Taxes and Depreciation MACRS

advertisement

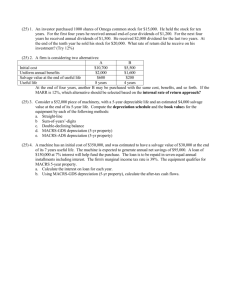

Taxes and Depreciation MACRS Review • What is Depreciation? – Decline in value due to wear and tear (deterioration), obsolescence and lower resale value. • • Why do we compute depreciation? To reduce net profit before taxes =>Decrease taxes =>Increase the cash flow after taxes Review (cont’d) • How do you compute Depreciation? – It is computed separately for each asset. – It depends on » » » » the age of the asset, the Initial Cost of the asset (P), the Tax Salvage of the Asset (S) (sometimes), and the Tax Life of the asset (N) Depreciation Methods • • Several depreciation methods exist. So-called historical or classical methods – Straight Line – Sum of the Years Digits – Declining Balance • Current method mandated by the government – Modified Accelerated Capital Recovery System (MACRS) Method 4: Modified Accelerated Capital Recovery System (MACRS) • • • • MACRS was created in 1986 and prescribed by the IRS MACRS is now the principal method for computing depreciation. MACRS assigns a class (tax life) to various kinds of property. (Useful life estimates are no longer relevant.) Most tangible personal property fall in one of the six categories: – 3-, 5-, 7-, 10-, 15-, 20-year classes • • Rental property is assigned a 27.5-year tax life Nonresidential real property is assigned a 31.5-year tax life) MACRS (cont’d) • • • • MACRS gives a percentage depreciation for each year. The depreciation is the percentage times the initial cost. MACRS gives organizations the choice of two depreciation systems: General (GDS) or Alternative (ADS). GDS is more accelerated and thus most often preferred. General Depreciation System (GDS) • The GDS percentages are computed with a declining balance method using a switch point. – Double rate for 3-, 5-, 7- and 10-year classes, – 1.5 rate for 15- and 20-year classes, – Straight line method for » Rental property (27.5 year life) » Nonresidential real property (31.5 year life) Half-Year Convention • The half-year convention assumes that an asset purchased in a year is purchased in the middle of the year. Therefore, only half a year of depreciation is allowed. Year 1 2 3 4 5 6 3-year class 33.33% 44.45% 14.81% 7.41% 5-year class 20% 32% 19.2% 11.52% 11.52% 5.76% Recall Example 1: Should we invest? • New Machine: – – – – – – – Investment = $11,000 Tax Life and Actual Life = 5 years Tax Salvage and Actual Salvage = $1,000 Income = $4,000 per year Operating Expenses = $1,000 per year 40% Tax Rate After Tax MARR = 9% Example 1 with MACRS 3-year • Periods Before Tax Cash Flow Depreciat ion Taxable Income Tax Aft er Tax Cash Flow 0 -1 1 00 0 1 3 0 00 3 6 66. 6 7 -6 6 6.3 0 -2 6 6.5 2 3 2 66. 5 2 2 3 0 00 4 8 88. 8 9 -1 8 89. 5 0 -7 5 5.8 0 3 7 55. 8 0 3 3 0 00 1 6 29. 1 0 1 3 70. 9 0 5 4 8.3 6 2 4 51. 6 4 4 3 0 00 8 1 5.1 0 2 1 84. 9 0 8 7 3.9 6 2 1 26. 0 4 5 3 0 00 0 3 0 00 1 2 00 1 8 00 5 Salvage 1 0 00 1 0 00 400 600 -1 1 00 0 At the end of period 5, Book Value= 0 Economic Analysis for MACRS 3-year • Before-tax NPW = -11000 + 3000 (P/A, 0.09, 5) + 1000 (P/F, 0.09, 5) = 1319 • After-tax NPW = -11000 + 3266.52 (P/F, 0.09, 1) + 3755.8 (P/F, 0.09, 2) + … + (1800+600) (P/F, 0.09, 5) = 117 • • Before-tax ROR = 13.34% After-tax ROR = 9.45% Example 1 with MACRS 5-year • Periods Before Tax Cash Flow Depreciation Taxable Income Tax After Tax Cash Flow 0 -11000 1 3000 2200.00 800.00 320.00 2680.00 2 3000 3520.00 -520.00 -208.00 3208.00 3 3000 2112.00 888.00 355.20 2644.80 4 3000 1267.20 1732.80 693.12 2306.88 5 3000 633.60 2366.40 946.56 2053.44 5 Salvage 1000 -267.20 -106.88 1106.88 -11000 At the end of year 5, Book Value = 11,000 - 2200 - 3520 - 2112 - 1267.2 - 633.6 = 1267.2 Economic Analysis for MACRS 5-year • • After tax NPW = -110 After tax ROR = 8.61% Summary • Every problem has three kinds of cash flows – Investment: cash flow at time 0 – Annual Revenues /Operating Costs: At times 1 through end of life – Salvage Value: cash flow at end of life Summary (cont’d) • Investment – For new assets, there is no tax effect at time 0. Year 0 1 2 3 4 4 Sal. BT Cash Depr Taxable –Tax AT Cash Flow Income Flow -10000 -10000 5000 -2000 3800 3000 +800 2500 500 2800 3000 -200 1250 1750 2300 3000 -700 625 2375 2050 3000 -950 625 1375 1450 2000 -550 Summary (cont’d) • Annual Revenues / Operating Cost – ATCF = BTCF - Tax – Tax = (BTCF - Depreciation)(tax rate) Year 0 1 2 3 4 4 Sal. BT Cash Depr Taxable –Tax AT Cash Flow Income Flow -10000 -10000 5000 -2000 3800 3000 +800 2500 500 2800 3000 -200 1250 1750 2300 3000 -700 625 2375 2050 3000 -950 625 1375 1450 2000 -550 Summary (cont’d) • Salvage Value – If Book Value (BV) is different than salvage value (SV), there is a tax effect. – Salvage ATCF = Salvage BTCF - Tax – Tax = (SV - BV)(tax rate) Year 0 1 2 3 4 4 Sal. BT Cash Depr Taxable –Tax AT Cash Flow Income Flow -10000 -10000 5000 -2000 3800 3000 +800 2500 500 2800 3000 -200 1250 1750 2300 3000 -700 625 2375 2050 3000 -950 625 1375 1450 2000 -550 What tax rate do we use? • • Assume we have a new project with additional income over the current project. What tax rate do we use to find the tax on the additional income? – Use the tax rate that would be applicable to the next dollar of income. • This is the incremental tax rate appropriate to your highest level of taxable income When the asset is actually sold for the price SV, there may be a tax effect. • If SV > BV then the amount SV - BV is a capital gain, – you must pay tax on the capital gain • If SV < BV then the amount BV - SV is a capital loss, – you may deduct the loss from other capital gains and have tax savings Conclusions • • • • All previous analysis methods described work with tax considerations Use after tax cash flows and after tax MARR for analysis Depreciation of investments is required in analysis The method of depreciation may affect the decision