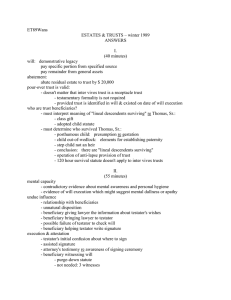

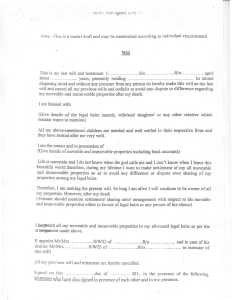

I. Introduction-

advertisement