costs that are otherwise allowable but are not recovered may often be used to satisfy matching or cost sharing requirements under specific awards. (4) For indirect costs to be eligible for recovery from Federal programs, they must represent legal obligations of the governmental entity that makes the claim. 7 To provide for the equitable distribution of indirect expenses to cost objectives served (including Federal awards), it is necessary for a County Agricultural Extension District to prepare an “indirect cost rate proposal” (ICRP). Attachment E of Circular A-87– State and Local Indirect Cost Rate Proposals Attachment E was added to OMB A-87 (1995 version) for state and local indirect rate proposals. The attachment provides definitions, submission requirements, general procedures on how to develop rate(s), and documentation requirements. An ICRP is the basis for computing an indirect cost rate which is simply the percentage (ratio) relationship of indirect costs to direct costs. Several types of rate approval mechanisms exist, including “provisional/final” and “fixed” approval. A discussion of the choices of rate approval mechanisms is included in the topics discussed in the next few paragraphs. The direct costs referred to in this ratio are known as the direct cost base. The direct cost base is used to distribute indirect costs to individual Federal awards, i.e. an indirect rate must be applied to a direct cost base in order to determine the amount of indirect costs. A discussion of the choices of potential costs to be included in the direct cost base is included in the discussion below. Types of Rates Circular A-87 defines four possible types of indirect costs rates. However, two of these types provisional and final, are actually two stages of one approach: 1. Provisional – Final Rate. This approach involves two stages. In the first stage, a provisional rate is used as an estimate for the future. It is a temporary rate based on anticipated future costs and is subject to retroactive adjustment at a future date after actual costs are known. It is usually determined based on actual costs from a prior period. In the second stage, a final rate is determined after actual costs are known. The Final rate is used after- the- fact to adjust prior provisional claims, and for this reason, can be administratively burdensome. In addition, obtaining additional reimbursement for underpayments that may result from application of a provisional rate is subject to the availability of funds. 2. Fixed Rate. This form of rate is also based on an estimate of future costs (usually derived from historical costs), but it is not retroactively adjusted. Instead, the difference between estimated and actual costs is carried forward to a future period. The fixed rate approach is only permissible where the 8 governmental entity has relatively stable funding and the amount of Federal programs is not expected to change materially in the future. Note: the fixed rate is generally recommended, and this rate type is used in the ICRP instructions section of this manual 3. Predetermined rate. This form of rate is agreed to in advance, based on an estimate of future costs, but is not subject to adjustment except in unique circumstances. This type of rate is not available to any governmental unit that does not submit its indirect cost rate proposals to a cognizant federal agency for negotiation. Note: the predetermined rate is not available to most local governments since local governments generally do not submit their ICRP for federal review and approval. Types of Direct Cost Base Generally, the direct cost base is either a direct salary and wage base, or a total modified direct cost base: (1) Direct salaries and wages (S & W). This base includes the salary and wages of direct employees only. All salary expenditures must be included in either the indirect, or the direct calculation. Therefore, the direct S & W base is simply the total organization-wide salary expenditures, less the salary expenditures of allowable indirect employees, less the salary cost of any employees that are indirect but unallowable. For example salary cost of unallowable fund raising activities should be included in the direct base. The base should also include the expenditures related to paid absences. Fringe benefits are generally excluded from the base unless the base is pre-defined to include direct fringe benefits. If so defined the “direct salary and wages plus fringe benefits” base is generally acceptable assuming that the policy is consistently applied and approved. An approved indirect cost rate is in turn applied against the same direct salary cost base to determine the value of indirect costs that are assessable to specific Federal programs. (2) Total modified direct costs (MTDC). A MTDC base includes direct salary and wages plus other direct operational expenditures. The base excludes any “extraordinary or distorting expenditures”. Potentially distorting items usually include capital, debt service, subawards, assistance payments and provider payments. An approved indirect cost rate is in turn applied against the same MTDC direct cost base to determine the value of indirect costs that are assessable to specific Federal programs. 9 Types of Rate Calculation Methods There are two basic methods for calculation indirect cost rates – the simplified method and the multiple rate method. (1) The Simplified Method. A simplified method is relevant where each of a recipient agency’s major functions benefit from its indirect costs to approximately the same degree. Note: the Simplified method is generally appropriate for smaller agencies, and is the only type of rate illustrated in the instruction section of this manual. The steps involved in calculating a rate under a Simplified Method are listed below: Steps Involved in Calculating a Rate Under the Simplified Method 1. Adjust indirect costs for any “applicable credits” for the period by eliminating any costs directly reimbursed through Federal award awarded specifically for that purpose (none usually). Likewise, remove any administrative (indirect) salaries included in the pool that were funded as direct in a grant (none usually). The pool must also be adjusted for any A-87 unallowables and capital expenditures. 2. Adjust direct costs by eliminating flow-through funds and capital expenditures. 3. Divide the total allowable indirect costs (net of applicable credits) by an equitable direct cost base, e.g. salaries and wages (S & W) or modified total direct cost base (MTDC). (2) The Multiple Rate Method. A multiple rate method is relevant where a recipient agency’s indirect costs benefit its major functions in varying degrees. Note: The multiple rate method is not appropriate for the relatively small Ag Extension agencies, and is not illustrated in this manual The remainder of this document will address specific procedures to be followed by County Extension Offices in preparing ICRP’s. 10 INSTRUCTIONS FOR PREPARING INDIRECT COST RATE PROPOSALS The following instructions are provided to assist each County Extension Office to develop annual indirect cost rate proposals. Two important characteristics of indirect cost rate proposals are: The proposals will be based on actual costs for the most recently completed fiscal year and, Indirect cost rates are “organization-wide” and must encompass all funds and activities of the County office. The counties now have summarized year-end financial statements (AFR-4) covering all funds. We recommend that the starting point for completion of the ICRP be the preparation of a schedule similar to our example shown as Worksheet 1. This will greatly aid in organizing the expenditure information required for the proposal. For illustration, these instructions will assume that the costs are based on the initial plan year of FY 2001-02. Note that these illustrations use numbers from the Annual Financial Report (AFR) Sample County 2001-02 available on the ISU Extension Council web page. Costs incurred by the Iowa State University Extension Service on behalf of the local office will not be included in the proposal. However, allocations of county indirect costs that benefit state-paid personnel (Field Specialists) will be made on the ICRP. The proposal format is shown on Exhibit 1 of this Manual. Specific computations that are required, and other necessary supporting documents, are shown as numerically sequenced Attachments and Worksheets. Fictitious cost information is included to illustrate the process. Formatted Microsoft Excel spreadsheet templates are being separately provided to the ISU Extension Service for distribution to interested county offices. We emphasize that there is no single, uniform approach that will satisfy the needs of all 100 county offices. Therefore, various options will be addressed in the sections that follow, and each county office must select the options that best suit its own particular needs and circumstances. While A-87 addresses both indirect and direct costs, it is not the intent here to address direct costing concerns although comments in that regard are sometimes included. Overview of the Indirect Cost Rate Proposal The overall purpose for preparing an ICRP is to categorize each dollar of expenditure appropriately. When this is accomplished, the remainder of the rate computation procedure consists solely of prescribed mathematical computations. 11 For an overview of the indirect cost rate proposal, Exhibit 1 shows that the proposal consists of the following components: 1. Entry in the Total Costs column of the individual salaries and benefits and other major cost elements for the year. 2. Distribution of each cost item to the appropriate column(s), including : Excludable Items Expenditures Not Allowable Indirect Costs Direct Salaries and Wages All Other Direct Costs ISU Allocated Costs A brief description of each column follows: Total Costs - The total of the expenses entered for the year, excluding any computed Building or Equipment Use Allowance (discussed in later sections), must reconcile to the total costs incurred by the County for all funds. Excludable Items - This column is included for the purpose of excluding direct costs that do not benefit from the indirect costs of the County. An example would be pass-through funds or large sub-contracts to other entities that do not require (benefit from) the expenditure of material indirect cost resources. Expenditures Not Allowable – This column is used to record the costs of capital expenditures and indirect costs that are not allowable in accordance with A-87. Examples of unallowable costs include bad debts, entertainment, fines and penalties, and allowances for contingencies. Indirect Costs – This column is used to capture the County’s indirect costs that will be recoverable through the means of an indirect cost rate. Specific determinations of allowable indirect costs will be made in accordance with the instructions that follow. The total of this column is commonly referred to as the total “indirect cost pool” and provides the numerator for the indirect cost rate computation. Direct Salaries and Wages – This column is used to record the direct salaries and wages of the County. The column total is sometimes used as the “direct cost base.” If so, this is the denominator in the indirect cost rate calculation. The selection of an appropriate direct cost base is further discussed in a later section of this Manual. 12 All Other Direct Costs – This column is used to segregate all direct costs that are not otherwise classified as Excludable Items or Direct Salaries and Wages. In most cases, a County will wish to utilize a “modified total direct cost” base in the indirect cost rate computation. In that case, the total of this column is added to the total of the Direct Salaries and Wages column to arrive at the base (denominator) figure. ISU/non County Allocated Costs – This column is used to allocate a portion of the indirect cost items that benefit employees of the Iowa State University Extension Service. This includes Field Specialists and Program Assistants who are employees of ISU or benefit other non-County objectives, but are permanently assigned to the County and utilize the local office’s indirect cost resources. Following are detailed instructions for completing the indirect cost rate proposal. The General Comments provided further explain the requirements of A-87. All entries by the County should be made on blank copies of the Exhibits, Attachments, and Worksheets or on available copies of the Excel spreadsheet templates. Salaries and Wages General Comments: As discussed in the Composition of Cost section A-87 contains strict requirements for documenting personal service costs where employees split their time between indirect and direct activities. Specific provisions of the circular include: MAXIMUS, Inc. has designed a simplified Personnel Activity Report that may be used by the County. This form is included as Attachment 1 and is further discussed below under Option 2 for the Office Assistants. County Director – Cost-shared Salary. Under the current funding arrangement, the County Directors are employees of ISU, and therefore their salary is no longer a cost component on Worksheet 1 or the ICRP Exhibit 1. The current ISU Extension Service policy is to include the partnership share as an allocated indirect cost that benefits all functions of the Extension Service, and may also be allocated to non-County functions. Accordingly, the County’s partnership share amount should not be entered on the ICRP Exhibit 1, but should be transferred to the Worksheet 2 to be entered as “Partnership Share”. The cost will be allocated on Worksheet 2 to “County” and “non-County” objectives. In addition, include the County Director “FTE” in the “County” Column 1, Line A on Worksheet 2. This method will properly re-allocate the Director’s share of indirect costs to County and non-County cost objectives. Where the Director is full-time, enter 1.0 FTE to the “County – Column 1. Where the Director is shared, add 0.8 FTE as home county in the County Column (Col 1), and 0.2 to ISU/non-County (Col 2). 13 Office Assistants - Salaries & Wages. This discussion applies to the annual salary of each Office Assistant (or Administrative Assistant) employed by the County. These personnel are ordinarily engaged exclusively in administrative duties that support the overall operation of the County office, and their total salaries would usually be considered indirect. However, the salaries should be handled as described under one of the following two options: Option 1: Where the Office Assistant solely performs administrative duties in support of the overall office, and where this effort also supports ISU-paid personnel (Field Specialists and/or Program Assistants), it is then necessary to first complete an entry on Worksheet 2 (Allocation of Costs to ISU Personnel). On line A of Worksheet 2, enter the total number of County FTE employees, the number of ISUpaid FTE employees assigned to the office, and the total number of FTE employees in the columns provided. On line B of the Worksheet, convert the FTE’s to percentages of the total. On a subsequent line of the Worksheet, enter the employee’s name, title and annual salary amount and then spread the salary to the appropriate columns based on the percentages from line B. The distributed salary amounts will be transferred to the ICRP later with all other costs from Worksheet 2. No portion of this individual’s salary will be eligible for direct charging to Federal programs. In our example, this option was used for the salary of Brenda Brown on Worksheet 2. Option 2: Where the Office Assistant performs both indirect and direct cost duties, a Personnel Activity Report is required to document the split of effort. A Personnel Activity Report (PAR) should be completed according to the instructions below. . The indirect cost amount from the Personnel Activity Report should be transferred to Worksheet 2 for further partial allocation to ISU-paid personnel. In our example, this option was used for the salary of Julie Smith (See Attachment 1 example). Initial Year – On the % of Total line only, enter the percentages of effort for the year in the columns provided. Do not enter monthly information because this information will only be used to establish an indirect cost rate that will be implemented prospectively. The total of the percentages entered must equal 100 percent. On the Salary line, enter the annual cost-share amount and spread this to the appropriate columns based on the percentages of effort identified. The individual completing the report should then sign and date it. On the ICRP (Exhibit 1), transfer the resulting cost distributions to the appropriate columns. Entries will be made in the Total Costs, Indirect Costs, and Direct Salaries & Wages columns. Our sample ICRP utilizes this option, and the Office Assistant’s PAR is shown as Attachment 1. Succeeding Years – The Personnel Activity Report should be completed after the close of each month. For each month, enter the total number of hours worked, the number of hours applicable to each indirect and direct cost 14 column, and sign and date the form. At the close of the year, percentages of the total annual hours will be used to distribute the cost-share amount to the appropriate columns, and this data will be transferred to the ICRP in the same manner described for the initial year. Program Assistants - Salaries & Wages. This discussion applies to the salary of each Program Assistant employed by the County. These personnel generally spend their time solely in direct program areas and do not perform indirect cost functions. In the event that they do perform indirect functions the PAR form should be completed and the instructions followed for the Office Assistants. If no indirect activity, the salary for each individual should be entered on the ICRP and included in the Total Costs and Direct Salaries & Wages columns. If these personnel split their time between more than one direct program area (including a Federal program), the salary split must at a minimum be supported by a Personnel Activity Report, as described above. However, this will not affect the indirect cost rate computation. Moreover, if hourly / daily time sheets are currently used to document the salary charges to individual programs, we recommend that the more detailed procedure be continued. Employee Benefits (Worksheet 3) The County-paid expenditures for employee benefits should first be computed for each individual. Worksheet 3 is provided for this purpose. The specific benefit amounts for each individual should first be listed on the Worksheet. Individuals whose salaries are partially allocable to ISU-paid personnel will be listed under Section I. All other staff should be listed under Section II. If there is a direct cost total in Column 2 of Section I, it should be posted directly to the ICRP. The ISU Allocable total in Column 3 for each individual in Section I should then be transferred to Worksheet 2 for partial allocation to ISU-paid personnel. The columnar totals from Section II should then be transferred to the ICRP and included on a separate line labeled “Indirect cost– Not Prorated.” The important point is that the individual’s costs will flow in the same manner as the individual’s salary. The posting from Worksheet 3 is summarized below. Column 1 Section II total posted to ICRP (Exhibit I) in the column entitled “Indirect Cost’. There should be no entry in Section I. Column 2 total (Section I plus Section II combined) posted to the ICRP (Exhibit I) in the column entitled “All other Direct Costs” Column 3 Section I total posted for each individual employee to Worksheet 2, Employee Benefits column. The full costs of employee benefits for the County Director are paid by ISU and will not be included on the ICRP. Fringe benefit costs paid by the County for other staff may include any or all of the following: 15 FICA and Retirement Group Insurance Workers Compensation Unemployment Insurance Other benefits consistent with local policy Travel Expenses – Worksheet 4 The annual travel expenses for each individual should first be listed on Worksheet 4 and spread to the appropriate columns (Indirect Cost, Direct Cost, or Allocable to ISU Personnel) in accordance with the manner in which employees spend their time. Travel expenses for individuals whose salaries are partially allocable to ISUpaid personnel should be listed under Section I of the Worksheet. Travel costs for all other personnel should be listed under Section II. The indirect cost (Column 1) and direct cost (Column 2) totals should be posted directly to the ICRP. The total for Column 3 in Section I will then be transferred to Worksheet 2 for partial allocation to ISU-paid personnel. The posting from Worksheet 4 is summarized below. Column 1 Section II total posted to ICRP (Exhibit I) in the column entitled “Indirect Cost’. There should be no entry in Section I. Column 2 total (Section I plus Section II combined) posted to the ICRP (Exhibit I) in the column entitled “All other Direct Costs” Column 3 Section I total to Worksheet 2, Travel column. Building Occupancy Costs General Comments: A-87 recognizes the allowability of rental costs to the extent that the rates paid are reasonable in light of such factors as rental costs in comparable facilities and existing market conditions. However, the Circular states that rental costs under sale and leaseback arrangements or capital leases, where title to the property will ultimately vest in the leasee, are allowable only up to the amount that would be allowed had title to the property vested in the governmental unit on the date the lease agreement was executed. Under these arrangements, only the normal costs of ownership would be allowed, and this would include depreciation expense in accordance with the provisions of A-87. Building Occupancy Costs include any expenses incurred for the following: Building Rental (Subject to the limitations noted above) Maintenance and Repairs 16 Supplies & Materials Janitorial Expenses Utilities Waste Removal Property Insurance Other Facility / Grounds Operations Costs This category does not include the cost to purchase, renovate or remodel buildings. (These items are discussed under the Building Use Allowance section below.) The allowable costs of this category may be included on the ICRP under one of the following options: Option 1: Building space costs benefit the ISU-paid personnel who are assigned to the County office. Accordingly, a portion of these expenses should be allocated to those personnel. This can be accomplished by including the total occupancy costs on Worksheet 2 and allocating them to the Indirect Costs and ISU Allocations columns based on the percentages of FTE employees developed on Line B of the Worksheet. If this option is selected, it should be noted that all building space costs applicable to County operations will be included in the indirect cost pool and no space costs will be eligible for direct charging to federal programs. We recommend this approach because of its simplicity. However, it should be noted that in cases where Federal programs may occupy a disproportionate amount of space (in relation to the number of employees), then it would be to the County’s advantage to choose a methodology under Option 2 below. In our example of an ICRP for Sample County, we have used this option. Option 2: Some counties desire to charge a portion of its building occupancy costs directly to Federal programs, or use the costs for required federal match. It this situation, it will first be necessary to allocate the annual costs to the (1) Indirect Costs, (2) Direct Costs and (3) ISU Allocations functions of the office. This can be accomplished in one of two ways: Method 1: The total space costs for the year may be allocated to the three functional areas based on square footage occupied. We recommend this approach over the second method because it provides a more precise costing procedure and is fairly easy to compute. However, it should be noted that where direct costing to Federal programs is elected, there would be a need to maintain detailed monthly records of expense and the allocated amounts that are assigned to functions of the office. This approach requires the following steps: (1) Determine the usable square feet of space assigned to each staff member. This will exclude space for common usage areas such as hallways, restrooms, break rooms, etc. (2) Allocate the total allowable space costs for the year to individual staff 17 members based on their respective percentages of the total usable square feet. (3) The resultant allocations will then be handled as follows: Director’s Space Costs – Post this amount to the ICRP in the same ratios as the Director’s effort. This will either be 100 percent to Indirect Costs or split between Indirect Costs and All Other Direct Costs based on the PAR percentages of effort. Office Assistants Space Costs – Post the individuals’ Indirect Cost amounts (based on percentage of effort) to Worksheet 2 for further partial allocation to ISU-paid personnel. Any Direct Cost amount will be posted directly to the ICRP in the All Other Direct Costs column. Program Assistants Space Costs – Post the amounts directly to the ICRP in the All Other Direct Costs column. Field Specialists Space Costs – Post the total amount to the ISU Allocated Costs column on the ICRP. Method 2: The total space costs for the year may be allocated to the three functional areas based on FTE employee counts where it can be demonstrated that the number of employees is consistent with the amount of space assigned to them. The drawbacks here stem from the complexities that result where individuals split their time among the three functions, as well as the need to maintain detailed monthly records and allocations of costs to functions of the office. For these reasons, we prefer the approach stated under Method 1 if a direct costing methodology is elected. For simplicity we recommend the Option I method, which assigns all occupancy costs to Worksheet 2. Counties should be aware that the costs generated from the application of an indirect cost rate itself can normally be used to meet “federal match requirements”. This indirect cost match option may, in some cases, negate the need to charge building occupancy costs directly to grants. Other Expenditures Communications Costs - Worksheet 5 Office Supplies Expense – Worksheet 6 Equipment and Repairs Expense – Worksheet 7 Insurance, Legal and Bonds Expense – Worksheet 8 18 The annual expenses incurred for these cost elements should be entered on the appropriate Worksheets. Each cost element can be entered in one of three columns. Column 1 – Costs provide overall indirect benefit, and are not to be prorated to ISU personnel. For example counties may have bond or liability insurance expenses related to policies that cover only county employees. Column 2 – Costs provide direct benefit only, and are not to be allocated at all. For example counties may have special project printing expenses that are related to program specific objectives. Column 3 – Costs provide partial benefit to ISU and non-ISU activities, and are to be prorated on Worksheet 2. For example counties probably do not track telephone expenses by individual, and would enter telephone expense in this column so that the expense can be prorated to ISU and non-ISU personnel on Worksheet 2. The counties may choose the method based on their ability to track the costs specifically to the three categories. For the sake of simplicity, minor amounts should be listed in the Column 3 and be included in the allocations on Worksheet 2. We believe that this treatment is warranted in consideration of the time and expense that would be involved in tracking individual usage and cost and to allocate the individuals’ costs to indirect and direct functions under a direct charging methodology. Counties should be aware that the direct costs are defined as “costs that can be specifically assigned”. Therefore, it is recommended that any significant direct cost items be recorded as a direct cost in Column 2 of the appropriate worksheets (Worksheets 5 – 8). Two items may require additional consideration: Major equipment purchased under Equipment and Repairs. Any major equipment purchases that may have been recorded in this classification should be included in the Expenditures Not Allowable column of the ICRP. Major items of equipment will include any items costing more than the lesser of (1) $5,000 or (2) the amount of the County’s capitalization policy. (This is further discussed under the Equipment Use Allowance section below.) The balances of the allowable costs expended for County operations are entered on Worksheet 7. Insurance, Legal Notices and Bond Expenses. This category includes expenses for various insurance coverage, costs of publishing required legal notices, and bonding expenses incurred for County officials and employees. If the costs of Workers Compensation and Unemployment Insurance have been recorded here, they should be transferred to the Employee Benefits section of the proposal and distributed to functions of the office as stated therein. Additionally, if property insurance costs are included in this category, they should be transferred to the 19 Building Occupancy Costs section of the proposal. The balances of the annual expense for this category are entered on Worksheet 8. Project Activity Expenses This category includes various expenses for materials, supplies, subscriptions, meeting expenses, etc. that are applicable solely to one or more direct programs. The total costs of the Project Activity Expense category should therefore be entered on the ICRP in the Other Direct Costs column. Post Amounts from Worksheet 2 The columnar totals from Worksheet 2 should now be transferred to the ICRP. A line labeled “Worksheet 2 Costs” should be entered on the ICRP and the amounts from the Totals line of the Worksheet should be entered in the Total Costs, Indirect Costs and ISU Allocated Costs columns. Building Use Allowance General Comments: A Use Allowance on Buildings provides the means of allocating the cost of fixed assets to periods benefiting from the asset use. A-87 provides for Use Allowances on fixed assets in lieu of depreciation expense which is usually not recorded on the books of local governmental entities. Important provisions of the Circular in this regard include: Use Allowances must be based on the actual acquisition cost of the assets involved. A Use Allowance is not allowed on the cost of land. A Use Allowance is not allowed on the cost of assets that were paid for or donated by the Federal Government or on any portion of the cost of assets used to satisfy Federal matching requirements. A Use Allowance is generally not allowed on assets that would otherwise be considered to be fully depreciated. Adequate property records must support charges for Use Allowances. The Use Allowance for Buildings and Improvements (including land improvements such as paved parking areas, fences, and sidewalks) is computed at an annual rate of two percent of the acquisition costs. 20 County Extension Offices reside in leased facilities or facilities that they own. If the County has incurred significant expenses for leasehold improvements, a Building Use Allowance may be computed at two percent of the actual cost of the improvements, subject to the limitations stated above. The computed Use Allowance should then be entered on the ICRP on a separate line and the amount should be included entirely in the Indirect Costs column. It would not be expected that any material amount of this computed cost would benefit ISU-paid personnel, therefore, no allocation to them is required. Equipment Use Allowance Subject to the general limitations stated above, and dependent upon the existence of adequate equipment inventory records, the County may include an Equipment Use Allowance at 6 2/3 percent of the cost of equipment on the ICRP. This would be accomplished by entering the amount on a separate line and including it entirely in the Indirect Costs column. Again, we would not expect any amount computed to be material with respect to benefited ISU personnel. A couple of additional explanatory comments are required in this regard: The consistency requirements of A-87 have been noted throughout this Manual. However, if the County chooses to include an Equipment Use Allowance on the ICRP, this will not preclude it from claiming the direct costs of special purpose equipment that may be required in the direct performance of a Federal program. The allowability of these expenditures as direct costs of any Federal program is, of course, still subject to the terms of the specific award as well as to the provisions of A-87. Secondly, A-87 states that Equipment is defined as an article of nonexpendable, tangible personal property having a useful life of more than one year and an acquisition cost which equals the lesser of (a) the capitalization level established by the governmental unit for financial statement purposes or (b) $5,000. In the situation where County offices do not have standard capitalization policies in place we recommend that the $5,000 threshold should apply. 21 FINAL STEPS IN COMPLETING THE ICRP At this point, the County has entered all required cost data on the ICRP and is nearing completion of the indirect cost rate computation. The final steps will be: 1. Enter Totals. Enter total amounts for each of the columns on the ICRP. The total for the Total Costs column must equal the sum of the totals for all other columns. The total for the Total Costs column (excluding any additions for Building and Equipment Use Allowances) must also reconcile to the total expenditures in all funds for the year. In our example, we have used Worksheet 1 to aid in the final reconciliation process. And as stated earlier, a schedule similar to Worksheet 1 will also greatly assist in the initial summarization and organization of cost data prior to beginning preparation of the ICRP. 2. Select the Direct Cost Base. Direct Salaries and Wages is often the preferred direct cost base for local governmental entities. However, this is not required, and a base consisting of Direct Salaries and Wages plus All Other Direct Costs (called Modified Total Direct Costs) is usually equally acceptable. In our example, we have used a Modified Total Direct Cost base. Additional considerations in selecting the base include: The particular base selected will be the same base used in applying the indirect cost rate for recovery of indirect costs from specific Federal programs. Direct Salaries and Wages is the simplest base both to compute and to administer the recovery of funds from Federal programs. The use of Direct Salaries and Wages for the base avoids potential distortions that may arise in the use of a Modified Total Direct Cost Base. For example, where the latter is used, a question may arise as to whether large sub-contracts should be included, and, if so, up to what amount. Typically, a modified indirect cost base excludes the amount of any individual subcontracts that exceeds $25,000. A Modified Total Direct Cost base is sometimes preferred for “cosmetic” reasons. This is because the larger base (compared to salaries) provides a greater denominator in the rate computation and, thus, a lower percentage rate. Federal awarding agencies sometimes hold higher rates suspect, even though the total indirect cost recoveries to the local government under either method should be about the same. 22 3. Calculate the Rate. Divide the total amount from the Indirect Costs column on the ICRP by the total costs for the base selected. Express the result as a percentage, ordinarily to one decimal place. In practice, we suggest that the County compute the rate using both available bases and then select that base that best suits its own purposes. Further guidance is given below regarding the specific type of rate that will be used and other implementation considerations. 4. Write Statements of Base, Treatments of Fringe Benefits and Paid Absences, and List Fringe Benefits. At the bottom of the ICRP, include a written description of the direct cost base, the treatment of fringe benefits and paid absences, and provide a listing of the specific fringe benefits provided. These usually take the following forms: BASE: Direct salaries and wages, including all paid absences but excluding all other fringe benefits. BASE: Total direct costs, excluding items of equipment, alterations and renovations, subawards and flow-through funds. TREATMENT OF FRINGE BENEFITS: Fringe benefits applicable to direct salaries and wages are treated as direct costs. TREATMENT OF PAID ABSENCES: Vacation, holiday, sick leave pay, and other paid absences are included in salaries and wages and are claimed on grants, contracts and other agreements as part of the normal cost for salaries and wages. FRINGE BENEFITS: FICA, Retirement, Group Insurance, Workers Compensation and Unemployment Insurance. 5. Sign the Required Certification Statement. A-87 requires that a specifically worded Certification Statement be included with the ICRP. For Federal purposes, any “responsible official” could potentially sign the statement. We recommend that the Council Chairperson should sign this statement (shown in our sample proposal as Exhibit 2). 6. Prepare an Organization Chart. An organization chart should be prepared (if one does not already exist) and placed on file with the proposal. This chart will show the relationship in the organization of the County Extension Council, County Director and other County staff members, including ISU-paid personnel. 7. Assemble the ICRP and All Supporting Documentation. The final ICRP together with all other supporting documentation, including copies of the annual financial reports, should be placed in a file and retained by the County. The 23 Federal records retention requirement is three years, except that if any negotiation, audit or other action involving the records has been initiated before the three-year retention period has expired, the records must be retained until the action in completed and all issues are resolved. 8. Federal Approval of the ICRP. The Federal Government operates under the Cognizant Agency concept whereby that agency with the predominance of funding at a state or local unit of government acts on behalf of the entire Federal Government in reviewing and approving indirect cost rates. Where a Federal cognizant agency assignment has been specifically designated by OMB for a governmental unit, that unit must submit its ICRP to the cognizant negotiation agency for approval. This applies to all state governments and larger cities and counties but not to County Extension Districts. A-87 states that the cognizant agency for all governmental units or agencies not identified by OMB will be determined based on the Federal agency providing the largest amount of Federal funds. Further, these governmental units must develop an ICRP in accordance with A-87 (to be eligible for reimbursement) but are not required to submit their proposals unless specifically requested to do so by the cognizant agency. Where a local governmental unit only receives funds as a sub-recipient, the primary recipient is responsible for reviewing and/or negotiating the subrecipient’s proposal. CONSIDERATIONS FOR IMPLEMENTATION OF INDIRECT COST RATES Once the ICRP and supporting documentation have been completed and assembled, the following considerations will also need to be addressed. Type of Indirect Cost Rate to Be Used A-87 defines two types of indirect cost rates that are available to local units of government. These are: 4. Provisional – Final Rate. This approach involves two stages. In the first stage, a Provisional rate is used as an estimate for the future. It is a temporary rate based on anticipated future costs and is subject to retroactive adjustment at a future date after actual costs are known. It is usually determined based on actual costs from a prior period. In the second stage, a Final rate is determined after actual costs are known. The Final rate is used after- the- fact to adjust prior provisional claims, and for this reason, can be administratively burdensome. In addition, obtaining additional reimbursement for underpayments that may result from application of a provisional rate is subject to the availability of funds. 24 5. Fixed Rate. This form of rate is also based on an estimate of future costs (usually derived from historical costs), but it is not retroactively adjusted. Instead, the difference between estimated and actual costs is carried forward to a future period. The fixed rate approach is only permissible where the governmental entity has relatively stable funding and the amount of Federal programs is not expected to change materially in the future. We find that the time frames for which fixed rates are effective, and the required carry-forward procedures, are two features of fixed rates that tend to be very confusing for our local government clients. However, we support the use of fixed rates, where possible, and offer the following guidance in their use. Time Frames for Fixed Rate Implementation The fixed rate procedure employs a skip-year in the implementation of indirect cost rates. This is because actual costs for a prior year do not become known until well after the succeeding year has begun. For governmental units first establishing an indirect cost rate based on actual FY 2005 costs (sometime during FY 2006), the implementation schedule would be as follows: ICRP Based on Actual FY 2005 Costs (prepared during FY 2006): Is used to establish a fixed rate for both FY’s 2006 and 2007 ICRP Based on Actual FY 2005 Costs (prepared within 6 months of year-end): Is used to establish a fixed rate for FY 2007. ICRP Based on Actual FY 2006 Costs (prepared within 6 months of year-end): Is used to establish a fixed rate for FY 2008. In future years, the cycle would continue in the same manner. Carry-Forward Computation Procedures This is the most complicated part of the fixed rate approach. However, the Federal Government has prescribed a very specific computation procedure that makes the process somewhat easier. Worksheet 9 contains the required format for the carryforward computation. For counties that initially develop an indirect cost rate based on actual FY 2005 expenditures, a carry-forward computation will not be required until after the close of FY 2006 when the second ICRP is developed. 25 Gaining Approval of Indirect Costs in the Grant Award The ASMB C-10 instructions state the following in Attachment E, Section 6.6.1: “Because Circular A-87 establishes a policy that Federal programs bear their fair share of costs recognized under the Circular, Federal awarding agencies are expected to recognize and use indirect cost rates approved by the cognizant agency for a particular recipient. This recognition and use usually occurs at the time that an award is made. Awarding agency officials review direct cost proposals and applications to determine that anticipated costs included are necessary, reasonable, and allocable. Any proposed indirect costs are assessed according to whether or not an agreement exists with a cognizant agency. If one does, the awarding agency officials determine whether it will be fully recognized and to which object class categories of expenditure it will be properly applied. (Some Federal programs impose regulatory limits on the indirect percentage that will be allowed, e.g., HHS training grants that limit reimbursement to 8% of MTDC.)” Where a grant has been awarded prior to the establishment of an indirect cost rate, the reimbursement of indirect costs after the development of a rate is subject to negotiation between the grantor and grantee. We think the important point here is that no provision for indirect costs may be made prior to the development of a rate proposal. Applying the Indirect Cost Rate and Calculating Claims The following is also taken directly from the ASMB C-10 instructions (Attachment E, Section 6.6.2): “Once the indirect cost rate is recognized within an award document, the governmental unit is permitted to apply that rate to the applicable base of the allowable direct costs incurred during award performance. Periodically the governmental unit is expected to submit a Financial Status Report (usually either Standard Form 269 or 269A) which summarizes total expenditures incurred under the award. It may claim indirect costs by multiplying its indirect cost rate by the direct cost elements to which the rate may be applied under the terms of the award. Thus, its total cost recovery for the applicable period is comprised of the allowable direct costs incurred plus the allowable, allocable indirect costs." 26 Effect of Rate Changes from One Fiscal Year to Another Governmental units frequently receive Federal awards that they perform over periods of time that do not correspond with their own fiscal years. In these cases, the recipient is required to apply its indirect cost rate to expenditures incurred during the applicable fiscal year and to maintain consistent accounting treatment according to its normal procedures of expenditure recognition. 27