Student ID:MA3N0202 Name: Li-Wen Chang(Jenny) 1

advertisement

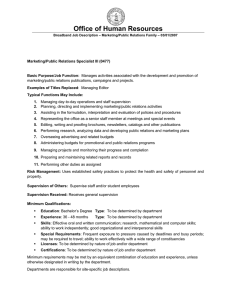

Student ID:MA3N0202 Name: Li-Wen Chang(Jenny) 1 What’s the “Financial supervision mechanism” The Financial Supervisory Commission (FSC) Case ─ The Bank of Lithuania Conclusion Reference material 2 Financial regulation refers to the financial authorities in accordance with the legal powers conferred by law on financial institutions and supervise the operations and management in order to maintain normal financial order, the protection of depositors and investors in the interests of the financial system to protect the safety, health, and efficient run. 3 1. The market access regulation Market access regulation is the central bank for qualified institutions to enter the financial markets , management of financial products , providing financial services to review and approval process. 4 2. Operations supervision The risk of financial institutions, is gradually formed and accumulated in the course of daily business operations. 5 Business compliance. The purpose of this regulation is to urge financial institutions to strictly comply with banking laws and regulations as well as the financial rules and regulations established by the Central Bank to maintain appropriate competition among financial institutions, to maintain a healthy financial order. 6 3.Market exit regulation Financial institutions out of the market in the form of the main dissolved, withdrawn (closed) and bankruptcy three forms. Rescue or take the more shock small exit form The strength of financial institutions mergers and acquisitions. 7 8 FSC was established on 1 July 2004 Supervision, regulation, and examination Create a sound, fair, efficient, and internationalized environment for financial industry Strengthen safeguards for consumers and investors 9 Maintaining financial Implement financial stability reform Establish a fair, healthy and profitable financial environment, to enhance the competitiveness of the financial sector Assist industry development Strengthen consumer and investor protection and financial education 10 Chairman Vice chairman Vice chairman Chief Secretary Committee meetings Financial Supervisory Commission Bank Board Securities and Futures Bureau Insurance Bureau Inspection Bureau Integrated Planning Office International Business Department Legal Office Information Services Office of the Secretary Personnel Office Comptroller room Political plenum 11 http://www.lb.lt/financial_stability 12 The role of the Bank of Lithuania is very important for the country’s economy and financial system. Its principal objective is to maintain price stability. https://www.lb.lt/about 13 Commercial banks, other credit , payment institutions, securities and insurance markets Investigates disputes between consumers and financial institutions 14 Supervision of Credit Institutions The goal of the supervision of credit institutions is to monitor compliance of credit institutions with the standards of safe ≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡ Analysis of the financial situation of credit institutions Analyses the performance and trends of the banking system The Bank of Lithuania also periodically performs inspections and examinations of credit institutions. 15 Supervision of Payment Institutions A payment institution is an economic entity providing payment services ≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡ Off-site inspections of payment services provided by payment institutions Additional services closely related thereto 16 The goal of the supervision of electronic money institutions---Monitor whether electronic money institutions and foreign electronic money institution branches operating in Lithuania, having a license issued by the Bank of Lithuania, are in compliance with the requirements provided in the laws and the Bank of Lithuania’s statutory requirements. 17 The purpose of supervision of insurers and insurance intermediaries--Ensure reliability, efficiency, safety and stability of the insurance system Protection of the interests of the policyholders 18 Insurers and insurance intermediaries with the requirements of the legal acts regulating their activities and with the licensing conditions Examines complaints concerning the activity of insurance market participants Provides methodological assistance to insurance market participants. 19 Unified financial supervision system Establishment of a financial holding company Government Financial Management Financial business organizations Principle of functional management A fair and reasonable financial environment 20 http://www.fsc.gov.tw/ch/home.jsp?id=167& parentpath=0,1 http://www.zwbk.org/zhtw/Lemma_Show/131774.aspx https://www.lb.lt/about_the_supervisory_acti vities http://www.zwbk.org/zhtw/Lemma_Show/131774.aspx http://www.lb.lt/about http://old.npf.org.tw/PUBLICATION/FM/090/ FM-R-090-059.htm 21 Thank you for listening http://www.youtube.com/watch?v=6mkvGvTVdgY 22