報告人:林書禎 報告日期: 2015/12/30

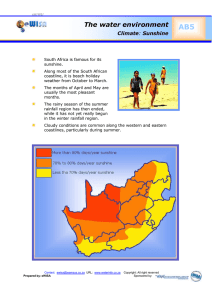

advertisement

報告人:林書禎 報告日期:2015/12/30 • • • • Introduction Literature review Methodology Conclusions • This paper primarily examines whether there is a relationship between the stock market and three specific weather variables such as the temperature, humidity, and sunshine duration, using the Shanghai A- and B-share indexes • Sunshine : Saunders , Hirshleifer and Shumway , Kamstra, Kramer and Levi , Garrett, Kamstra and Kramer • Multiple weather effect : Keef and Roush , Dowling and Lucey , Keef and Roush and Cao and Wei , Chang et , Yoon and Kang • No weather effect: Trombley, Jacobsen and Marquering , Krämer and Runde , Pardo and Valor , Tufan and Hamarat The weather effect exists in the A-share returns, but it does not exist in the B-share returns over the whole period. This finding suggests that the existence of weather effect raises questions about the validity of EMH in Chinese stock markets, and that incorporating weather variables into asset pricing models may be useful to understand the dynamics of Chinese stock markets. THANK YOU FOR YOUR ATTENTION