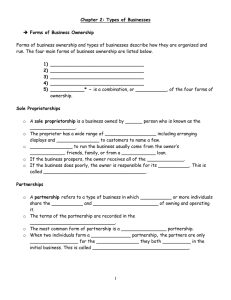

TABLE OF CONTENTS SECTION TITLE

advertisement