Corporations Outline

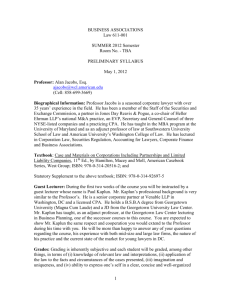

advertisement