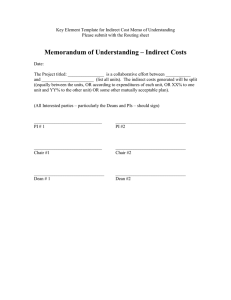

Indirect Rates Iowa County Agricultural Extension Offices

advertisement

Indirect Rates Iowa County Agricultural Extension Offices Key Points of the training Understand the concepts of indirect costs, direct costs and allocated costs Understand the general guidance contained in OMB Circular A-87 To learn how to construct a basic indirect cost rate proposal (single rate) To be aware of issues that might increase “audit exposure risk” for non-compliance SCHEDULE Training on Indirect Cost Rate Proposals Quick overview of basic concepts of cost and indirect rates OMB Circular A-87 and ASMB C-10 overview Over view of sample forms and Instructions Lunch Walk-thru instructions and do some sample exercises Wrap up (2:30 – 3:00) Who is MAXIMUS, Inc? National firm that specializes in various consulting services to State/Local Governments (NYSE MMS) Cost Services Division specializes in cost accounting, cost allocation, fees, federal grant cost recovery Cost Services Offices in the Midwest include Illinois, Iowa, Minnesota, Indiana, others Springfield Illinois office: Robert Antrim or Kurt Sames (217-789-0041) robertantrim@MAXIMUS.com How much do you know about ...? INDIRECT COST? Can someone give a one sentence definition? DIRECT COST? Can someone give me a one sentence definition? INDIRECT COST RATE? Can someone tell me the two basic factors (Ratio of “A “divided by “B”) EXPERIENCE? How many have had experience in using indirect cost rates? How much do you know about . ..? WHY do we use indirect cost rates? To recover some of the “overhead cost” related to the administration of federal and state grants Rates make it relatively easy, since no extensive tracking of costs to every indirect activity WHEN should we use an indirect cost rate? When we have a timely rate on file that is completed in accordance with OMB Circular A-87 And when award allows reimbursement of indirect costs And when we choose to claim (use as match) Basics – Indirect cost rates INDIRECT costs are those costs that cannot be readily assigned (without disproportionate effort). DIRECT costs are basically all other costs. Except for some “flow thru” or unallowable costs which are neither direct or indirect An INDIRECT COST RATE is a practical (easy) way to assign indirect cost to various “cost objectives” For example, to grant activities or other direct activities Rates are ESTIMATES for a future period Calculated using one FULL FISCAL YEAR of actual costs Applied as ESTIMATES for recovery in some future fiscal year. Rate are calculated on “ORGANIZATION-WIDE” basis The rate is NOT focused on individual grants Basics – Indirect cost rates INDIRECT COSTS Divided by DIRECT COSTS (chosen base) Equals INDIRECT COST RATE (% Ratio) Basics – Indirect cost rates EXCLUDABLE costs are left out of the indirect rate ratio altogether Excludable costs may not require “material administrative effort”, and their inclusion could unfairly distort the rate calculation Considered “flow-through costs” like sub grants, debt service, capital, client payments UNALLOWABLE costs are specifically defined in OMB Circular A-87 (discuss later) Unallowable costs may or may not be included in the BASE (discuss later) Basics – Indirect cost rates DIRECT COSTS – “BASE” Denominator in the Indirect/Direct ratio Direct costs are also known as the “BASE” for computation of indirect rates Several options exist for which “cost elements” are chosen for the Base “All Direct Salary and Wages” (S&W) “Total Direct Cost”, less excludable (TDC ) “ Modified Total Direct Cost” (MTDC) Typically includes first $25K of each sub-grant Basics – Indirect cost rates DIRECT COST BASE - Other key points CONSISTENTCY is important Same TYPE of “cost elements” included year-to-year Rate should be APPLIED to same cost elements as used to CALCULATE the rate Example: An indirect rate calculated using a S & W base should not be applied to the “Total Direct Costs” of a grant EXCLUDABLE COSTS Both Total Direct Cost (TDC) Base and Modified Total Direct Cost (MTDC) base, should exclude certain “flow-through” expenditures that might distort the rate calculation - like capital, debt service client payments MTDC excludes amount over the first $25K of each sub-grant (typically) Basics – Indirect cost rates OMB Circular A-87 Indirect cost and direct cost guidelines are discussed in Federal OMB Circular A-87 Why is the Federal government interested? Because the federal government provides significant grants to states and local governments Federal reimbursement is sometimes based on documented ACTUAL COST of providing services The Federal government determined that it was necessary to define what ACTUAL COST means! Next we will review some of the OMB Circular A87 “Actual Cost” Principles OMB CIRCULAR A-87 COST PRINCIPLES FOR STATE LOCAL AND INDIAN TRIBAL GOVERNMENTS OMB CIRCULAR A-87 KEY POINTS OF THIS SECTION OF TRAINING To discuss the importance of and the general guidance contained in OMB Circular A-87 To learn some of the important cost principles as defined in the Circular To learn basics on allowable and unallowable cost To introduce the A-87 “ASMB C-10 Guide” Published by U. S. DHHS ASMB C-10 is the “Implementation Guide for OMB Circular A-87” OMB CIRCULAR A-87 General “COST PRINCIPLES FOR STATE, LOCAL, AND INDIAN TRIBAL GOVERNMENTS” ORIGINAL VERSION IN 1968 MAJOR REVISION IN 1995 “Tightened up” the documentation requirements for claiming personal services cost AVAILABLE ON THE WEB: http:/www.whitehouse.gov/omb/circulars/ a087/a87_2004.pdf A-87 ORGANIZATION Highlighted items are relevant to Locals ATTACHMENT A - GENERAL PRINCIPLES FOR DETERMINING ALLOWABLE COSTS ATTACHMENT B - SELECTED ITEMS OF COST ATTACHMENT C - STATE/LOCAL-WIDE CENTRAL SERVICES COST ALLOCATION PLANS (NEW) ATTACHMENT D - PUBLIC ASSISTANCE COST ALLOCATION PLANS (NEW) ATTACHMENT E - STATE AND LOCAL INDIRECT COST PROPOSALS THE PURPOSE OF OMB CIRCULAR A-87: SETS POLICIES/PROCEDURES FOR IDENTIFICATION OF COSTS OF PROGRAMS IDENTIFIES ALLOWABLE AND UNALLOWABLE COSTS SPECIFIES COST ALLOCATION CRITERIA/REQUIREMENTS STIPULATES DOCUMENTATION REQUIREMENTS MANDATES COGNIZANT AGENCY APPROVAL/APPEAL CONCEPT BRINGS “ORDER AND RATIONALITY” TO THE COST DETERMINATION AND APPROVAL PROCESS A-87 DOES NOT OVERRIDE A PROGRAM’S SPECIFIC LAWS OR REGULATIONS OMB CIRCULAR A-87 Application The Circular does apply to Cost-reimbursement contracts Grants and cooperative agreements Sub-grants or subcontracts awarded to governmental units under grants awarded to the Federal recipient (grants to states for example) Costs presented as required program “match” Match refers agreements that stipulate a “cost-sharing ratio” between the funding source and the grant award recipient Total overall “allowable program cost” is shared OMB CIRCULAR A-87 Summary The Circular summarized in one sentence The Circular is all about: ACTUAL COSTS incurred by STATE (and Local) GOVERNMENTS, and documenting the BENEFITS RECEIVED and the ALLOWABILITY of the costs, when the costs are presented for REIMBURSEMENT by FEDERAL agencies, under “COST REIMBURSEMENT” type arrangements OMB CIRCULAR A-87 Summary More specifically, A-87 Defines the concept of actual cost, and reimbursable cost Describes direct vs. indirect costs Requires consistent treatment of cost elements Many other specific rules about cost documentation standards Does not supercede specific federal programs that may limit reimbursement of indirect costs OMB CIRCULAR A-87 Summary General vs. Specific Guidance OMB A – 87 provides GENERAL Guidance Other documents provide more specific guidance related to administration and audits of federally funded programs (next slide) OMB CIRCULAR A-87 Summary Other specific guidance ASMB C-10 “Supplemental Guide” published by DHHS to provide procedural guidance for implementation Specific program legislation may supersede A-87 “Single Audit Act” and OMB Circular A-133 established uniformity among federal audit requirements GAAP - Audit guides, such as Federal Acct Stds Board Finally, the auditor’s judgment regarding compliance OMB CIRCULAR A-87 Summary ASMB C-10: Implementation Guide for OMB Circular A87. The Organization of Guide follows A-87 Available on the web at “http://www.hhs.gov/grantsnet/state/asmbc10.pdf” Section relevant to LOCAL governments include: Part 1: Basic Information Part 2: General principles for determining allowable costs Part 3: Selected items of cost Part 6: State and Local IDC Rate Proposals, with Illustrations OMB CIRCULAR A-87 Summary Review HIGHLIGHT in Manual Manual page 1 Beginning at bottom of page one, last paragraph: “The Circular addresses the key concepts of …. End: To the end of the paragraph (on page 2) Manual page 2 Highlight the web address for OMB A-87 and also ASMB C-10 READ in Manual Manual page 2 – the section “STAGES of GRANT ASSISTANCE and the APPLICABILITY of CIRCULAR A-87” Composition and Allowability of COST Factors affecting the allowability of COST Necessary and reasonable Allocable to Federal awards. This means joint costs must be allocated to ALL benefiting activities, including non-federal and unallowable All allocated cost elements must at least have some POTENTIAL BENEFIT to Federal awards Authorized and not prohibited under State or local laws or regulations Composition and Allowability of COST Factors affecting the allowability of COST continued: Costs must conform to any limitations or exclusions, including terms and conditions of federal awards Costs must be CONSISTENT with policies and regulations that apply uniformly to both Federal awards and other (non-grant) activities Costs must also be accorded CONSISTENT TREATMENT Example: Same type of cost elements can’t be assigned as direct in one circumstance and indirect in another! Composition and Allowability of COST Factors affecting the allowability of cost continued: Conform to GAAP Must not be included as cost or match for some other federal award (unless provided by award) Net of applicable credits (Like ISU reimbursements for cost for Extension Services) Costs must be adequately documented Composition and Allowability of COST Some costs are specifically UNALLOWABLE under OMB A-87 Selected items of cost are A discussed in ATTACHMENT B of the Circular The list discusses the ALLOWABILITY of certain items and discusses DOCUMENTATION REQUIREMENTS Some common “unallowable” items are shown on the next slide Ref: OMB Circular A:87 Attach B: Selected Items of Cost Composition and Allowability of COST Examples of unallowable costs (whether direct or indirect) continued: Advertising, except for recruitment or procurement, unless specifically required by the grant award Most public relations, unless specifically required by the award Most legal defense costs (legal expense required in the administration of federal awards is allowable) Equipment o r other capital expenditures (a “use allowance” or “depreciation” may be computed and is allowable) Ref: OMB Circular A:87 Attach B: Selected Items of Cost Composition and Allowability of COST Examples of unallowable costs continued: Fund raising and investment activities Lobbying Unused facilities and “idle capacity” (normally) Losses that could have been covered by insurance Interest, but exceptions are made for interest on financing of allowable equipment or buildings Others – see Attachment B for discussion Ref: OMB Circular A:87 Attach B: Selected Items of Cost Composition and Allowability of COST DIRECT vs. INDIRECT costs No universal rule for determination of Direct vs. Indirect Direct costs are those that are readily assignable to specific “cost objectives” For example staff that keep an activity timesheet Indirect costs benefit multiple cost objectives, but are not readily identified to any particular cost objective Indirect costs in one agency may be direct in another agency – but should be consistent within own agency Composition and Allowability of COST HIGHLIGHT in Manual The first sentence of each “allowability factor” (starts on p. 4) Highlight the definition of Direct Costs (first sentence only under “Direct Costs”, page 5) Highlight the definition of Indirect Costs, including two points (Under Indirect Costs on page 6) Ref: Manual pages 4 and 5 Composition of Cost Salaries and Wages Documentation of Salaries and Wages A-87 contains strict requirements for documenting personal services costs where employees split their time between DIRECT and INDIRECT activities Important points (suggest highlighting in Manual): Costs to be based on “standard payrolls”, whether direct or indirect employees Ref: Manual pages 6 and 7 Composition of Cost Salaries and Wages Important points on Salary and Wages continued For employees who work SOLELY on a Federal grant award: At least a semi-annual Certification signed by the employee that confirms their assignment For employees who work partially INDIRECT and partially DIRECT Must keep a Personnel Activity Report (PAR) to support the split between indirect and direct A “PAR” is basically an ACTIVITY TIME SHEET with two categories (DIRECT time vs. INDIRECT time) Ref: Manual page 6 -7 Composition of Cost Salaries and Wages Important points on Salary and Wages continued The PAR requirements are especially important to agencies that have employees who split their time between direct and indirect Example: If a PA spends some time working on a an indirect activity (like general agency-wide accounting work) and spends some time working in particular program areas: He or she must keep a record of this activity on a PAR with at least two categories: Category 1: Estimate of % of time on all INDIRECT activity (combined) Category 2: Estimate of % of time on all DIRECT activity (combined) Composition of Cost Salaries and Wages MAXIMUS has designed a simplified Personnel Activity Report (PAR) that may be used by the County See Handout – PAR examples Jane Jones signed entered her estimated hours each month and signed the form. Note: If for the first year “Jane Jones” did not keep a monthly time estimate, suggest she completes her percentage of time for the FULL YEAR and sign Manual pages 6 and 7 Also, refer to “PAR form” handout Depreciation or use allowances Depreciation or “use allowances” are a means of allocating the cost of equipment or building assets Depreciation is possible if the formal accounting records of the county record depreciation under a standard fixed assets policy A “use charge” can be used instead of depreciation (optional) Building use charges are calculated at 2% of the acquisition value, including improvements Equipment use charge are calculated at 6 2/3% of original acquisition value Refer to “Use Charges” handout, and Manual pages 21-22 Depreciation or use allowances Depreciation or use charges are normally charged as indirect in the indirect rate proposal (ICRP( calculation worksheet Exception: The County may choose to charge occupancy space as direct certain programs, including depreciation. If the County chooses to identify some of the building space as direct (or as “match”) Requires a square footage cost allocation method be applied to all direct and indirect space to determine the appropriate cost Then only the INDIRECT office space can be included in the indirect rate proposal For Equipment Use, we recommend that only the indirect equipment items be included in the use charges or depreciation Refer to OMB A-87, Attachment B (11) for more information on Depreciation and Use Charges, and pages 20 and 21 of MANUAL Review of A-87 and Cost Principles So far we learned: The basic elements of cost are INDIRECT, DIRECT and also EXCLUDED and UNALLOWBLE Indirect costs are defined as costs that are NOT READILY identified to specific purposes An indirect cost rate is the ratio of INDIRECT to DIRECT (or BASE) That the provisions in OMB Circular A-87 is important (and also the Guide ASMB C-10) Review of A-87 and Cost Principles So far we learned (continued): Basic concepts in OMB A-87: Like elements of cost are to be treated CONSISTENTLY Documentation of Personal Services costs is important There are certain costs that are UNALLOWABLE or have special documentation requirements ATTACHMENT B of OMB A-87 provides a useful discussion of cost, and documentation standards “Building use or equipment use charges may be included as indirect costs. Special allocation procedures required if County chooses to include space costs are DIRECT INDIRECT COST RATE PROPOSAL (ICRP) HOW TO DEVELOP A RATE & DOCUMENTATION REQUIREMENTS Indirect Cost Rate Proposals Basics Mechanism to easily estimate the full cost of providing direct services Based upon costs for a full fiscal year “Organization wide” Provides a ceiling up to which the county may recover a portion of its allowable indirect costs Indirect costs may be used to satisfy matching or cost sharing requirements if not claimed Manual page 7 Indirect Cost Rate Proposal Basics Types of approvals for rates “Provisional/Final” Requires an retroactive adjustment to actual cost reimbursement claims once final costs are known “Fixed with Carry Forward” This type will probably to be used by the Counties The cost adjustment is “carried-forward” and is embedded in the newly proposed rate Predetermined rate (probably not used) Manual page 8 Indirect Cost Rate Proposal Basics Types of Direct Cost Base Direct salaries and wages Modified total direct cost (MTDC) Excludes distorting items such as capital, debt service, subawards, assistance payments, and provider payments This type of base is illustrated in our Example IDC forms Other bases might be chosen such as S&W including fringe benefits Total direct cost (if no material distorting items) Manual page 9 Indirect Cost Rate Proposal Basics Format of the ICRP “Simplified Method” is recommended as illustrated in ASMB C-10 (Section 6.2.3) The simplified method is used where each of the agency’s major functions benefit from its indirect costs to approximately the same degree If not, a more complex cost allocation plan is necessary (not covered in this training) Manual page 10 Indirect Cost Rate Proposal - Basics Under the SIMPLIED METHOD, a determination is made as to which activities are DIRECT COST and which are INDIRECT costs A set is Schedules is prepared based on one full year of agency cost to estimate a proposed rate to be used in some future year Manual page 10 Indirect Cost Rate Proposal – Steps “Simplified Method” Step 1 – Adjust INDIRECT costs for the period: Eliminate any indirect costs directly reimbursed through a federal award specifically for that purpose For example, if a construction grant was received than no depreciation or use allowance (rare) Eliminate administrative salaries in the indirect pool that were funded as direct by a grant Eliminate any A-87 unallowables and capital improvements, and “applicable credits” Add use allowances if this option is chosen Manual page 10 Indirect Cost Rate Proposal – Steps Step 2 – Adjust DIRECT costs for the period: Eliminate any flow through funds and capital expenditures Step 3 – Divide the total allowable indirect costs by an equitable direct cost base Usually Salaries or Wages, or Modified Total Direct Cost Manual Page 10 and see also page 9 (Direct Cost Base) ICRP Instructions and Schedules Introduction Please note: There is not single, uniform approach that will satisfy the needs of all counties Various counties may have their won particular needs and circumstances Various options will be addressed It may be necessary for counties to tailor the worksheets to meet their own particular needs Manual page 11 ICRP Instructions and Schedules Introduction “ISU Allocated Costs” - Discussion ISU employees are located on-site Logically they should receive their share of some of the indirect costs – This complicates the rate computations! These activities are identified on Schedule 2, and the ISU share of cost is then transferred to a separate column entitled “ISU allocated Costs” on Exhibit 1 (Col 8) The basis for the County/ISU allocation on Schedule 2 is the number of FT Employees (County vs. ISU employees) Example: 10 employees total, of which 2 are ISU. Therefore the ISU allocated share is 20% of certain indirect costs. ICRP Instructions Exhibit 1 – ICRP Summary Exhibit 1 is the ICRP SUMMARY SCHEDULE Explanatory “Notes to ICRP Exhibit 1” are contained in a MS Word document Some Column entries are made directly from the Expenditures Worksheet 2 (explained later) Some Column entries are transferred from Schedules 2 through 8 (explained later) Ref: See Manual page 12 for a discussion of Exhibit 1; see also “Exhibit 1” of sample forms, and “Sample IDCR Proposal Notes” (MS Word Document) ICRP Instructions Exhibit 1 – ICRP Summary (cont’d) Column 1 contains the TOTAL COSTS, and then assigns all cost to 6 additional columns: Col 2: Excludable costs (flow-through) Col 3: Expenditures not allowable (may also included in base if it either generated or benefit from the indirect cost) Col 4: Indirect costs – all must meet A-87 cost allowability requirements Col 5: Direct Salary and Wages - chosen BASE for example Col 6: All other Direct Costs Col 7: ISU Share Allocated costs ICRP Instructions Exhibit 1 – ICRP Summary (cont’d) Expenditures that are exclusively direct can be entered directly from the Summary Worksheet 1 Example: By policy, the Director’s salary is considered 100% direct and is entered in the DIRECT column Other expenditures are entered from Worksheets 2 through 8, and are transferred to the appropriate columns The rate is calculated at the bottom of the worksheet, and is based on the following: The sum of the “Indirect” column (A) divided by The sums of the “Direct S & W” col. plus the “Other Direct” col. (B + C) ICRP Instructions Worksheet 1–Expenditures Summary Worksheet 1 is the initial SUMMARY OF EXPENDITURES Expenditures are transferred from the most recent annual financial statement (AFR 4) The purpose of the worksheet is to help organize the expenditure date for easy entry in other worksheets The total costs should reconcile to Column 1 total on Exhibit 1 Ref: Worksheet 1 in Sample Forms packet ICRP Instructions Worksheet 2 – Allocation of Costs to ISU Personnel Enter number of ISU and total employees in Line A & B Enter the salary for any indirect employees that partially benefit ISU employees Enter fringe benefits for the same employees, which is transferred from Worksheet 3 Janitor salary and fringe and building occupancy costs may be entered Other costs are transferred from Worksheet 3 through Worksheet 8 (see instructions for Worksheets 2 – 8) The final column totals are entered on Exhibit 1 in the INDIRECT and the ISU ALLOCATED SHARE columns Ref: Worksheet 2 ICRP Instructions Worksheet 2 – Allocation of Costs to ISU Personnel (cont’d) Special note on employees who are split: DIRECT and INDIRECT salary expenditures Some employees may split their time between direct and indirect (based on their PAR %’s) IF so, only the INDIRECT share of the salary is entered on Worksheet 2; the DIRECT share is entered on Exhibit 1 Julie Smith in our example has $2,221 entered on Exhibit 1 and $8,882 entered on Schedule 2 Similar process for fringe benefits see Worksheet 3 instructions next slides Ref: to Manual page 13 and 14 for a discussion of Options for entering salary and wages cost ICRP Instructions Worksheet 3 – Summary of Employee Benefits Enter all benefit amounts, by employee, in the appropriate “benefit type” columns. Include all employees. Employees that partially benefit ISU staff are entered in Section I; Others are entered in Section II Transfer the benefit type totals to one of three columns: Col 1 Indirect: Enter amounts here if employee is indirect, but does NOT benefit ISU staff Col 2 Direct: Enter amounts here if employee is direct Col 3 ISU Allocated: Enter amounts for INDIRECT employees that PARTIALLY benefit ISU staff. Ref: Worksheet 3 and Manual page 15 EXERCISE Exhibit 1 and Worksheets 2 and 3 The purpose of this exercise is to: Understand Worksheet 3 (Benefits) Lean to post the entries from Worksheet 3 to: WORKSHEET 2 if indirect costs are to be allocated to ISU/NonISU employees, OR to EXHIBIT 1 if no allocation is required Refer to the exercise instructions on the bottom of WORKSHEET 3 I will show you the completed exercise worksheets after you do the work ICRP Instructions Worksheet 3 – Summary of Employee Benefits (cont’d) Special note on employees who are split: DIRECT and INDIRECT fringe benefit expenditures Some employees may split their time between direct and indirect (based on their PAR %’s) The total of all of the benefit cost is entered on Worksheet 3 However, the DIRECT share is entered in the “Direct” column, The INDIRECT share is entered in the “INDIRECT” column OR the “ISU ALLOCATED” column on Worksheet 3 Julie Smith in our example has $292 entered in the DIRECT column and $1,166 entered in the ISU allocated column on Schedule 2 ICRP Instructions Worksheets 4 - 8 These similar worksheets provide an allocation of the other operational costs that might be indirect or partially indirect Worksheet 4 – Travel expenses Worksheet 5 – Communications expenses Worksheet 6 – Supplies expenses Worksheet 7 – Equipment (non-capitalized) expenses Worksheet 8 – Insurance, Legal and Bonds expenses The posting instructions: Col 1 Indirect – Transfer sum to Exhibit 1 INDIRECT column Col 2 Direct – Transfer sum to Exhibit 1 DIRECT column Col 3 Allocable to ISU – Transfer sum to the appropriate column in Worksheet 2 Ref: Manual pages 16 and 18 ICRP Instructions Building Occupancy Costs Building occupancy costs are discussed on pages 16 through 18 of the manual (please read) In general - options are available: If all costs partially benefit ISU staff, and the County does not choose to charge any as direct costs can be entered on Worksheet 2 If the County desires to charge some building costs directly to grants (or used as match) it will be necessary to allocate the costs based on sq footage or FTE counts (see manual page 17 and 18) If allocated, the costs may be entered on Schedules as follows: Directly to Exhibit 1 (and assigned to direct or indirect columns) Or to Exhibit 2 if some to be allocated to ISU/non-ISU personnel Ref: Manual pages 16 through 18 for complete discussion Calculating Equipment Use and Building Use Charges See manual page 20 and 21 if you wish to charge a use allowance for either buildings or equipment. We recommend equipment use be calculated only for “indirect” equipment (like accounting office or Director’s Office Equipment When calculated the use charges can be entered as follows: Building Use – Enter on Worksheet 2 to be allocated to ISU/non ISU personnel; or directly on Exhibit I Indirect column if no ISU benefit Equipment Use – Enter on Worksheet 2 also, assuming indirect equipment benefits both ISU and non-ISU personnel Ref: Manual pages 20 and 21; also see examples handouts of Equipment Use and Building Use calculations FINAL COMPLETION of ICRP Follow instructions in Manual pages 22 -23 Make sure the required certification is signed by the Board chairperson Assemble all the Exhibits, Worksheets and supporting documents Normally the ICRP package should not have to be submitted for federal approval (local governments are exempted unless requested) The State funding source may choose to review The documents should be kept on file at least 3 years QUESTIONS for MAXIMUS Robert Antrim, or Kurt Sames 217-789-0041 Robertantrim@maximus.com