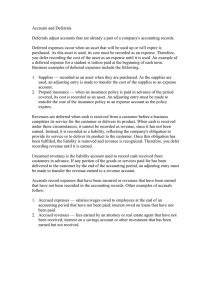

Adjusting 調整 Why?為什麼要調整? When?什麼時候要調整?

advertisement

Adjusting 調整 Why?為什麼要調整? When?什麼時候要調整? What?有哪些項目? The Accounting Period Annual 1 2 Semiannual 1 2 3 4 Quarterly 1 Jan 2 3 4 Feb Mar Apr 5 6 7 May Jun Jul 8 9 10 Aug Sep Oct Monthly 11 12 Nov Dec Accrual Basis vs. Cash Basis Accrual Basis Cash Basis Revenues are recognized when earned and expenses are recognized when incurred. Revenues are recognized when cash is received and expenses recorded when cash is paid. Not GAAP Accounting Adjusting Accounts調整分錄 An adjusting entry is recorded to bring an asset or liability account balance to its proper amount. Framework for Adjustments Adjustments 預付項目 Deferred Items Prepaid (Deferred) expenses* Unearned (Deferred) revenues *including depreciation 應收項目Accrued Items Accrued expense Accrued revenues 調整項目 壹>遞延項目Deferred Items(記實轉虛,記虛轉實) – 預付:如預付保險費轉成保險費用 – 預收:如預收房租轉成房租收入 貳>應計項目Accrued Items 應付或應收:應付利息或應收利息 叁>估計項目Estimated Items 折舊Depreciation 呆帳Bad Debt Prepaid (Deferred) Expenses Resources paid for prior to receiving the actual benefits. Asset Unadjusted Balance Credit Adjustment Here is the check for my first 6 months’ rent. Expense Debit Adjustment Unearned (Deferred) Revenues Cash received in advance of providing products or services. Liability Debit Adjustment Unadjusted Balance Buy your season tickets for all home basketball games NOW! “Go Big Blue” Revenue Credit Adjustment Accrued Revenues Revenues earned in a period that are both unrecorded and not yet received. Asset Debit Adjustment Yes, I’ve completed your tax return, but have not had time to bill you yet. Revenue Credit Adjustment Accrued Expenses Costs incurred in a period that are both unpaid and unrecorded. Expense Debit Adjustment We’re about one-half done with this job and want to be paid for our work! Liability Credit Adjustment Depreciation Depreciation is the process of computing expense from allocating the cost of plant and equipment over their expected useful lives. Straight-Line Asset Cost - Salvage Value Depreciation = Useful Life Expense 問題與討論