Chapter 9 – Taxes and Foreign Investment Differences in Income Accrual Book income:

Chapter 9 – Taxes and Foreign

Investment

Differences in Income

Accrual Book income:

Based on GAAP

Different timing of revenues and expenses

Accrual tax income:

Based on IRS code

Biggest difference is generally depreciation

Tax rates

Different types of income:

Ordinary income

Capital Gains - Sale of financial instruments

1245 Gains - Sale of equipment

1250 Gains - Sale of Buildings

Ordinary:

Very progressive

Federal rate goes to 35% quickly

All income taxes eventually at ordinary rates

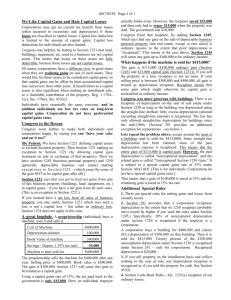

Taxes at the Acquisition Stage

Some outlays are treated as expenses

Common examples -- training and advertising

Entire amount taken to the income statement in year 0

After tax cost = Before tax cost * (1- marginal tax rate)

Most outlays are capitalized -- taken to the balance sheet

Some are written-off over time -- depreciation

Some never written-off -- land, cash balances

Taxes at the Operating Stage

Depreciation

MACRS and older rules

Choosing a depreciation method

MACRS’s rapid depreciation is best if you have the income

If you do not have the income use slower straight-line depreciation

Taxes at the Operating Stage

Alternative minimum tax

If you have too many tax preference items like rapid depreciation you may be subject to a 20 percent minimum tax

Operating loss carry-back

Operating losses can be carried back 3 years and matched against prior income

Operating loss carry-forward

Maximum of 15 years

Taxes at the Disposition Stage

Capital gains, 1245 gains, 1250 gains,

(and losses) are netted together within classes, then the classes are netted together

Ordinary corporate rates apply

Replacement Decision with Taxes

Replacement where the worn out asset’s trade-in value is different than the sale value

Depreciable cost

What you paid for it

Initial outlay

Depreciable cost plus after tax opportunity cost of foregone sale

Replacement Decision with Taxes

Replacement where one usable asset is replaced with another

Do not net the two assets together

Calculate the after-tax foregone sale value

Calculate the net after-tax repair cost

Add together to get the initial outlay

Work the alternatives as equivalent annuities

Corp orate Taxation -- Owners

Income

Dividend exclusion rule

own less than 20 % -- exclude 70%

own 20 to 79 % -- exclude 80%

own 80% or more -- exclude 100%

Small family owned businesses can be subject to the accumulated profits tax

Businesses Not Taxed as

Corporations

Proprietorships

Partnerships

Limited partnerships

S Corporations

Personal Income Taxes

Not as quick to progress as corporation rates

Hit higher rates than corporation rates

Vastly different treatment of 1245 gains and losses versus 1250 gains and losses

Can deduct a maximum of $3000 in capital losses each year

Choice of Tax Form

Make the choice to maximize the after tax cash flow to the investor after consideration of both corporate and individual taxes

Timing of Tax Payments

Slightly different than individuals

Pay estimated payments throughout the year

Corporate returns due by March 15

Foreign Capital Investment --

Taxes

Taxation allowance made by the US government for taxes paid to foreign countries

No dividend exclusion rule from foreign subsidiaries

Coordination of taxes between countries

Foreign Capital Investment --

Cash Flows

Exchange rates influence cash flows

Repatriations agreements can hinder cash flows