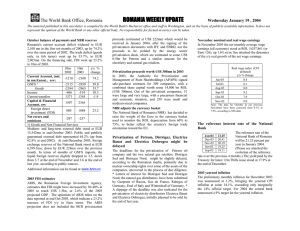

ROMANIA WEEKLY UPDATE The World Bank Office, Romania

advertisement

ROMANIA WEEKLY UPDATE The World Bank Office, Romania Wednesday, October 29, 2003 The material published in this newsletter is compiled by the World Bank's Bucharest office and staff in Washington, and on the basis of publicly available information. It does not represent the opinion of the World Bank or any other official body. No responsibility for factual accuracy can be taken Constitution revision The revision of the Constitution was approved by 89.7 percent of the electorate who participated in the referendum held on October 18/19, according to the data centralized at the Central Electoral Bureau (BEC) and quoted by public sources. The participation rate was 55.7 percent of the number of persons registered on the electorate lists. The new Constitution came into force on October 29, 2003. Relation with the EU PM Adrian Nastase sent a letter to Romano Prodi, the Chairman of the European Commission, informing on the Government’s additional commitments to be accomplished before the release of the annual EU Progress Report for Romania. A main commitment was to identify ways to cut down the payment arrears. According to the Finance Minister, Mihai Tanasescu, the other three additional commitments were the finalization of the Siderurgica Hunedoara privatization, the approval of the national companies’ budgets for 2004, and the approval of the state budget for 2004. Privatisation of Siderurgica Hunedoara The privatization contracts for Siderurgica Hunedoara steel maker and Petrotub pipe maker are to be signed next week with LNM Ispat, according to Ovidiu Musetescu, Head of the Privatization Agency (APAPS). The foreign investor would purchase some 81 percent of Siderurgica’s shares and 70 percent of Petrotub’s shares. The privatization process might imply significant layoffs, as LMN intends to cut the number of employees by some 4,000, from 9,400 currently, for the two companies. 2004 budget law and underlying pre-requisites The Parliament will start debating the 2004 State Budget Law and Social Security Law on November 17. Underlying assumptions under the draft new budget are presented in the comparative table below, suggesting at the same time that, in 2004, economic growth will be investment and exports driven. Real % growth rates , y/y 2002 Gross Domestic Product Domestic Demand Households Public Administration Gross Fix Capital Formation Change in Stocks 1 Export Goods and Services Import Goods and Services 4.9 3.9 3.0 2.1 8.3 0.0 16.9 12.1 1) 2003 2004 projection 4.8 5.5 5.1 5.5 3.8 3.7 2.0 2.0 10.5 13 0.2 0.0 9.6 8.2 9.9 8.0 contribution to GDP growth Industrial production growth is projected at 5.5% in 2004, as compared to a projected 5.2% in 2003. The disinflation process will continue, bringing the 2004 end of year inflation to 9%, as compared to a projected 14% in 2003. The main disinflation pre-requisites are the implementation of enterprise restructuring and privatization programs, the reduction of payment arrears and the cooperation of all social partners to support prudent wage policies. The exchange rate regime will continue to rely on a managed float and a moderate real appreciation of the national currency vs. the 40/60 US$/Euro currency basket. The CA deficit is expected to deepen (Euro –2.4 bn) in 2004, and be supported by an increased positive balance of current transfers from abroad. (in million Euro) Current Account Balance Export Goods and Services Import goods and Services 2002 - 1662 2003 -2050 2004 -2360 17135 18535 20115 19927 21615 23505 Other assumptions for 2004 are a 5.4% increase in labor productivity, a 0.5% increase in the number of employees and an unemployment rate (ILO methodology) of 7.6% ( down from 7.9% in 2003). The consolidated budget (CB) deficit was targeted at 3% of the GDP , up 0.3% as compared to 2003 deficit of 2.65%. The two tables bellow are presenting the structure of the consolidated budget revenues and expenses. Revenues (CB) as % of GDP Total, ow: Fiscal revenues Direct taxes Tax on profit Tax on income Social Security Contrib. Indirect taxes Value Added Tax Excises Customs Duties Non-fiscal revenues Capital Revenues 2003 Program 30.4 28.8 16.6 2.2 3.0 10.4 1 2004 Proposal 30.1 28.6 16.4 2.3 3.0 10.0 12.2 7.4 3.0 0.7 1.6 0.1 12.2 7.3 3.2 0.6 1.4 0.1 1) Including recovery of arrears, re-classified from non-fiscal revenues Expenditures (CB) Total , ow: Wage and salaries Material and operating expenditures Interest Subsidies, premia, transfers Reserves Capital expenditures Lending Program 2003 Proposal 2004 as % of GDP Program Proposal 2003 2004 as % of total expenditure 33.1 33.1 100 100 5.0 5.0 15.2 15.0 7.1 6.5 21.4 19.7 2.4 2.2 7.1 6.6 14.7 15.6 44.4 47.3 0.1 0.1 0.2 0.2 3.7 3.6 11.3 10.9 0.1 0.1 0.4 0.3 Additional details are available at www.mfinante.ro , the web site of the Ministry of Public Finance